Eni, Enel, Poste, Terna, Leonardo and more. What’s really at stake in the nominations

The complete picture on the top management of the expiring state subsidiaries according to the report of the Comar study centre

The match for the renewal of top management in companies owned or controlled by the State is in full swing.

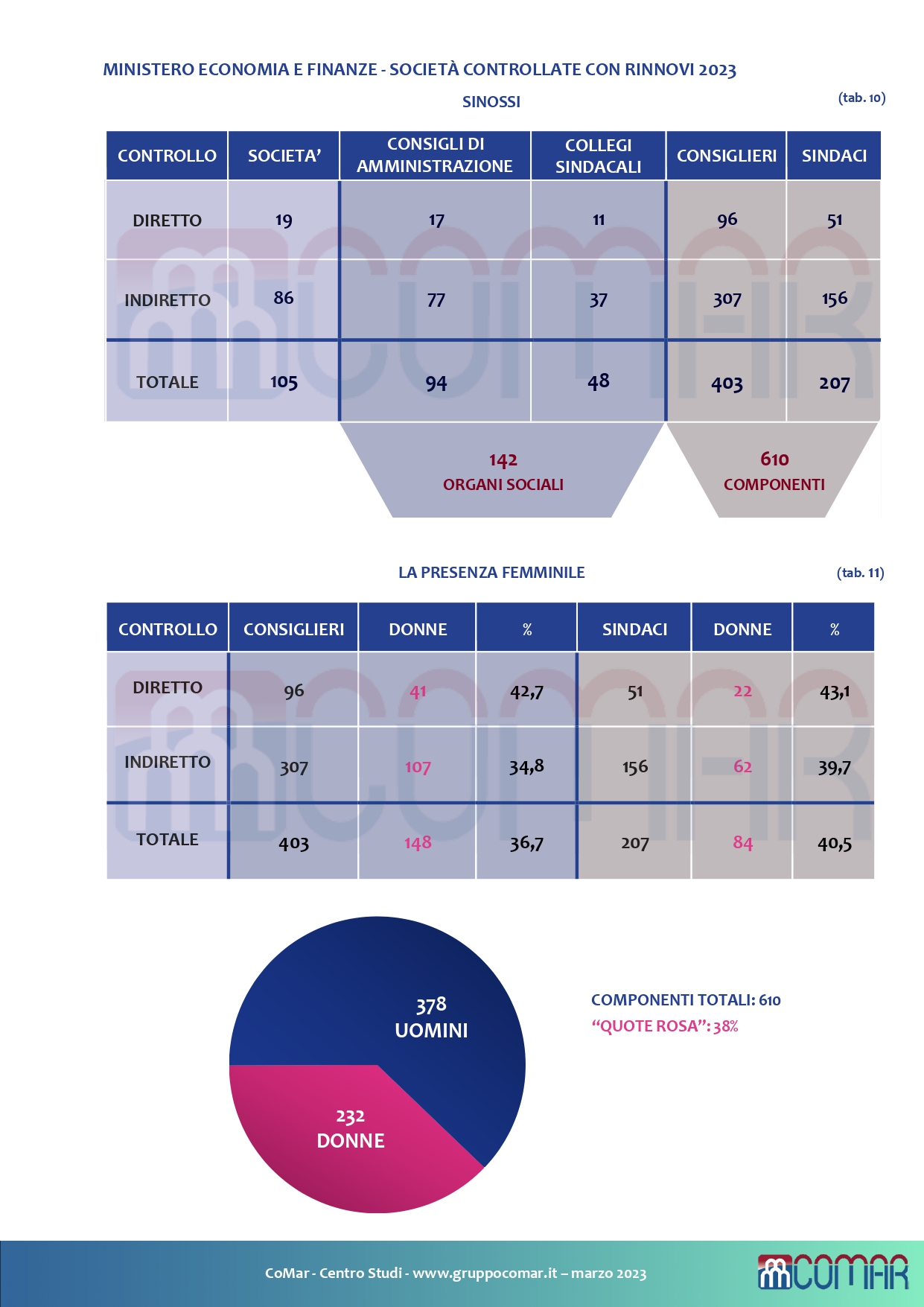

One hundred and forty-two corporate bodies, including 94 boards of directors and 48 boards of auditors, in 105 companies of the Ministry of Economy and Finance, have expired and will be renewed with the budget meetings scheduled for the coming months; in all, therefore, 610 people are at stake, including 403 directors and 207 statutory auditors.

This is the picture that emerges from the sixth edition of the analysis by the Comar study center on the governance of all state-owned companies.

This year the aspect of appointments is particularly significant, because the three-year mandates (2020-2022) of many of the largest companies are ending: Banca Mps, Consip, Enav, Enel, Eni, Ipzs, Leonardo, Poste Italiane , triad; but also Italy-Italy Transport by Air, some Rai subsidiaries; or, in the energy sector, for Gse and Sogin; and appointments are also foreseen in Cinecittà, Consap, Sogesid, Sport and Salute.

Comar has calculated, on the latest financial statements, that the companies for which renewal is expected in 2023 have a turnover of 189.9 billion euros (160.6 only considering Enel and Eni), profits of 10.6 billion, with 288,146 employees (187,702 only between Poste Italiane and Enel).

