Cloud, how Intesa Sanpaolo, Unicredit, Banco Bpm and more are moving

Projects and moves by Intesa Sanpaolo, Unicredit, Banco Bpm and more on the cloud. The in-depth study by Fernando Soto and Francis Walsingham

How do Intesa Sanpaolo, Unicredit, Banco Bpm and not just on the cloud and surroundings move?

This is what analysts and observers not only in the sector have been asking for a long time after the recent flop of Ibm and Nexi due to the tilt of the ATM circuit and after the hacher attack suffered by the Italian banking association ( here and here the insights from Start Magazine ).

What does the ABI say on the subject (hacker attack apart)?

"Banks are focusing on digitization processes to provide customers with a virtual service – said to Corriere Pierfrancesco Gaggi, president of Abi Lab and member of the executive committee of the European Banking Federation with Giovanni Sabatini, deputy director general of ABI -. Two thirds have as priority the enhancement of services on mobile devices and Internet banking, despite the heavy investments already made ". Gaggi lists three directions: «Better customer experience, strengthening onboarding with sales and increasing the range of services: first of all with the possibility of opening a current account.

WHAT THE ABI LAB REPORT SAYS

Growing investments, above the approximately 5.3 billion already achieved in 2021, to strengthen on three levels: digital, IT security and customer relations.

Big banks, over 20 billion in assets, allocate more resources to technology: more than eight out of ten (84.5%) declare a growing budget. The share is reduced to 41.6% for small institutions, where however only eight out of ten (8.3%) plan to invest less than in 2021.

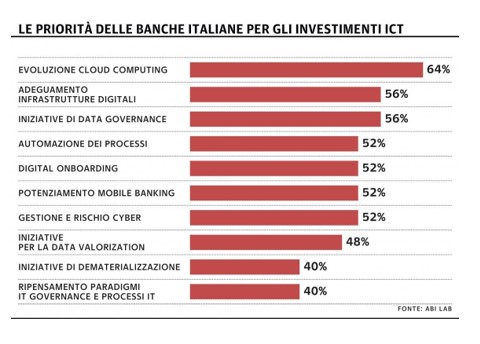

Where does this money go? At the top of the list of priorities is the development of cloud computing (64%), the Internet cloud for data storage. This is followed by the adaptation of infrastructures (56%), data processing (56%) – for example on privacy with the GDPR legislation -, process automation (56%) and digital onboarding (52%), i.e. "Ferrying" customers on board the bank, with digital. Already 43% of operators, says the Report, offer the possibility of subscribing personal loans digitally.

According to a survey conducted globally by the Economist Intelligence Unit of banking IT managers, 72% believe that integrating the cloud into their organization's products and services will help them achieve their goals. Source Repubblica .

CLOUD MISSION FOR BANKS

But it is in the cloud that there are big maneuvers in banks. Because? The cloud offers cost savings associated with greater efficiency. And, alongside this advantage, there are four others: scalability, which allows you to better manage peaks in activity; technological innovation closely linked to the cloud, such as the use of artificial intelligence algorithms in day by day activities; the speed, or rather the simplicity, to expand into further markets – think for example of a bank with an international presence – without the need to build new data centers; the ability to analyze data which, thanks to the cloud, is strengthened and allows to identify fraud and money laundering operations but also to know and anticipate customer needs.

Finally, banks wishing to enter the cloud face two main challenges. First of all, the security of all processes, applications and data must remain guaranteed, and it is now common ground that the cloud is extremely more secure than the data center of a single bank. This is because the cloud giants concentrate their investments – unthinkable in a single nation and even less for a single operator – on the security of software infrastructures, also having the ability to attract the best talents operating in cyber security.

Finally, all regulatory and compliance requirements must be met. On these aspects, however, the panorama is now clear, between the guidelines of the EBA and the Bank of Italy , and the National Security Perimeter, supervised by the new Cybersecurity agency. The CLOUD Act issue also appears to be outdated, among advanced data encryption systems with physical keys in the hands of customers, renewed Euro-Atlantic relations and the awareness that in any case such a rule would also affect Italian companies with business of any kind in the USA (for example the Tim herself given the intertwined relations with Google).

On the subject of privacy, the association of cloud providers CISPE (including Italian companies such as Aruba, Netalia and Seeweb) has published a self-regulation code for which its members guarantee their cloud infrastructure services meet the requirements applicable to personal data processed in the scope of the GDPR (EU regulation). This provides cloud customers with additional security of being able to choose services that have been independently verified for their compliance with the GDPR. The CISPE code is the first pan-European code of conduct for data protection focusing on cloud infrastructure services, and is endorsed by the European Data Protection Board and approved by the French Data Protection Authority (CNIL), which acts as the main authority for data protection.

