Because the pandemic drives oil prices

The oil market is very fragile, and barrel prices are breaking record after record. The article by Azzurra Pacces for Rienergia

In these two years of the pandemic it has shown great flexibility and coordination, but now the delicate mechanism that made the oil market work is starting to creak, and it is not clear whether the crunches are the result of the transitory uncertainty of the times or arise from structural reasons, on which it would be good to intervene as soon as possible.

However, it is clear to everyone that the price of oil is breaking record after record, with Brent traveling “in the time of cholera” towards 90 dollars a barrel; that crude oil and fuel consumption are returning to pre-Covid levels at a faster rate than expected and that this year will probably even exceed the threshold of 100 million barrels per day; that the nervousness among producing countries increases, causing fear for the stability of the supply; that the level of stocks of crude oil and products is decreasing from month to month and it is increasingly difficult to count the barrels, because there is more clarity and coordination than usual; that oil companies are less inclined to make “risky” upstream investments, committed as they are to the energy transition and the achievement of environmental sustainability objectives; whereas global refining capacity last year declined for the first time in 30 years, as plant closures were not offset by the start-up of new refineries, and thus new bottlenecks could be created.

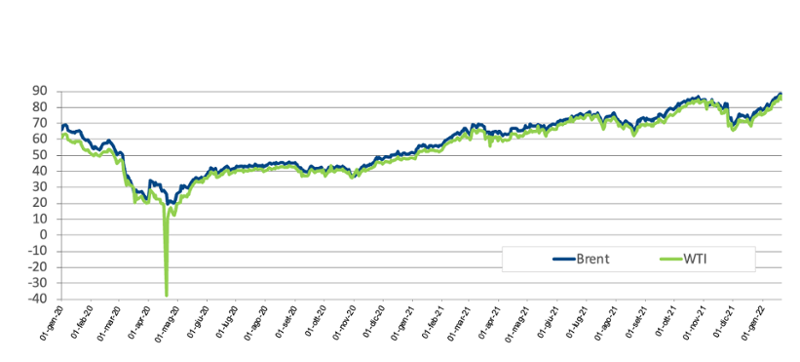

All these elements, put together like pieces of a puzzle, give back the image of a very fragile market. From the lows recorded in April 2020, when the WTI fell below zero and the Brent dropped below $ 20 a barrel, now the oil is heading towards 100, the plateau level of the 2013-2014 two-year period.

A surge that should be avoided in this historical context, especially for Europe which is already dealing with a violent energy crisis, but also for the US struggling with a level of inflation that has not been seen for 40 years. part.

To turn the tables, the Omicron variant arrived in December, with its limitations before Christmas, which once again froze the projections on fuel consumption, in particular jet fuel. Last month, in fact, barrel prices were very unstable.

From the beginning of 2022, however, the variant of the virus is less scary and therefore the arrow of the Brent graph points without real hesitation upwards, helped, on the one hand, by geopolitical tensions, with Yemen attacking the United Arab Emirates and Russia which is making claims on Ukraine; on the other, by the new monetary policies that central banks around the world have announced. To deal with runaway inflation, this year the Fed and the ECB will put in place restrictive measures, such as the increase in interbank interest rates, and this new policy will also have its effects on the euro / dollar exchange rate, making crude oil prices and even more unpredictable products.

However, major business houses, from Goldman Sachs to Morgan Stanley, estimate that the price of oil will go up again. And these bullish forecasts outweigh the cautious ones numerically because, while the demand for crude oil and products is returning faster than expected to pre-pandemic levels, the supply seems to be struggling to adjust to the rebound: as stated in the latest AIE report, also in December, OpecPlus did not produce as much as it could have.

What's more: the international energy agency raises doubts as to whether the Kremlin will ever be able to produce as much as its quota will be allocated, that is, 11 million b / d, given that before the pandemic the Russian offer reached the maximum at 10.6 million b / g and that the production of GazpomNeft and Rosneft has already dropped significantly last year.

So – as always – Saudi Arabia is the only one that can intervene for a timely and calming increase in production, together with its allies in the Gulf.

But after the Yemeni Shia attack on the Emirates, the tangle of interests within OpecPlus has become terribly tangled. Saudi Arabia and Iran are at loggerheads just now that a new OPEC general secretary, Kuwaiti al Ghais, has taken office. So much so that the doubt arises whether or not the latter will be able to preserve the legacy of his predecessor Barkindo, the one who created the conditions for the birth of OpecPlus, more than five years ago.

To the problems of OpecPlus, there are political instability in Libya and Ecuador, the riots in Kazakhstan, the maintenance of upstream plants in Nigeria, the North Sea and the Gulf of Mexico, in short, all those unknowns that the oil market it is cyclically called to face. With the difference that today it appears more "disunited" than ever.

As further proof, in December, the two main consumer countries, the United States and China, independently decided to release stocks to calm the price of oil, relieving the IEA from one of its most important functions: precisely to coordinate the release of strategic stocks between OECD countries, when the conditions arise, as happened most recently on the occasion of the deposition of Gaddafi in Libya in 2011.

That spirit of unity and collaboration of April two years ago seems to have been lost in the mists. Then all the producing countries, including the United States, unanimously decided to withdraw more than 10 million barrels a day from the market to avoid the free fall of barrel prices.

Unfortunately, as always happens, the rise in oil prices has awakened the greed of producers, creating divisions. And instead – even more so now that the pandemic is not completely eradicated – that united spirit should be found, to restore balance to the oil market and help central banks to combat the specter of inflation and its alarming economic and social repercussions.

“Wisdom comes when it is no longer needed”, wrote the Nobel laureate Gabriel García Márquez in the cult novel “Love in the Time of Cholera”. It is hoped that this is not true for the OpecPlus producer countries, which during the next meeting on February 4th could also decide together to speed up the timing of the production increase, putting a stop to the return of Brent to 100.

(Extract from an article published on Rienergia; here the full version)

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/petrolio-andamento-brent-wti/ on Sun, 30 Jan 2022 07:30:16 +0000.