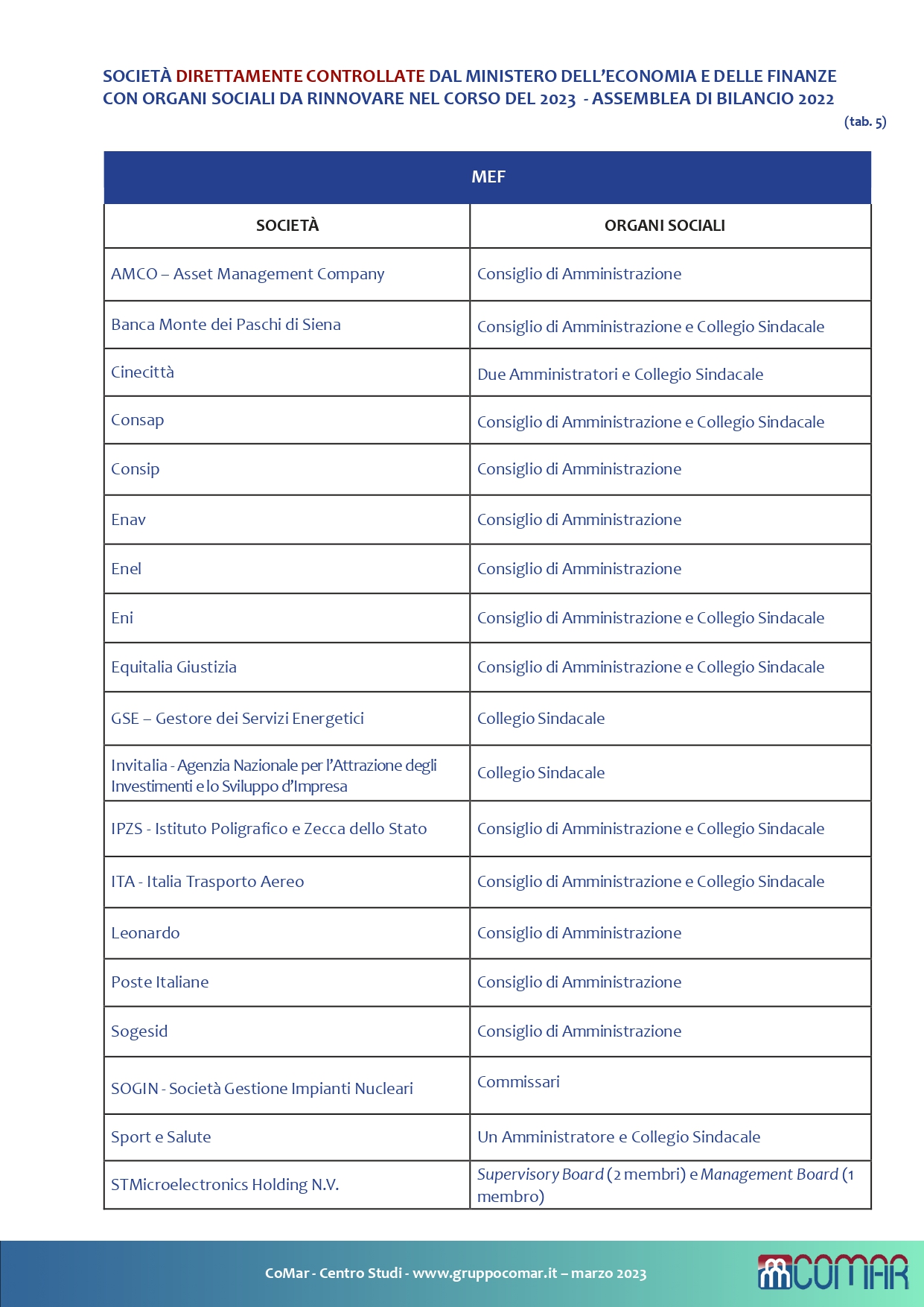

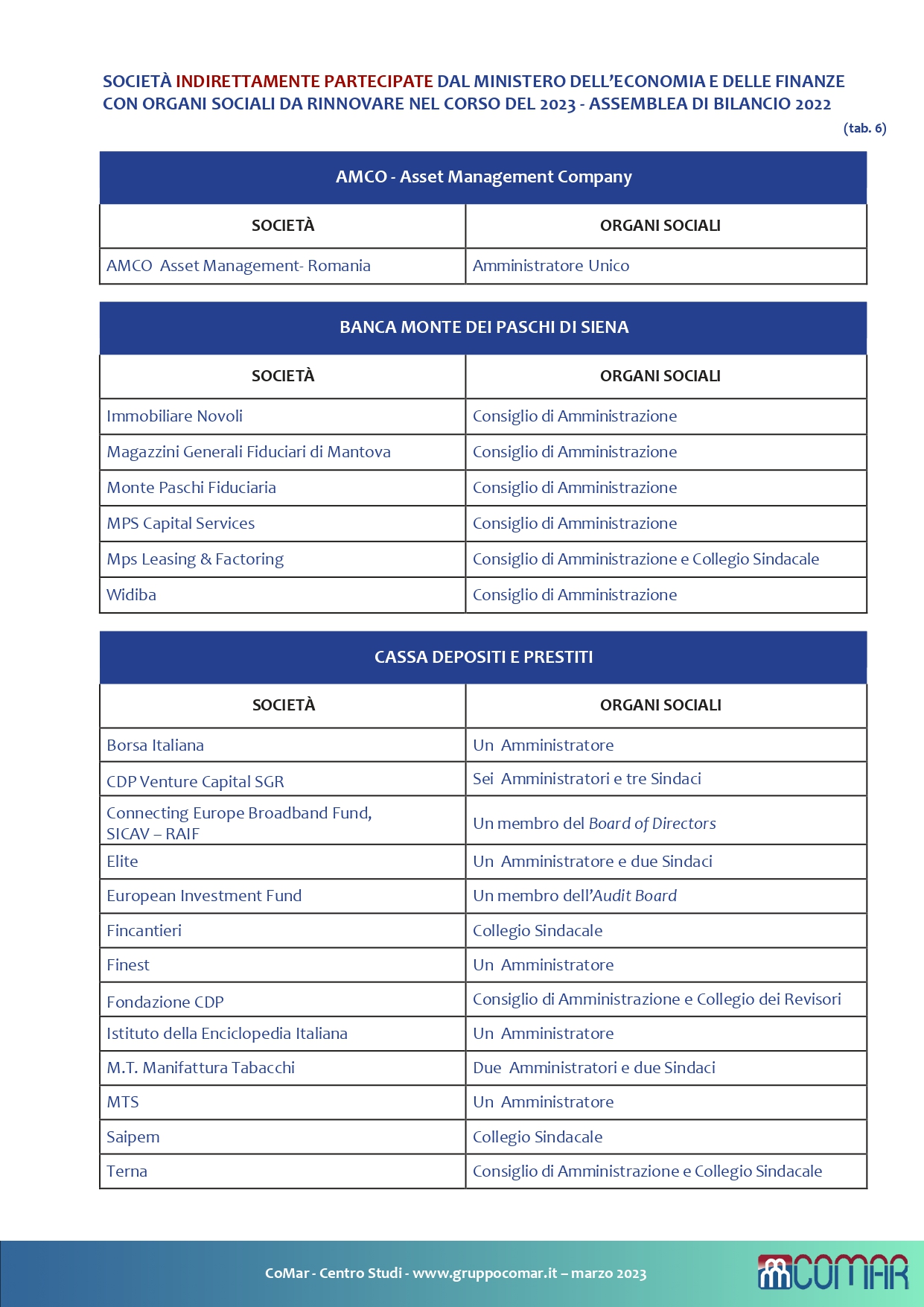

In more detail, of the total 610 people expiring, 147 sit in 19 companies controlled directly by the MEF (96 directors and 51 statutory auditors), while 463 are in 86 indirect subsidiaries (307 directors and 156 statutory auditors), through its various parent companies.

Among the criteria that must be followed for the appointments is that of gender balance. Currently, out of the 610 members of the corporate bodies who will leave in the coming months, there are 232 women, equal to 38% overall; they were still 38% in the companies that went to renewal in 2022, but 31.3% in those of 2021 and less than 28% in all previous years.

In percentage terms, women are more present in companies controlled directly by the MEF (63 female directors out of 147 total directors – 42.8%) than in indirect ones (169 directors out of 463 total directors – 36.5%); just as they are higher in percentage terms in the board of statutory auditors (84 female auditors out of 207 total auditors – 40.5%) than in the board of directors (148 female directors out of 403 total directors – 36.7%).

