Commodities, what will happen to prices? Cdp report

What factors led to the sharp rise in commodity prices? Here is what emerges from a report by the Cdp research office (Cassa Depositi e Prestiti)

"What happens to the raw materials?"

This is the title of the new CDP report that investigates which factors led to the sharp rise in the prices of raw materials.

In fact, from April 2020 to December 2021, the increases in the price lists were extraordinary, both for energy raw materials and for agricultural and industrial ones: + 1,692% natural gas, + 108% soybean oil, + 89% copper.

First of all, the reasons for the increases are attributable to cyclical, structural, geopolitical and speculative factors, according to CDP analysts.

Among the economic factors, the analysis first notes the imbalance between supply and demand but also the cuts in oil production by OPEC + countries, extreme climatic conditions and other adverse events; the structural causes include the strong increase in the demand for commodities necessary to achieve the objectives connected with the ecological transition; among the geopolitical factors emerge the preponderant weight of a few players, as well as the occurrence of some destabilizing events that have slowed down the global supply chains; finally, among the speculative factors, it must be taken into account that numerous commodities act as financial assets and financial speculation has amplified the upward pressure on their prices.

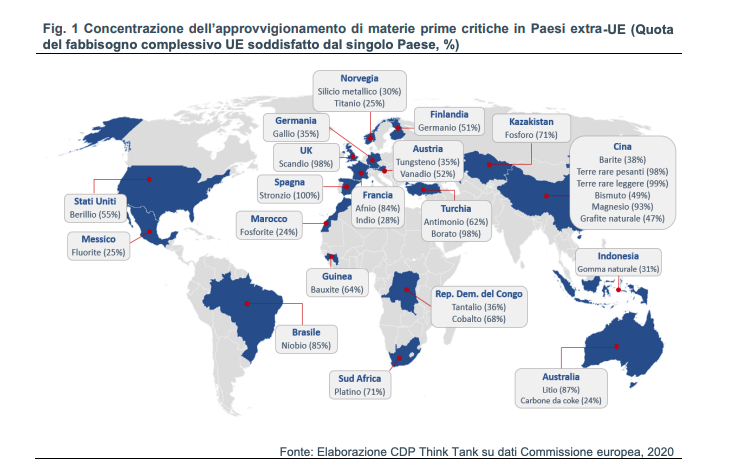

In Europe, the supply of most of the "critical" raw materials – such as copper , nickel, lithium, cobalt or manganese – is met by third countries: over 98% of rare earths from China, 87% of lithium from Australia, 71% of platinum from South Africa.

According to the CDP report, one option for Europe is to invest in innovation, diversify supplies from third countries and strengthen the circular use of resources. In order to guarantee a safe and resilient supply of raw materials. And in this, Italy already has a competitive advantage, according to CDP analysts. In fact, our country is the one in Europe with the highest percentage of recycling out of all the waste collected.

+++

THE COMPLETE CDP REPORT : WHAT HAPPENS TO RAW MATERIALS?

The global economic recovery was faster than expected, driving demand for raw materials and semi-finished products. This increase in demand is not matched by an adequate increase in supply, generating a marked rise in prices which, for some raw materials, has brought the levels to maximum values for over twenty years. From April 2020 to December 2021, the price increases were extraordinary: + 1692% for natural gas, + 218% for Brent, + 152% for coal, + 89% for copper or + 85% for aluminum . The reasons for these increases can be traced back to various factors: conjunctural, structural, geopolitical, speculative. Among the economic factors, in addition to the imbalance between supply and demand, the cuts in the production of crude oil by OPEC + countries, the extreme climatic conditions that occurred in some critical markets and other adverse events, such as the blockade of the Canal Suez. The structural causes include the strong increase in the demand for commodities necessary to achieve the objectives connected with the ecological transition. Among the geopolitical factors, appear the preponderant weight in the international context of a few players, such as China and Russia and their satellite countries, for the control of some raw materials, as well as the occurrence of some highly destabilizing events, such as the coup in New Guinea , a major exporter of bauxite, which have caused severe slowdowns in global supply chains. Finally, it notes financial speculation, which has amplified upward pressure on prices. For Europe, the supply of most of the "critical" raw materials, essential for the energy transition, is met by third countries: over 98% of rare earths from China, 87% of lithium from Australia, 71% of the platinum from South Africa. It is crucial to invest in innovation, diversify supplies from third countries and strengthen the circular use of resources, in order to guarantee a secure and resilient supply of raw materials.

