Chip, how the accounts and prospects of the Dutch giant Asml are going

ASML reported better than expected results in the last quarter of 2022. The company – a global leader in advanced processes for the production of microchips – is optimistic for 2023. But restrictions on China could hurt its business. All the details

Will ASML be able to resist US restrictions on sales to China?

ASML Holding, Europe's largest technology company and global leader in advanced semiconductor manufacturing processes, reported better-than-expected results in the fourth quarter of 2022 and expects sales to grow by more than 25 percent this year .

THE IMPORTANCE OF ASML FOR THE EUROPEAN UNION

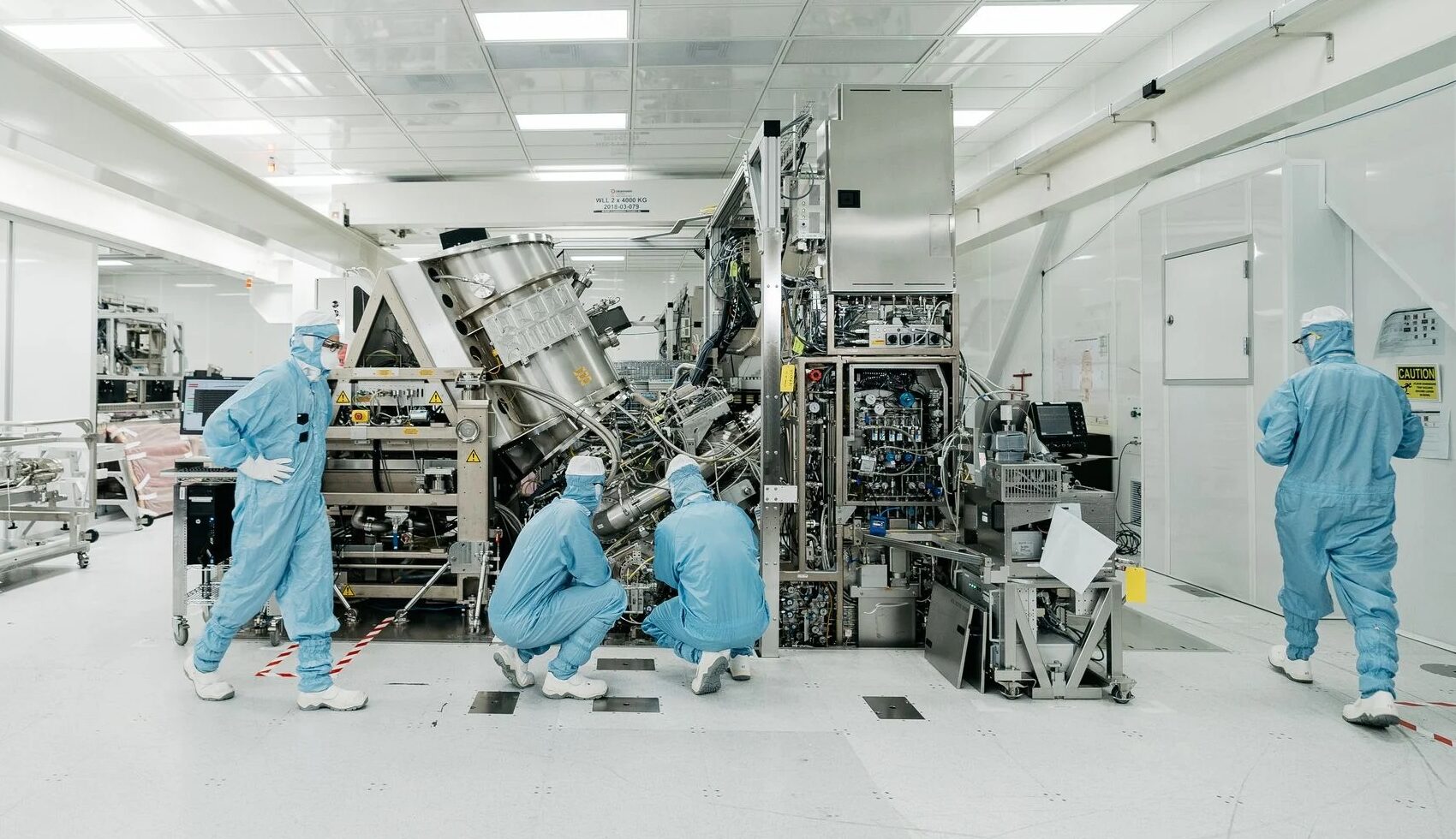

ASML is headquartered in Veldhoven, the Netherlands, and represents the European Union's main trump card in the global competition for microchips: the company has an international monopoly in the production of extreme ultraviolet (EUV) lithography machinery, a process which allows the production of semiconductors on very small scales.