+++

HERE IS THE FULL ANALYSIS OF THE COMAR STUDY CENTER:

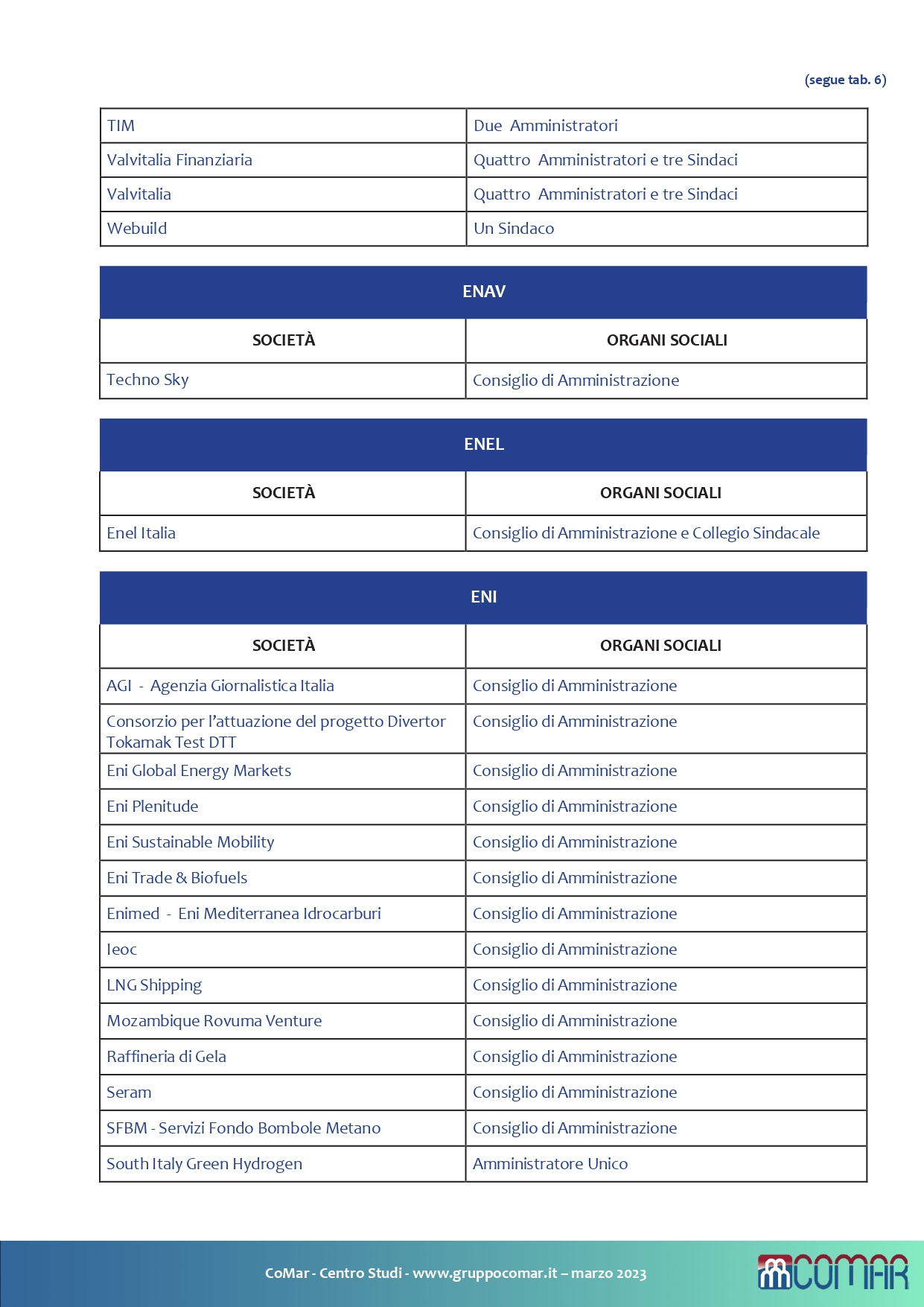

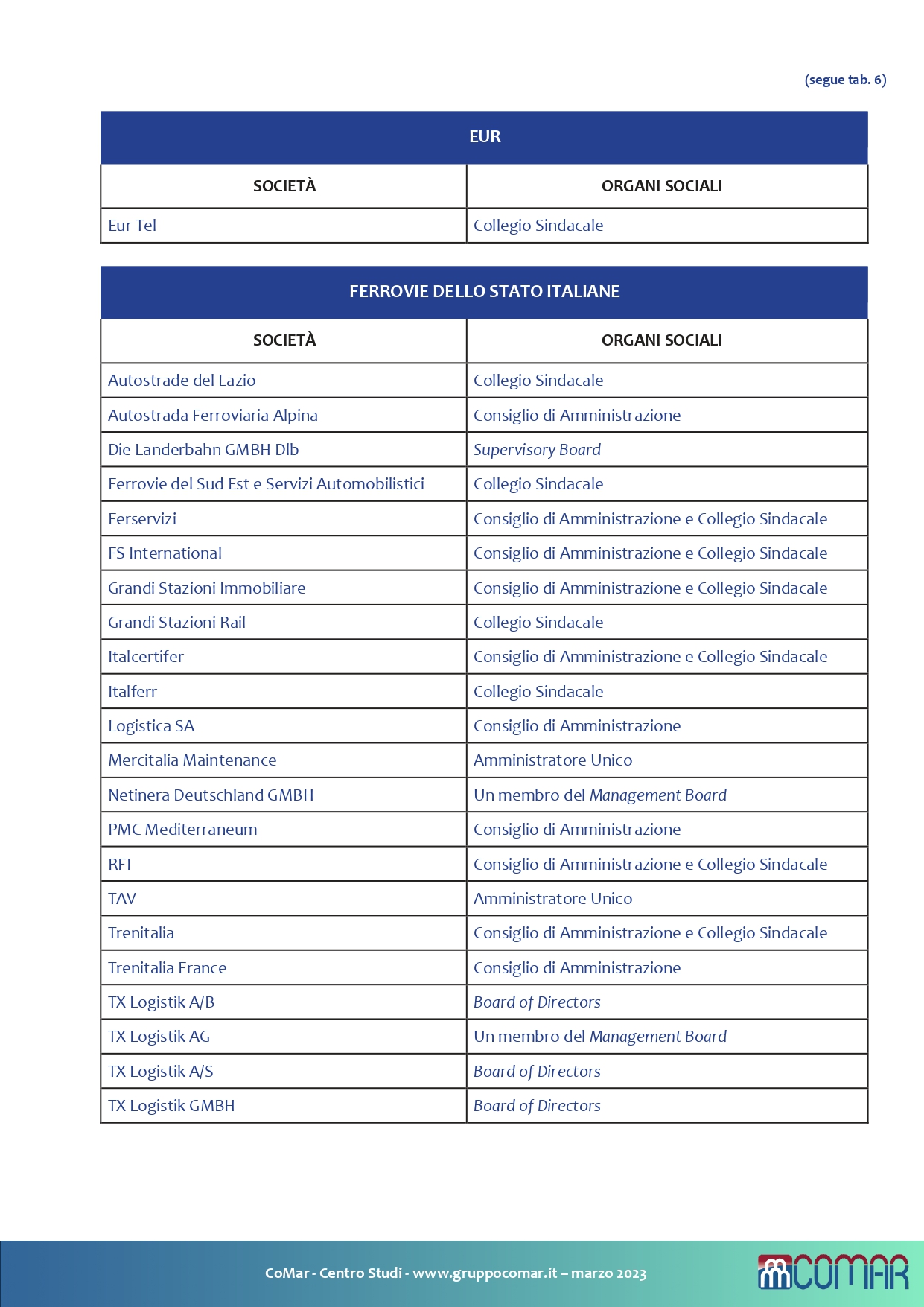

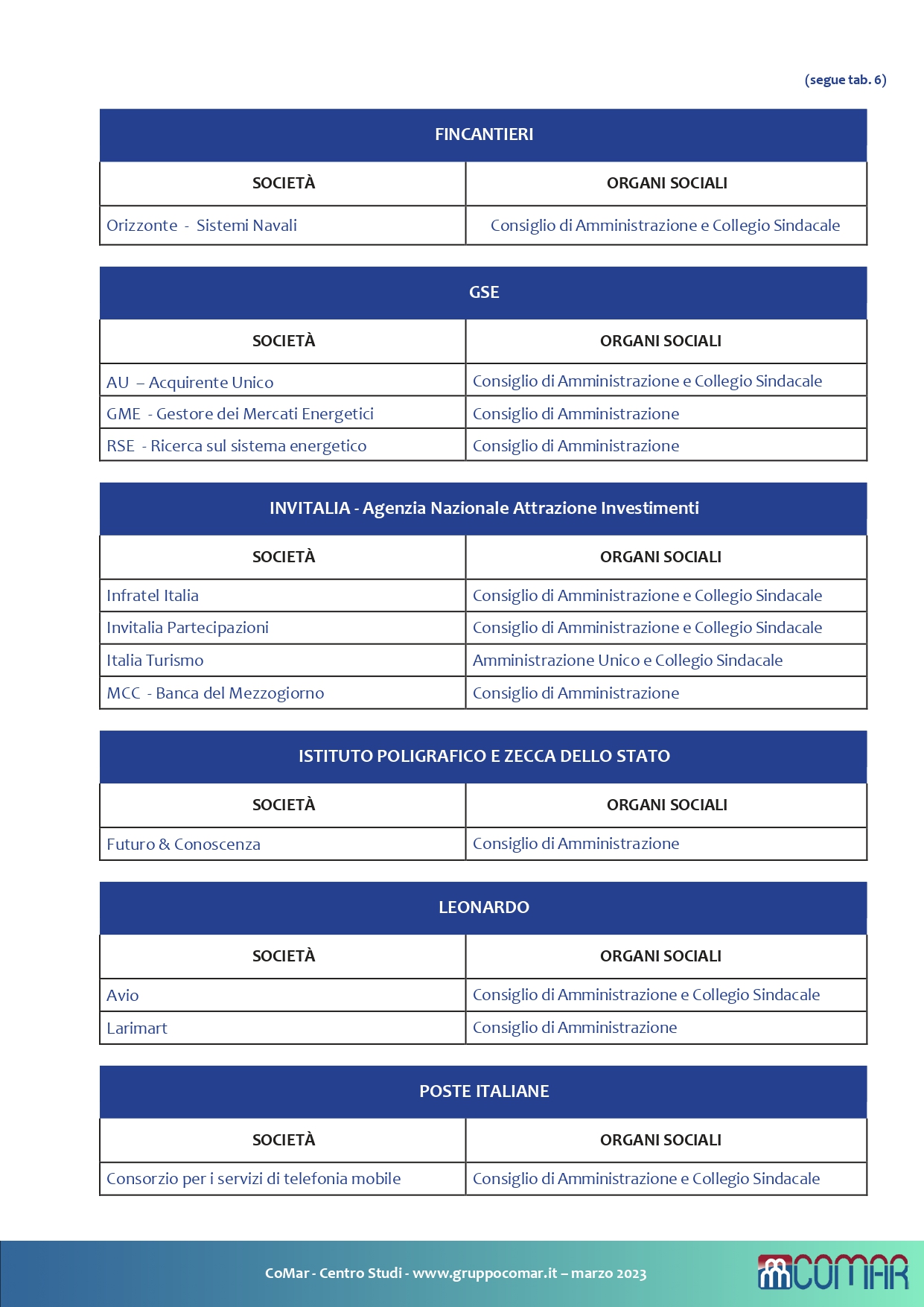

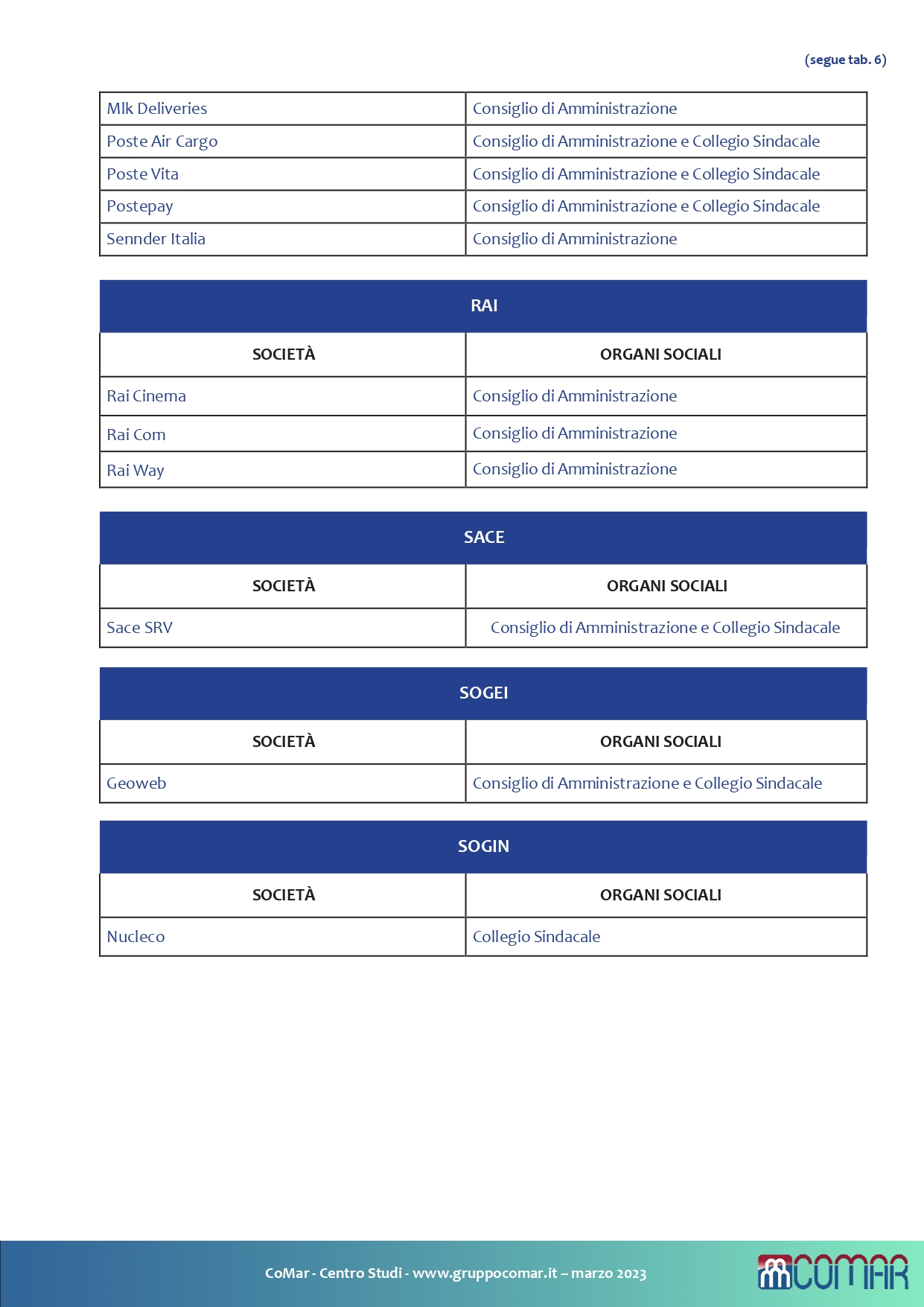

In the coming months, the administrative bodies, which expired on 31 December 2022, will be renewed for 105 MEF companies – 19 under direct control and 86 under indirect control, through its parent companies Amco, Banca MPS, Cassa Depositi e Prestiti, Enav, Enel , Eni, Eur, Italian State Railways, Fincantieri, GSEGestore Servizi Energetici, Invitalia, IPZS-Istituto Poligrafico Zecca dello Stato, ITA-Italy Air Transport, Leonardo, Poste Italiane, Rai, Sace, Sogei, Sogin, Sport and Health, STMicroelectronics (tab. 5, tab. 6 and tab. 7).

Therefore, together with the approval of the respective Financial Statements, there will be appointments for the 142 Corporate Bodies of these 105 companies overall, of which 94 are Boards of Directors and 48 Boards of Statutory Auditors (tab. 10); currently, these expiring Bodies are made up of 610 people, of which 403 are Directors and 207 Statutory Auditors; of these 610 total members, 147 people work in companies controlled directly by the MEF (96 directors and 51 statutory auditors) and 463 in indirect companies (307 directors and 156 statutory auditors). Not all of them are designated by the MEF or by its parent companies, since there are members who are expressions of other shareholders (table 8 and table 9).

The companies for which renewal is planned have reported overall, with the latest financial statements (tab. 2), a turnover of 189.9 billion euros (160.6 only considering Enel and Eni), profits of 10.6 billion, with 288,146 employees (187,702 between Poste Italiane and Enel alone).