WHAT THE FOREIGN COLOSSES DO

Worldwide, the banking landscape already has a clear physiognomy when it comes to alliances with the giants of the cloud. Capital One and Goldman Sachs, for example, chose AWS; Deutsche Bank and PayPal are on Google; Bank of America and BNP Paribas instead rely on IBM's "tradition"; finally, UBS and Morgan Stanley fly to the new one from Microsoft. On the other hand, the Italian situation is quite different, backward and far from international best practices (according to most of the analysts in the sector), even if something is finally moving.

THE MOVES OF INTESA SANPAOLO

Intesa Sanpaolo has developed an alliance with Tim and Google , betting over 45 million euros on the project of the new Isybank digital bank with the fintech Thought Machine (led by Paul Taylor, formerly of Google). with theMemorandum of Understanding signed on 21 May 2020 , it signed the definitive agreements with Tim and Google under which the institute will migrate a significant part of its information system on Google cloud services. Google is finishing two Google Cloud Regions in Turin and Milan, on which Intesa Sanpaolo will build its digital services. The Google Cloud Regions will be built within Tim's Data Centers, which will also be used for the PSN. However, there is a certain delay in the migration to the cloud of Intesa, in particular of the critical functions, and the bank of Carlo Messina would be looking around – wrote the newspaper Verità & Affari in recent days – for possible alternatives, while remaining focused on an operation that sees infrastructure investments by Big G in Settimo Torinese.

HOW BNL, UNICREDIT AND MORE

BNL with the CEO, Elena Gotini, has announced an acceleration on innovative technologies with a series of outsourcing – anda special relationship with the French Capgemini – which have also sparked trade union strikes, as well as a lighthouse in Palazzo Chigi for a operation in progress with Accenture ( here the in-depth analysis of Start Magazine ). In Unicredit Andrea Orcel focuses heavily on technology, with the cloud at the center, setting up 7 guided digital areas Jingle Pang, former executive of China Construction Bank and the insurance giant Ping An, while Daniele Tonella was resigned, who was unable to carry out the mission of cloudifying the bank in Piazza Gae Aulenti. Orcel recently said: “We will invest 2.8 billion in digital (…). At group level, we expect 2,100 people to be hired in the Digital & Data area (…) We have agreed on a new hiring plan, but also the re-skilling of our resources. We must transform the bank from the inside, focusing on customers-relationship-trust ". At the moment Unicredit (which at the technological level for internal processes has established a relationship with IBM ) is accelerating and a tender for the cloud should be launched shortly, in which the training of the current bank resources will be central, which will see at the forefront the usual greats: Aws, Google and Microsoft.

THE ROLE OF THE BANK OF ITALY

However, Big G's current relations with Intesa could disadvantage it, also because the Bank of Italy would prefer to see its systemic banks use different vendors, in order to avoid possible risks. A problem that also arises for Microsoft, considering that it already has the so-called "individual productivity" in its hands, that is the use by employees of the Windows operating system and Office software, considered by many to be problematic as it certainly cannot be replaced with so-called open source software. While for AWS the problem could derive from Amazon and its expansionary aims – even if not in Europe for now – in credit as well as in retail. Another decisive point will then be the presence of cloud infrastructures in Italy – the only one at the moment is AWS, present since 2020 – and in the other countries of interest for Unicredit, in particular in Germany and Eastern Europe.

THE MOVES OF BANCO BPM

Banco BPM is also involved, increasing the annual resources allocated to digital by 40% in the 2020-2023 business plan, with a focus on cloud, data analytics and artificial intelligence. According to what Verità & Affari wrote, a tender for the cloud would be in the process of being assigned, with the managing director Giuseppe Castagna who, however, will soon have to decide whether to accelerate the digital transformation or continue to await any developments deriving from possible mergers. and acquisition. A stand still which, however, could harm the institute in Piazza Meda.

Instead, he chose Oracle for the Banca Mediolanum cloud, while among the native digital banks, Corrado Passera's Illimity focused on Microsoft – to which the former Intesa has always been very close -, Paolo Fiorentino's Banca Progetto instead entrusted the management of own cloud infrastructure to Amazon Web Services.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/banche-cloud/ on Thu, 05 May 2022 07:29:05 +0000.