Because US yields are rising

The deepening of The Walking Debt , the blog edited by Maurizio Sgroi

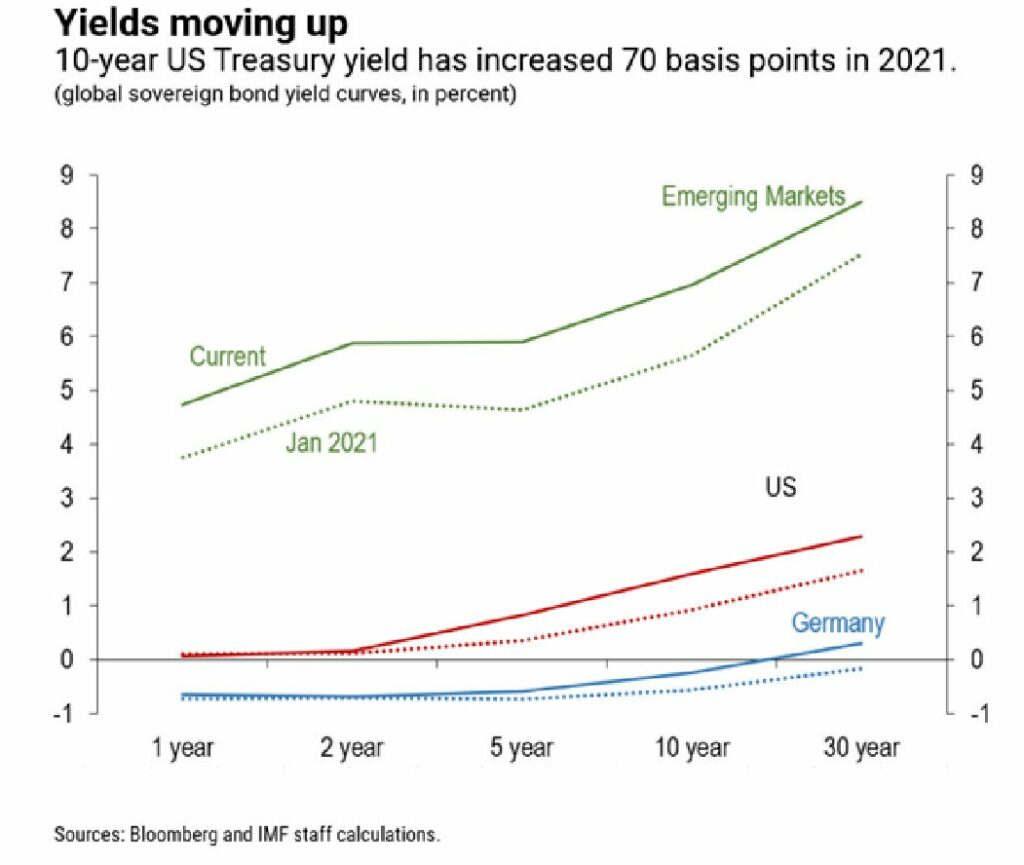

It is not difficult to understand why the world looks with some apprehension at the rise in US yields which have risen by about seventy basis points since the beginning of the year for a series of reasons that are analyzed by the IMF in a recent article that is worthwhile. reread when US inflation , which has a lot to do with yield trends, exceeds 4% .

The first reason for this spike in yields is the expected improvement in the US economy, and this is certainly good news, as the way the world is, what's good for America is good (still) for the rest. of the world. And yet there are also other reasons that explain what happened. And they are worth remembering just as central banks around the world, starting with the Fed, are busy keeping interest rates low. One of these reasons, identified by the IMF, is investor concern over the US fiscal position, further stressed after the Trump era, by the further announcement of nearly two trillion fiscal stimulus promised by Biden.

Before illustrating the other reasons, it is worth remembering that the tensions over American yields frighten half the world for a number of excellent reasons, first of all the fact that the American paper holds – literally – a large part of the global financial system, to begin with. from the fixed income market. A persistent rise in yields, therefore, is capable of leading to a repricing of all assets, and therefore of the underlying risks, creating significant turbulence in the markets, starting with those most exposed to the dollar, ie the emerging ones. Anyone who remembers the latest stock market bugs triggered by the rise in American yields will understand.

