Because the ECB excites Unicredit

The ECB Supervision says yes to the Unicredit maxi-buyback. The bank has received the authorization to execute the share buyback program for 2022. The bank's note, the effects on the Stock Exchange and the analysts' comment

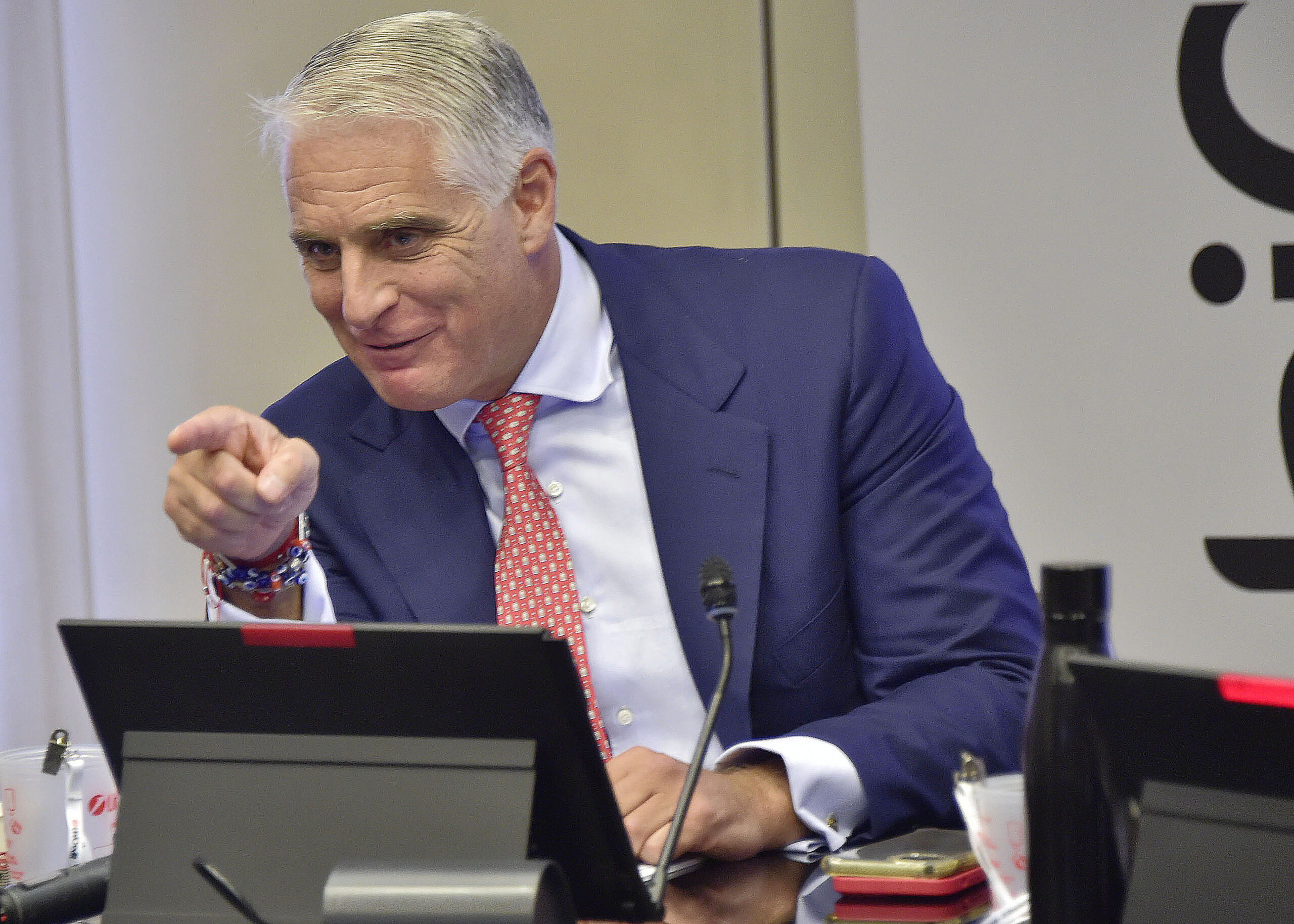

The European Central Bank has given the authorization to Unicredit for the execution of the buy-back program for 2022 for a maximum amount of 3.343 billion euros. A decision that comes despite the difficult moment for the markets and the banking sector, and which confirms – the analysts underline – the solidity of the group led by the CEO, Andrea Orcel .

THE COMMENT OF SOLE 24 ORE ON THE ECB AND UNICREDIT

"It was an expected green light, the one that arrived yesterday from the inspectors of the European Central Bank – Il Sole 24 Ore underlined today – But it is still the confirmation of the appreciation by the top management of the Banking Supervision Mechanism of the bank's solidity".

ECB EFFECT ON THE STOCK EXCHANGE FOR UNICREDIT

Yesterday afternoon, the news had an impact on the Unicredit stock which came to light in Piazza Affari, marking the best performance among the Milanese blue chips at the end of the day with an increase of over 4%.

THE DECISION OF THE ECB

The approval, according to a statement from the company, is based on financial information provided by the bank, which highlighted significant solidity of capital levels and organic capital generation at the top of the sector. Together with the consistency of the liquidity position, these elements ensure that the company can face stress scenarios from a position of strength. The valuation took into consideration a capital trajectory with conservative assumptions and updated macroeconomic scenarios.

WHAT CHANGES FOR SHAREHOLDERS

Together with the proposed dividend, this results in a total distribution to shareholders for 2022 of €5.25 billion: a 40% increase compared to 2021. This underlines UniCredit's commitment to deliver meaningful and sustainable returns for shareholders, while maintaining at the same time a robust capital. UniCredit's CET1 ratio, pro-forma for distribution, is in fact equal to 14.9% at the end of the year 2022 and a further increase is expected in the first quarter of 2023.

THE OBJECTIVE OF THE SHARE BUYBACK PROGRAM

The launch of the treasury share buyback programme, as well as the dividend for a maximum of 1,906,562,000 euros, depend on the approval by the company's shareholders at the shareholders' meeting called for 31 March.

The objective is to carry out the buyback of treasury shares in two tranches, the first of approximately 2.34 billion euros to be launched as soon as possible after the approval of the Shareholders' Meeting, while the second tranche of approximately 1.0 billion euro is expected to start in the second half of 2023, shortly after the completion of the first tranche.

STOCK EXCHANGE PERFORMANCE AND SCENARIOS FOR UNICREDIT

"In short, UniCredit receives the "yes" to the share buyback, a functional operation to support a share price that has soared in recent months and to increase the overall remuneration for shareholders – remarked the newspaper Sole 24 Ore – The title of the bank led by Andrea Orcel has gained around 80% in the last 6 months. Together with the proposed dividend, the buyback results in a total distribution to shareholders for 2022 of €5.25 billion, an increase of 40% compared to 2021.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/bce-buyback-unicredit/ on Wed, 29 Mar 2023 05:07:38 +0000.