Because the Fed anticipates the first rate hike to 2023

What the Fed will do. The analysis by Paolo Zanghieri, senior economist at Generali Investments

The Fed is showing more confidence in the positive signals coming from the economy. In a surprise move, he brought the hike date forward to 2023 and expects two rate hikes in that year.

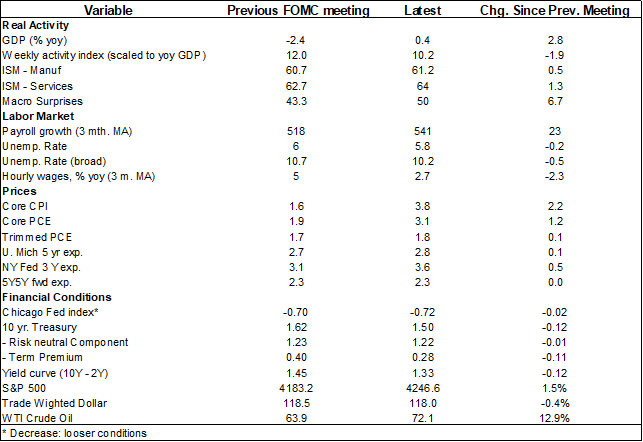

This increased confidence was also seen in the tone of the press release: the reference to the past slowdown in the pace of the recovery was replaced by a strong focus on strengthening the economy. Significantly, the statement acknowledged that inflation is no longer running below 2%.

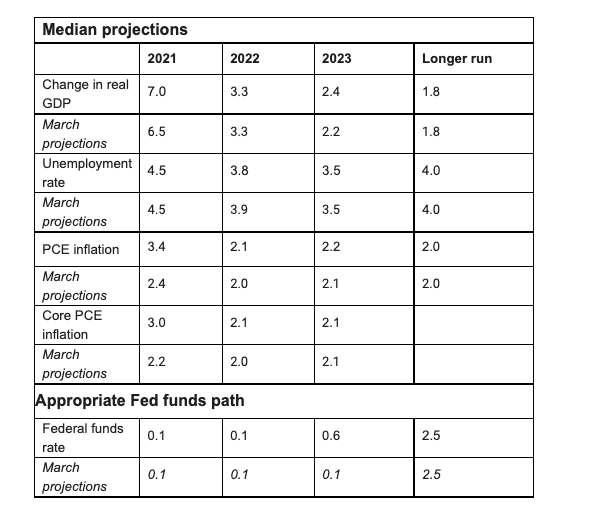

The FOMC expects a stronger rebound this year and higher inflation than expected in March. To a large extent, this represents a marking to market with respect to recent data, with no repercussions on the 2022 and 2023 forecasts. The end of fiscal support will slow growth, which in any case will remain well above the potential 2%.

Inflation should then return to a slower dynamic, remaining just above the 2% target in both years. By 2023, with unemployment back to the 10-year low of 3.5% reached just before the outbreak of the pandemic, the conditions for take-off will therefore be met.

President Powell tried to downplay the appearance of the dots, indicating that two years is a long time and that discussing a rate hike in practice remains premature. Furthermore, the dots are limited predictors of the Fed's actual moves.

The change in the outlook for Fed funds rates was not accompanied by any clear signals on tapering. In any case, President Powell admitted that at this meeting the FOMC initiated the discussion on tapering. The substantial progress needed to cut asset purchases has not yet been achieved, but there is growing confidence that the economy is heading in the right direction. However, even greater clarity on timing requires more data; we continue to expect more information to be revealed at the Jackson Hole meeting (August 26-28). Considering the rosiest prediction painted by the Fed, details on tapering will likely be released at the meeting on September 22.

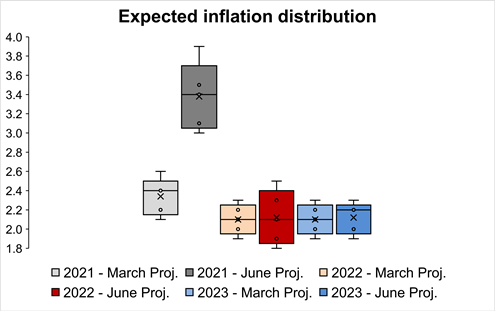

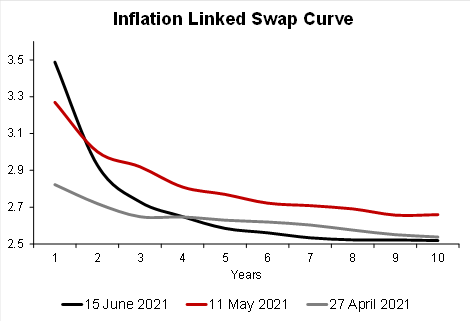

Most of the Q&A session was devoted to providing details on inflation and employment forecasts. As for inflation, Powell insisted that while the strength of the April and May charts was surprising, the FOMC view remains unchanged. When the economy has normalized, the structural factors that have moderated inflation over the past decade will become more visible, and the dynamics will be entirely influenced by the improvement in the labor market. The distribution of FOMC members' views on inflation shows a rather high degree of confidence in this outcome. The financial markets are also showing more and more convinced of this vision.

According to President Powell, long-term inflation expectations have started to rise again and are now “well under way”, consistent with the 2% inflation target. The risk of them showing signs of disengagement is not excluded, but there is currently no evidence of this. The move from zero to two peaks in 2023 can be read as a way to demonstrate the Fed's commitment to avoiding slippage in inflation.

The labor market continues to evolve towards full employment, but, as President Powell pointed out, the economy is still a long way from that, both in terms of aggregate outcomes and the distribution of job growth across groups. President Powell highlighted the role of labor market participation in defining what the Fed sees as full employment.

More in the short term, the Fed expects very strong and fast progress in job creation, looking through bottlenecks and "speed limits" due to skills mismatch. Rapid employment growth is not yet accompanied by worrying pressures on wage levels.

Finally, the FOMC increased the IOER and RRP rates by 5 basis points (to 0.15% and 0.05%). Powell said the Reserve Repo facility is doing a good job of keeping the money market running smoothly.

Markets were taken aback by the evidence of a less patient Fed. The 10-year Treasury rate gained 0.06 basis points at the time of the announcement, reaching 1.56%, with more rapid upward movements at the end of the curve. The S&P fell 0.6%, pushed lower by tech companies.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-la-fed-anticipa-al-2023-il-primo-rialzo-dei-tassi/ on Thu, 17 Jun 2021 12:27:39 +0000.