Among the criteria that must be followed for the appointments is that of gender balance, already envisaged by Law no. 120 of 2011, strengthened with the Budget Law for the 2020 financial year (Law 27 December 2019, n.160; the application of which starts from the first renewal of the entry into force of the Law), which provides that women ("the less represented gender”, according to the dictates) obtain a representation of at least two fifths of the Board of Directors and Statutory Auditors in listed companies; with the exception of newly listed companies, which have an obligation set at 20% (amendments implemented by Consob in May 2020). The EU is also preparing a directive on the subject.

These rules have already led to a progressive and significant increase in the presence of women, growing with each renewal. Out of the 610 members of the corporate bodies who will leave in the coming months, 232 are women, equal to 38% overall; they were still 38% in the companies that went to renewal in 2022, but 31.3% in those of 2021 and less than 28% in all previous years. In percentage terms, women are more present in companies directly controlled by the MEF (63 female Directors out of 147 total Directors – 42.8%) than in indirect companies (169 Female Directors out of 463 total Directors – 36.5%); just as they are higher in percentage terms in the Boards of Statutory Auditors (84 female Auditors out of a total of 207 Auditors – 40.5%) than in the Boards of Directors (148 female Directors out of a total of 403 Directors – 36.7%). These figures show, beyond the quantitative data, how there is more distance between male and female components, where there are greater operational and management powers (tab. 10); and it is on this aspect, rather than on the purely numerical, almost acquired one, that there is still clear room for improvement.

With regard to the timing, following the epidemiological emergency, notwithstanding the provisions of the Civil Code (articles 2364 and 2478-bis) or the various statutory provisions, according to the provisions of Law no. 27 of 2020, the Ordinary Shareholders' Meetings of the Companies must be held (i.e. held, not simply "convened") within 180 days of the end of the financial year, also with any methods of conducting and forms