Because the dominance of the US dollar is stronger than ever

What will happen to the dollar. The analysis by Jeffrey Cleveland, chief economist of Payden & Rygel

In the last period there has often been fear of a possible sharp decline in the trading value of the US dollar against other developed country currencies, a concern that seems to coincide with the loss of its reserve currency status worldwide.

We believe, however, that the reality is the complete opposite: today the dollar role is more important than ever, as demonstrated by the most recent financial crisis.

Understanding the reasons for the dollar's strength is essential to understanding if and what could affect its dominance. Two decisive factors: the potential competitor must be recognized globally as a destination for invested capital and must offer a better and safer system than the US for savings, loans and regulation.

The madness of current accounts

For the dollar, predictions of doom are nothing new. In the mid-2000s, a flight from the dollar was predicted for the same reasons recently invoked in 2020, namely the huge "current account deficit", as US imports outstripped exports.

The United States as a whole saves too little and spends too much. This "deficit" must be financed in some way. To work, the system is based on foreign countries financing US imports. Dollar skeptics love to dramatically chart the country's current account imbalance and predict a sharp decline in the currency's value.

However, the current account deficit tells, at best, only half the story. The other half is represented by the capital surplus. The United States is an unparalleled destination for global capital: savings from around the world converge there through investments in Treasury bonds, corporate bonds and shares of leading companies globally (one example: Apple).

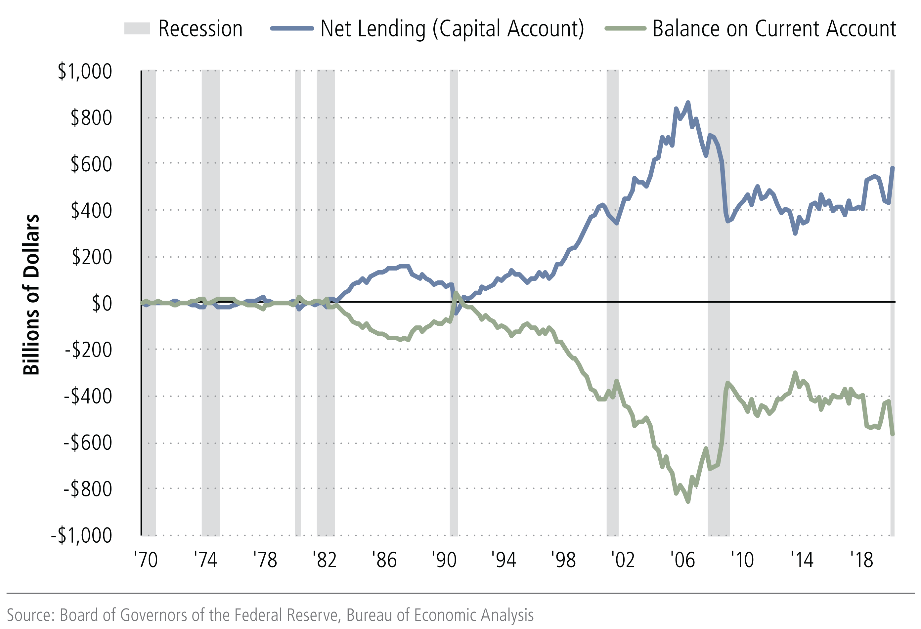

All this capital inflow means that the United States, all other things being equal, can rely on lower levels of domestic savings and higher levels of consumption, thanks to its role as a global savings broker. Savings levels show a capital surplus, an almost mirror image of the current account deficit (Figure 1).

Observers should also take note that the last time the US current account deficit dramatically improved was between 2006 and 2008, but it's hard to argue that Americans enjoyed better economic performance during that time. , when the country and the whole world were mired in a devastating recession.

Investors, far from shunning the dollar, are clamoring for it. Some might say that it is a privilege to be such a sought-after currency, but it is a hard-won privilege by those who represent the world leader in innovation, offer safe and liquid assets and boast a reliable legal system.

Anyone who argues that the dollar is going to take a beating must also explain which destination for global capital would be more attractive than the United States.

The dollar remains more dominant than ever

A. RESERVES AND LOANS

Dollar skeptics may not accept it, but it is a truly global currency that everyone uses, sometimes preferring it to their local currency. Foreign investors keep their savings in dollars, and companies take out loans in dollars. It makes sense: why take on additional currency risk when a common currency can be used?