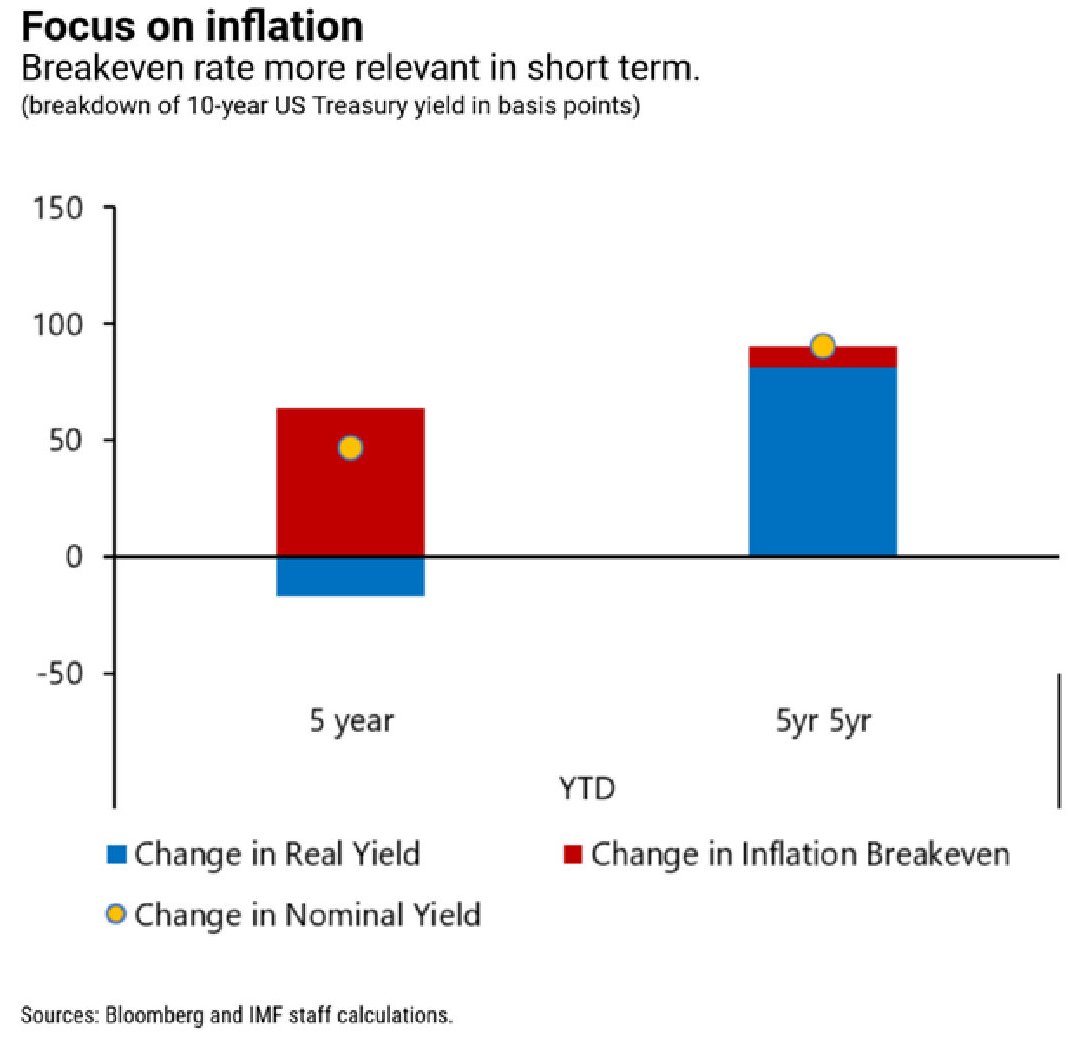

To understand the dynamics of these movements, we need to take a step back. The ten-year yield incorporates a real yield, which somehow measures the expected rate of growth, and an expected inflation rate. Adding the two elements together give the nominal yield, which therefore serves to evaluate not only the expected growth rates, but also those of inflation. To these two elements is added a third which helps to determine the level of return: the compensation requested by the investor to assume the risk of both. This compensation is called term premium ( term premium ). Put simply, yield pays off, by incorporating a premium, the investor for the time he has to wait to get his capital back, betting on a certain level of real growth and inflation.

In addition, investors use to divide the ten-year yield into two sub-five-year periods to better evaluate the effect of the factors considered in the short and long term: the 5-year yield and what the market calls "5-year -5-year forward ”, which covers the second half of the maturity of the bond.

The interesting point is that the spike in yields seen this year was largely driven by inflation expectations in the first five-year segment of the curve, which was coupled with a rise in commodity prices encouraged by the improvement in the economy and the Fed's repeated assertions that it intends to maintain an accommodative monetary policy. On the contrary, the increase in the second five-year segment is largely due to expectations of an increase in real growth, with inflation appearing under control.

