Because the Fed’s run will be a challenge for the ECB

Moves and scenarios on the Fed and the ECB. The economic report of the Confindustria study center

What has the Fed changed?

In the document on the new Fed monetary policy strategy, there are two formal changes: to bring inflation to + 2.0% in the medium term, no longer on time in the short term; react to the shortage of employed compared to the maximums (ie high unemployment), not to a possible excess. Furthermore, the difficulty created by the lower bound of zero on rates and the importance of preserving a stable financial system are recognized.

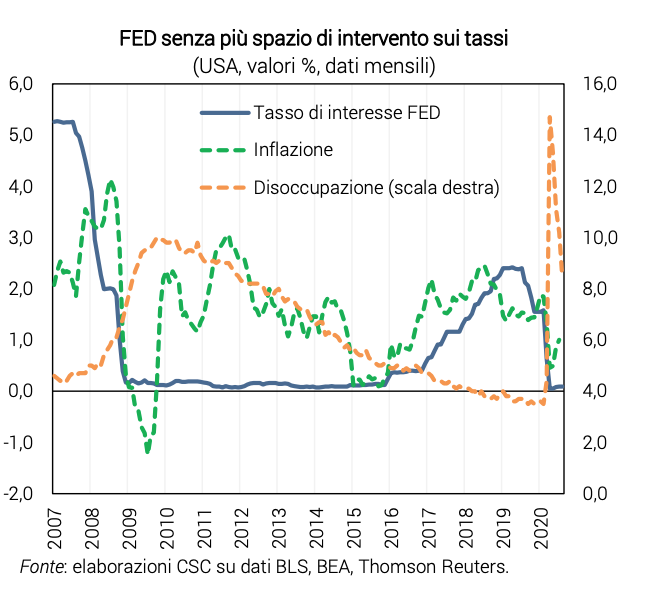

Rates already at a minimum.

Prior to the onset of the pandemic in mid-2019, the Fed had already used some of the policy rate room. Then, in March 2020, it cut the rate back to zero. Now on this tool he no longer has room to stimulate the economy. This is also why the Fed wanted to send an expansive signal to the markets, with the revision of its strategy. The ECB is in a similar situation. For this reason, both institutions use and have used a lot of “unconventional” instruments, such as QE which acts on medium-long term rates.

Inflation too low.

In recent years, US inflation (+ 1.5% the PCE measure in 2019) has often remained below the central bank's target, set at + 2.0% per annum, a value that the Fed has not changed even now. With the crisis, the dynamics of prices further slowed down, falling to + 1.0% in July. In the Eurozone, inflation in recent years has been even lower and slipped to -0.2% per annum in August.

Pre-Covid Employment Online.

Before the economic crisis caused by Covid, the US unemployment rate was at its lowest (3.7% in 2019), below the long-term value estimated by the Fed (4.1%). Then it jumped to over 14%, but quickly returned to 8.4%. The Fed now seems to be saying it no longer wants to worry if unemployment is too low (as in 2017-18, when it raised rates), but only if it is too high.

Possible implications in the US.

Powell's speech in Jackson Hole , also on August 27, added some nuances of meaning. The most probable scenario, for the medium term, is that in the US: more inflation will be tolerated than in the past, because a few years above + 2.0% will be in line with the new target; employment will be considered more relevant than prices in situations such as the present (low inflation, high unemployment), when expansionary measures are needed. Various analysts hailed the Fed announcement as the “end of obsession” with inflation, which has dominated monetary policy for decades.

How will the ECB respond?

The Covid-19 crisis led the ECB to postpone the review of its strategy , which started at the beginning of 2020 with the establishment of Lagarde. Various analysts and the CSC had proposed to look at inflation “on average at + 2%, over a longer horizon” as a move to help the economy: it would allow for a postponement of a rate hike and fuel inflation expectations. Furthermore, more explicit support for employment and economic growth would be desirable.

But the ECB is not the Fed.

A crucial difference is that the ECB has price dynamics as its sole objective, although in its analyzes it is also attentive to GDP and employment (and these variables are usually correlated). Furthermore, the ECB has an asymmetrical definition of the inflation target, “just under + 2%”, while the Fed definition was already symmetrical (around + 2%). In addition to this, the Eurozone is a monetary area that is not very homogeneous within it, not a federal state like the United States, which often complicates the choices of the ECB.

Adverse consequences via the exchange rate?

If markets perceive the Fed as structurally more expansive than the ECB, the dollar would tend to weaken against the euro. This would act, via less exports, to the detriment of growth in the Eurozone. The first reaction of the exchange rate was, in fact, a weakening of the dollar (from 1.18 to 1.20 per euro), although along a trend that has already been underway for some months.

We need a quick move from Frankfurt.

The financial and monetary markets of the USA and the Eurozone are very integrated and the economies rather interdependent. This makes it essential that the ECB act quickly and courageously also on the revision of the monetary policy objectives in the medium term, in an expansionary key.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-la-corsa-della-fed-sara-una-sfida-per-la-bce/ on Sat, 12 Sep 2020 05:38:51 +0000.