Big tech, because it is holding back the growth of Alphabet (Google), Microsoft and Meta

Quarterly from Microsoft, Alphabet and Meta: tech is slowing down. The report edited by Simone Di Biase, Head of Relationship Management BG SAXO

On the day following the presentation of the quarterly accounts, Meta loses 25% of its value on the stock exchange (Corriere). Amazon closes the third quarter with revenues up 15% to 127.1 billion dollars. Net profit fell to 2.9 billion. It fared better for Apple, which closed its fiscal fourth quarter with revenues up 8.1% to $ 90.15 billion . ( Start Magazine editorial staff )

The report edited by Simone Di Biase, Head of Relationship Management BG SAXO:

Microsoft and Alphabet are disappointing this third quarter earnings season. Compared to initial estimates, the increase in wage pressure, energy costs, falling advertising prices, slowing PC sales and too many hires have weighed.

Meta, in the wake, also released some downward data, with the accounts highlighting a decline in turnover and forecasts of a new drop in sales for the fourth quarter of the year.

THE COMPLEX MOMENT OF TECHNOLOGICAL COMPANIES

Apple recently raised its prices on various of its service offerings, from music to TV, and Spotify is also considering raising its prices. The culprit is the increase in wage pressure and the increase in energy costs that are affecting “energy-intensive” apps.

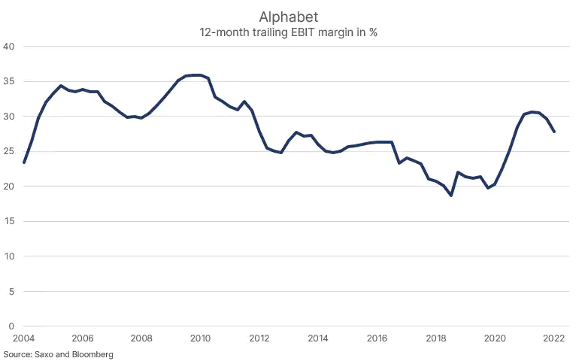

Microsoft provided the best clue to this by announcing that it expects $ 800 million more in energy costs in the current fiscal year, which is about 1% of its current operating income. More broadly, as the net profit margin chart below shows, US technology companies are facing the biggest margin squeeze since the Great Financial Crisis.

THE ARREST OF MICROSOFT AND ALPHABET

The two tech giants, Microsoft and Alphabet, have released weaker-than-expected results. Microsoft's revenue and earnings per share in the third quarter were slightly above estimates, but growth indications were lower.

Higher energy costs, wage pressures, slow PC sales, slow ad sales, and a strong dollar are all contributing to the expected impact on operating margin. To curb high costs and counter the slowdown in growth, the software maker has decided to freeze hiring.

Alphabet also disappointed after Snap reported weak advertising results last week. But then investors hadn't lowered expectations as Alphabet had previously been decoupled from Snap's performance. Today, however, thoughts run to that alarm bell, in the face of the evidence of Alphabet's declining results. Data down on both revenue and operating income with the former at $ 69.1 billion compared to an estimated $ 70.8 billion and the latter at $ 17.1 billion compared to an estimated $ 19.7 billion.

The company hired 10,000 new employees in the third quarter, an aggressive increase given the slowdown in the economy, but now it says hiring will be significantly lower in the future. Alphabet's EBIT margin declined in the 10 years leading up to the pandemic which then raised prices due to the high growth of the online economy. Already last year the story changed with the operating margin in sharp decline from 32.3% to 24.8% in the third quarter this year.

STOP ALSO META, ZUCKERBERG: DO MORE WITH LESS

Meta also experiences the same situation. After making numerous hires and betting on the Metaverse, it has hit critical blocks in terms of user "adoption", it is now burning money on an unprecedented scale.

In the second quarter, Meta's operating margin dropped to 29% from the previous year's 42.5%, as advertising prices were also drastically dropping due to Apple's new data privacy rules that made it more difficult for Meta. publish targeted ads.

Meta announced that its third quarter profit more than halved to $ 4.4 billion from last year's $ 9.2 billion. The data shows the group's revenue, which Facebook, Instagram, WhatsApp and Messenger refer to, in fact fell by 1% in the second quarter of 2022, coming in at $ 28.8 billion, while net profit fell to $ 6. 7 billion. This is a 36% drop from 10.39 billion in the same period a year ago. Zuckerberg specifies that we will have to do more but with less, but look to the future with confidence: "We are approaching 2023 by focusing on the definition of priorities and efficiency that will help us navigate the current environment and emerge as a company again. harder".

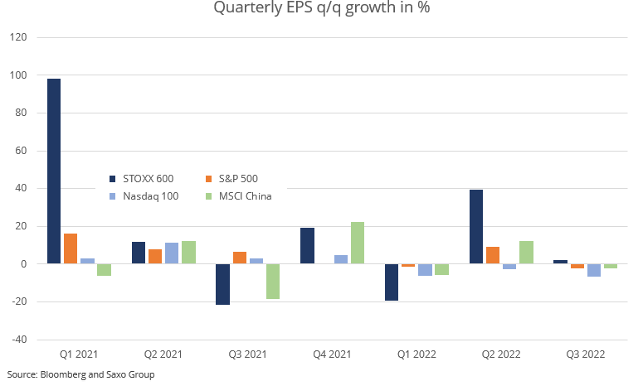

IN EUROPE, THE QUARTERLY SEASON IS BRILLIANT

We are still at the start of Q3 earnings, but initial indications suggest European earnings are doing better than US and Chinese earnings, also due to the strong US dollar obviously creating favorable ground. Given this relatively better earnings momentum, lower equity valuations and a higher discount rate, it makes sense to have a more positive attitude towards European than US equities.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/big-tech-perche-frena-la-crescita-di-alphabet-google-microsoft-e-meta/ on Fri, 28 Oct 2022 07:09:02 +0000.