Because in the US inflation falls more than rents

Inflation continues to fall in the United States, despite the slow rate of decline in rents. The analysis of Antonio Cesarano, Chief Global Strategist of Intermonte

Overall positive news comes from the US inflation in May in the context of a figure that in fact reflected the consensus of Bloomberg analysts:

- general index to 4% from 4.9%

- core index to 5.3% from 5.5%

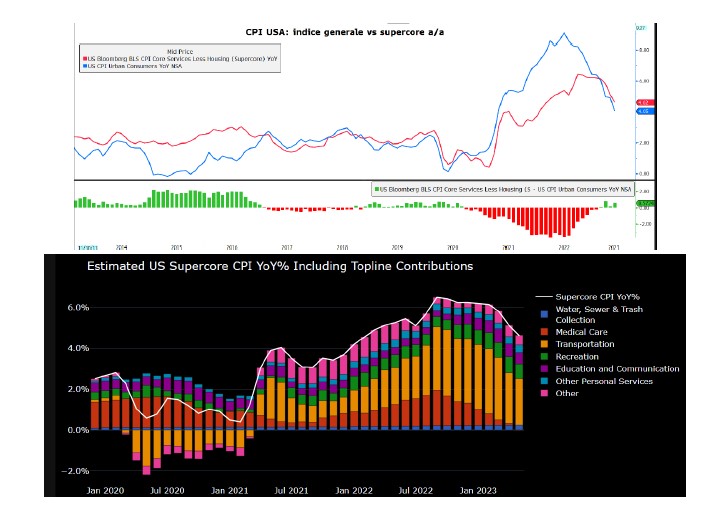

- supercore index to 4.6% from 5.10%

ENERGY AND RENTALS SLOW INFLATION DOWN

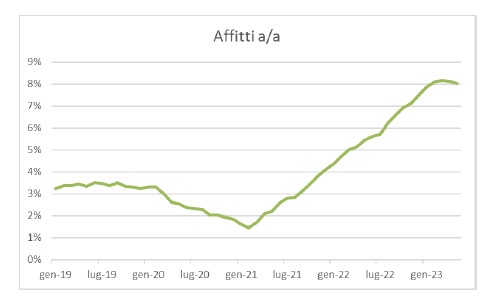

The energy component is one of the main factors that contributed to the slowdown in inflation, while the rental component is still delaying the slowdown phase, however registering at least an adjustment at 8% y/y.

The supercore index (that is, net of food, energy and rents) is approaching the general index (4.6% vs 4%), the latter signaling a possible more marked slowdown in inflation in the second half.

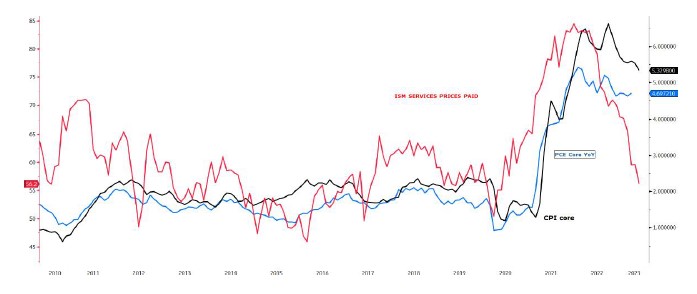

Prospective indications from the services sector also support this hypothesis:

IN SUMMARY

The data is in line with the possibility (already incorporated in the prices of the OIS) that the Fed temporarily stops the rate hike phase at its meeting on June 14, signaling however at the same time that it could be a non-definitive pause (so-called "hawkish skip "). The pause would be to be reconnected:

- partly to the need to further verify the impact of the increases already made;

- in part to avoid a negative impact during the phase of accentuation of the liquidity drain (most evident in the second half of June, after the fiscal deadline of 15 June) necessary to replenish the treasury account after the agreement on the debt ceiling reached last minutes in early June.

The DOTS that will be published after Wednesday's Fed meeting (i.e. the "cloud of points" that anonymously describes the expectations of Fed members up to 2025) could register a rise in the median for 2023, moving closer to 5, 5% from the 5.125% indicated in March, to signal a possible further (but potentially final) rise of 25 bps at the July 26 meeting, i.e. after the next June inflation figure to be published on July 12.

For the second half of the year, the scenario of a reduction in market rates is currently confirmed in expectation of a slowdown in inflation and above all in growth, which together would lead to a climate of expectation of a softening/reversal of monetary policy with a view to 2024.

The important level of support in terms of the 10-year Treasury rate to hypothesize a second phase of decline in US rates is represented by the 3.30% area.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/calo-inflazione-affitti-stati-uniti/ on Wed, 14 Jun 2023 06:09:47 +0000.