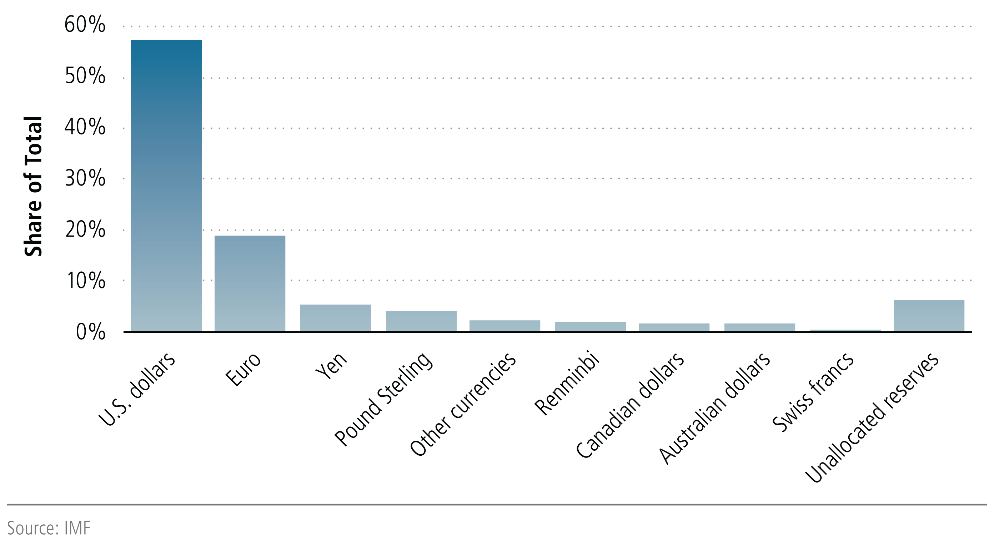

For example, official foreign exchange reserves are predominantly in dollars (Figure 2). That picture hasn't changed much over the past 30 years, and even today it's still a good idea to keep a few dollars on hand to secure your payment balance.

On a global level, loans are also made mainly in dollars. As an indicator of global funding, according to estimates by the Bank for International Settlements, non-U.S. Banks held 13 trillion in U.S. dollar-denominated debt at the end of 2019. Since 2008, European banks have reduced their dollar liabilities as a result of the global financial crisis, while Chinese, Japanese, Taiwanese, Canadian and British banks have increased them.

B. ESCAPE TO THE DOLLAR

The financial crisis of March 2020 highlighted the vital role of the dollar. With the outbreak of the pandemic, investors panicked and took refuge in the US dollar rather than fleeing it.

For individual savers, this has meant more cash on hand or in bank deposits; for corporations, it has meant drawing on credit lines and increasing bank deposits. But holding dollar-denominated assets wasn't enough: Treasury bills aren't edible after all. What interests global investors is the ability to meet payments, hence the need for cash (or, more modernly, bank deposits) and, consequently, the sale of Treasuries and the increase in demand for dollars on the markets. monetary.

The spike in base swap FX tells this very story. To finance dollar investments, global investors often "exchange" their national currency (eg the Japanese yen) for the dollar. In turn, the banks provide those dollars as a service. In this sense, the dollar plays a vital role in the global system.

A negative “base” means that borrowing dollars through FX swaps is more expensive than borrowing them on the dollar money market. In March 2020, many investors who held dollars preferred to keep them rather than lend them, and a "dollar crunch" ensued. The cost of dollar loans has skyrocketed. For example, the three-month basis (i.e. the difference between FX swap loans and money market loans) increased to -144 basis points for the Japanese yen, -85 basis points for the euro, -107 basis points for the Japanese yen. the Swiss franc and -62 basis points for the British pound.

Fortunately for the Federal Reserve, there was a solution at hand: with banks unable to procure dollars or unwilling to provide them, the Fed was providing dollars to foreign central banks (e.g. the Bank of Japan), which in turn they supplied local banks. In March, at the height of the crisis, the Fed "traded" $ 400 billion with 19 central banks.

Indeed, what the Fed did in March and April was to provide more dollars to ease the shortage and allay the panic, either by buying Treasuries from cash-strapped traders or by exchanging dollars with the Bank of Japan. In this way, the Fed has played not only the role of the central bank of the United States, but also that of the "global central bank". Therefore, as long as the Fed is willing to back the dollar, it will be difficult for other currencies to undermine its dominance.

What if the future 21st century reserve currency is a digital currency?

Rather than fancy headlines touting the end of dollar domination due to the current account deficit, it may be more productive for investors to consider whether and what might really threaten dollar dominance. Who – or what – will come next? For now, with the United States as the number one destination for global capital and the Federal Reserve willing and able to support the dollar system, the dominant role of this currency appears to be solid.

An intriguing hypothesis is the possibility that undermining the dollar's dominance is not another fiat currency such as the Chinese renminbi or the euro, but a digital currency that would allow investors around the world to deposit their local currency, transactions and settle payments in a new global currency.

In the 21st century, open-source software could provide proof of reserves to ensure investor confidence or perhaps receive central bank support (a central bank digital currency or CBDC).

We doubt that dollar rule will be eternal. After all, history teaches how the British pound ousted the guilder and the greenback itself replaced the pound just a hundred years ago.

However, we believe that, until a viable competitor arrives, the US dollar will remain the global standard; in the meantime, it is good to ignore those who prophesy the doom of the dollar.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-il-dominio-del-dollaro-americano-e-piu-forte-che-mai/ on Tue, 01 Jan 2002 06:16:31 +0000.