Because the Chinese yuan conquers the French Total, Russia and beyond

The Chinese yuan is gaining ground in the world: it is the most popular currency in Russia, overtaking the dollar; Total has used it for LNG transactions and Malaysia would like it instead of the US currency. All the details

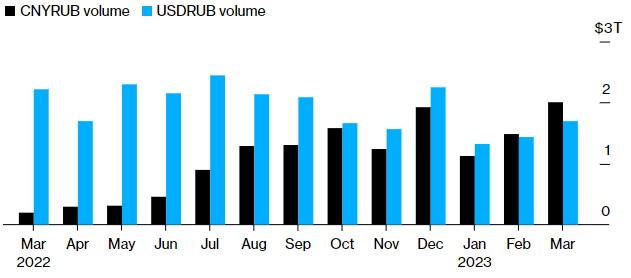

About a year after the invasion of Ukraine and Western sanctions, the most traded currency in Russia is no longer the US dollar but the yuan, the Chinese currency.

THE YUAN SURPASSES THE DOLLAR IN RUSSIA

In fact, last February, the yuan surpassed the dollar in monthly trading volume for the first time, and in March the gap between the two currencies widened. As Bloomberg writes, which elaborated the data, before the invasion of Ukraine the volume of exchanges of yuan on the Russian market was all in all negligible.

SANCTIONS AND APPROACH TO CHINA

China's overtaking of the United States came after the tightening of sanctions on Russia, which affected the country's few banks were able to make transfers in dollars or in a currency of countries considered "hostile" by the Kremlin (i.e. , in essence, those who imposed the sanctions). One of the Russian banks that came under the most pressure from European and US authorities was Raiffeisen Bank International, whose Russian branch is one of the main channels for international payments in the country.

If, however, on the one hand, the aggression against Ukraine has compromised Russia's political, economic and financial relations with the West, on the other it has allowed for a deepening of the relationship between Russia and China: a symbol of this "friendship ” (however, behind which there is a clearly unbalanced balance of power towards Beijing) was the visit of Chinese President Xi Jinping to Moscow last March, the first abroad since he was confirmed for a third term.

– Read also: This is how Xi's China keeps Russia's economy alive

THE YUAN-DOLLAR COMPARISON

Despite the deepening of relations with China, until February 2023, the US currency still remained the most popular in Russia.

IS THE CHINESE YUAN A RISK FOR MOSCOW?

The yuan's share in Russia's foreign exchange reserves is increasing, and the Chinese currency will therefore find itself playing a particularly important role in Moscow's finances. However, the yuan is a managed currency , the level of which is decided by Beijing on the basis of its economic and political interests. As a result, according to Reuters analyst Pierre Briançon, "Moscow is sinking into an asymmetric relationship that will limit its economic sovereignty."

Iskander Lutsko, an analyst for ITI London, explained to Bloomberg that "there are now fewer dollars on the market, as Russia's revenues have decreased due to the drop in oil prices [since Monday the price has started to rise again due to the cuts of OPEC+ , ed ] and the decrease in exports”. At the same time, "China's imports of raw materials from Russia have increased by 29 percent, even as exports from China have stagnated."

TOTAL BUY LNG… IN YUAN?

In March, French oil company TotalEnergies completed its first payment in yuan to Chinese company CNOOC for a shipment of 65,000 tonnes of liquefied gas imported from the United Arab Emirates. China strongly emphasizes energy transactions based on its currency, which it wants to promote internationalization to the detriment of the dollar.

According to some analysts of the banks BNP Paribas and Credit Suisse, and according to those of FXCM, a company that offers brokerage services, there is the possibility that this year and the next a significant part of energy trading will switch to being based on the yuan ( petroyuan , in jargon), rather than on the dollar.

MALAYSIA WANTS TO GET AWAY FROM THE DOLLAR

Then there is a part of Asia that would like to emancipate itself from the dollar, at least in part. For Malaysia, for example, which is a net importer of food, the strength of the US currency is an issue.

Prime Minister Anwar Ibrahim said "there is no reason for Malaysia to continue to depend on the dollar", and proposed that China work on establishing an Asian Monetary Fund to reduce its dependence on the dollar and the International Monetary Fund ( headquartered in Washington).

Furthermore, the Malaysian central bank is working on a mechanism that would allow trade between Kuala Lumpur and Beijing to be based on the ringgit and the yuan.

China has pledged to invest 39 billion dollars in Malaysia: among the projects there is a high-tech automotive hub led by the Malaysian house Proton.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/yuan-sorpasso-dollaro-russia-total/ on Thu, 06 Apr 2023 04:19:52 +0000.