Because the turbulence in the banks will not be the same as in 2008

The turbulence in the banking sector will shake the economy, but will not lead to a repeat of the events of 2008. The analysis by Arun Sai, Senior Multi Asset Strategist, Mickael Benhaim, Head of Fixed Income Investment Strategy & Solutions and Patrick Zweifel, Chief Economist of Pictet Asset Management .

Cheap money dulls judgment. It transforms meticulous accountants into intrepid risk-takers and induces usually scrupulous companies to take actions they would otherwise avoid. But it is only when there is a sudden rise in interest rates that the price to pay for these exuberance becomes clear. From this perspective, the collapse of some regional lenders in the United States and the acquisition of Credit Suisse are inevitable events and not anomalies. Everyone knows that when central banks initiate monetary tightening, a reckoning looms for the economy.

IT'S NOT LIKE 2008

Nonetheless, it would be a mistake to predict a new financial crisis similar to that of 2008. Economic growth will slow down, perhaps even significantly. Still, the chances of a credit crunch appear remote. One encouraging factor for investors is the fact that regulations introduced following the collapse of US bank Lehman Brothers more than a decade ago have significantly strengthened the foundations on which the global banking system rests.

Non-performing loans (main cause of the 2008 crisis) will always cause problems to raise rates. However, now, they no longer weigh down bank balance sheets as they once did.

In Europe, with the introduction of tighter capital requirements, banks have reduced non-performing loans from around €1 trillion a decade ago to less than €350 billion today, a share equivalent to less than 2 % of total loans. Furthermore, the same banks also appear healthy under other parameters.

Data from the European Banking Authority shows that banks' liquidity coverage ratios (i.e. the amount of highly liquid assets held by banks in relation to expected deposit withdrawals over a 30-day period) average 162%. for the whole region, against a mandatory level of 100%. Barclays data shows that, meanwhile, the loan-to-deposit ratio in the US banking sector has fallen overall to 70% (from around 95% in 2007-2008).

THE REFERENCE FRAMEWORK FOR BANKS

Improved strength of banks' balance sheets is not the only positive legacy of 2008. The underlying framework for the global banking sector has also greatly improved.

Burnt by the experience of the sub-prime mortgage crisis, Central Banks have turned into shrewd managers of the financial system. Guided by the US Federal Reserve (among the first to recognize the limits of conventional monetary policy in containing financial risk), the world's main central banks have granted the market an incredibly wide range of anti-crisis tools.

Quantitative easing, forward guidance and concessional lending to banks (such as the Fed's recent $300 billion Bank Term Lending Program) have been implemented alongside the purchase of corporate debt, bonds and stocks.

Arguably, there is no limit to what central banks can do to safeguard the financial system if they work in synergy with national governments. If the collapse of Lehman Brothers was the darkest moment for policymakers, UBS's takeover of Credit Suisse should put them in a much more favorable light.

