Because Caio in Saipem made a splash

Here are the reasons for Caio's flop in Saipem. The analysis of the economist Alessandro Penati for Domani Quotidiano

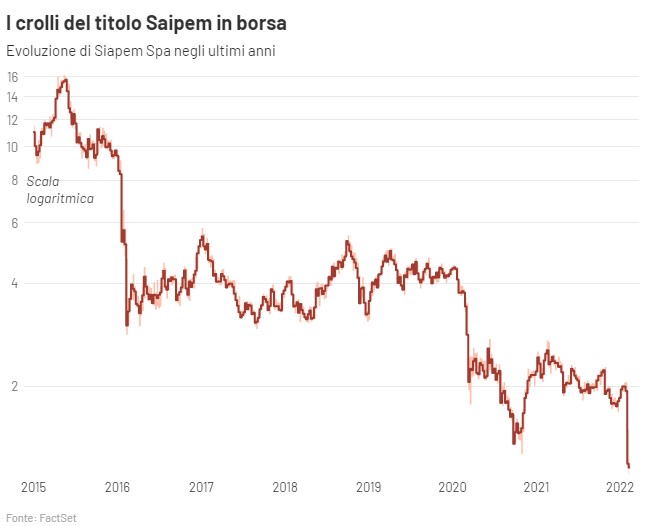

Today's Saipem crisis: the triggering cause is the announcement of a collapse in profits, a sign that the strategic plan for the conversion to the green economy of just six months ago must be thrown away.

A company's environmental transition comes at a huge cost because investor pressure to reduce its carbon footprint immediately devalues its assets, making it more difficult to find the resources to finance the conversion. Lesson number two.

Many polluting companies sell pieces of business to investors or companies that don't care about green ratings (ESGs) (unlisted, hedge funds or sovereign wealth funds from oil producing countries) and then invest the proceeds in green projects.

For every seller there is a buyer and therefore things do not change for the environment; but the green rating of those who sell improves, proving that the ESG criteria are often institutional marketing.

Saipem, however, has no market today, assuming you want to sell it. The alternative is to merge it with another group in the sector, regardless of its nationality and ESG rating, and maximize the value for the public shareholder; and once restructured with the merger, the state could get out of the capital of a not very green company. As was done with Technip in its time.

On the other hand, the defense of "Italianness" prevails and so we talk about a merger with the Italian company Maire, to defend a "strategic" company, without considering the "dowry" that the State presumably will have to pay for Maire to accept Saipem , having not restructured it, and without any benefit for the ESG rating of the two companies. The experience with WeBuild also teaches, as in other cases, that the shareholder state is forever.

To understand how the plan to deal with Saipem's green conversion would be doomed to failure, perhaps it was enough to read the interview with Sole-24 Ore (29/10/2021) by its CEO Francesco Caio in which he defined it "a transition through a new dual approach that allows on the one hand to continue serving customers of the traditional cycle with respect to market demands, also with the optimization of assets, and on the other hand to compete effectively in the challenge for the energy transition by adopting innovative operating models and flexible ". It looks like a supercazzola of the legendary Count Mascetti in the film Amici My .

And here we come to the third lesson: the good public manager for all seasons. Scrolling through the long CV of Eng. Caio, I see that he was director of Omnitel and Cable and Wireless (telephony), Nomura and Lehman Brothers (finance), Indesit (household appliances), Poste Italiane, Ita Airways ex Alitalia, Avio (aeronautics), and as president of Saipem, also government consultant for the Ilva plan (steel) and for Digital and Broadband Technologies: all businesses that have little to do with Saipem's drills and plants.

I also note that all his experiences as an administrator have never lasted more than three years, or a single mandate: certainly not a good business card to ensure the management continuity required by a complex plan.

I have no reason to doubt the professionalism of engineer Caio, but that someone may have managerial skills in so many disparate sectors, yes.

However, that of Caio is not an isolated case: often the managers chosen for publicly-owned companies pass indifferently from one company to another, as in a carousel.

At the other extreme are the top managers who have instead made their entire career within the same company. The only feature that accumulates them is the Italian passport: there are probably no good foreign managers to attract; or perhaps they are hardly amalgamated with the Roman environment.

Whatever the criteria for appointing public managers, the Saipem case teaches that, in terms of governance, the State as the controlling shareholder leaves much to be desired.

(Extract of an article published in Domani Quotidiano , here the full version)

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/perche-caio-in-saipem-ha-fatto-splash/ on Mon, 21 Feb 2022 06:47:46 +0000.