Because European stock markets aren’t dazzling

At a sector level, European equities were able to benefit only marginally from the boom in the technology sector and growth stocks that we have witnessed in recent months. The analysis by Giorgio Broggi, Quantitative Analyst at Moneyfarm

After the extraordinary performances at the beginning of the year, in recent months European shares have lost ground compared to the indices of other developed countries, recording a -6.4% compared to US equity and even a -10.9% compared to Japanese stocks (early June to September 8, 2023). Several factors influenced this negative performance. Let's start with the ever-present geopolitical risk linked to the conflict in Ukraine and the issue of energy dependence on Russia, to which Europe is still struggling to find a viable alternative. The difficulties in energy supply bring with them significant consequences in economic terms, especially with the approach of the winter season and with the increase in the share of public debt that European countries will be forced to invest to limit the impact of energy dependence on businesses and consumers. Therefore, although the situation on the Ukrainian front appears "stable" for the moment, the Old Continent will still remain exposed to possible future interruptions in energy supply, with potential damage to the economic stability of the entire European Union.

China's challenge

Another significant challenge is represented by the crisis of the Chinese economy : the Dragon is currently grappling with a difficult post-Covid reopening phase, aggravated by the onset of the real estate crisis. There are several sectors of the European economy that are highly dependent on Asian demand, such as luxury and automotive, and which therefore could be severely penalized if the delay in the Chinese recovery continues.

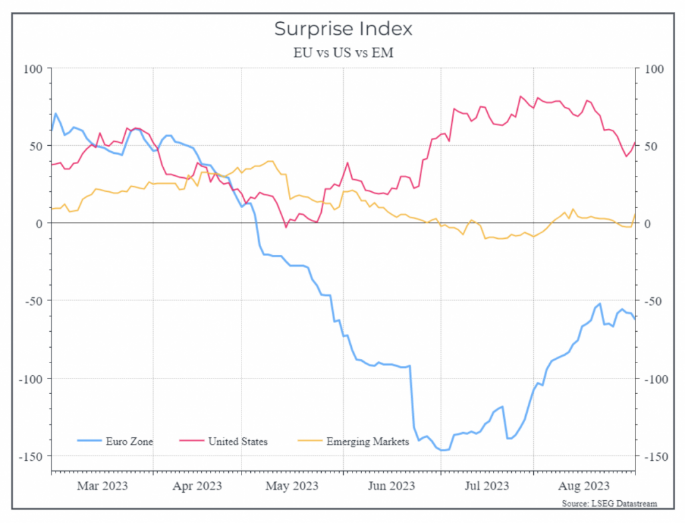

It must then be considered that the European stock market is being played against the backdrop of a marked economic slowdown, clearly also impacted by the Chinese slowdown mentioned above: in recent months European macro data have consistently disappointed expectations, as confirmed by the economic surprise index (graph below), i.e. the comparison between the expected data and the data actually published, which is currently at its lowest level compared to the average of the last 10 years, well below that of emerging markets and the United States.

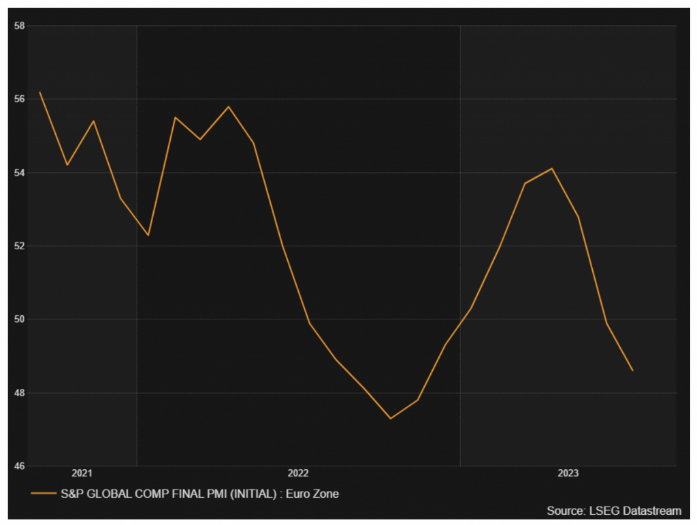

The manufacturing orders index goes negative

Another useful data for interpreting the current scenario is represented by the manufacturing orders index (OMI) which has fallen into negative territory, below 50 points. Although GDP growth expectations for 2023 remain slightly positive, the overall picture is therefore uncertain, also because the resilience of inflation has made a reversal of the ECB's monetary policy unlikely, which, for the next few months, will remain probably committed to finding a balance between inflationary pressures and economic growth.