of remote participation; the individual Articles of Association could in any case provide that the term for the renewal of the corporate bodies may be extended by the Directors in the presence of exceptional conditions. Lastly, the "Milleproroghe" Decree Law (converted into Law No. 14 of 2023) confirmed the extension to 31 July 2023 of the effectiveness of the aforementioned provisions.

The appointment of the Boards of Directors and of the Boards of Statutory Auditors in the MEF investee companies (whose shares are admitted to listing on regulated markets) takes place through the list voting mechanism (articles 147-ter and 148 of Legislative Decree no. 58). The lists are filed by the Shareholders within the 25th day prior to the date of the Shareholders' Meeting; these are also made available to the public at the registered office, on the website and with the other methods envisaged by Consob, at least 21 days before the date of the Shareholders' Meeting.

PUBLIC HOLDINGS IN THE ITALIAN ECONOMY. THE ROLE OF THE MEF

The economic Units participated by the public sector (Ministries, Regions, Provinces, Municipalities, Mountain Communities, Chambers of Commerce, Health Bodies, etc.) are 7,969 in total, with 908,571 employees; in recent years, the number of active enterprises with public participation has decreased significantly, with a decrease of 25.8% since 2012 (Istat, January 2023). Of all these subsidiaries, 5,662 are engaged in the specific sector of industry and services (above all for the supply of energy and water, waste treatment and sanitation, sewage networks, transport), generating 58 billion euro of added value; while the subsidiaries (over 50% ownership) number 3,448, with 582,669 employees.

It is the Ministry of Economy and Finance – MEF, however, that exercises by far the prevailing role, under all parameters – economic, financial, employment – with its 336 controlled companies (up to the third level); 9.7% of all public, for 309,115 employees, 53.1% of the total (Istat, January 2023).

