Because US growth continues to surprise. Confindustria report

In the third quarter of 2023, US GDP grew for the fifth consecutive quarter, exceeding expectations. What Confindustria 's November "Flash Economy" report says

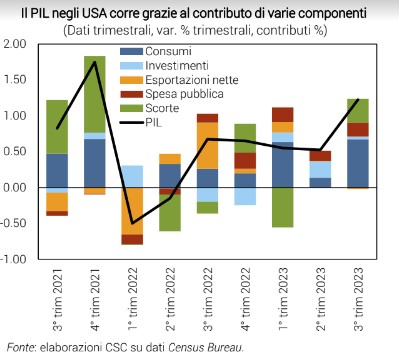

US growth continues to surprise. US GDP in the 3rd quarter of 2023 grew for the fifth consecutive quarter (+1.2%, after +0.5% in the 2nd), above expectations and strongly accelerating compared to the average of the previous four quarters (+0.6%).

Consumption, but not only

Compared to the 3rd quarter of 2022, American growth was +2.9%. Driven in particular by consumption, which contributed 1.6% to this trend change (+0.6% consumption of goods, +1.0% consumption of services) and 0.7% to that of 3rd quarter 2023.

On the other hand, investments appear to have reversed the negative trend observed in the second half of 2022 (+0.3% contribution to the trend change in GDP), due exclusively to the negative contribution of those in construction (-1.4% in last year, compared to +2.0% in other investments); which returned to growth in the 3rd quarter, for the first time since March 2021.

Net exports (+0.2% contribution to the trend change in GDP, nil in the 3rd quarter), inventories (+0.2% and +0.3%) and public spending (+0.8% and +0.2%) also contributed positively.

Why did consumption go so well?

The American performance, therefore, is mainly due to an unexpected stability in household consumption decisions. Which enjoyed a growth in hourly wages (+0.33% the average of monthly variations between July and September, +0.37% in the 2nd quarter) greater than core inflation (+0.25% and +0 .33%) and a consolidation of the labor market in 2023: the unemployment rate stabilized below 4.0% (3.7% in the 3rd quarter, from 3.6% in the 2nd), the jobs created between January and October 2023 in the non-agricultural sectors totaled 2.4 million (they were 4.8 in 2022, of which 4.3 in the first 10 months), accelerating in the 3rd quarter (+799 thousand ) compared to 2nd (+603 thousand).

Furthermore, families supported purchases by eroding the liquidity reserves accumulated during the pandemic period: the propensity to save decreased more than in other countries.

And investments?

US companies have been able to take advantage of the tax breaks introduced with the Inflation Reduction Act (IRA), an impressive 386 billion dollar plan (excluding the healthcare part) and do not yet appear to have fully suffered the effects of the high policy rates monetary, with the exception of those operating in the construction sector.

Weak industrial prospects

The economic analysis reveals some elements of weakness in the 4th quarter of 2023. In the 3rd quarter, industrial production had a good dynamic, thanks above all to the increase in July (+1.0%), with a quarterly variation of + 0.6%, which follows +0.2% in the 2nd quarter. The change acquired for 2023 is +0.5%.

However, the indicators, which had returned close to the expansion threshold during the 3rd quarter, took a step backwards in October: the manufacturing PMI stopped at 50 points (from 49.8), but the ISM and the Chicago Purchasing Managers' Index collapsed (to 46.7 from 49.0 and to 44.0 from 48.7) and the FED's local manufacturing activity indices stood at recessionary values.

Risk of further rise in rates

There is still the possibility that, counting precisely on the resilience of the US economy, the FED decides to continue raising interest rates, to deal another blow to inflation, still above +3.0% (with the core at +4.0%). At that point, the risk is that the ECB decides to follow the path of "further increases", to avoid repercussions on the dollar/euro exchange rate which would fuel imported inflation. It would be another blow to the already weakened Italian and European economies.

Braking forecasts

Compared to the 4th quarter of 2019, the pre-pandemic level, the cumulative growth of the USA up to the 3rd quarter of 2023 was +9.6%, much higher than that in the Eurozone (+3.0%).

The main forecasters expect the expansion to continue next year, but with a clear slowdown, already from the end of 2023: in September the FED forecast a GDP dynamic of +2.1% in 2023 and +1.5% in 2024, a scenario confirmed by the IMF in October (with the updated data, the annual growth already achieved for 2023 is +2.4%).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/crescita-economia-usa-confindustria/ on Mon, 20 Nov 2023 06:29:31 +0000.