Does bank liquidity exceed GDP?

The reserves of households and businesses close to € 2,000 billion. Numbers and comparisons taken from a report by the Unimpresa study center

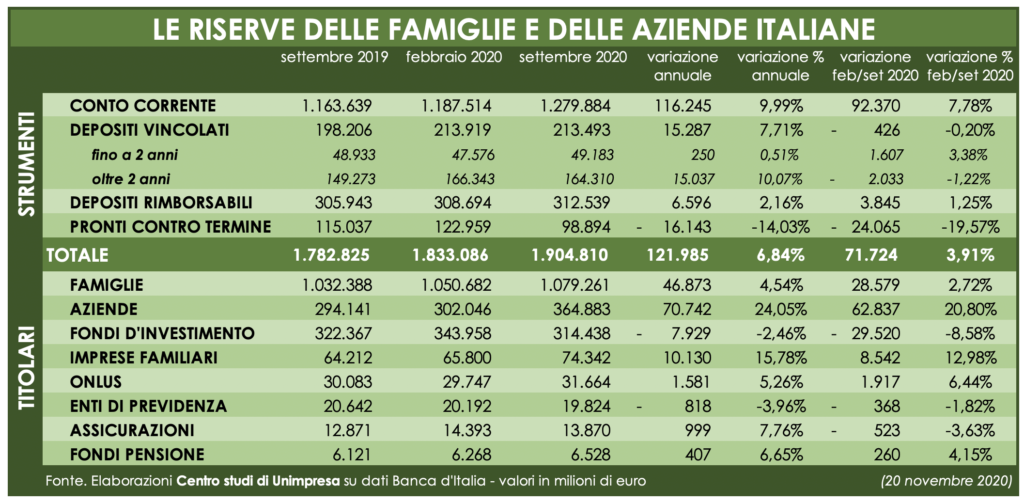

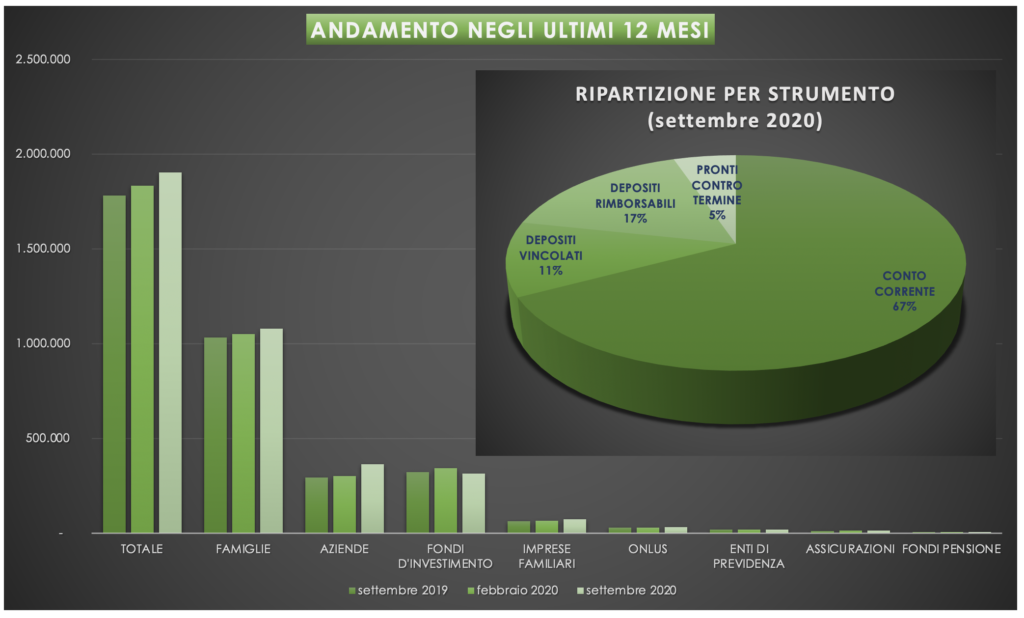

Boom of "forgotten" money in the bank due to the lockdown for Covid : in recent months it has grown, approaching 2,000 billion euros, a figure much higher than the value of gross domestic product, liquidity from households and companies in the our country. The "reserves" of Italians reached 1,904 billion euros in September 2020, up by almost 122 billion on an annual basis (+ 7%) and by 71 billion (+ 4%) compared to last February, the beginning of the pandemic . There are 1,279 billion on current accounts, up by 92 billion (+ 8%) in seven months. This is what emerges from an analysis by the Unimpresa Study Center according to which there are more than 1,000 billion in households' piggy banks, while in those of companies there are almost 365 billion; a further 314 billion are attributable to investment funds, 74 billion to family businesses, 31 billion to non-profit organizations, almost 20 billion to social security institutions, 13 billion to insurance companies and 6 billion to pension funds. "Trust has collapsed and the fault lies not only with the health emergency, but also with the Conte government which is in a state of confusion and is unable to ensure certainty for our country. Hence the fear of spending and making investments, that is, of looking to the future with a positive perspective which, despite the dramatic situation, should in any case be supported and strengthened ", comments the general secretary of Unimpresa, Raffaele Lauro.

The surge in reserves has a direct impact on the consumption of citizens and slows the investments of entrepreneurs, with consequential effects on the economic situation. In these seven months, families have accumulated over 28 billion euros (+ 2.72%), in the same period the liquidity of companies has risen by 62 billion (+ 20.80%). In total, this amounts to over 90 billion euros, which have been stolen from the economic circuit and which, on the other hand, would have been important in favoring the recovery.

According to the study of the association, based on data from the Bank of Italy, from September 2019 to September 2020, the liquidity of Italians went from 1,782.8 billion to 1,904.8 billion, up by 121.9 billion (+6 84%); in February 2020 it stood at 1,833.1 billion and, over seven months, the increase was equal to 71.7 billion (+ 3.91%). In the "piggy banks" of households there were 1,032.3 billion in September 2019, 1,050.6 billion in February 2020 and 1,079.2 billion last September: on an annual basis the growth was equal to 46.8 billion (+4, 54%), an