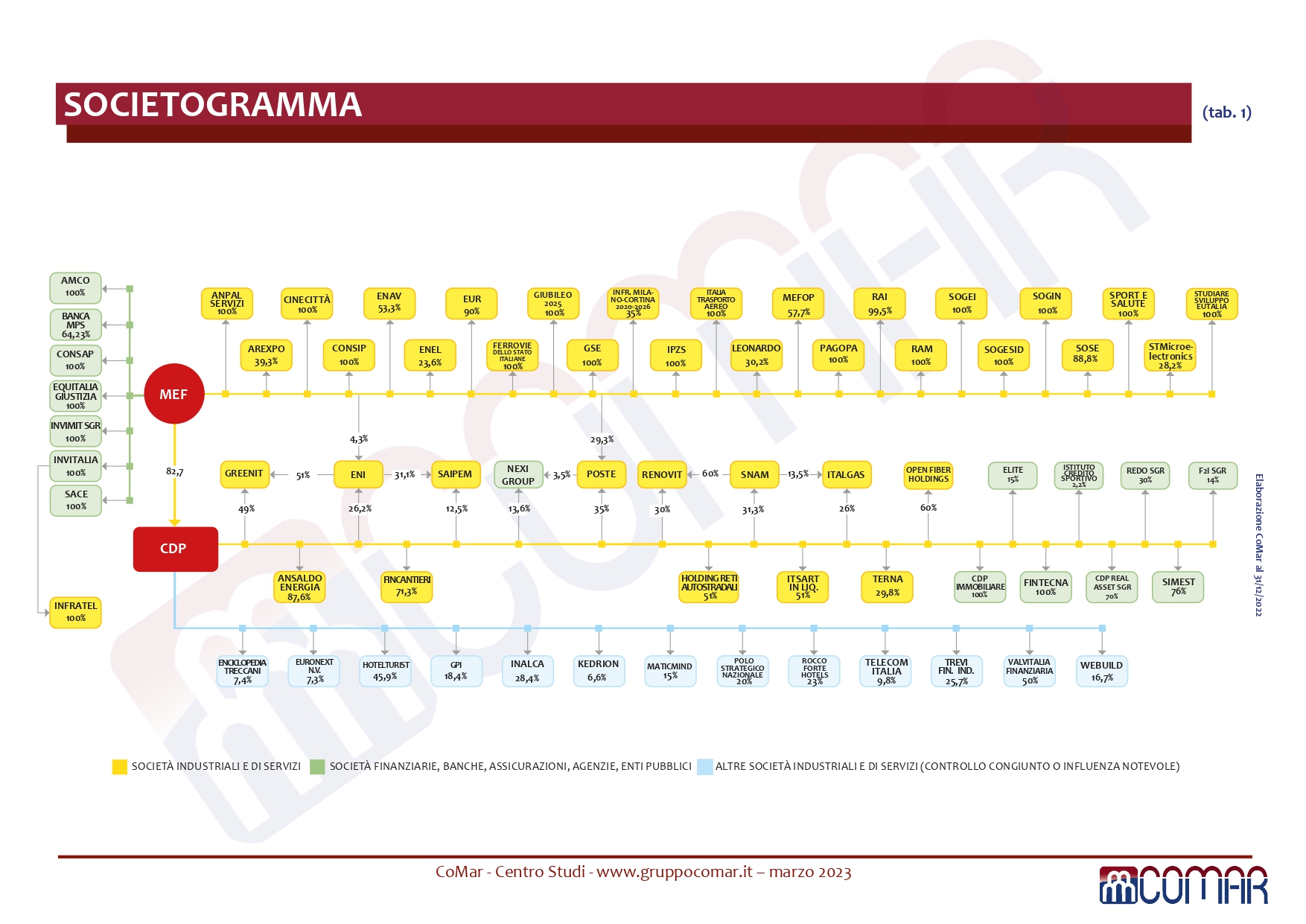

Among all these in the MEF perimeter, as at 1 January 2023, there are 55 subsidiaries, directly (35) or, indirectly, with Cassa Depositi e Prestiti (tab. 1), operating in industry, services and finance. In this Document, the 2 Subholdings CDP Reti and CDP Equity have not been considered (the merger by incorporation of CDP Industria into CDP Equity was finalized at 31 December 2022, which led to the cessation of operations of CDP Industria), including, immediately, the respective subsidiaries; nor were the additional 13 companies examined where CDP does not go beyond joint control or a power of influence, albeit considerable (Enciclopedia Treccani, Rocco Forte Hotels, Telecom Italia, Webuild, etc.).

