Do anti-Russia sanctions work? What is said in the White House

White House officials quoted by Bloomberg now privately admit that "the collateral damage" of the Russian sanctions "was greater than expected." Federico Punzi's article for Atlantico Quotidiano

Not that the sanctions have not had a very serious impact on the Russian economy, also recognized by the highest authorities, such as the governor of the central bank Nabiullina ("the conditions for the Russian economy have changed dramatically ").

And, on the other hand, they implicitly admit it every time they denounce the sanctions as "an act of war" against Russia, brandishing as "hostile" the countries that have adopted them, or that respond to the requests of the West, for example on the Ukrainian wheat, putting the lifting of sanctions as a first condition on the table.

Uncertain impact on Russia

The ruble seems to have stabilized and it is difficult to assess the likelihood of a default by Russia, which in the past weeks was considered imminent, or the real impact of sanctions on the operations of the Russian armed forces engaged in Ukraine, which at the moment do not seem to be affected.

Western sanctions have forced Moscow to embark on a painful adjustment process, which in practice will have the effect of making the Russian economy even more dependent on the export of energy commodities, financially isolated, while it will have to do without of high-tech imports from the G7 countries, not easily available elsewhere.

An impoverishment that in the long run cannot fail to have dire consequences in terms of both living conditions and strategic production. But if the goal of the sanctions – the toughest ever adopted against a country like Russia – was to stop the war, then we must admit that they are not working today.

Recently, the Italian Prime Minister Mario Draghi said, without providing explanations, that the maximum impact of the sanctions on the Russian economy will come in the summer, between July and August. We will see, even if by that date Putin may have achieved most of his military objectives.

Collateral damage for the West

However, it is beginning to be difficult to deny that sanctions are backfiring on the West to a heavy degree, while at least one benefit to Russia is being ensured: Moscow's coffers are overflowing.

Runaway inflation forced the Fed and the ECB to quickly turn monetary policy, initiating a tightening path on rates, which were kept at zero for too long. A necessary move which, however, inevitably has the contraindication of slowing down the economy.

And there is a high risk of a double political backlash: fatigue of Western public opinion for policies in support of Ukraine and a decline in support for the governments that promote and implement such policies.

