Because the world economy is returning to normal

The analysis by Richard Flax, Moneyfarm chief investment officer

The economic recovery that is taking place in most of the developed countries makes the debate about the duration of this transition period alive. Consumers have accumulated savings during the lockdown period and are now supporting demand, putting pressure on prices, especially in those sectors most affected by the lockdown measures (hospitality, leisure and automotive). At the same time, labor shortages persist, as well as government aid for workers.

However, these inflationary trends are likely to subside over time and supply curves are likely to shift to meet demand, defusing further price increases.

The key themes affecting the financial markets remain broadly unchanged from the end of the first quarter. The progress of the recovery is still largely driven by the speed and effectiveness of the global vaccine launch, value stocks are still underperforming growth stocks (despite the turnaround that occurred for a few weeks during the quarter) and the main concern for central banks is still inflation.

If the first quarter laid the foundations for a post-Covid economy, the second quarter marked a decisive step towards normalization. There is always likely to be turbulence in an unprecedented situation like the one we are in, but with the reopening of economies and the impact of vaccines, the outlook is much brighter than it has been in the past year and a half.

THE LAUNCH OF VACCINES CHANGES THE PERSPECTIVES

To see what the actual scope of the vaccination campaign will be in Europe, it may be useful to look at the situation in the UK, a couple of months ahead of the EU as regards the vaccination plan. The country has approximately 70% of the adult population fully vaccinated, and nearly nine out of ten adults have had at least one dose. However, in the UK we currently find the highest rate of Covid-19 infections in Europe (with a number of tests much higher than the average in other countries also thanks to the distribution of free do-it-yourself swabs). This discrepancy is explained by the fact that the government has just sanctioned the almost complete revocation of the social distancing mandates. With the majority of the elderly and vulnerable population fully vaccinated, the direct link between number of cases and hospitalizations and deaths appears to have been (at least partially) broken. This results in the complete resumption of normal commercial practices. If the vaccine continues to disrupt the relationship between the number of infected and hospitalized people, we can expect a practically normal autumn in most of the Western world.

CENTRAL BANKS AT THE CENTER OF THE SCENE

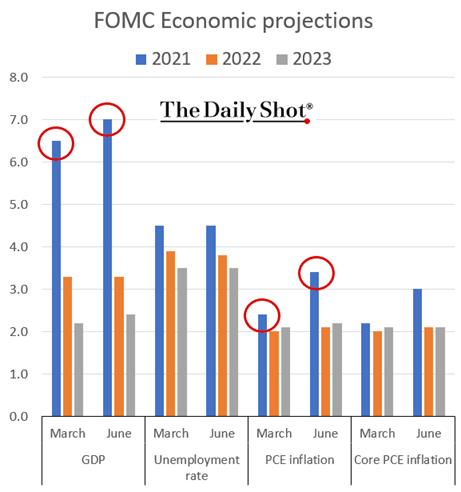

Despite improvements in the global health situation in the second quarter, the threat of higher-than-expected inflation remains the guest of stone. Price growth is a feature that is common to most of the countries that have come out of quarantine. It is in moments of radical monetary policy that financial markets tend to dance to the notes of the Fed and the ECB. The main signs that emerged in the second quarter are that interest rates could rise sooner than expected, due to inflation and growth prospects being revised upwards. The last meeting of the Federal Reserve showed a slight change of course with reference to the forecasts linked to the increase in interest rates. The so-called "Dot Plots" (aggregate forecasts) show two increases in 2023 that were not expected in March. Additionally, President Powell said the Fed is considering initiating discussions on bond purchase tapering.

The Fed argues that the current spike in inflation is largely driven by short-term factors. These include elements such as fuel costs and production bottlenecks which are expected to be temporary and set to be reabsorbed in the coming months. Indeed, there are already signs of a cooling of inflation in the United States. In our view, any changes to interest rates are unlikely to be particularly aggressive, and if the Fed's projections are correct, we do not see the equity market particularly exposed to this risk. That said, the gradual removal of quantitative easing in the coming months is certainly a delicate junction for the markets and needs to be followed with particular attention. Tapering will most likely be reported at the Jackson Hole meeting in August and possibly introduced in early 2022. We remain convinced that the Fed will be cautious and measured in scaling down monetary stimulus and will be able to manage the delicate balance between monetary stimulus and control. of inflationary risks.

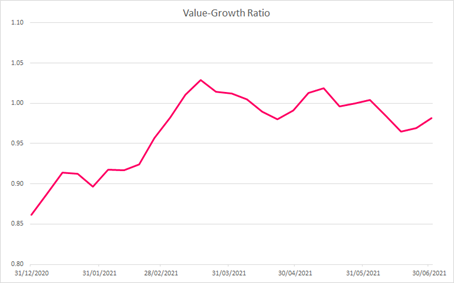

GROWTH SECURITIES OVERCOME VALUE FOR NOW

The month of June was characterized by the outperformance of "growth" stocks compared to "value" stocks in Europe and the United States, confirming a trend observed in the second quarter of 2021. The rotation towards "value" stocks that we saw in the first quarter – in the wake of the U.S. election and vaccine approval in November 2020 – appears to have stalled and, at the same time, long-term yields have narrowed slightly.

European equities also slightly outperformed their US counterparts, in part thanks to the acceleration of vaccination campaigns across the continent. Even after a period of strong recovery, the economic situation is still plagued by uncertainty. Consequently, the strong performance of these stocks raised some questions. Equity valuations were already high six months ago and remain high, although they are still relatively cheap compared to other asset classes.

LABOR MARKET USA IN THE SPOTLIGHT

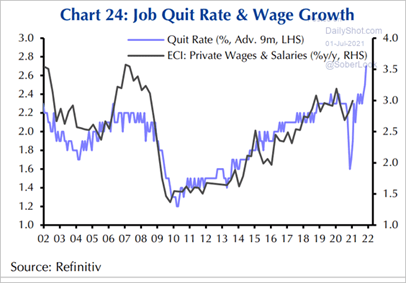

In June, the data that emerged regarding the labor market were ambiguous. Data on "jobless claims" and "non-farm payrolls" indicate that some of the temporary labor shortages are starting to ease. On the other hand, the workforce, up by just 151,000, is still a long way from the pre-pandemic value (more than three million below). This data suggests caution and it is likely that the Fed will use it to justify the expansionary economic policy. The widespread labor shortage that emerges from surveys and from job opening and cessation rates is partly due to transitory factors, including higher unemployment benefits, declining international migration and the wave of early retirements we have experienced. assisted in the last year. In the graph below it can be seen how one of the components listed above, namely the rate of termination of work, tends to be correlated with wage growth.

The pressure these factors will exert on wage rises and ultimately inflation is a hotly debated topic and we believe it has the potential to influence the pace of action at which the Fed moves. Should the labor market recover more quickly than expected, the central bank would have one less argument to continue with the hyper-expansionary policy.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-economia-mondiale-sta-tornando-alla-normalita/ on Sun, 08 Aug 2021 06:41:32 +0000.