Because Intesa Sanpaolo, Unicredit, MPS and others have bankrupted the government

This is how much the government will not collect from the tax on banks' extra profits after the decisions of Intesa Sanpaolo, Unicredit, Mps, Mediobanca, Bper, Banco Bpm and more. Giuseppe Liturri's analysis

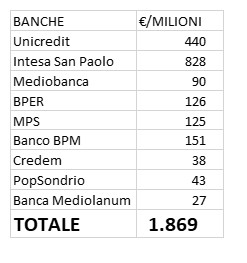

We are at 1,869 million. Distributed across 9 banks. At the end of the round of quarterly accounts updated to 30 September, this is the total we obtained by adding the tax on extra profits that each bank declared that it will not legitimately be paid. The law offered them the option not to pay, as long as they set aside an amount equal to 2.5 times the amount due as a reserve, and all the administrators diligently exploited this opportunity. Because, if they hadn't done so, their respective shareholders would have accused them of bad management. Purely and simply.

Therefore it makes no sense – as has been done by some newspapers – to distinguish between state-owned banks, such as MPS or Mediocredito Centrale and other banks. No board of directors, regardless of the shareholder, wanted to be accused of weakening the bank's assets by burdening the bank's accounts with a tax.

Considering other smaller banks, it will be easy to arrive at around 2.5 billion estimated by the government in various declarations , but never in official documents. Because, ever since the legislative decree at the beginning of August reached the Senate for conversion, the revenue estimate in the technical report has always been "prudently" equal to zero.

It's a shame because at least the conditions were there, the banks having announced sensational results, with interest margin (the one on which the tax should have been calculated) and net profit in many cases increased from 50% to 100%. This bears witness to the exceptional favorable economic situation that the banks have benefited from in the last 9/12 months. Well beyond the normal dynamics observed in these cases. Of which, moreover, there are no precedents in recent history, because 450 points increase in 12 months is a more unique than rare event. To understand the exceptional nature of the "favorable wind" regardless of the "captain", evenBanca Popolare di Bari – which is struggling to recover after the recent misadventures – has gone from loss to profit. It is enough to consult the data published by the ABI (as we explain here ) to get an idea of the upward trend that immediately affected the average rate of the entire stock of banking assets, while the average rates on the stock of deposits underwent only modest increases. Not a normal economic fluctuation but a market aberration, as well explained by authoritative interventions in the Financial Times, Bloomberg and Wall Street Journal.

On this point, the thesis of the personal definition provided by Massimo Doris, head of the Mediolanum group, according to which " There will be an extra profit for the State with regards to the banks that this year will pay at least 50% more in taxes than compared to last year, but I expect something much higher […] We will pay more than double, because if you make more profits you pay more taxes, so the State's collection will be much more substantial than in 2022 – added Doris -. We estimate that we will pay 158 million in total taxes in Italy in 2023, compared to 71 in 2022 ”.

In fact, the " rationale " underlying the tax on extra profits ( windfall profit tax in international doctrine) is that of considering a part of the profits worthy of a greater levy than the ordinary one, precisely due to their nature, which obviously remains to be demonstrated, of profits resulting from of an extraordinary situation almost completely independent of managerial choices.

Doris's position therefore raises perplexity when she reiterates the obvious – that is, that more profits mean more revenue for the State – probably pretending to forget that part of those profits are manna that has fallen from heaven and, for this reason alone, there is it is a part of the doctrine that believes it is justified to subject them to a greater levy. But now the milk has been spilled and these are purely academic discussions.

Not without mentioning that the decree provided that any sums collected would be allocated to the guarantee fund for the purchase of the first home, to the guarantee fund for loans to SMEs and to interventions aimed at reducing the tax burden of families and businesses.

Will be for another time.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/extraprofitti-banche/ on Sun, 12 Nov 2023 06:13:24 +0000.