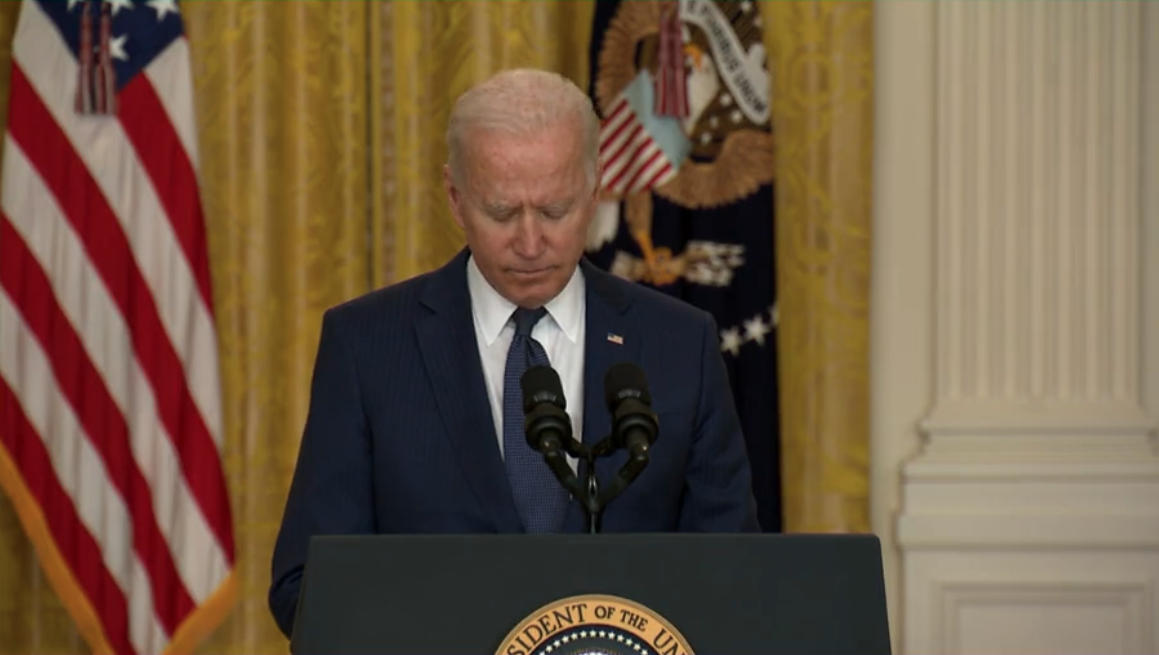

Difficult to make precise estimates, the price increases are not entirely due to the war and sanctions, the inflationary wave was already visible for months before, but White House officials cited by Bloomberg now privately admit that the "collateral damage" of the sanctions Russians "was wider than expected".

And that initially the Biden administration was convinced that exempting the energy and food sectors from sanctions would minimize the effects on inflation at home. Instead, Bloomberg notes, Americans have found themselves with the highest inflation of the last 40 years, driven by energy and food.

Record revenue from oil and gas

In the face of greater-than-expected collateral damage for Washington, Moscow has just recorded an all-time record of oil profits. Sanctions appear to help push prices to historic highs for Western consumers by funding Putin's war machine as China and India buy at discounted prices.

In the first hundred days of the war, Russia grossed a record 93 billion euros from its oil, gas and coal exports, according to data from the Center for Research on Energy and Clean Air , a research center based in Helsinki. reported by the New York Times . About two thirds of these gains came from the European Union.

Revenue "unprecedented, because prices are unprecedented and export volumes are close to the highest levels ever recorded," said researcher Lauri Myllyvirta. According to the centre's estimates, the revenue exceeds what Moscow is spending on the war in Ukraine.

And this even before the effects of the partial embargo on Russian crude oil (only that delivered by sea, among other things for Moscow which is easier to redirect) decided in recent days by the EU.

The bizarre thing is that the risks were well known within the US administration. Treasury Secretary Janet Yellen had warned that as a result of an EU ban, Moscow would export less oil, but at higher prices. In fact, according to the research cited by the NYT , export volumes may not even decrease.

Gazprom cuts the gas

Europe made major efforts to reduce its imports of Russian gas, purchasing 23 percent less in the first 100 days of the invasion than in the same period last year. However, Gazprom 's revenue remained roughly double the previous year, thanks to higher prices.

And just yesterday Gazprom announced that it will reduce the flow of gas to Germany through the first Nord Stream gas pipeline by 40 percent, from 167 to 100 million cubic meters per day.

The reduction in supplies, Gazprom explained, is due to the "need to carry out repairs" to the pipeline, but "the necessary equipment was not delivered by the German Siemens group". Siemens Energy confirmed that it had overhauled a Nord Stream 1 turbine, but that "due to the penalties imposed by Canada it cannot be returned to the customer".

Europe also reduced its Russian crude oil imports (-18 per cent in May), but the decline was offset by India and the United Arab Emirates, which did not lead to any net change in oil export volumes. Russian.

We have repeated this several times in Atlantico Quotidiano the only effective sanction against Putin's Russia is to increase the production of electricity, by returning to investing in hydrocarbons and nuclear power, so as to increase global supply and lower prices, and reduce our own. dependence on Russian supplies. But we are doing the opposite, chasing the Gretine ideology of the green transition.

China's tariffs are also at risk

Inflation could also do another excellent victim: the tariff policy towards China adopted by the Trump administration and to this day maintained by Biden.

As reported by Axios , in fact, the US president, "in a meeting last week in the Oval Office with key members of his government, indicated that he is leaning towards the removal of some products from the administration's Chinese duty list. Trump ”, in order to cool down inflation.

And so not only Russia, China too would indirectly benefit from Western sanctions against Moscow.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/sanzioni-russia-ripercussioni-occidente/ on Wed, 15 Jun 2022 09:28:16 +0000.