Because it’s impossible to have batteries without China. Report Economist

The energy transition rests on batteries, but their supply chain is dominated by China. Doing without Beijing doesn't seem possible: here's why. The deepening of the Economist

“I'd like to eliminate all gas emissions from the world's highways,” John Goodenough, one of the Nobel Prize-winning scientists who developed the lithium-ion battery four decades ago, said in a 2018 interview. Goodenough died on June 25 before his dream could come true. But governments around the world are working to make it happen, with remarkable results. Global sales of electric cars increased fivefold between 2019 and 2022, surpassing 10 million units last year.

However, the speed of transformation collides with supply constraints and geopolitical headwinds. The supply of minerals needed to produce lithium-ion batteries must grow by a third annually this decade to meet estimated global demand. Tens of millions of batteries will be needed in America alone to meet the ambition of ensuring that half of American vehicle sales are EVs by 2030. Yet its great rival, China, is by far the largest processor of battery metals, maker of battery cells, and producer of finished batteries.

– Read also: Can we do without China for electric car batteries?

Even when manufacturing occurs overseas, Chinese companies dominate the process. American policy makers see this as a threat to the stability of American supply chains. All this makes Goodenough's technology one of the most important industrial battlefields of the new cold war – writes The Economist .

THE BATTERIES MATCH IS PLAYED IN ASIA

The outcome will be determined in Asia, where most of the battery supply chains are based. The first bottlenecks concern the production and processing of materials, including two of the most important materials for batteries, lithium and nickel. It will be crucial for manufacturers around the world to ensure a constant supply of both. Almost half of the lithium produced in 2022 comes from Australia, 30% from Chile and 15% from China. In the case of nickel, Indonesia produced 48% of the global total last year, the Philippines another 10% and Australia 5%.

So far, America is pursuing narrow trade deals with some of these countries to gain access to minerals and manufacturing capacity, and offers huge subsidies to manufacturers through its Inflation Reduction Act. To qualify for the US $7,500 credit for new electric vehicles, manufacturers must meet increasingly stringent requirements on the share of processed minerals and batteries made in America or in a country, other than China, with which America has a free trade agreement. Meanwhile, China is building a parallel battery supply chain.

Indonesia's dominance in the nickel sector is itself a potential bottleneck. An estimate from consultancy Pwc last year indicates that by 2035, 2.7 million tonnes of nickel will be needed annually for electric vehicles. Indonesia currently produces only 1.6 million tons, most of which is used for stainless steel. A huge metal mining and processing capacity is being planned or built. Processing may be the most difficult segment of the supply chain to make China-free. By one estimate, China smelts and processes about three-quarters of the world's nickel. It also has about two-thirds the processing capacity of lithium. Even these figures underestimate the weight of China, because many processes carried out outside China involve Chinese companies.

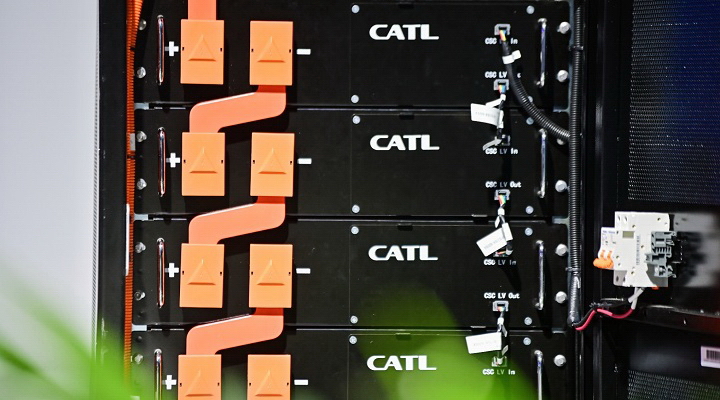

The three operational plants in Indonesia use high-pressure acid leaching, an advanced process that extracts nickel from its ore without smelting it. All are based on Chinese technology, operating skill, or both. To secure supplies of nickel, US automaker Ford formed a joint venture with a Chinese mining company, Huayou Cobalt, to invest in an Indonesian nickel processing plant. The Chinese company hailed the partnership as a contribution to its country's Belt and Road Initiative, a sentiment unlikely to be appreciated in Washington. Ford is already facing political fire at home over another venture with a Chinese firm: a new plant in Michigan to produce nickel- and lithium-based batteries, for which it has joined forces with a Chinese battery giant, Contemporary Amperex Technology Co. Ltd. ("Catl"). The Chinese company produces more than a third of the world's electric vehicle batteries, based on their total capacity.

THE ROLE OF CHINESE COMPANIES

The massive presence of Chinese companies is not only the result of their impressive industrial experience. According to mining executives and experts, it also reflects their ability to move quickly and take risks. The relatively small number of Western nickel mining and processing companies spend more time conducting studies and preparatory work. Sumitomo Metal Mining, a Japanese mining firm, withdrew from a nickel processing project last year, due to disagreements with its partner, Pt Vale Indonesia, another resource firm. The feasibility study of the project had been ongoing since 2012.

Chinese companies also dominate the production of battery components. Among battery cell components, China accounts for at least half of the production and more than 70% in some categories. The rest of the industry is concentrated in South Korea and Japan. Among them, the three East Asian countries account for between 92% and 100% of the intermediate parts of the industry. Even if America manages to secure enough processed minerals, a massive deployment of Korean and Japanese know-how in battery manufacturing in North America will be required to achieve its ambitious goals.

LG Energy Solution, based in South Korea, is the second largest battery manufacturer after Catl. The company is expanding into America, with joint ventures underway with Hyundai, Honda and General Motors. LG aims to produce 278 gigawatt-hours of storage capacity in North America by 2030, up from just 13 GWh in 2022. Maybe that's too optimistic a target. Kim Myung Hwan, the company's purchasing manager, notes that rising construction costs, shortages of skilled personnel and volatile prices for materials needed for batteries are all obstacles to rapid growth.

Some Asian manufacturers fear that the cost of manufacturing overseas could be prohibitive for years. “It's much more important to think about how to make the business profitable for ten, fifteen, twenty years,” says Hideo Ouchi, director of W-Scope, a Japanese company that manufactures separators used in battery cells. Ouchi estimates that to meet EV goals by 2030, America alone will need as much battery separator material as was produced globally in 2021.

Government policy represents another uncertainty, especially as many Asian battery makers are counting on decades of financial support. Last month, the United Auto Workers criticized the Biden administration for failing to impose strict labor rights conditions on a loan of up to $9.2 billion to Ford and Skon, a Korean battery maker, for a new plant in Michigan. Future Republican administrations may reduce or simply eliminate current EV goals.

The picture that emerges is worrying. Expanding the battery supply chain to meet the huge global demand for electric vehicles represents one of the biggest industrial challenges ever attempted. The current array of bottlenecks in the industry will also make this difficult. Succeeding – for the sake of the climate, human health and much more – without the country that, in most cases, dominates the battery industry, may be downright impossible.

(Excerpt from the press release of eprcommunication)

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/batterie-cina-economist/ on Sat, 22 Jul 2023 05:14:18 +0000.