Equalization 2024: here are the new penalties in the revaluation of medium-high pensions

What will happen to medium-high pensions? The speech by Michele Poerio, national president of Federspev , and Stefano Biasioli, organizational secretary of Federspev

The INPS message 4050 of 11/15/23 noted that the definitive percentage change calculated by Istat for the year 2022, to be used for the purposes of the automatic equalization of pensions for the year 2023, "was equal to + 8 .1%“, compared to the forecast devaluation of + 7.3%.

Furthermore, the positive adjustment due above (+ 0.8%), pursuant to art. 1 of Legislative Decree 145/2023 and to counteract the negative effects of inflation for the year 2023, "it was brought forward to 1 December 2023" (usually it happens in the first months of the year following the one to be adjusted).

Each pensioner is therefore responsible for the arrears relating to the first 11 months of 2023 of pension, while for December 2023 and the thirteenth the amounts are already updated.

Naturally, the aforementioned + 0.8% will also be attributed according to the reductions referred to in law 197/2022, i.e.: 100% = + 0.800% up to 4 times the INPS minimum; 85% = + 0.680% over 4 and up to 5 times the minimum; 53%= + 0.424% over 5 and up to 6 times the minimum; 47%= + 0.376% 6 to 8 times the minimum; 37%= + 0.296% 8 to 10 times the minimum; 32%= +0.256% above 10 times the minimum.

Also in this case, a guarantee mechanism operates which intervenes when, by calculating the equalization with the percentage to which one is entitled (based on the overall value of the personal pension), the result obtained is lower than the limit of the previous band, which is also equalised. , an amount that is in any case insured.

Finally, pursuant to the joint Economy-Labour Ministerial Decree of 11/27/2023, it was established, given the consumer price index for families of workers and employees (without tobacco) recorded by Istat in the first 9 months of 2023 and on the optimistic estimate (i.e. clearly decreasing inflation) of the last 3 months, the provisional revaluation index of + 5.4% for 2024 pensions, effective from 1 January 2024, subject to adjustment (positive, more probable, or negative or zero) to be established at the end of 2024.

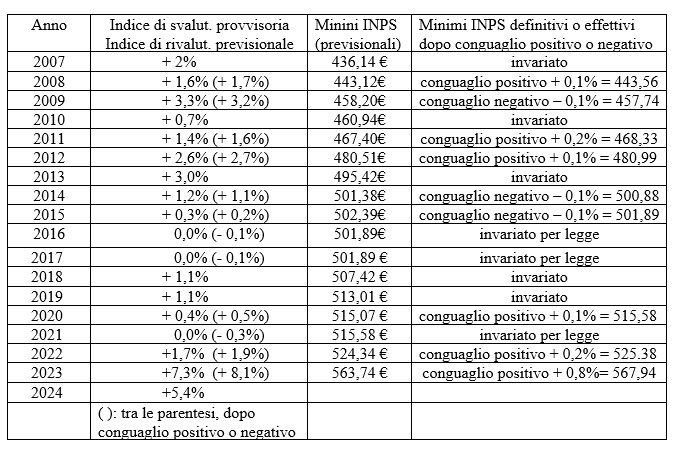

Below are the devaluation indices (provisional and definitive) and revaluation indices for the last 18 years.

As a result of the aforementioned Ministerial Decree, as well as the INPS Circulars, as well as the provisions of the latest budget law (in particular law 30/12/2023, n.213 on supplementary order n. 40 to the Official Gazette 303 of 30/12 /2023), in 2024 the INPS minimum payment goes from €567.94/month (after adjustment) to €598.60/month; the value of the social allowance from €507.03/month to €534.40/month; the social pension goes from €417.05/month to €439.57/month (again after an adjustment made on the 2023 values).

Therefore, from 1 January 2024, given the persistence of robust devaluation rates and in order not to further aggravate the permanent damage caused by the revaluation criteria introduced by law 197/2022 (first Meloni budget law), instead of returning to the revaluation in stages with respect to the different amounts of the same pension, i.e. + 100% Istat index for amounts up to 4 times the INPS minimum, + 90% for amounts between 4 and 5 times the minimum and + 75% for amounts over 5 times the aforementioned minimum (ranges taken up by budget law 234/2021 of the Draghi Government, along the lines of law 388/2000, valid for 2022), we continued with the much more penalizing and unjust criteria introduced by the Letta Government with law 147/2013, according to which the revaluation took place, and takes place, according to a single percentage, decreasing with respect to the overall value of the check and on the entire size of a single pension, without any band of true revaluation guarantee at least for a portion of the pension check.

Indeed, it even raged (second Meloni budget law) penalizing by 10 points (from 32 to 22%) the revaluation of pensions over 10 times the INPS minimum (with an increase of + 1.188%, therefore, compared to + 5.4 % of recognized forecast inflation). We didn't even proceed with the simple proportion 7.3% : 32% = 5.4% : x, which with a little rounding would have led to 24%. And instead with the 22% increase the aim was to disfigure (in two subsequent years: 2023 and 2024) a category of pensioners which includes, with family related activities, at least one million people. We could have expected treatment like this, at most, from those who have class hatred in their ideological-cultural baggage.

Therefore, from 2024 INPS pensions, formerly INPDAP, will have the following development, based on the different overall amount bands (naturally starting from the 2023 INPS minimum adjusted of €567.94):

- up to 4 times minimum INPS 2023 (€2,271.76) + 100% Istat index = + 5,400% increase;

- from 4 to 5 times “ (from €2,271.77 to €2,839.70) + 85% Istat index = + 4.590% increase;

- from 5 to 6 times “ (from €2,839.71 to €3,407.64) + 53% Istat index = + 2.862% increase;

- from 6 to 8 times “ (from €3,407.65 to €4,543.52) + 47% Istat index = + 2.538% increase;

- from 8 to 10 times “ (from €4,543.53 to €5,679.40) + 37% Istat index = + 1.998% increase;

- over 10 times " (from €5,679.41 onwards) + 22% Istat index = + 1.188% increase.