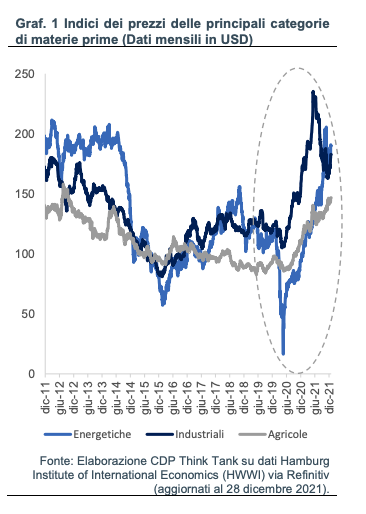

With the outbreak of the Covid-19 crisis and the imposition of restrictions on economic activities and the movement of people globally, the demand for raw materials has fallen sharply causing a rapid decline in price lists: the price indices of energy and industrial commodities and agricultural sectors reached a low point in April 2020. This dynamic was particularly marked for energy commodities, whose index recorded a fall of more than 80% from February to April 2020. In May 2021, the index of prices of industrial commodities – which includes metals, minerals and fertilizers – had reached an annual increase of 114%, the highest level of the last 25 years, and then gradually fell over the following months. The prices of energy commodities – which include, in addition to oil, also natural gas and coal – have continued the strong upward trend even in the most recent months, albeit with large fluctuations: in December the index was about higher levels. 90% compared to January 2021 and over 1050% compared to the minimum of April 2020. Although to a lesser extent than those of other types of raw materials, the prices of agricultural commodities also recorded a progressive increase from 2020 to today: in fact, the relative index increased in December 2021 by approximately 25% compared to January 2021 and by over 70% compared to the minimum reached in April 2020 (Graph 1).

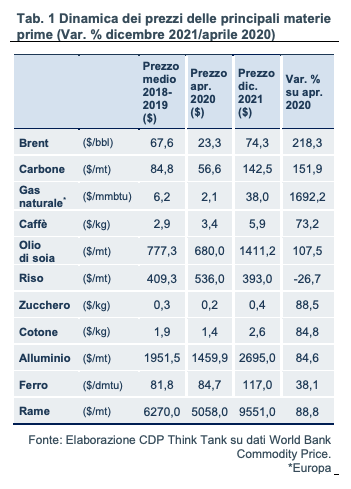

The average variation of these composite indices hides a strong variability among the raw materials that are included in the basket: from the minimum recorded in the last ten days of April 2020 to December of this year, the price of natural gas has increased by 1692%, that of Brent by 218%, that of coal by 152%; the price of copper rose by 89%, of aluminum and cotton by 85%, of iron by 38% (Table 1).

The reasons that explain the rise in the prices of raw materials are of various kinds and mainly attributable to four macro-categories of factors: economic, structural, geopolitical and speculative.

