Because there is a perfect storm for the West on raw materials

Sanctions against the world's largest supplier of raw materials can threaten the financial stability of the entire West. The analysis by Ole Hansen, head of commodity strategy for BG SAXO

The swings in the markets continue after Russia invades Ukraine. At the center of attention remains the commodities sector, where increasingly severe sanctions by parts of the United States and the European Union have triggered the launch of a large number of self-sanctions with the aim of stopping the supplies from Russia. Obviously this scenario has impacted the cost of numerous key raw materials from gas and oil to several industrial metals and key crops such as wheat. Ukraine, often called the granary of Europe due to its vast fertile lands, also faces the breakdown of supply chains with closed ports that effectively block the export of key food products such as wheat, barley and corn. .

The large amount of self-sanctions contributes to a climate in which the raw materials produced in Russia are treated as toxic and as such as not to be touched. The latest example of this trend was Shell's announcement earlier in the week, which halted all spot purchases of Russian crude oil. A decision that comes in response to the uproar and criticism following the operation of the same company that last Friday bought a shipment of Russian crude oil at discounted prices.

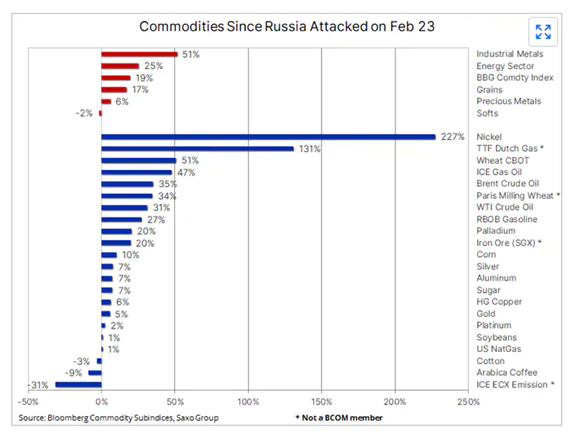

As a result of these developments, the cost of individual materials has skyrocketed again, as shown in the table below.

On gas and oil, sanctions on Russia and self-sanctions are causing an increase in the price gap between the “offline” Russian product and raw materials from other producers. These developments lead us to the next and increasingly dangerous stage where sanctions against the world's largest commodity producer could undermine financial stability in the West.

In this context, some observers are wondering if there are sufficient collateral and credit for the margin call. The most insistent question is: what happens to commodity futures trading if players fail?

In any case this is the phase we have entered and whether you are long Russian or non-Russian commodities, whatever short futures position you hold, you will need strong margin to hedge your exposure.

Commodities typically tend to trade relatively quietly with price fluctuations determined by supply and demand prospects as well as speculative interest between individual commodities.

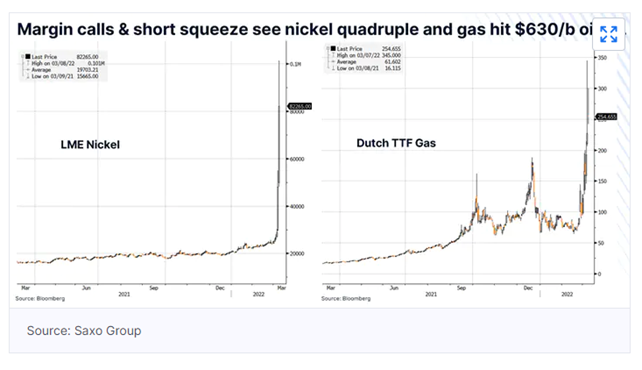

What we have seen in recent weeks has shocked the markets and, suddenly, producers who hedged, or sold futures to cover future production of metals, energy and agricultural commodities, were increasingly caught off guard with trading in these futures which have required more and more collateral to prevent their short positions from being blocked.

In recent days, these mechanisms have driven the price of gas in Europe to reach a price of $ 630 per barrel of crude oil equivalent – these dramatic movements are unlikely to be driven by speculators. If anything, it was the same insiders who tried to manage their revenues through the use of futures to offset price movements and block earnings on future production.

A scenario, therefore, complex for financial stability in the West which sees numerous stocks face significant losses due to margin call requests for companies that are usually very profitable: a situation that, until resolved, will continue to cause a strong market volatility.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-sulle-materie-prime-ce-una-tempesta-perfetta-per-loccidente/ on Sun, 13 Mar 2022 07:00:30 +0000.