Conad, Coop, Esselunga, Lidl and more: who goes up and who goes down in the large-scale distribution

Esselunga and Eurospin stand out for their profit growth, Conad for their market share (where Coop loses ground) and Lidl for sales: this is how large-scale distribution is doing in Italy according to a Mediobanca research

Esselunga queen of profits, but Conad holds the largest share of the large-scale retail market.

The large-scale distribution stores a record 2020, with a progress of 5%, of which 11% is due to the e-commerce channel. Well Esselunga, Eurospin and Conad, but also small hidden champions are growing.

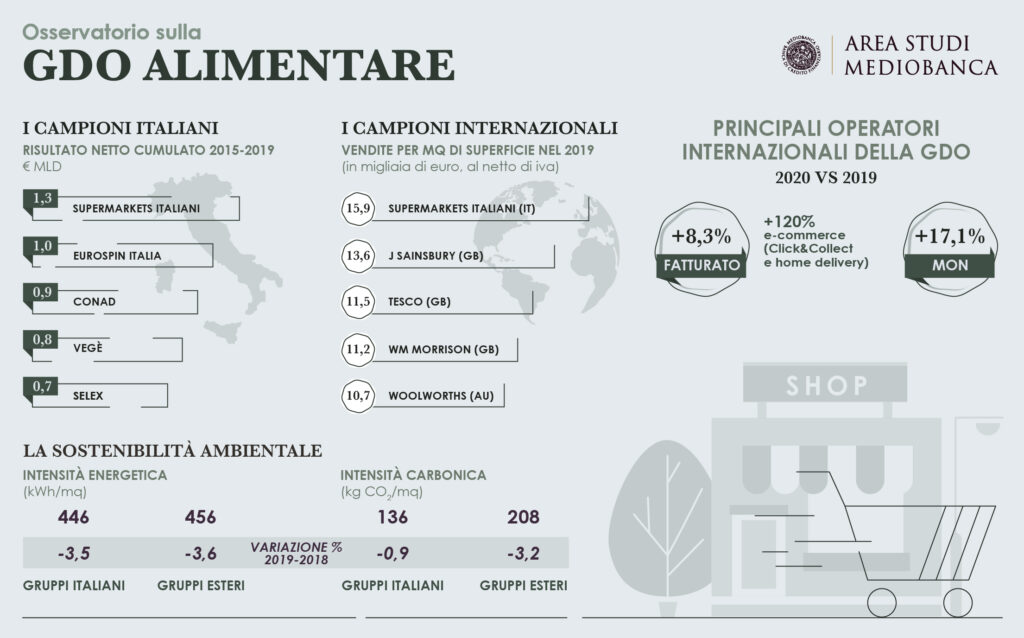

This was revealed by a survey on large food distribution presented by Mediobanca's research area which aggregates the economic and financial data of 117 national companies and 27 major international players for the period 2015-2019.

A RECORD 2020 FOR GDO

The numbers for 2020 are record-breaking. Better, from a "bubble", as they are defined in the report: the year of the food large-scale retail trade should close with an increase of 5%, of which 1% attributable to the explosion of the online channel. The most “marked” increases were recorded by “Discount (+ 8.7%), Super (+ 6.8%) and Drugstore (+ 6.6%)”.

CONAD HAS THE HIGHEST MARKET SHARE

In this record-breaking 2020, Conad conquers the first position in terms of market share, with 14.8%. The group is followed by Selex at 13.7% and by Coop at 12.9%. A market that in just 9 years has radically transformed: “In 2011 the Coop were the first group with 15.3%, followed by Conad at 10.6% and by Selex at 8.1%”.

A LESS PERFOMING 2021 FOR GDO

Instead, 2021 should go less better: the whole system, explained by Mediobanca, “should fall back by 1.6% in 2021, cumulating in the two-year period an increase of 3.3%. On the other hand, the crisis of large surfaces continues, which is expected to lose 4.8% in the two-year period 2020-21 ".

E-commerce (expected at + 61.6% in 2021 after + 134.4% in 2020) could reach 3% of the market in the current year.

ESSELUNGA AND EUROSPIN QUEEN OF PROFITS

Looking at the 2015-2019 period, the biggest profits are collected by Esselunga, controlled by Supermarkets Italiani di Caprotti, with 1.34 billion followed and Eurospin, 1.01 billion. Conad follows, at 879 million, and VeGe ', at 839 million.

THE LOSSES OF CARREFOUR AND COOP

Less rejoicing, however, are Carrefour and Coop which have accumulated losses of 603 million and Coop for 252 million respectively.

LIDL ITALIA FIRST IN THE RANKING FOR SALES

Lidl Italia, on the other hand, won the title of sales growth champion for the years 2015-2019: + 8.7% average per year, followed by Eurospin and Agorà paired with + 7.6%. This is followed by the trio Lillo-MD (+ 6.9%), VeGe (+ 5.3%) and Crai (+ 5.2%).

THE HIDDEN CHAMPIONS OF GDO

The report also talks about "hidden champions". Companies of significant size operate within the Organized Distribution: those with “a turnover exceeding 500 million are twenty, from Finbre (Maxi Di) with 2,124 million, to Poli with 506 million”.

Some of them marked significant performances in terms of Roi in 2019, explains Mediobanca: "Verofin (Tigros) at 18.2%, Arena Group at 18%, SC Evolution (Iperal) at 15.8%, Tosano Cerea Supermarkets at 15.3 %, Cannillo (Maiora) at 15.2% and Mega Holding (Megamark) at 15.1% ".

In aggregate, the twenty operators bill 20.6 billion.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/conad-coop-esselunga-lidl-e-non-solo-come-vanno-i-conti-dalla-gdo/ on Sun, 14 Mar 2021 17:02:18 +0000.