2. CONJUNCTURAL FACTORS

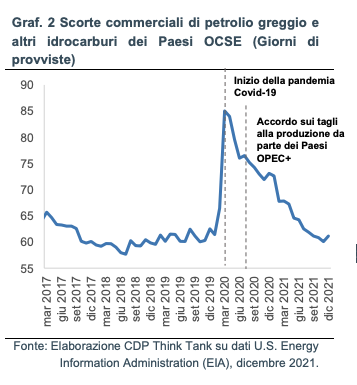

The profound reduction in activity due to the restrictions imposed to limit the spread of Covid-19 in the spring of 2020 was followed – with the easing of containment measures – by a rapid recovery that drove the increase in demand for raw materials and of semi-finished products which, however, is not paid an adequate increase in supply. Furthermore, some temporary factors not strictly connected with the economic dynamics linked to the pandemic have also intervened: in the specific case of crude oil, for example, the increase in prices is accelerated by the production cuts agreed by OPEC +, the Organization of Petroleum Exporting Countries1, which, starting from July 2020, has established a significant reduction in oil production on a global scale, with the aim of progressively reducing inventories present on the market and support prices towards a gradual recovery of pre-crisis values (Graph 2). If both supply and demand cyclical factors on oil prices have played a significant role in determining upward pressures, in the case of the prices of food goods and those of other energy commodities such as natural gas, the main reason concerns supply. . Pandemic outbreaks and extreme climatic events, including increasingly cold or hot temperatures, in various regions of the world, have, in fact, caused a production shortage of some agricultural raw materials at a global level, such as, for example, soybean, oil palm and corn, or resulted in a progressive depletion of stocks, as in the case of natural gas, as a result of the harsh winter that occurred last year in important international markets, including Asia, Japan, Europe and the United States .

As is well known, the health crisis has also brought significant unrest along global value chains, determined not only by the outbreak of pandemic outbreaks in some crucial nodes of the supply chains but also by the fact that many companies have been taken by surprise by the vigorous demand recovered in 2021 and found themselves unable to rapidly adjust supply, causing bottlenecks in the most disparate sectors of global supply chains. Global container traffic then suffered significant delays both due to the slowdown in production capacity in some sectors and the occurrence of adverse events, not always linked to the pandemic crisis, in certain strategic junctions, such as the obstruction of the Suez Canal which occurred in last March due to the grounding of the Ever Given container ship, the restrictions imposed on some Chinese ports to contain the outbreak of some Covid-19 outbreaks or the congestion that hit large ports such as Los Angeles and Long Beach. The costs of maritime transport, albeit gradually decreasing, in December 2021 were almost double compared to a year earlier for both commercial ships and container ships.

3. STRUCTURAL FACTORS

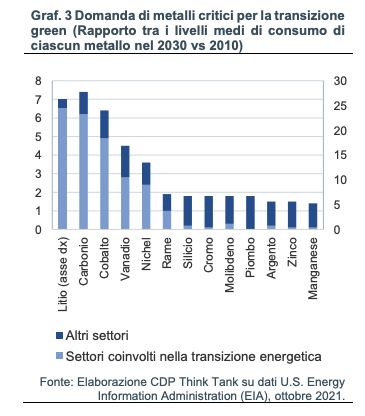

The technological changes necessary to achieve the ecological transition will lead, in the next few years, to a significant increase in the demand for commodities essential to support this new structure. The so-called "green technologies", including renewable energy, hydrogen or electric vehicles, require the use of so-called "critical" metals such as copper, nickel, lithium, cobalt or manganese: according to estimates by the International Energy Agency (IEA), the average levels of lithium consumption, particularly important for the creation of the batteries necessary to power electric cars, will increase by 2030 by more than 26 times those recorded in 2010, while the average consumption levels of metals such as cobalt, nickel or copper will increase by approximately 6, 4 and 2 times respectively (Graph 3). Also exerting upward pressure on commodity prices are the more favorable growth prospects globally and the massive stimulus packages launched in various parts of the world, particularly in advanced economies, such as the United States and Europe. These measures will lead to a significant increase in public and private investments, especially infrastructure, and therefore to a greater demand for raw materials, especially those used for industrial purposes.

