Because the Fed and the ECB won’t have a soft landing

Moves and prospects for the Fed and the ECB. The analysis by Katharine Neiss, chief European economist of PGIM Fixed Income

As expected, the ECB left rates unchanged at 4% and maintained a hawkish tone in its latest press conference . President Lagarde noted that domestic inflationary pressures remain too high, particularly in the European labor market. The main news of today's meeting was the announcement of the ECB's plans for reinvestments of its PEPP (Pandemic Emergency Purchase Programme), which will result in an acceleration of the liquidation of its balance sheet in the second half of 2024. This change should contribute to tighten financing conditions in the euro area. Although the ECB's growth and inflation projections have been revised downwards, they continue to point to a "weakflation" environment, with GDP growth below potential and inflation above the target for 2024.

OUR OPINION ON THE MEETING

At first glance, the announcement of an early end to PEPP reinvestments and therefore a faster pace of balance sheet clearance would indicate that the ECB Governing Council is still in “policy normalization mode” and not yet in the process of easing . However, we believe that the market could interpret this choice as a shift towards a dovish attitude. First, the latest announcement involves a more gradual divestment plan than many in the market expected. Second, the pre-announcement of PEPP outflow plans, which can now take place in the background, paves the way for the ECB to reduce rates more nimbly if necessary.

When asked about the prospects for rate cuts, President Lagarde made it clear that it is too early for the Governing Council to lower its guard on inflation. When asked explicitly whether the cuts had been discussed at the monetary policy meeting, he replied “no”. We placed relatively little weight on this signal, as we were told that the end of PEPP reinvestments had not been discussed in a previous meeting. This suggests that, if facts were to change, the ECB would be responsive. Indeed, it is possible to hypothesize a scenario of strong deterioration in economic activity in the euro area which would lead the ECB to cut rates early and aggressively in 2024.

However, this is not our base case scenario. We believe that the eurozone economy will move essentially sideways, with GDP growth expected to stand at 0.5% in 2024. This would suggest that the data available so far is not sufficient to induce the ECB to react with of cuts. In our view, however, the ECB will want to see evidence of lower inflation, weaker wages and reduced profit margins before it has the confidence to cut rates. As Lagarde pointed out, this evidence will likely only be available after the first half of next year. This makes the third quarter the earliest that cuts could be made. Our base case assumes that the ECB cuts rates by 50 bps in the fourth quarter of 2024 and that rates fall again to 3%.

MARKET REACTION

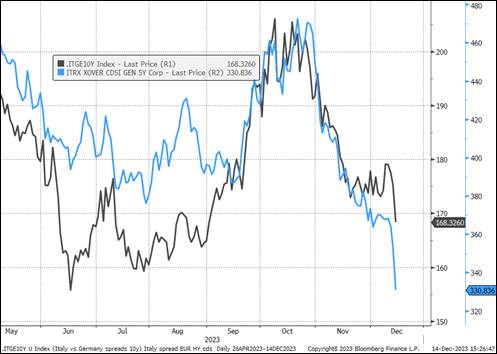

The message of the press release from the ECB and President Lagarde during the press conference had clear hawkish elements. However, in many respects it also seemed more balanced, as if to lay the foundations for a transition towards easing if the data continues to hold up at the start of the new year. From a market perspective, this meant that bonds and risky assets followed suit with the more dovish tone set by the Fed the day before. As a result, German government bond yields fell sharply, while risk assets, such as euro corporate bond spreads and euro sovereign peripheral spreads, tightened significantly (Figure 1).

The Italy vs Germany 10-year spread and HY EUR CDS spreads have narrowed

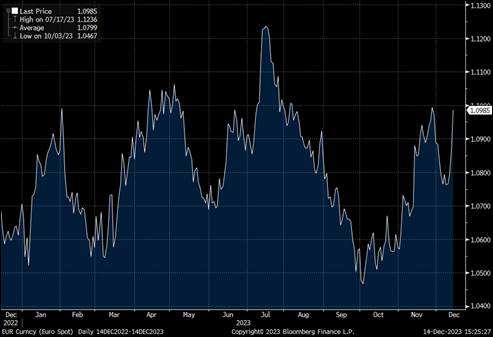

The fact that risky assets and, especially, peripheral bonds have surged strongly supports the idea that investors feel comfortable using the Fed's example as a green light, at least in the short term. The news that the ECB intends to reduce the PEPP by €7.5 billion per month was probably not a big surprise and does not appear to have reduced risk appetite for euro assets. If anything, it could be seen as paving the way for further cuts. The most obvious way to gauge a differentiated market reaction to the Fed's more dovish stance relative to the ECB is found in the currency market. The euro has clearly appreciated against the US dollar, signaling that investors view the Fed as a more immediate candidate for interest rate cuts (Figure 2).

EURUSD appreciated after the Fed and ECB meetings

Longer term, the key question is how much room there is for bonds and risk assets to rally. Rate markets had already expected almost 100bps of cuts from the Fed before their meeting and almost 150bps from the ECB. After both monetary policy meetings, even bigger cuts were priced in. Risky assets followed the same pattern. The underlying narrative has been reduced to that of a “soft landing”. While plausible, we believe this is a very optimistic hypothesis, based on rapid disinflation without production costs. Both hypotheses are questionable. After all, the disinflation we have seen in the United States has been driven mostly by energy and goods prices and much less by services. The same applies to the euro area. And there is also a lot of uncertainty about growth prospects. For this reason, in our opinion, an environment of weak growth and persistent but declining inflation is more likely. We do not believe this is consistent with the aggressive cuts expected by the ECB or the Fed.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-fed-e-bce-non-faranno-un-atterraggio-morbido/ on Sun, 07 Jan 2024 06:26:01 +0000.