Because China is a two-faced Janus in energy

On the one hand, China is the world leader in the development of renewable energies and, on the other hand, has recorded the largest increase in generation capacity from coal. Analysis by Jin Xu, Portfolio Manager, and Jess Williams, Portfolio Analyst, Lead Investment at Columbia Threadneedle Investments

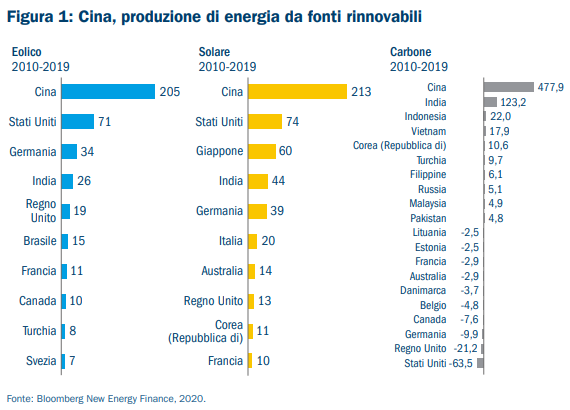

China is like a two-faced Janus: on the one hand, it is a world leader in the development of renewable energy, having installed more than double the capacity (measured in gigawatts, GW) of its closest competitor in the last decade in terms of both solar and energy. than wind (Figure 1); on the other hand, in the same period, it recorded the greatest increase in generation capacity from coal, almost four times the amount observed in India.

The Chinese government has announced that it intends to reach the peak of emissions from coal-fired plants by the end of the current five-year plan ending in 2025, but the new plants with a useful life of 40 years do not reconcile with a zero-year target. net emissions by 2060. China is a country of great progress and great opportunities, but also of great contradictions.

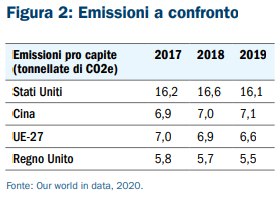

In absolute terms, China provides the largest contribution to global emissions, but this is largely due to its size. On a per capita basis, Chinese emissions are much lower than those of the United States and roughly in line with those of the EU, with the difference, however, that after more than a century of rising emissions, the EU is now on a downward trajectory, unlike China (Figure 2).

Another point to consider is that the data on emissions at national level refer to those deriving from production activity. As a result, the emissions generated by the production of Chinese goods that are consumed in the EU or the US are reflected in China's carbon footprint. If we looked at emissions associated with per capita consumption, China would probably rank much better than the EU, the US and the UK.

Given China's new "net zero" targets and its leadership in renewables – the country produces 70% of solar panels and half of the world's electric vehicles, and controls a significant share of many of the underlying materials of battery technology – no wonder investors have targeted China's renewables market.

The growing interest of investors, especially those aware of ESG factors, has prompted companies to pay more attention to sustainability disclosures. The use of forced labor in production chains is a particular risk area on which investors currently place a lot of emphasis.

Towards the end of 2021, a more detailed decarbonisation program is expected to be published. This could solve some of the dilemmas posed by coal-fired power plants, and is likely to focus on three key areas: carbon pricing, green finance, and technology investment.

Such developments could accelerate the already favorable scenario. This is a huge opportunity: the International Renewable Energy Agency (IRENA) predicts that 8,519 GW of solar energy will be needed by 2050 in a scenario of rising temperatures below 2 ° C, in line with the agreement Paris; we are talking about an increase equal to 18 times the levels of 2018.

It is believed that Asia, and especially China, will represent more than 50% of the total installed photovoltaic power, compared to 20% in North America and 10% in Europe.

Forecasts for onshore wind paint a similar picture, with 5,044 GW required by 2050, nine times the installed capacity in 2018. IRENA estimates that more than 50% of this capacity would be in Asia.

In light of recent announcements, which signal a dramatic shift in emphasis on the energy transition, improved reporting standards and a significant range of opportunities, we believe it is worth following the evolution of the Chinese market.

However, important for ESG-conscious international investors, this will be conditional on ensuring that supply chains have no exposure to Uyghur human rights violations in the Xinjiang region.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/perche-la-cina-e-un-giano-bifronte-nell-energia/ on Sat, 23 Oct 2021 05:21:08 +0000.