4. GEOPOLITICAL FACTORS

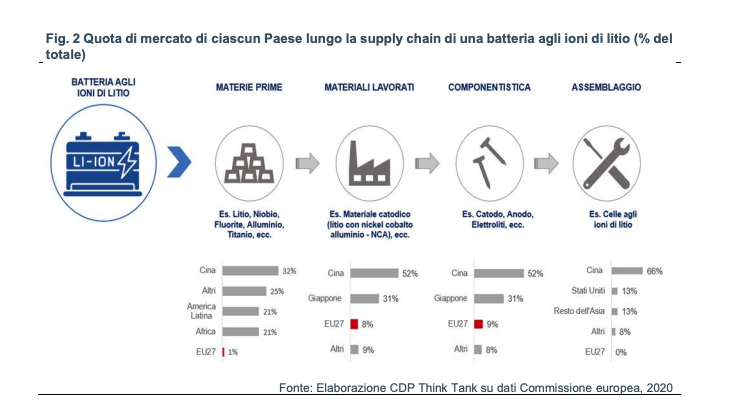

The new geopolitical balances drawn by the monopoly of some countries on important raw materials have played an important role in the rise in the prices of some raw materials and represent, in perspective, one of the most significant risk factors, in light of the energy transition process. The supply of some “critical” raw materials is in fact concentrated in the hands of a few important players who exert pressure on the international geopolitical chessboard. Countries like Russia and China are already putting their geopolitical weight to bear in this crisis, slowing down global supply chains (Russia with gas to Europe and China, among other things, with components). The European Commission in 2020 identified 30 critical raw materials (including lithium, gallium, graphite, magnesium, titanium) essential for building batteries, semiconductors, photovoltaic cells, to make light alloys used in the automotive, electronics, aeronautics, packaging, construction. The difficulty in procuring these commodities exposes the mobility, defense and aerospace industries, renewable energy, electronics and energy-intensive sectors to greater risks. By way of example, it can be highlighted that few companies located in China, Korea and Japan represent an oligopoly in the supply of lithium batteries and that, according to some estimates6, by 2028 China will be equipped with 46 battery production plants with a capacity total production of 1,000 GWh per hour while Europe will have only 9 with a total capacity of 248 GWh or, again, that the Democratic Republic of Congo represents about 70% of production and 50% of cobalt reserves at the level global and that China already holds a monopoly on these reserves.

The degree of concentration of the supply of critical raw materials and Europe's dependence on third countries in terms of supply is very high: of the 30 critical raw materials included in the list drawn up by Brussels, only just over 20% is supplied by countries members of the EU. For the vast majority of critical raw materials, procurement is almost totally concentrated in third countries: but not limited to, over 98% of the EU's rare earth supply comes from China, 98% of borate from Turkey, 87% of lithium from Australia, 71% of platinum from South Africa, 85% of niobium from Brazil (Fig. 1). At present, China holds the record as the main supplier of critical raw materials to the EU, making the latter particularly vulnerable to any restrictions on exports or other strategic decisions by Beijing, including the possible choice to support the competitive advantage of Chinese industries by reserving them greater production quotas. In the last period, China, thanks to the current energy crisis, has reduced exports of magnesium, a metal that requires a conspicuous consumption of energy to be processed and which, among its various uses, is indispensable for the production of vehicle components. , with catastrophic repercussions on the European automotive sector, considering that almost 95% of the European magnesium supply comes from China. If we analyze, for example, the entire process that leads to the production of a lithium-ion battery, a new generation technology that offers far higher performance than traditional batteries and that is used in a wide range of applications beyond that for the electric cars mentioned above, to date the role of the EU is marginal along the entire supply chain.

China, on the other hand, followed by Japan, controls most of the production phases, from the supply of raw materials, to the processing of materials up to the assembly of the finished product (Fig. 2).

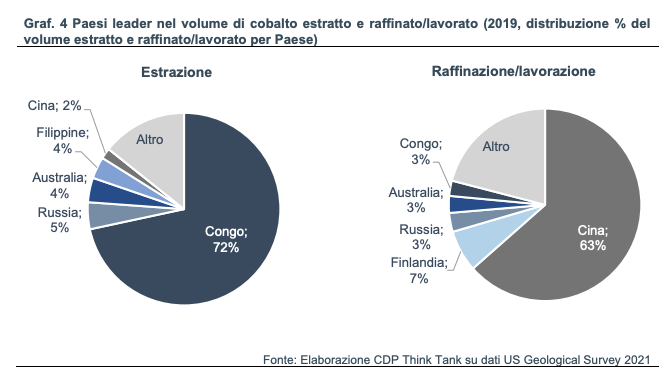

Looking at other types of raw materials, over 70% of the volume of cobalt extracted from mines comes, as mentioned above, from the Democratic Republic of Congo and is largely in Chinese hands, which oversees 15 of the 19 active mines in Congo (Graf . 4). The areas with high extraction intensity (east and south of the country) are at the center of a new course of geopolitical instability and the central government has called a State of Emergency, entrusting the management to the military.

A similar context occurred in New Guinea, where a coup d'etat took place in early September. New Guinea has the largest bauxite deposits in the world, on which China also has a monopoly, and is therefore an important exporter of this raw material. This event had an influence on the sharp acceleration in the prices of aluminum, a metal derived from bauxite.

