Everything about Btp Valore

Btp Valore: advantages and risks of the new upcoming issue. The analysis of Roberto Rossignoli, Senior Portfolio Manager of Moneyfarm

The placement of the fourth issue of the BTP Valore will take place from Monday 6 May to Friday 10 May.

Like the one in February, the new issue will also have a duration of six years, in line with the Treasury's plan to extend the average maturity of Italian public debt. While waiting to know the minimum returns guaranteed by the security, which will be communicated today, let's take stock of the main characteristics of the issue.

THE CHARACTERISTICS OF THE NEW BTP ISSUE COMING VALUE

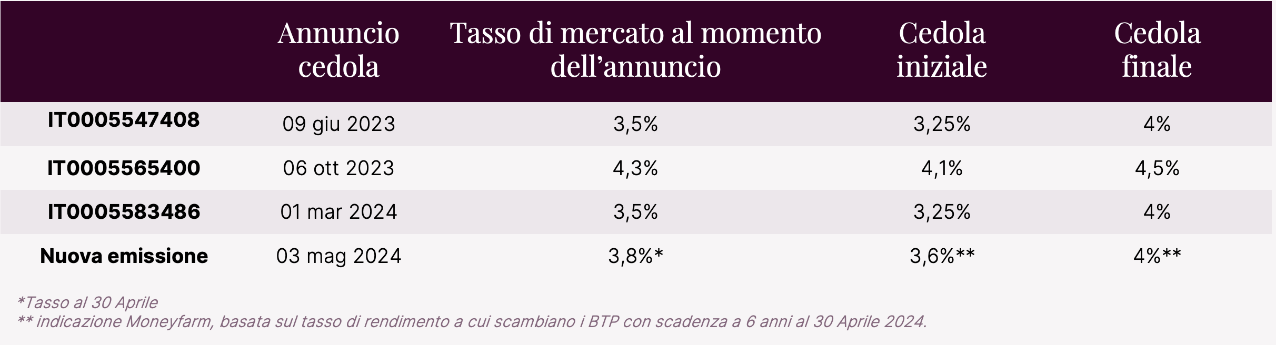

First of all, the quarterly coupons have a "step-up" mechanism, i.e. they pay a fixed rate for the first three years of the security's life and a new, higher fixed rate for the remaining three years. Based on the yield to maturity of other BTPs with overlapping characteristics, it is possible to hypothesize a coupon flow of between 3.4% and 4%, as long as market conditions remain similar to the current ones.

THE RISKS RELATED TO BTP VALORE

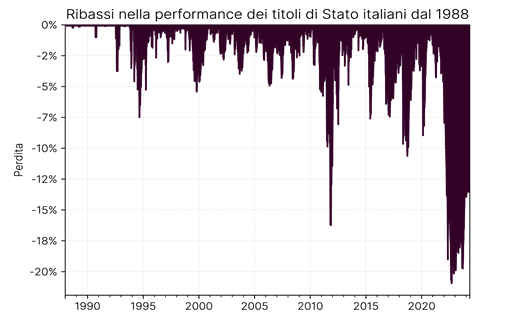

Although the macroeconomic context of high rates leads us to look with greater confidence at the return prospects of government bonds, we must not forget that there are still risks associated with this type of instrument: first of all, as with all bonds, rate variations can lead to significant price fluctuations and, despite the guarantee of reimbursement of the invested capital upon maturity, periods of negative performance, even long ones, cannot be ruled out a priori.

As can be seen from the graph below, during the Eurozone crisis in 2011 or immediately after the Russian invasion of Ukraine in February 2022, the performance of a generic index that replicates a position in BTPs lost more than 15%.

HOW IS THE SPREAD GOING

To date, the BTP-Bund spread stands at around 140 basis points, a relatively narrow value compared to the history from 2011 onwards, but any possible upward variation represents a significant risk for investors overexposed to this type of instrument. Subscribers who decide to maintain their positions would not incur direct losses, since the State would continue to pay the coupons and repay the capital at maturity, but those who wanted to redeem their investment to obtain immediate liquidity before six years may have to sell the securities at a lower price than the purchase price, recording losses.

THE PUBLIC DEBT FACTOR

Furthermore, the value of the BTP can also fluctuate following changes in the government's creditworthiness. One of the main variables at play is represented by public debt: if, as foreseen by the Def 2024, Italian public debt were to exceed the threshold of 3,000 billion euros starting from 2025, those who invest in the BTP Valore could face strong uncertainties.

AND THE SUPERBONUS VARIABLE

According to the Mef , the amount of debt until 2026 will be affected above all by the Superbonus , which has weighed on public accounts for a total of 219 billion euros, of which 160.3 billion for Super-Ecobonus and Super-Earthquake bonus and 58.7 billion for the other incentives provided. The 2023 deficit at 7.4% is only a small part of the problem, the critical issues will manifest themselves as the tax credits are offset, leading to drops in revenue that will make it difficult to meet commitments to reduce public debt in the coming years.

WITHOUT FORGETTING THE EXTERNAL VARIABLES

Therefore, it is essential to understand whether the BTP Valore is an instrument in line with your risk profile, objectives and time horizon, without neglecting the external variables that can influence the investment. For those with a time horizon in line with the Btp Valore, it is important to remember that there are alternative investments capable of generating higher returns. As always, the key word remains "diversify", that is, not concentrating risk on a single instrument, but building multi-asset portfolios, in which exposure to BTPs is considered within broader financial planning.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/tutto-su-btp-valore/ on Sun, 05 May 2024 06:16:33 +0000.