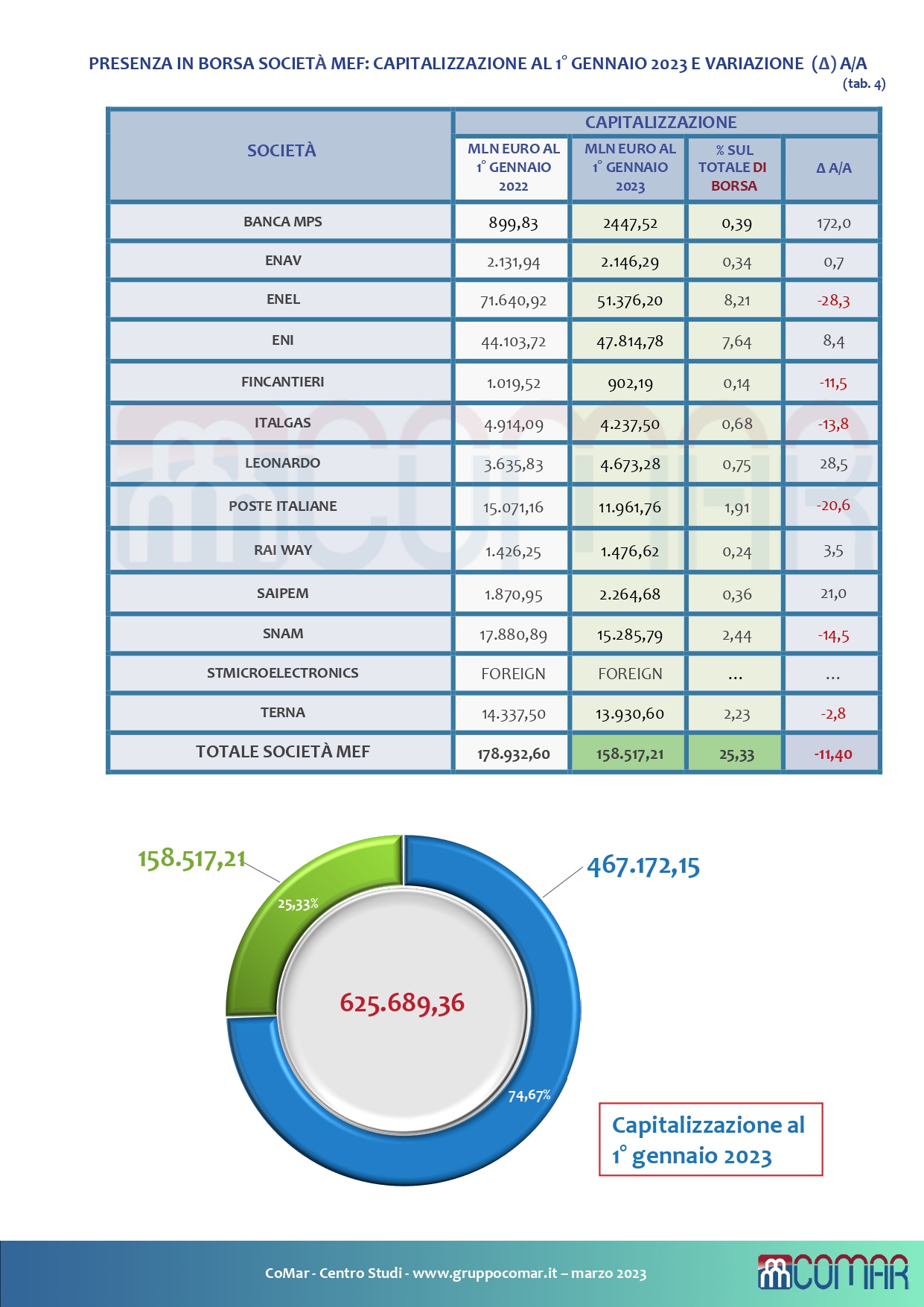

Evaluating only the 34 industrial and service companies of the MEF (excluding, therefore, banks and insurance companies, as well as Holding Reti Autostradali – which does not yet have comparable financial statements – but including Infratel, of Invitalia), the aggregate of the latest financial statements (tab. 2), approved by the respective Shareholders' Meetings, showed the following data: – turnover of 279.6 billion euros (up 45.1% on the 192.7 billion in 2020); – profits of 11.4 billion euros (while in 2020 there were losses of 4.2 billion); – 462,880 employees (up by 1.13% on the 457,725 in 2020); – financial debts of 182.8 billion (up from 164.1 billion in 2020). Of these 55 MEF companies, 13 are listed on the Stock Exchange (Banca MPS, Enav, Enel, Eni, Fincantieri, Leonardo, Italgas, Poste Italiane, Rai Way, Saipem, Snam, STMicroelectronics, Terna), for a capitalization that as of 1 January 2023 was 158.5 billion euros, 25.33% of the total value; 20.4 billion lower than the 178.9 billion as at 1 January 2022; the 11.4% Y/Y loss of the MEF companies is in any case lower than that of 18.6% recorded by the overall stock market in the same period: from 768.8 billion to 625.6 billion between the beginning of January 2022 and the beginning of January 2023 (table 4). Confirming the size of the investee companies, Enel and Eni alone represent over 15% of the entire capitalization of the Italian Stock Exchange.

These 13 listed companies are joined by another 6 companies that have listed financial instruments (Amco, Invitalia, CDP, Ferrovie dello Stato Italiane, Rai and Sace).

Listing, including the issue of listed instruments, involves significant differences in the legislation governing administrative transparency and market disclosure obligations (also understood as discretionary powers of confidentiality) and in the remuneration of the Company's Directors.

Not only for the listing on the Stock Exchange of some of them, however clear differences emerge between the 55 companies jointly owned by the MEF, especially in terms of exposure to the market and competition or the presence in the shareholding structure of institutional investors, including foreign ones or individual. Some of these companies are classified by Istat as Entities, whether they are producers of economic services (Amco, Consip, Equitalia Giustizia, Eutalia-Studiare Sviluppo, Fintecna, Invimit, Ram, RFI-FS, Sogei, Sogin, Sogesid, Sose) or producers of recreational or cultural services (Cinecittà, Rai, Sport and Salute). The same legal personality can vary from SpA to Srl.

As sectors of intervention, energy predominates, absorbing over 79% of turnover, followed by mechanics (10.4%) and transport and TLC (7.7%), with marginal shares in ICT, publishing-entertainment -sport, in services to the PA, in the environment-territory.

THE EFFECTS OF PANDEMIC AND GEOPOLITICAL CRISES AND THE OBJECTIVES OF THE PNRR ON THE SCOPE AND MISSIONS OF INVESTEE COMPANIES

The need to make up for widespread situations of economic difficulty or instabilities that can no longer be remedied has led, in the last four years, to a renewed expansion of the intervention of the "State-entrepreneur". By way of example, new companies were born, such as ITA-Italia Transport Aereo or Holding Reti Autostradali or the PSN-Polo Strategico Nazionale or DRI of Italy (in Invitalia, for the iron and steel supply chain and the former ILVA reclamation) or, connected to the ecological transition, Green.It (CDP and ENI) or Renovit (CDP and Snam); while Infrastrutture Milano Cortina 2020-2026 is functional to the Winter Olympic Games; and, still with regard to "major events", a new company was set up, called "Giubileo 2025", headed by the MEF, open to the participation of other companies of the same Dicastery; still others have seen a renewed state presence, such as Btx Italian Retail and Brands, Ceramiche Dolomite, GPI, LIS Holding, Maticmind, Mooney Group, Sicamb, Titagarh Firema. Then there are those transferred to the MEF following receiverships of the Parent Company, as happened for Anpal Servizi. Conversely, Expo 2015 has ceased operations and is in liquidation; as, since December 2022, also ITsArt, born in May 2021; with others, minor ones, above all owned by Invitalia (Italia Turismo, Invitalia Partecipazioni). Others have been divested, such as Bonifiche Ferraresi, Eur Tel, FSI Sgr, Kedrion, Quattror Sgr. (table 11) .

Even the PNRR – National Recovery and Resilience Plan is determining a redesign of the skills and activities of the individual investee companies: not only for the larger ones, they are recipients of substantial funds, in particular if connected to the Missions aimed at the digital transition, the ecological one , to social inclusion and territorial rebalancing; Ferrovie dello Stato Italiane (with Anas) and Enel are among the main contracting stations; Invitalia carries out technical-administrative consultancy activities and even more, in this sense, CDP, which supports you with the direct management of resources linked to strategic initiatives and market operations or industrial initiatives.

THE REGULATION, THE POWERS, THE SELECTION PROCEDURES

The MEF manages its shareholdings, through the Treasury Department, in the typical ways of any Shareholder, in terms of definition of objectives, control of results, composition of corporate bodies. The main regulatory references, with which this action must comply, reside in the Civil Code and, where specifically contemplated, in special provisions envisaged by primary and regulatory sources, due both to the presence of publicistic profiles and the multiplicity of the administrations involved; and, therefore, in:

– Civil Code, articles 2449 and following, as amended by article 13 of the Law of 25 February 2008, n° 34;

– Legislative Decree of 19 August 2016, n° 175 (“Consolidated law on publicly-owned companies – Tuspp”), implementing the delegation contained in art. 18 of Law No. 124 of 2015 and as amended by Prime Ministerial Decree No. 100 of 16 June 2017;

– Legislative Decree of 14 March 2013, No. 33 ("Transparency Decree"), as amended by Legislative Decree No. 97 of 2016; which, among other things, excludes companies with listed shares and companies issuing listed financial instruments from certain disclosure obligations (such as those on the remuneration of directors); – Legislative Decree of 30 March 2001, n° 165 (“General rules on the organization of work employed by public administrations”)

– Legislative Decree No. 58 of 24 February 1998 (“Consolidated text of provisions on financial intermediation – TUF”), in the event that the shares representing the capital are admitted to trading on regulated markets; – a series of Directives issued by the MEF, following one another chronologically:

• directive relating to the procedures for identifying the members of the corporate bodies of investee companies by the Ministry, dated 31 January 2023, signed by Minister Giancarlo Giorgetti;

• directive relating to the procedures for identifying the members of the corporate bodies of investee companies by the Ministry, dated 31 March 2021, signed by Minister Daniele Franco;

• directive relating to the procedures for identifying the members of the corporate bodies of investee companies by the Ministry, dated 14 April 2020, signed by Minister Roberto Gualtieri;

• directive relating to the procedures for identifying the members of the corporate bodies of investee companies by the Ministry, dated 16 March 2017, signed by Minister Pier Carlo Padoan;

• directive for the implementation of the legislation on the prevention of corruption and transparency in subsidiaries or investee companies of the MEF, dated 25 August 2015, signed by Minister Pier Carlo Padoan;

• directive on the adoption of criteria and methods for the appointment of members of administrative bodies and policies for the remuneration of top management of companies controlled directly or indirectly by the MEF, of 24 June 2013, signed by the Minister Fabrizio Saccomanni;

• directive to strengthen the statutory safeguards aimed at guaranteeing a high standard of subjective requisites for holding and maintaining the office of director, of 24 April 2013, signed by the Minister Vittorio Grilli. Moreover, there are investee companies which, by virtue of art. 2 of the Prime Ministerial Decree of 25 May 2012 containing “Criteria, conditions and methods for adopting the ownership unbundling model of the company Snam SpA pursuant to law 24 March 2012, n. 27”, are not subject to the aforementioned MEF directives of 24 June 2013 and 16 March 2017.