5. SPECULATIVE FACTORS

Speculative factors also helped push the rise in commodity prices. In fact, numerous commodities, in addition to oil, act as financial assets on which large operators carry out speculative transactions linked to the fundamentals of individual markets or to expectations on the future trend of prices or the global economy. This "financial speculation" is often responsible, for many commodities, for the accentuation of price fluctuations. In the specific case, speculative activities were supported by expectations of further price increases and this, in turn, pushed up the lists. According to CFTC (Commodity Future Trading Commission) data, long positions, which bet on an increase in prices, have contributed to accentuating the commodity cycle especially in the final part of 2020, then gradually reducing from spring 2021.

6. WHAT PERSPECTIVES IN THE LIGHT OF THE NEW GLOBAL BALANCES?

From the framework outlined above, a change of pace that considers risk mitigation strategies along the supply chains, aimed at strengthening the EU's strategic autonomy and guaranteeing a secure and sustainable supply, is indispensable for the resilience of the EU. This is an essential step also in view of future challenges, first of all the energy and ecological transition, the implementation of the European Green Deal and digital development. Some data contained in a prospective study by the European Commission give an idea of the urgency with which this change of pace must be implemented in order to overcome the great challenges of the coming decades. For the production of batteries for electric cars and energy storage alone, the need for lithium in Europe could be up to 18 times higher by 2030 than the current supply level and up to 60 times by 2050. Allo Similarly, the demand for rare earths, used in various high-tech, green and defense applications, from wind turbines to submarines, from robotics to 5G, could be up to 10 times greater by 2050. According to the roadmap towards climate neutrality (“net-zero”) by 2050, developed by the IEA, the increasing use of low-carbon technologies will lead to a significant gap between the volumes of demand and supply of metals. At current production rates, the supply volume of metals such as graphite, cobalt, vanadium, nickel and lithium will cover only one third of overall demand between 2021 and 2050. Current supplies of copper, rare earths and platinum may also be inadequate. to meet future needs, covering up to 40% of total demand at the most. The possible future misalignment between supply and demand of metals could lead to a further marked increase in the price level of some metals compared to what has already been observed in recent years and, consequently, even delay the energy transition itself. In order to reduce its dependence on third countries, Europe therefore only has to strengthen its value chains internally to make them more resilient to exogenous shocks. To do this, Europe should therefore ensure an ever greater commercial and geopolitical autonomy in terms of internal supply of critical raw materials, which cannot fail to pass, for example, through the reshoring of some strategic phases of the production chains but also for the development of innovations to be applied to production processes. Since factors linked to the geological nature of the territories make it difficult to find many of the critical raw materials locally, the real challenge for the EU will be to invest in other essential processes of the value chain such as, for example, transformation, refining and separation. of raw materials, operations that are currently carried out in non-European territories even in the limited cases in which raw materials are extracted in Europe. To this must be added the need to diversify the sources of supply, also by strengthening the use of trade policy instruments, including free trade agreements or strategic partnerships with countries richest in mineral resources. Finally, a systematic change in the use of resources that is more efficient and sustainable and that encourages their recovery is a priority for the EU's strategic autonomy. The development of a strong raw material recycling industry as well as product and process innovations aimed at increasing the circular use of resources is, in fact, a strategic issue for any country that intends to adopt sustainable economic development models, but it is even more so for economies, such as Europe, which are heavily dependent on imports of raw materials. In this respect, Italy shows that it has already made important progress and can act as a driving force for the rest of Europe. Italy is the European country with the highest percentage of recycling out of all collected waste (industrial and urban): it recycles 79% of materials against 43% in Germany and 38% of the European average11. The circular material use rate in Italy in 2019 was 19.3%, higher than the European average (11.9%) and the share of Germany (12.2%). Finally, for every kg of resource consumed, our country generates 3.6 euros of GDP, against a European average of 2.3 euros, 2.5 in Germany and 2.9 in France.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/energia/materie-prime-cosa-succedera-ai-prezzi-report-cdp/ on Sat, 12 Mar 2022 06:30:47 +0000.