Because everything seems to be supporting emerging market currencies

By Kate Griffiths, Client Portfolio Manager of Pictet Asset Management's Emerging Debt Team

Three general factors underlying our current favorable view on emerging market currencies and why investors should consider taking (or broadening) exposure to this asset class are outlined in the summary below.

MACROECONOMIC DRIVERS

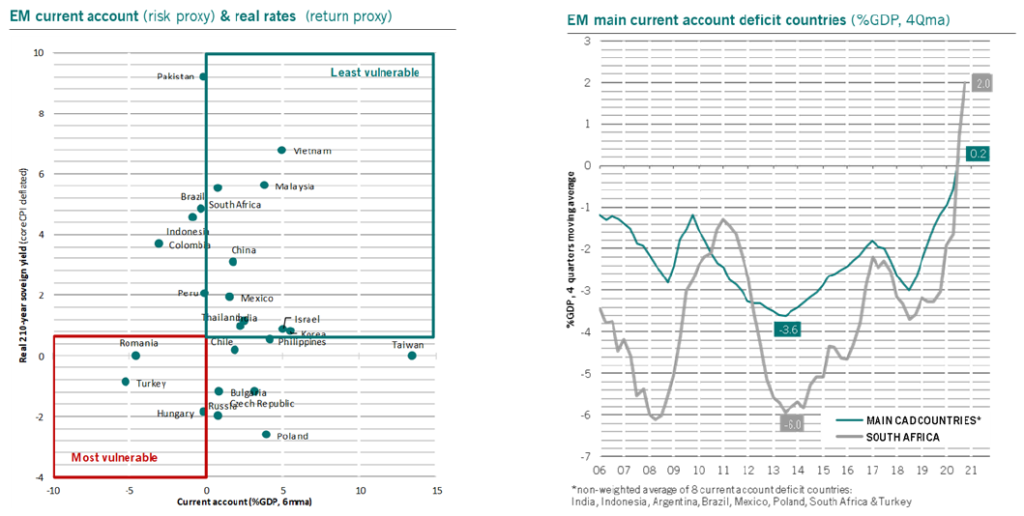

Global demand for emerging market products looks solid and we expect further growth. In the presence of weak domestic demand and the consequent reduction in imports in emerging areas, we have witnessed a significant improvement in the external accounts of emerging economies. In this way, the positioning of emerging countries that already boasted solid fundamentals was further strengthened and noteworthy progress was also recorded in the current account balance of nations that were structurally more fragile. For example, South Africa and other countries historically characterized by a current account deficit now have a surplus.

In particular:

- the exporting countries of manufacturing products from Asia and Central Europe benefited from the recovery in China and the solidity of consumption in advanced Western markets.

- commercial activity in emerging commodity exporting countries enjoyed a sharp acceleration thanks to the rally in commodities. The increase in the price of raw materials should continue in light of the importance attributed by the main advanced economies (US and EU) to infrastructure investments and the global commitment to increase the generation of renewable energy and to expand sustainable infrastructure. The prospects for long-term demand for commodities (especially industrial metals) therefore appear encouraging. At the same time, historically low capex in the commodities sector will lead to persistent supply constraints, which in turn will fuel upward pressure on prices.

Furthermore, it must be considered that the central banks of emerging countries are a step forward in terms of tightening monetary policy: In Brazil, Russia and Turkey the cycle of rate hikes has already begun and in the near future there will be new tightening by the authorities monetary policies of these or other countries. Interest rate differentials vis-à-vis advanced markets are therefore improving, supporting currencies.

Furthermore, it must be considered that the central banks of emerging countries are a step forward in terms of tightening monetary policy: In Brazil, Russia and Turkey the cycle of rate hikes has already begun and in the near future there will be new tightening by the authorities monetary policies of these or other countries. Interest rate differentials vis-à-vis advanced markets are therefore improving, supporting currencies.

Finally, the advancement of vaccination campaigns in emerging countries in the second half of the year will translate into an improvement in prospects, which are more favorable to growth. Given that a strong correlation has been found between the evolution of the pandemic situation and the trend of currencies, more encouraging news on the health front should support emerging currencies.

THE EVALUATIONS

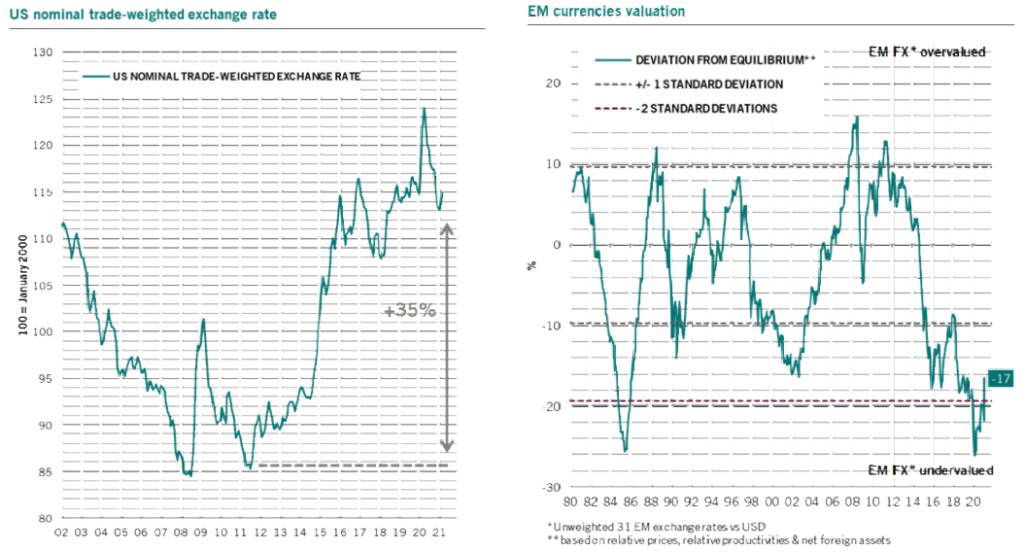

In light of the view of a structural weakening of the dollar and improving fundamentals in emerging areas favored by the macroeconomic environment, emerging currencies, which are cheap relative to historical levels, should be among the biggest beneficiaries of international capital flows and compression. risk premiums.