As regards the sectoral composition of the European indices, EU shares have been able to benefit only marginally from the boom in the technology sector and growth stocks that we have witnessed in recent weeks. This element of diversification, however, could always be useful in a cyclically adverse phase.

How to move in the next few months?

The next few months could be difficult for European equities and economic and geopolitical risks suggest approaching this asset class with caution. Nonetheless, there may be reasons for optimism in the medium and long term:

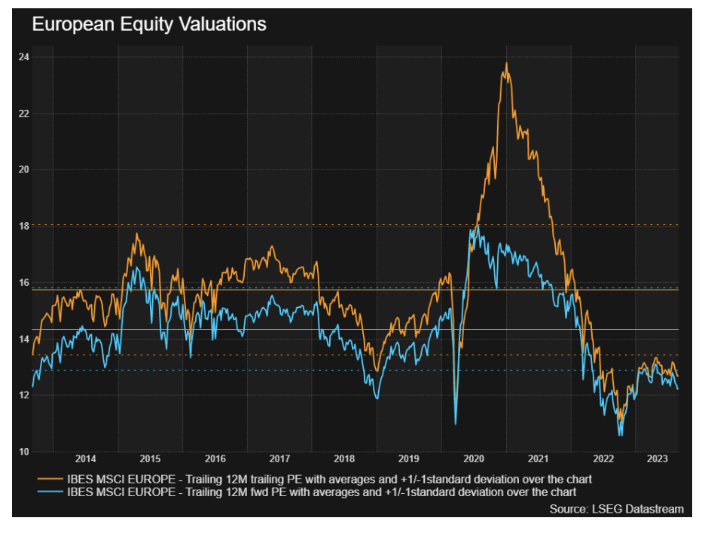

First, European equity valuations remain attractive and already appear to incorporate many of the concerns mentioned. Current and forecast Price/Earnings ratios are below the average of the last 10 years by more than one standard deviation;

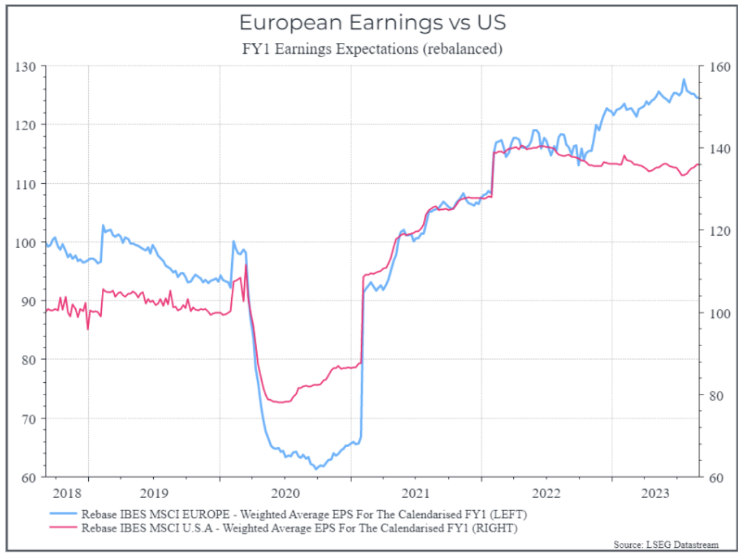

Earnings and earnings expectations have proven surprisingly resilient, despite adverse macro data, confirming that markets may already have priced in the economic slowdown expected in the coming months. At the end of 2022, one-year earnings expectations for European companies rose significantly, even exceeding those of their US counterparts. 12-month earnings (both past and forward) show an upward movement following the end of China's zero-Covid policy, while US data is still recovering from mid-2022. Margin data also shows a similar situation, although American companies remain more profitable than European ones.

The uncertainty of European stocks

In conclusion, European equities are currently going through an uncertain phase, with significant challenges on the horizon, both from a geopolitical and economic point of view, but the attractive valuations and excellent corporate earnings results give rise to medium- to medium-term investment opportunities. long term, especially in the context of a diversified strategy. We therefore maintain a cautious position on this asset class and continue to monitor the geopolitical and economic developments of the entire region, with a prudent and flexible approach which, in a world characterized by increasing complexity, will be increasingly fundamental for making informed investment decisions.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/azionario-europeo-fase-incertezza/ on Sun, 24 Sep 2023 05:18:35 +0000.