RISKS TO THE ECONOMY

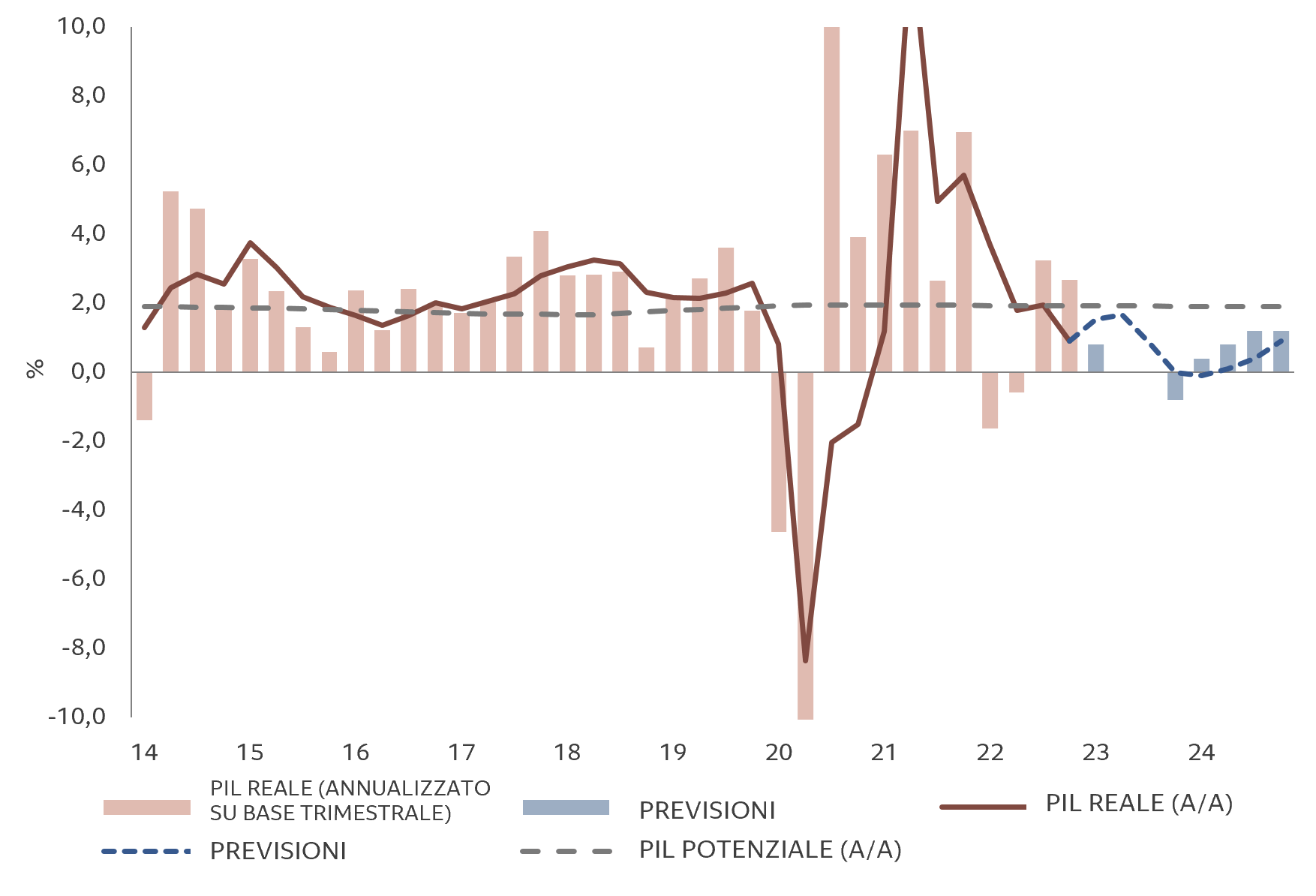

But that doesn't mean that the economy will emerge unscathed. Consumer and business sentiment will inevitably feel the consequences of the banking sector's frantic reactions. The granting of bank loans could also slow down significantly. These reasons prompted us to cut our GDP growth forecasts for the global economy for 2023.

One economic risk that could emerge from the Credit Suisse acquisition is the decline of the Additional Tier 1 (AT1) bond market, a source of funding relied upon by banks around the world. Its future was called into question as holders of AT1 bonds issued by Credit Suisse saw their investments unexpectedly vanish as part of the deal that eventually led to the takeover by UBS. These bonds were introduced following the 2008 global financial crisis to prevent any banking sector bailouts from being financed by taxpayers.

These bonds paid investors high coupons precisely because they carried the risk of being converted into equity in the event of a financial restructuring. With interest rates at historic lows, AT1s had been a huge hit with investors and banks, growing this market to nearly $300 billion. However, the write-off of Credit Suisse's AT1 bonds could have detrimental consequences. At the very least, it could in fact prompt investors to ask for higher coupons on this type of debt, thus increasing the funding costs of banks. This, in turn, could lead to a reduction in lending, exacerbating an already existing trend, particularly among small and medium-sized US banks. Any further cuts in this area are likely to reduce the supply of credit to small businesses and households, which typically rely on local banks, and this could have serious economic repercussions.

Banking sector concerns could also negatively impact consumer and business sentiment. Any loss of confidence is likely to impact consumer spending and business investment, as both households and businesses will tend to keep the savings accumulated during the pandemic.

THE TREND OF THE GDP

Some investment banks, such as JP Morgan, have signaled that the recent banking turmoil could reduce GDP growth by up to one percentage point over the next two years. In our view, the economy should prove a bit more resilient, not least as the Fed will likely respond to the financial tightening by lowering its expected terminal rate this cycle.

In any case, this represents an economic obstacle that could have repercussions on the financial markets in the short term. For their part, investors should prepare for a change in market dynamics.

