Because the Bitcoin futures ETF will not attract many investors

Bitcoin futures ETF facts, analysis and scenarios. The analysis by Mads Eberhardt, Cryptocurrency Analyst for BG SAXO

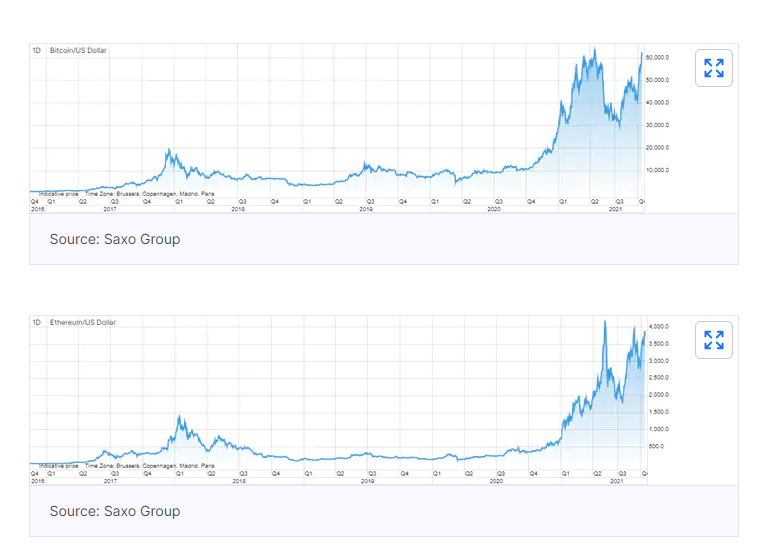

For years the Bitcoin community has fantasized about when a Bitcoin ETF would go public in the United States. The ETF has been eagerly awaited for several reasons but particularly because it allows investors in the United States to gain exposure to Bitcoin through their regular brokerage account based on a regulatory framework without the management overhead typical of Bitcoin.

By comparing ETFs to ETPs, tradable in multiple parts of the world, ETFs are often able to offer a more competitive management fee than cryptocurrency ETPs, while reducing the risk to investors in the event of issuer default.

With Bitcoin currently the most influential cryptocurrency market in the US, ETF listing has been highly anticipated, with more issuers seeking approval for an ETF over the years. So far, every proposal has been rejected by the SEC. But with more ETFs approved in Canada and US-listed MicroStrategy acting to some extent as an ETF of sorts due to their sizeable 114,000 Bitcoin hoard, the SEC had to give up.

On Thursday, credible rumors began circulating that the SEC would not block the launch of ProShares' Bitcoin futures ETFs which in fact began trading this week. After the stock market closed on Friday, the rumor was confirmed as the futures ETF was listed on the SEC's website to begin trading on the New York Stock Exchange, provided there are no last-minute complaints from part of the SEC.

The futures ETF has not received formal approval from the SEC, but will simply begin trading as the rules state that it can be done if no objections are raised now that 75 days have passed since the initial submission for ETF listing. From rumors to confirmation, the time frame was particularly short, so it felt like it was coming out of nowhere. According to rumors and confirmation from the same last week, Bitcoin jumped from around 57,500 (BTCUSD) asking Friday close to 62,500, close to new records.

Despite this situation, the futures-based Bitcoin ETF is likely to prove less important than cryptocurrency advocates hope. This is mainly due to the ETF holding Bitcoin futures that need to be rolled over with a negative yield upon expiration of each contract (the total annual cost increases by up to 5% – 10% in addition to the management fee) rather than holding Bitcoin " physical ”that the ETF stores.

Additionally, Bitcoin futures may not be as priced as physically held Bitcoins, potentially exposing investors to a price premium. The lowest management fee for Bitcoin ETFs was previously recognized, but this does not benefit investors who hold Bitcoin futures ETFs. For some investors, this actually makes holding futures ETFs less risky but rather expensive. For these reasons, the ETF is unlikely to attract many long-term investors, presumably making the futures ETF less influential on Bitcoin than expected.

The futures ETF could likely lead to greater confidence from the SEC that it might look forward to releasing a spot ETF, as many cryptocurrency advocates believe. While this may be true, there are notable differences between a Bitcoin spot ETF and a futures ETF. One in particular: physical Bitcoins must be held by a custodian, which increases the risk of loss through hacking attacks or trading errors.

Additionally, Bitcoins must be bought, sold, and stored in a highly unregulated environment, particularly on native crypto-financial service providers, which the SEC is likely not comfortable with. For the SEC, these factors can represent a significant obstacle to the listing of a spot ETF. For example, the SEC postponed the deadlines of four Bitcoin spot ETF applications to November and December of this year.

Last Friday the financial regulator of the Bailiwick of Guernsey (Crown Dependency consisting of the island of Guernsey and other smaller ones, all located in the English Channel) approved a European Bitcoin ETF spot from Jacobi Asset Management, a multi-stakeholder investment company. – London-based asset, with Bitcoin itself being held by Fidelity Digital Assets, a subsidiary of Fidelity Investments.

The ETF will be open to non-US investors on the CBOE Europe Equities exchange provided it receives listing approval from the Financial Conduct Authority (FCA), a UK financial regulator. The approval of this spot ETF is likely to put further pressure on the SEC to list a spot ETF in the US as well.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-etf-dei-futures-su-bitcoin-non-attirera-molti-investitori/ on Sun, 24 Oct 2021 05:34:21 +0000.