increase of 28.5 billion (2.72%) was recorded in the space of seven months. Company reserves amounted to 294.1 billion in September 2019, 302.1 billion in February 2020 and 364 billion in September: in one year the increase was 70.7 billion (+ 24.05%) , almost all accumulated (62.8 billion, with an increase of 20.80%) from February to September 2020. Investment funds, on the other hand, have reduced liquidity in the last year: a decrease of 7.9 billion in one year ( -2.46%) and 29.5 billion in seven months (-8.58%), from 322.3 billion in September 2019 to 343.9 billion in February 2020 to 314.4 billion in September 2020. of family businesses went from 64.2 billion in September 2019 to 65.8 billion in February 2020 to 74.3 billion last September: the increase of 10.1 billion recorded a year (+ 15.78%) is linked mainly to the 8.5 billion more accumulated in seven months (+ 12.98%).

As for the analysis by instrument, on current accounts there were 1,163.6 billion in September 2019, 1,187.5 billion in February 2020 and 1,279.9 billion last September: plus 116.2 billion on an annual basis (+9.99 %), plus 92.3 billion in seven months (+ 7.78%). In term deposits, the total "balance" was 198.2 billion in September 2019, 213.9 billion in February 2020 and 213.4 billion: plus 15.2 billion in a year (+ 7.71%) and minus 426 million in seven months (-0.20%). Repayable deposits recorded a balance of 305.9 billion in September 2019, of 308.6 billion in February 2020 and of 321.5 billion in September last year: the increase over 12 months was 6.5 billion in one year (+ 2.16%) and 3.8 billion in seven months (+ 1.25%). Repurchase agreements went from 115.1 billion in September 2019 to 122.9 billion last February to 98.8 billion last September: on an annual basis there was a decrease of 16.1 billion (- 14.03%), in seven months of 24.1 billion (-19.57%). For non-profit organizations, the change was 1.5 billion more in one year (+ 5.26%) and 1.9 billion more in seven months (+ 6.44%): from 30.1 billion ( September 2019) to 29.7 billion (February 2020) to 31.6 billion (September 2020). Negative change for social security institutions: minus 818 million in one year (-3.96%) and minus 368 million in seven months (-1.82%). For insurance, it went from 12.8 billion in September 2019 to 14.3 billion in February 2020 to 13.8 billion in September 2020: plus 999 million in one year (+ 7.76%) and minus 523 million in seven months (-3.63%). Slight increase in the liquidity of pension funds: 407 million more in one year (+ 6.65%) and 260 million more in seven months (+ 4.15%), from 6.1 billion in September 2019 to 6, 2 billion in February 2020 to 6.5 billion last September.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/la-liquidita-in-banca-supera-il-pil/ on Fri, 20 Nov 2020 11:42:38 +0000.