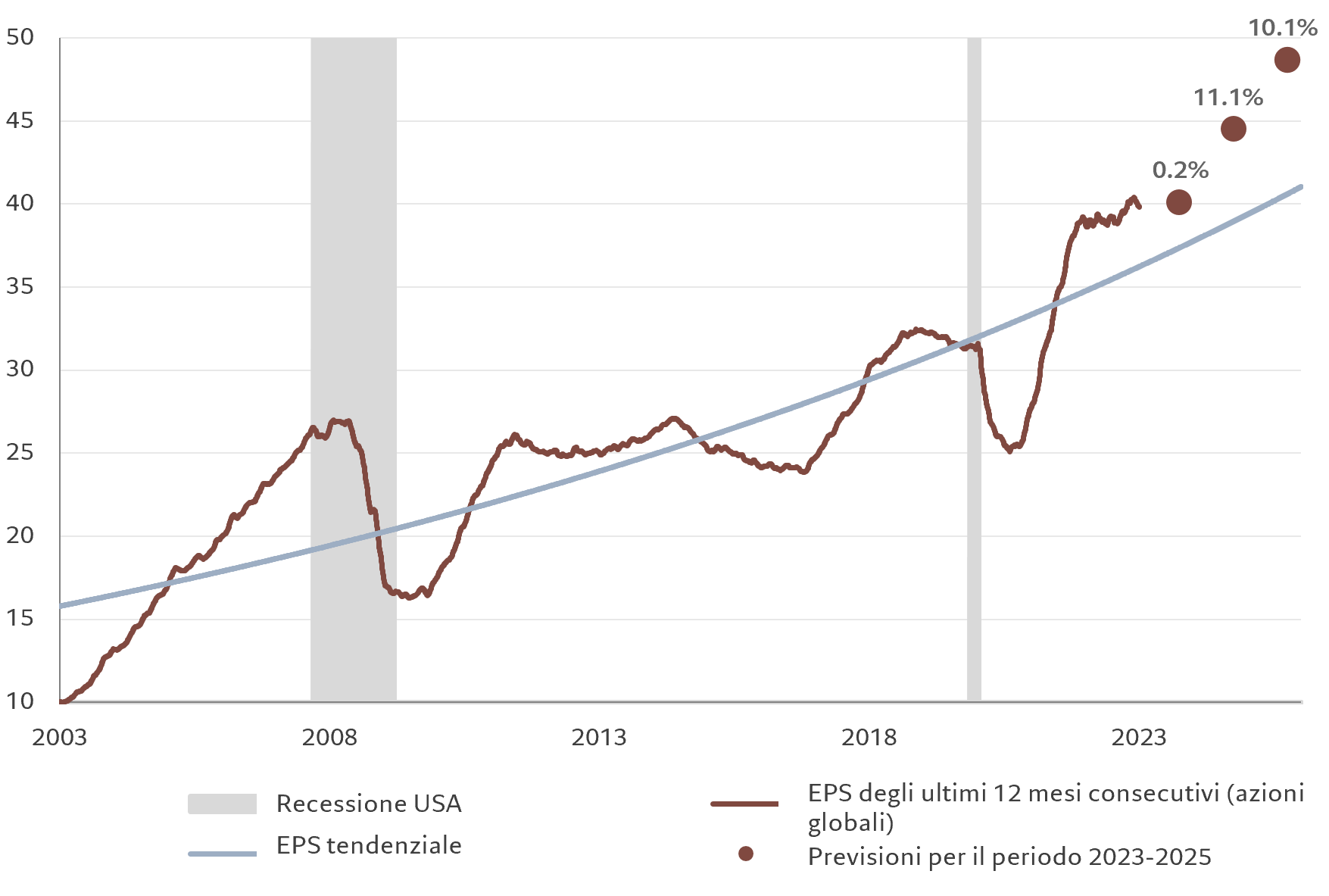

Small cap and cyclical stocks appear particularly vulnerable to further correction, as do riskier bonds such as high yield debt. None of these asset classes sufficiently discount the likelihood of further deterioration in economic conditions. Conversely, quality stocks (companies with solid revenues and therefore less sensitive to fluctuations in the economic cycle) should hold up well. Government bonds could also rally. It is therefore likely that markets are about to suffer further shocks as the economic climate deteriorates. However, the current banking turmoil in the US and Europe should not lead to major financial distress.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/banche-turbolenze-confronto-2008/ on Sun, 23 Apr 2023 05:36:31 +0000.