Cryptocurrencies will lead the markets. What are the institutions doing?

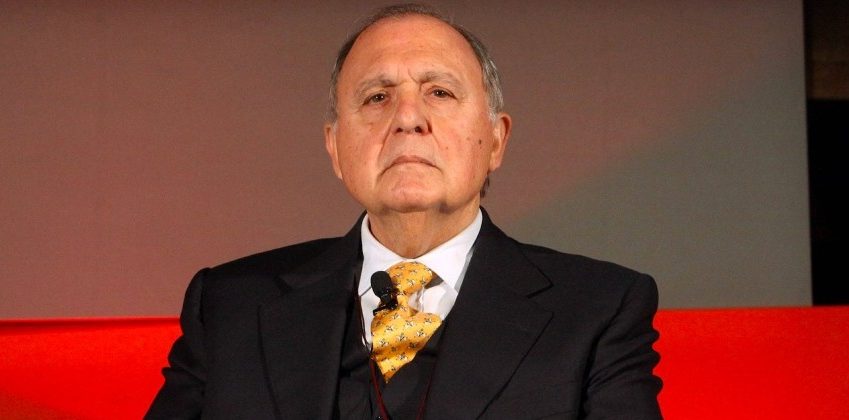

We publish an extract from the Lectio magistralis by Consob president, Paolo Savona, at the University of Cagliari on the theme: "Theoretical and practical features of an economy with cryptocurrencies"

The birth of crypto creates "out of thin air" a purchasing power in the hands of that part of families and businesses, especially financial ones, which "undermine" and "multiply" them through exchanges. While it is true that they have the characteristics of financial products, they are used as currency for exchanges; the fact that the authorities claim that they are not is does not correspond to the reality of the market. The result is both distorting effects of the destruction of income generated by the interaction of the macro-variables examined, and a loss of effectiveness of monetary and fiscal policy; this is due to the fact that following their diffusion, central banks lose the monopoly of monetary creation and control of interest rates, and the organs of democracy the power to fix the distribution of income they desire.

The free circulation of cryptocurrencies alters the known parameters of the monetary multiplier, because it would integrate the supply of the monetary base on the initiative of individuals and the demand from households, businesses and banks. The alteration would be less if the forms of the cryptocurrencies were of the stable coin type, with reserves, but the problems already highlighted for the functioning of the two tier market and for the repetition of the effects of Gresham's Law would arise. If the central banks recover the monopoly of crypto monetary creation, creating CBDCs, the greater monetary instability could be resolved, but an adaptation problem would arise for the banks which, for the reasons already examined, should devote themselves only to the management of savings by collecting it. in suitable forms. Such a solution would improve the functioning of finance for growth if banks entered into competition with technological platforms by offering credit services characterized by objective choices, such as those based on artificial intelligence algorithms and certifiable with DLT / DeFi techniques. If this were done, real instability would be reduced because the market would act more rationally and the need for fiscal policy would decrease. The splitting of the double easement of banks, obtainable by applying technological innovations to money and finance, would make the functioning of the market and of the transmission mechanism of economic policy better interpretable, since there is no risk of insolvency due to the variability of the choices to keep deposits for the alternation of micro and macroeconomic expectations.

In conclusion, the definition of an economics with cryptocurrency involves the recalculation:

to. the national income multiplier to take into account the exogenous impulse coming from the purchasing power created by "undermining" crypto;

b. the monetary multiplier according to the regulated or non-regulated forms that the cryptocurrencies will take;

c. the parameters of the real investment function due to the presence of financial resources created by the free market in encrypted form;

d. the parameters of the functions of international exchanges to take into account the global operations of cryptocurrencies;

And. the contents and possibilities of fiscal policy in the face of the spread of virtual monetary and financial innovations.

Parliaments, governments and market control authorities are faced with an inadequacy of their knowledge of how the economy works and of the laws on which their current regulation and surveillance activity is based. Economists had warned that, even before the birth and spread of crypto, their choices were made by scrutinizing a black box, which becomes increasingly obscure without reducing the demand for economic policy interventions. In the absence of new rules, the market would increasingly take the lead in the economic system and in the distribution of income, ignoring the history of its failures; but also economic policy would ignore its own, which could increase if it did not resolve the classification of cryptocurrencies in the existing institutional structure (bodies and regulations).

We must be aware that an enormous dispute has arisen between large interests at stake that have already matured, the solution of which would require far-sightedness and a common will on the part of the owners of capital, labor and public institutions; that from which most of the world benefited, despite many traumas, in the twentieth century, but which still does not return to manifest itself today; perhaps there is a lack of economists and legislators at the level of those who were able to transmit the results of their intuitions to politics. Without this happy conjunction, politicians would continue to ignore how the economy really works with crypto, a source of imbalances that the "man in the street" will suffer. After two centuries of experiments and failures on alternative political regimes of governing human society, systems of freedom and welfare had established themselves, but these are now experiencing moments of great uncertainty about their future.

Ignorance of economics with cryptocurrency accentuates this trend, which is masked behind arguments of mere exaltation of technological progress. The situation urges government and market control authorities to urgently equip themselves with new knowledge and tools to carry out their tasks, as well as to share them among all institutions.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/le-criptovalute-guideranno-i-mercati-che-fanno-le-istituzioni/ on Fri, 01 Oct 2021 10:37:16 +0000.