Expenditure on “pure social security pensions”: the real numbers

The intervention of Michele Poerio, National President FEDER.SPeV. and general secretary of CONFEDIR, Pietro Gonella, coordinator of the Centro Studi, Stefano Biasioli, secretary of APS-Leonida and organizational secretary of FEDER.SPe V.

CONFEDIR, FEDER.SPeV. and APS-Leonida cannot refrain from making known to a larger audience what was the real disbursement of INPS for "pure social security pensions" in the years 2019-2020-2021, i.e. those pensions that are assisted/accompanied/generated/ financed by the social security contributions paid – during the working life – by the pensioner and by the respective employer.

The intention of the intervention is to refute the Unimpresa Report (which elaborated the data of the government's latest Economic and Financial Document, with publication of the same on Startmag of 29 June last) in order to put the data back in order/ containing numbers that are reported below, so as to give them a greater – more complete and complete – explanatory articulation:

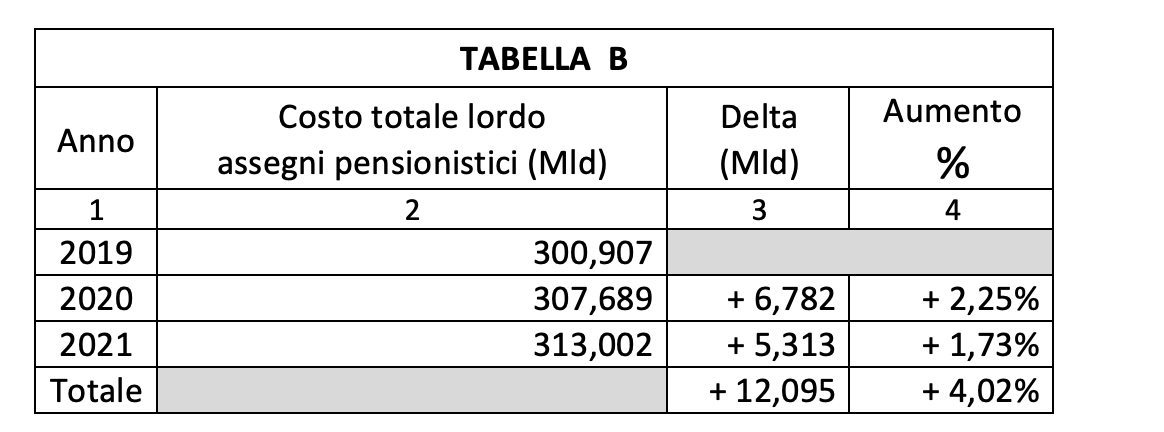

In this regard, it should be noted that the aforementioned amounts concern the total gross pension expenditure, both pure social security and social security, total gross expenditure of which the relative amount recorded in the three-year period 2019-2021 is reported below (data extracted from the Central Register of Pensions and of Pensioners managed by INPS):

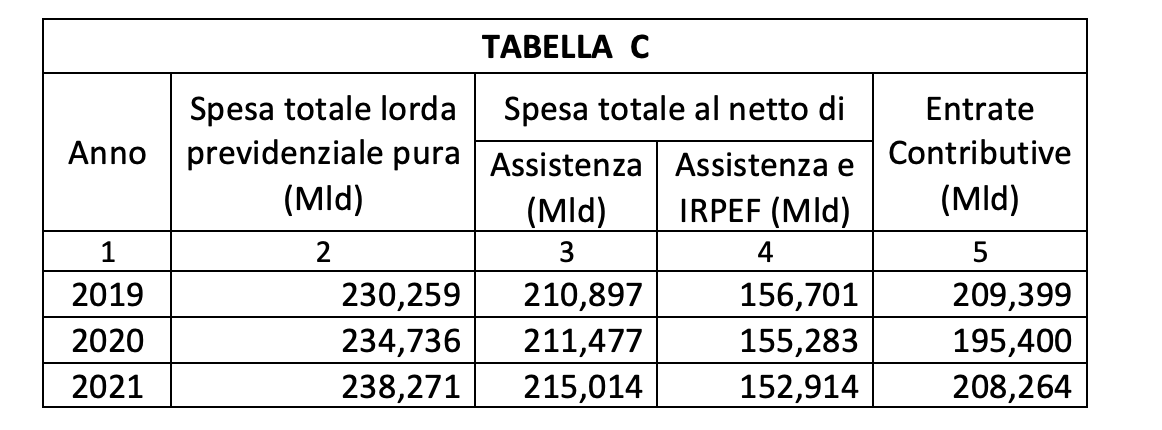

The amount of "total gross pure social security expenditure" recorded in the aforesaid period is shown below (data which – taken from Reports nos. 8, 9 and 10 on the "Italian Social Security System" elaborated by the Centro Studi e Ricerche Social Security Itineraries, of which the President is Prof. Alberto Brambilla, one of the leading experts on the subject in our country – they are fully shared by CONFEDIR, FEDER.SPeV. and APS-Leonida):