In 2021, the market value of ASML exceeded 300 billion dollars.

RESULTS IN THE FOURTH QUARTER OF 2022

In the fourth quarter (October-December) of 2022, ASML recorded a net profit of €1.82 billion on revenues of €6.43 billion. In the same period of 2021, the net profit had been 1.77 billion.

The company's results exceeded the forecasts of analysts, who expected a net profit of 1.70 billion for the past quarter on a total business volume of 6.38 billion.

THE ORDER PORTFOLIO

ASML has made it known that it has had difficulty satisfying all the demand for semiconductors: at the end of 2022 its order book has reached the record sum of 40 billion euros.

THE EVALUATION OF CREDIT SUISSE AND THE PERFORMANCE OF THE SHARES

Analysts at Swiss investment bank Credit Suisse argue that ASML's earnings could be "negatively received" by the market, in light of the recent increase in the value of the company's shares: in January they rose by 22 percent, and by 55 per cent. percent from the lows reached in October.

Today ASML shares lost 1.7 percent, to 605.4 euros.

WENNINK'S PREDICTIONS

According to the CEO of ASML, Peter Wennink, the economic outlook for 2023 is clouded by fears about the performance of the economy and the growth of inventories of semiconductors in companies, but demand could react positively to a recovery in China after the end of anti-COVID restrictions.

“That means,” Wennink said, “that the demand is still higher than what we can produce.”

THE RESTRICTIONS ON CHINA

ASML's economic results were released a week after discussions between Dutch Prime Minister Mark Rutte and US President Joe Biden on new restrictions on exports of ASML products to China, motivated by security reasons. Washington wants to prevent Beijing from accessing advanced technologies – such as ASML's EUV systems, in fact – for the production of cutting-edge semiconductors, which are in turn necessary for the development of civil-military applications such as artificial intelligence and supercomputers.

For ASML, however, China represents a very important sales market, the third largest after Taiwan and South Korea. In 2022, the company had sales in China of 2.16 billion euros, accounting for 14 percent of total turnover.

THE IMPACT FOR ASML

Wennink said "nothing has changed" regarding ASML exports to China, despite US restrictions. “We just have to wait for governments and politicians to keep talking and come to a reasonable solution” on the new restrictions, he added. He concluded that the company can "still ship DUV fixtures," a lithography process not as advanced as EUV, to mainland China.

As Finimize explains, the machinery that ASML exports to China is generally less advanced than that subject to US restrictions, which according to the company will impact its order book by only 5 percent. Otherwise, ASML has a large order backlog with which to shore up its accounts.

THE ARESU ANALYSIS

The geopolitical analyst Alessandro Aresu has dedicated a lot of space to ASML in his latest book , The dominion of the XXI century. China, the United States, and the Invisible War on Technology .

– Read also: I'll tell you about the world war for chips. Aresu speaks

Regarding ASML's economic relations with China and the American restrictions, Aresu writes that the company “began its activities in China in 2000, and in the People's Republic it has overall more than a thousand employees. Since 2018, the company has become the target of a major US campaign to block the sale of the machines to the People's Republic […]. We are witnessing sanctionsism in the form of moral suasion and the primacy of the geopolitical bond over market conveniences”.

“It all started”, continues the analyst, “from the company's request to the Dutch government for a license to export its material considered sensitive to a Chinese company, which is easy to identify as Smic. The United States apparatuses, through the confidential meetings of the Dutch with the National Security Council, press for the license to never be granted. During Prime Minister Rutte's official visit to the United States in July 2019, he was shown an intelligence report on the repercussions of the Chinese acquisition of ASML technology. Sanctions offices are engaged in a calculation related to the US supply chain of ASML, to determine if the machinery giant meets the threshold of 25% of components from the United States, to be able to apply the export restrictions of the Bureau of Industry and Security . The answer seems to be negative, but the Dutch government is following Washington's indications".

“A curious paradox”, Aresu points out: “on the one hand, the Netherlands must support the position of the bearers of the free market, even within Europe, while on the other hand, they must obey the suggestion of their guarantor, and therefore submit to his national security needs. All this generates a precarious balance. The market culture of the Netherlands, even if it does not correspond to the reality in which we live, nonetheless represents a barrier against improper interventions in the management of the Veldhoven Machine, on the product and on the suppliers. The government knows that if it meddles excessively in ASML's affairs, it damages the company's innovative capacity”.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/asml-risultati-quarto-trimestre-2022/ on Thu, 26 Jan 2023 12:22:34 +0000.