The revaluation mechanism identified, as well as the coarseness of the cuts to the revaluation itself (even the Letta Government in 2013 had stopped at 40% of the increase due, but today we are at 22%), suggest that today's legislator is thinking more about -tax medium-high pensions into enjoyment rather than defending their value from inflationary insults. But, at least, in Letta's time the devaluation was modest and the discrimination less lacerating, today it is still galloping between 5 and 6%. Furthermore, for three years (2016,2017,2021) the punitive will of the legislator was nullified by devaluation rates around 0%.

On the other hand, the tax category to which we belong (on average over €55,000 gross/year of income, so to speak over 8 times the INPS minimum, "rewarded" by 37% or 22% of the revaluation recognized on the basis of the ascertained devaluation) represents almost 5% of all Italian taxpayers and already supports almost 40% of the country's total IRPEF revenue (ratio 1:8). What else do you want from us? And the CGIL National Secretary still has the courage to request "more progressive" taxation!

Furthermore, this improper taxation, which however represents a real "patrimonial" on medium-high pensions, does not even possess the requirements required for legitimate tax levy (art. 53 of the Constitution), i.e. the generality of the levy and its proportionality: in fact, penalties or favors are distributed at the same time, the law of all or nothing applies. How can we think that we are not always looking for "a vote in exchange", flattering the most numerous categories?

What happens to the principle, reiterated several times by the Council, according to which the pension is nothing but deferred remuneration and that remuneration requires proportionality between the quantity and quality of the work performed?

The only pensioners always protected from officially recognized inflation were instead, even in the difficult years of the economic situation (from 2008 to today), exclusively holders of checks up to 3 times the INPS minimum (up to 4 times the minimum, from 2020 ).

On the contrary, at the end of 2024 we will be able to say that the equalization of medium-high pensions (that is, those of the managerial classes, healthcare ones in particular) has been eliminated, or severely limited, in 13 of the last 18 years (72.22% of the period ), trampling on fundamental constitutional principles (in particular those of articles 3, 36, 38, 53) and dozens of sentences of the Council, causing the pensions in question to lose at least 20-25% of the legitimately accrued and consolidated value (and more those who also had to suffer "the proletarian expropriation of the Soviet memory of the solidarity contribution" lost.

Those decided so lightly by the legislator are in fact structural, permanent and growing damage to medium-high pensions. In fact, the effect accumulates over time, given that future indexations will also be applied to reduced amounts, especially when the cuts are repeated over time, almost habitually and fiercely, something which the Council had repeatedly warned the Government and Parliament not to continue to do. Do.

Naturally, it is legitimate for the institutions to aim to increase minimum pensions, which however are those with inadequate contribution bases and frequently without any contributions, but the resources must derive from general taxation and not from cuts in the indexation of medium-high pensions, well differentiating assistance from social security in INPS budgets.

Even without the aforementioned interventions, the automatic equalization of pensions never achieves full compensation from inflation for at least the following main reasons: 1) because the recovery occurs later than the moment of the inflationary insult; 2) because the official "basket" that weighs the increase in the cost of living for the families of workers and employees is not specific for elderly people; 3) because, even ordinarily, the revaluation percentage is recognized in a progressively decreasing amount as the amount of the pension enjoyed increases. But at least the criteria set out in law 388/2000, taken up by the Draghi Government as mentioned above, guaranteed an overall revaluation of around 80%.

With these premises, as you can see, medium-high pensions are not, in fact, revalued in 2024, but we continue to "raise cash" to the detriment of elderly people, who already have to pay for a decline in our welfare system.

ENPAM pensions, on the other hand, do not undergo significant changes in their 2024 revaluation: + 75% Istat index (= + 4,050%) up to 4 times the INPS minimum; +50% ( = +2.700%) from 4 times up.

ENPAM reversibility pensions (70% rate) are not subject to reductions based on the income of the surviving beneficiary, while INPS-ex INPDAP pensions (60% ordinary rate) are not subject to reductions based on the income of the entitled person only up to 3 times the minimum INPS (€22,149.66/year with thirteenth salary); they are then reduced: by 25% for incomes between 3 and 4 times the INPS minimum (over €22,149.66 and up to €29,532.88/year); 40% for incomes between 4 and 5 times the INPS minimum (over €29,532.88 up to €36,916.10/year); of 50% for the beneficiary's income that exceeds 5 times the INPS minimum (over €36,916.10/year, always with thirteenth).

In conclusion, given the havoc perpetrated from 2008 to 2024 on the revaluation of medium-high pensions and in full coherence with the statutory mandate of CONFEDIR, FEDER.SPeV. and APS-Leonida and the duty to protect our Associates, tired of being considered as the perennial St. Patrick's well of all the governments that have followed one another in the last 30 years, with the exception of the Draghi government.

We have already challenged the 2023 budget law, we will be forced to challenge the 2024 budget law, this time too before the competent judiciary against the illegitimate indexation criterion of INPS-ex INPDAP pensions in the certainty that the issue will be referred to the Constitutional Court to decide on the legitimacy of the rules contested by us, in the hope that the Judges called to decide will look at the rules and constitutional principles in force according to the spirit and letter with which they were written and approved, not according to the forced and interested interpretation that the Palace would like. Otherwise, first of all their credibility and that of the institution represented would be undermined.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/perequazione-2024-pensioni/ on Wed, 03 Jan 2024 06:56:18 +0000.