Because there is no Italy risk

Analyzing the macro data underlying the spread, it can be seen that the Italian numbers are no worse than those of other peripheral European countries. The analysis by Michele Morra, Moneyfarm Portfolio Manager

Italy's debt reliability has played a central role in the political debate of recent years.

One of the main tasks of every government is to represent the country, at the international level, as a reliable economic entity capable of managing its finances in a responsible manner, a task that is now more fundamental than ever in light of the risk of financial crisis and high stock of debt, which exceeded 150% of GDP during the pandemic. With the reversal of monetary policy and the gradual removal of ECB coverage (which in recent years has been the main buyer of Italian public debt), it is necessary to clarify whether or not Italy is exposed to the risk of a new crisis. financial and how the upcoming elections can affect this eventuality.

Spread effect: how it works

When investors begin to have doubts about a country's ability to repay its debt, demand for government bonds decreases and the cost of debt service increases, as the government must pay a risk premium on its debt to attract investors. government bonds issued. As regards Italy, this premium is generally expressed through the spread between the BTP and the Bund, or the differential between what the German state pays for its ten-year bonds and what Italy pays instead. This financial indicator has now become the “thermometer” of the perceived risk in the Eurozone and, in particular, around Italy; suffice it to recall when, between 2011 and 2012, speculation on the BTP rate hit the Italian system and the spread reached over 500 basis points.

Italy "observed special"

Italy has a huge public debt that needs the support of international investors: when this support, for whatever reason, falls, the spread increases making the service of the Italian debt even more expensive and putting the country at risk of losing the ability to finance itself. . When this happens, only drastic economic policy choices or central bank intervention can bring the debt back under control. The implications are obvious, since having a large debt, in a sense, limits the country's sovereignty and its freedom of self-determination.

However, it must be considered that markets are not an abstract entity, but are animated by operators who make decisions starting from even partial information on reality, with a purely financial purpose.

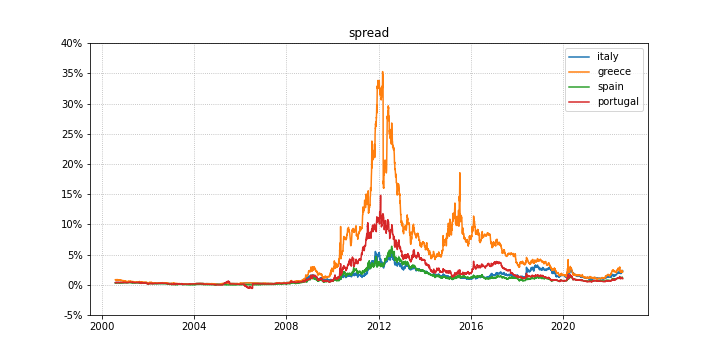

An analysis of how the spread has moved in recent years can be useful to understand what are the factors that determine its trend. If we look at the spreads of a selection of European countries with a long-term perspective, we see how they began to diverge starting from the financial crisis of 2008 and then undergo a surge in the crisis of the European debt crisis of 2011 and of 2012.

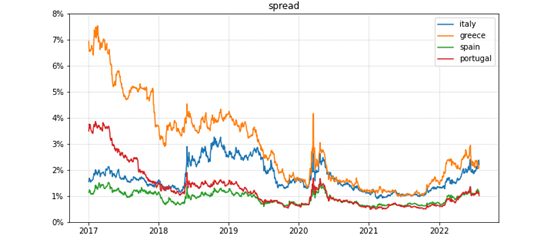

The spread level has since returned under control. If we look in detail at the trend of recent years, we note how the difference between the spreads with the other peripheral European countries has practically zeroed at the beginning of 2018. The spread of Italy was close to those of Spain and Portugal, while only Greece, engaged in a long recovery process from the technical default of 2012, enjoyed a higher level of spread.

Starting from the 2018 elections, due to the difficulty of finding a homogeneous majority in Parliament and the unclear positions of the winning parties in the elections regarding the position of Italy in Europe, the levels of rates have significantly increased.

Since then, the market has always asked for a premium for the purchase of Italian debt, despite the fact that the position of our country within the Euro Area and the European Union has never actually been questioned by the various governments that have succeeded each other. .

This trajectory clearly illustrates how the spread is not simply linked to the fundamentals of a country (deficit, debt, GDP), but in some cases also to the perception of reliability that this transmits, based on logics that are not always linear or easy to understand. . Another important evidence that emerges from observing these data is the fact that when perception changes, it takes a long time to fully recover confidence.

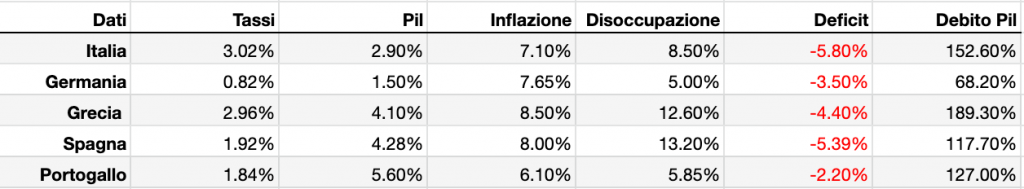

In fact, by analyzing only the macro data at the base of the spread, we note that the Italian numbers are not necessarily worse than those of the other countries of the so-called Peripheral Europe.

If, through a simple regression, we try to calculate the implicit spread in these data, we can see that Italy should have a less divergent level of interest rates compared to other peripheral European countries. Aware of the limited nature of this analysis, however, there would seem to be an imponderable and significant factor, linked to the international perception of Italy's role, which causes rates to rise beyond the fundamental economic data.

The importance of international perception: how important is politics

The issue of the country's international perception will be central in the coming months, when the ECB gradually reduces the purchase of government bonds and when interest rates gradually begin to rise. In this context, Italy today seems to occupy the uncomfortable seat of a country "under special observation".

Looking to the future, the elements that could generate further distrust of the country are:

- Fragmentation and uncertainty of the political framework: the complexity of the Italian party and political system is not always understood at the international level and the clarity of the electoral programs and coalitions will certainly be a stabilizing element;

- Doubts about the country's ability to continue on the current growth trajectory: when it comes to "debt sustainability", the emphasis is always on the rigor of public finances and never on the ability to generate growth, while the second element is at least as important as the first. In this sense, the ability to implement effective expansionary policies will be decisive.

Regardless of the outcome of the upcoming elections, Italy remains exposed from a financial point of view to a potential crisis, which could be triggered by a worsening of the international economic situation.

In this context, the will of the ECB to provide aid to the States most in difficulty, perhaps by putting in place ad hoc initiatives and tools, will be crucial. The announcement of the ICC, which took place in July, goes in this direction, even if there remains more than a few doubts about the effectiveness of this instrument, which subordinates the intervention of the Central Bank to political conditionality (compliance with parameters, enactment of reforms ), with risks of lack of clarity and predictability.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perche-non-ce-un-rischio-italia/ on Sat, 27 Aug 2022 06:10:49 +0000.