With regard to the relations between the MEF Shareholder and the Companies, the Ministry does not exercise the management and coordination activity referred to in article 2497 of the Civil Code, on liability matters, as sanctioned by Law no. 102 of 2009.

With regard to the aims of the action, all Public Administrations are prohibited from setting up, even indirectly, Companies whose object is the production of goods and services that are not strictly necessary for the pursuit of their institutional purposes, as well as from acquiring or maintaining shareholdings, including minority interests, in these companies (Article 4 of the Tuspp). Within this principle, what can be pursued through the investee companies is listed: a) production of a service of general interest; b) design and construction of a public work on the basis of a program agreement between public administrations or a partnership with a private contractor selected according to specific procedures; c) self-production of goods or services instrumental to the participating Public Entity or Entities or to the performance of their functions, in compliance with the conditions established by the European directives and by the relative national implementing legislation on public contracts; d) performance of purchasing services, including auxiliary activities, in support of non-profit organizations and contracting authorities.

The appointments or designations of candidates for the role of Sole Director, member of the Board of Directors or of the Board of Statutory Auditors imply the exercise of a political-administrative activity, the ownership of which lies with the governing body of the MEF. The deeds concerning the identification and evaluation of professional profiles in the context of selection procedures useful for the composition of corporate bodies are exempt from the right of access, as provided for by the Ministerial Decree of 13 October 1995, n° 561.

By 31 January of each year, the MEF discloses the investee companies with expiring bodies. The possibility of sending applications by interested parties by e-mail is contemplated, by filling in the already prepared forms. It is intended to base the selection process on the objective of identifying the best professionals and, to this end, since the first MEF directives of 2013, as revised over the years, there are requirements for eligibility, causes for exclusion or forfeiture, hypotheses of conflicts of interest, guarantees of transparency. The "Saccomanni Directive", of 24 June 2013, also introduced a "Guarantee Committee", made up of recognized independent and competent personalities and the possibility of making use of the support of several companies specialized in the search and selection of top managers.

Regarding the CDs. Head hunters, on the basis of the "Padoan Directive" of 2017, Korn Ferry International, Spencer Stuart and Eric Salmon & Partners were appointed. Along the same lines, following the procedure initiated on 7 February 2019 by the Treasury Department, on 8 March 2019 four assignments were conferred to the executive search firms Eric Salmon & Partners, Key2People, Russel Reynolds Associates and Spencer Stuart Italia, which fulfilled the required formalities until 31 December 2020 (CA 19 February 2020, Minister Roberto Gualtieri). Their role is also reiterated in the 2021 "Franco Directive"; and, finally, in the "Giorgetti Directive", which entrusted the task to Eric Salmon & Partners, Key2People, Spencer Stuart Italia.

Companies specialized in the search, selection and evaluation of candidates for the office of Director can avail themselves not only of the MEF, but also of the CDP, as part of a process to which the "Appointments Committee" is in charge: for the two-year period 2022-2023, following a European tender, this service was awarded, divided into two lots: for the Directors of significant industrial companies, with an estimated value of 385,000.00 euros; and for relevant financial companies, with an estimated value of 152,000 euros (total, 537,000.00 euros). Technically, it is still the Treasury Department that plays the lead role; monitor and report all expiring positions; then, in the case of direct subsidiaries, it takes care of the preliminary investigation and submits the results to the political guidance body for voting indications at the shareholders' meeting; while, in the case of indirect subsidiaries, it expresses a series of recommendations to the Parent Company (e.g.: valorise internal staff; refrain from appointing Directors of the Parent Company, barring exceptions; all-inclusiveness of remuneration), receives from them – before proceeding with the appointments – the results of the selection, verifies compliance with the nomination criteria and procedures, finally reporting in detail to the Minister.

For many investee companies, the prior acquisition of the impulse or agreement with another or other Ministries is contemplated, taking into account the prerogatives of the Presidency of the Council of Ministers. The appointment of corporate bodies in listed investees takes place with the list voting mechanism.

THE COMPOSITION OF THE CORPORATE BODIES

With regard to the composition of the corporate bodies, the Law (Legislative Decree 2016/175) provides that the Administrative Body of companies under public control is made up of a Sole Director; however, it is possible that the Assembly, giving reasons, decides on the possibility of a Board of Directors, with three or five members. Exceptions to this general provision are the companies issuing listed financial instruments, Consip, Sogei, Sport and Salute. The Board of Statutory Auditors, as per the Civil Code, is made up of three or five standing members and two substitutes. With the exception of listed companies, the presence of Ministry employees is expected, as far as possible.

It is forbidden to confer tasks to retired workers, both public and private (Law 2012, n. 135). For listed and asset management companies, the law requires the presence of one or more directors who meet the independence requirements.

CONTROLS ON INVESTEE COMPANIES

The topic of controls on investee companies remains insufficiently defined, after the season of privatizations carried out in the 1980s and 1990s. In this regard, the MEF plays the main role, exercising this competence over a significant number of companies, even where the shareholding is less than 50%, on the basis of three reasons: mainly public relations activities (such as Consip or Sogei); SpA deriving from public service providers (Italian State Railways, IPZS, Poste Italiane); strategic sectors (energy, defence).

Alongside the MEF, the control over the investee companies sees the Court of Auditors operate: the transformation from the legal form of the public body to that of the common law company, which took place with the privatizations, did not in fact exclude the competence of the accounting judiciary, as reaffirmed by the Constitutional Court in December 1993, after the attribution conflict raised by the same Court of Auditors against the Government; and this as long as the State maintains the economic management of the companies in its availability. The control of the Court of Auditors is of a referent nature: the companies must send the financial statements to the accounting judiciary accompanied by the reports of the administrative and auditing bodies; the Court can formulate its findings at any time to the MEF and to the competent Ministry and reports annually to Parliament. With regard to the latter, with the transformation of the PP.SS. any form of parliamentary control over appointments, programs and their implementation, acquisitions and disposals has ceased, as was envisaged, even preventively, by Law no. 14 of 1978.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/eni-enel-poste-terna-leonardo-e-non-solo-cosa-ce-davvero-in-ballo-nelle-nomine/ on Fri, 17 Mar 2023 08:01:28 +0000.