Because inflation will not abandon us

The macroeconomic projections that tell of a scenario characterized by persistent inflation. Comment by Martina Daga, Junior Macro Economist, AcomeA SGR

The macroeconomic projections updated to the first quarter of 2023 of the Fed and the ECB, presented at the monetary policy meetings in March, show substantial differences: the ECB prepares the projections before the meeting and, in this case, before the recent tensions that have affected the banking sector starting from the United States and then in Europe, with the Credit Suisse case . They are, therefore, projections subject to a high level of uncertainty.

Starting with economic growth, GDP is expected to grow at an average rate of 1% in 2023, slowing down compared to 2022, but this value has been revised upwards compared to the forecasts formulated in December (0.5%). The data published in the first months of 2023 showed a more resilient economy than expected, lower energy costs which drove down the value of inflation and the partial recovery in consumer confidence have meant that the growth projections for the 2023 were better than expected at the end of 2022. Medium-term growth has instead been revised slightly downwards compared to what was projected in December. For these years, the ECB expects, in fact, that monetary policies will have greater weight and that tax incentives by states for the energy crisis will be maintained for 2023 and eliminated thereafter.

As regards price growth, on the one hand the value of headline inflation has been revised downwards compared to the December projections for 2023 when a sharp slowdown in total price growth is expected to then stabilize in the following two years. The marginal recovery in energy price growth in 2024 and 2025 will be due to the removal of energy tax subsidies. On the other hand, core inflation is expected to remain more persistent over time, mainly driven by wage pressures. In fact, the labor market is proving to be resilient even in the face of the slowdown in economic growth, in this context the ECB expects the unemployment rate to settle at historic lows for the entire time horizon under analysis, allowing workers to put pressure on wages.

On the Federal Reserve front, on the other hand, the individual members of the board indicate the projections relating to the various macroeconomic variables and, since they can also differ considerably from one another, the reference value is their median. However, it is also interesting to analyze the distribution of these projections. This distribution indicates, in fact, whether or not there is broad consensus around a given and in which direction the visions of the voting members of the Fed are oriented.

Compared to the December projections, the macroeconomic context for the next few years has remained substantially stable. However, inflationary risks remain tilted to the upside; in addition to the fact that both headline and core inflation have been revised upwards marginally for 2023, looking at the distribution of projections for core inflation, while in December the maximum range expressed by board members was 3.7% – 3.8 % for 2023, the distribution was shifted up in March, with 4 members projecting a core inflation level of between 3.9% – 4% and one member at 4.1% – 4.2%. Also for 2024 the maximum value has moved from the range of 2.9% – 3% to 3.1% – 3.2%.

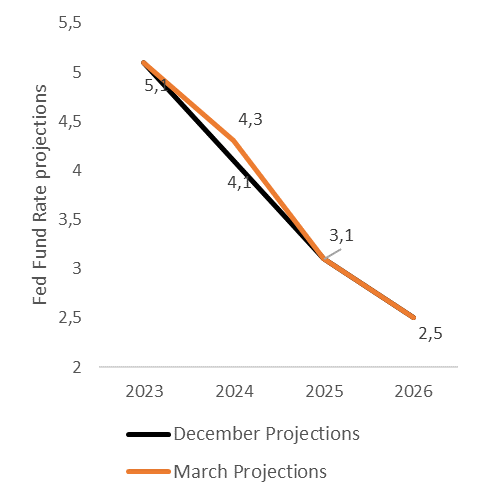

A peculiar element of the Fed's projections are the so-called dots, ie the projections of the board members regarding the level of the Fed Fund target rate for the next few years. The median for 2023 has remained stable relative to the December projections, has risen for 2024 and has converged again for 2025. This indicates that lower rate cuts are expected in 2024, and therefore will remain higher for longer, to then recover the following year. However, looking at the distribution of the forecasts it is important to note that for the long term, although the median remained at 2.50%, one member revised the projections upwards to indicate a value between 3.63% and 3.87%. This indicates that within the board some members are moving towards a more hawkish view compared to December, with inflation more persistent and the need for more restrictive monetary policy actions.

In terms of monetary policy decisions, the March meetings of the ECB and the Fed represented a turning point in terms of communication. If before the tensions in the financial sector that started with the Silicon Valley Bank in the United States the approach of the members of both central banks was substantially hawkish, following this event the rhetoric has become much more cautious, emphasizing that due to the high uncertainty it is not possible to give precise indications on future monetary policy decisions. While the ECB previously reiterated that rates still need to be raised significantly at a steady pace, the uncertain macroeconomic environment now gives way to a completely data-dependent strategy. Similarly, the Fed eliminated any reference to forthcoming increases in the Fed Fund target rate, saying only that further measures to tighten monetary policy may be needed to make financial conditions restrictive enough to achieve the 2% inflation rate. Furthermore, Powell emphasized during the last press conference the fact that, although it is too early to tell, in addition to the increase in key rates, the tightening of financial conditions could be accelerated by tensions in the financial sector. It seems that the central banks are now more cautious and want to maintain greater flexibility on their future moves, without giving precise indications which will then have to be satisfied. Acting differently from what is indicated would, in fact, undermine their credibility.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-linflazione-non-ci-abbandonera/ on Sat, 22 Apr 2023 05:34:21 +0000.