Emerging currencies are in fact particularly cheap against the US dollar. This is evident in particular from the analysis of trade-weighted indices: at the moment, the trade-weighted USD is 35% above the lows recorded in 2011. Emerging currencies are, on the other hand, undervalued by 17%. According to our economists, this undervaluation is particularly pronounced in Latin America (-44% above equilibrium level), with the region expected to benefit enormously from the improvement in trade linked to commodity exports.

On a relative basis, emerging currencies have an extremely high risk premium. If implicit volatility (an indicator of expected risk in foreign exchange markets) is taken into account, the spread between emerging and advanced currencies currently suggests that emerging currencies carry a significant risk premium which, once compressed , will offer great performance support.

THE STRUCTURAL TREND OF DOLLAR WEAKNESS

Several factors affect the structural trend of the weakening of the dollar. First, monetary policy.

The Federal Reserve's monetization of US deficits – the Fed's Quantitative Easing financing US Treasury spending – has established itself as the dominant strategy in US monetary policy.

As a result, a continuous expansion of the monetary base is expected in the country: the Fed has more room for maneuver than the other major central banks (at the moment the Fed's GDP-weighted balance sheet is smaller than that of the Bank of Japan or the European Central Bank), therefore the strategy can continue without noteworthy obstacles.

The coordination between the US Treasuries and the Federal Reserve led by the two formed by Yellen and Powell could reach new highs, leading the Fed to implement near fiscal measures.

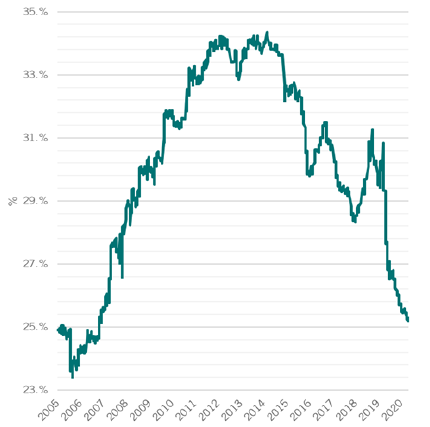

The slowdown in foreign demand for US Treasuries (confirmed by the reduction in the percentage of outstanding government bonds held by foreign investors) further increases the need to expand the Fed's balance sheet.

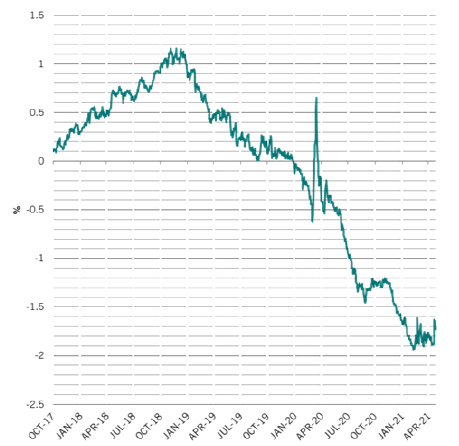

The Fed's dual mandate – adopting an asymmetrical average inflation targeting system and persistent focus on achieving a more equitable form of full employment – will result in an increase in the hurdle rate due to Fed policy tightening and in a greater propensity to tolerate a rise in inflation. For this reason, real yields in the US will remain depressed for some time to come.

Impacting on the prospects for the North American currency is also the double US deficit.

On the one hand, the fiscal deficit is constantly increasing in the United States due to the accommodative measures (stimulus program for the emergency caused by the pandemic, infrastructure investments, etc.) launched by the Biden administration in response to the current situation. We believe this trend is negative for the dollar for two reasons:

- spending exceeds the new taxes proposed, therefore a continuation of government bond issues is likely to fill the gap;

- the taxation of companies and individuals with high wealth, which would cancel the tax cut implemented by Trump in the period 2017/2018, favors the offshoring of capital in USD (a trend reversal compared to the substantial volumes of dollars repatriated after the cuts made by Trump, ultimately positive for the USD) and potentially reduces the competitiveness of US companies in the long run, making the US market an increasingly less attractive destination for foreign capital, which could be directed to emerging markets as an alternative.

On the other hand, the trade balance appears increasingly large as US consumers (recipients of direct government money transfers) spend on imported goods. As a result, there is a global dollar spill that particularly favors emerging manufacturing exporters, and this growing supply of dollars around the world is fueling bearish pressures on the greenback.

Finally, the signs of a general trend towards de-dollarization, albeit still in the initial stages, cannot be ignored. The progressive affirmation of China on the global scene, in fact, is accelerating the process of de-dollarization of world trade, which is proceeding at an ever faster pace.

More and more commercial transactions are concluded outside the "dollar system" and this trend will gain further momentum following the rise of central bank digital currencies, of which the Chinese CBDC appears to be the most innovative.

The hegemony of the dollar remains intact (given the current lack of valid alternatives), but the current trend is undoubtedly favorable to the affirmation of alternative trading currencies, also in light of the formation of new political and regional alliances (EU relations / China, RCEP) and therefore the refusal to depend entirely on the "dollar system".

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tutto-sembra-sostenere-le-valute-dei-mercati-emergenti/ on Sun, 15 Aug 2021 06:40:53 +0000.