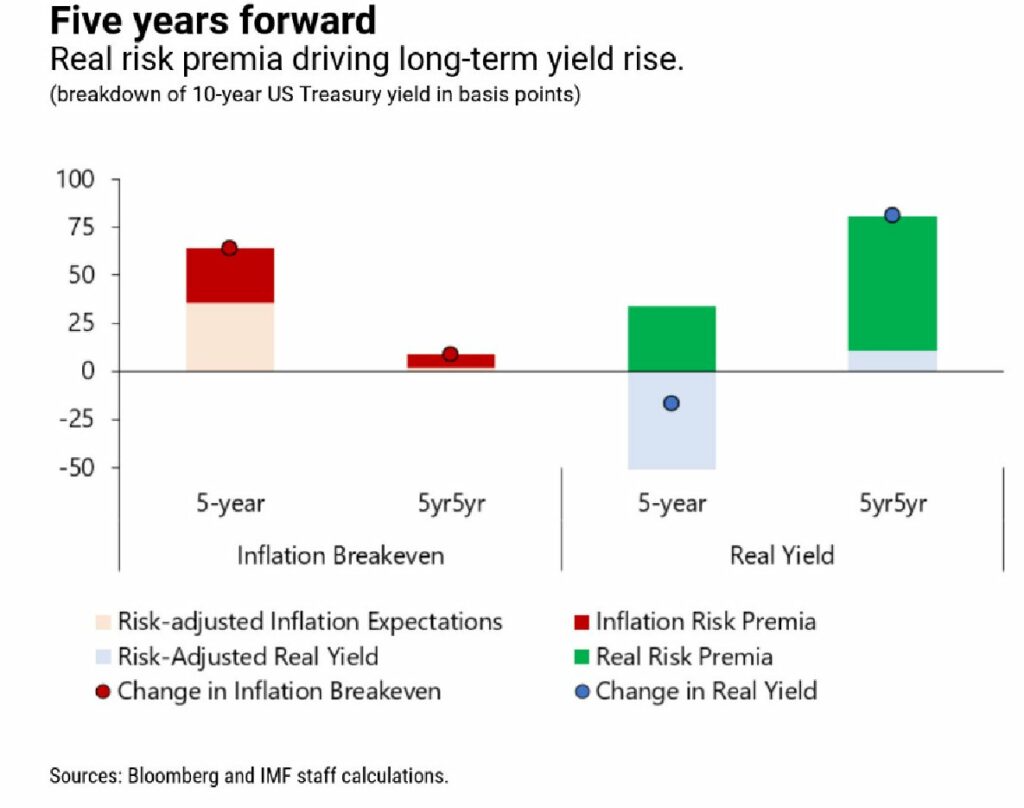

Here is how the IMF explains the two things: “The 5-year breakeven increase in inflation reflects an increase in both expected inflation and inflation risk premia. The strong increase in longer-term real return is mainly due to a higher real risk premium. This indicates greater uncertainty about the economic and fiscal outlook, as well as the outlook for asset purchases by the central bank, as well as longer-term factors such as demographics and productivity ”.

All this has obvious implications for monetary policy, which is expected to be very accommodative in the coming years, in the awareness that not only the short-term segment of the yield curve is influenced by the central bank, but "also the longer end of the yield curve. returns is significantly influenced by asset purchases ”, effectively acting on the compression of term premiums which ends up favoring the demand for riskier assets. "Therefore, – observes the IMF – the increase in real risk premiums over the horizon to 5-year-5-year forward can be interpreted as a reassessment of the prospects and risks relating to asset purchases, taking into account the forecast increased supply of treasury related to fiscal support in the United States ”.

Investors, therefore, must have some doubts about the Fed's medium-term intentions on purchases of the government's assets. And this is why the IMF hopes that the central bank will make it the subject of forthcoming communications on forward guidance to avoid volatile movements in the markets. In short, to lower yields, markets not only need to know that rates will remain low, but also that the central bank will continue to buy government bonds.

All this not so much because the increase in yields is in itself dangerous – indeed, the economists write "it is healthy and welcome" – but because in the current state "a tightening of global financial conditions remains a risk". The problem is how long this "current" lasts. And especially if it can last forever.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/rendimenti-usa-perche-salgono/ on Sun, 16 May 2021 06:00:48 +0000.