The difference between 313 and 238 billion euros (see columns 2 of Tables B and C – Year 2021), i.e. 75 billion, is welfare expenditure not accompanied/supported by any social security contributions or accompanied/supported by insufficient social security contributions.

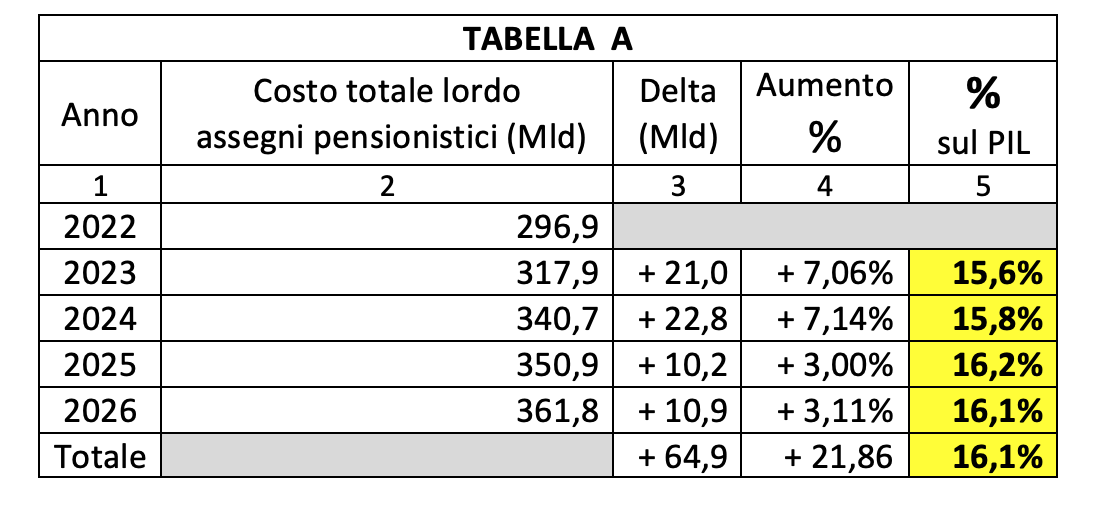

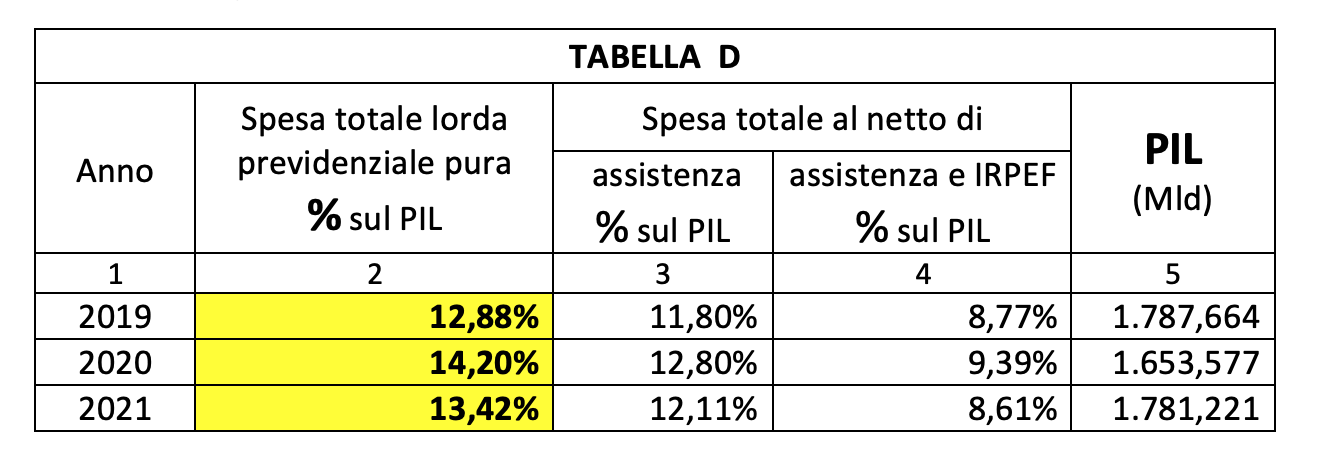

The aforementioned last data involve the percentage incidence on GDP (column 2 of Table D) indicated below by the "total gross pension expenditure", very different and lower percentages (ranging between 3 and 4 percentage points less!) than those prefigured for the period 2022-2026 from the Unimpresa Report (see column 5 of Table A):

The percentage incidences of total expenditure net of assistance (column 3 of Table D) are in line with the Eurostat average.

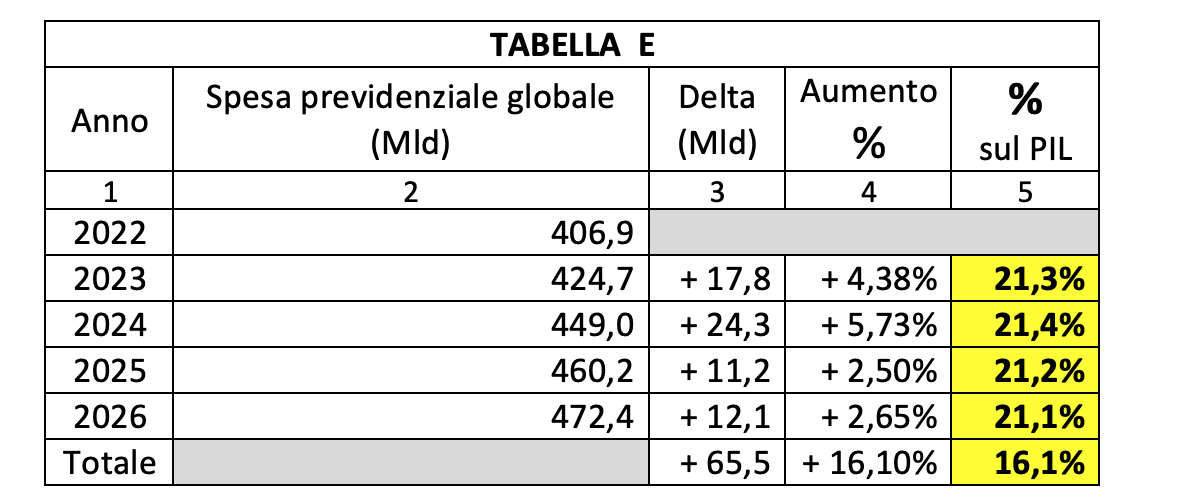

The same Unimpresa Report also reserves space for the impact on the State accounts induced by "social security expenditure" understood globally (pure social security expenditure + social security expenditure + purely welfare expenditure) as shown below:

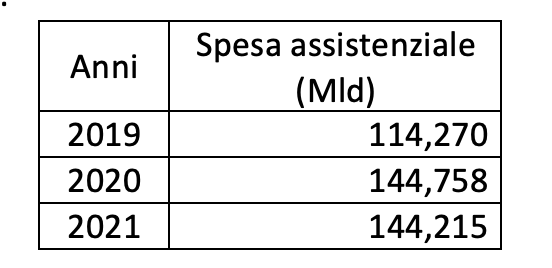

With reference to the data presented above, the below-specified values recorded for purely welfare expenditure should be highlighted (data taken from the aforementioned Reports nos. 8, 9 and 10):

It must be highlighted that in the period 2008 vs 2021 (thirteen years!):

- pure pension expenditure recorded an average annual increase of 1.5% (from 185.035 to 238.271 billion annually);

- purely welfare expenditure, on the other hand, recorded an average annual increase of 4.5% (from 73 to 144.215 billion euros per year).

It should also be noted that state expenditure for welfare pensions involved around 7 million citizens (44% of the total of 16,098,748 pensioners in 2021), the number of partially or fully assisted citizens/retirees. It does not seem credible that the majority of these people have failed in 67 years of life to pay even the 15/17 years of regular contributions to qualify for the minimum pension; these pensions, unlike those financed by social contributions, weigh entirely on general taxation, without even being subject to taxation.

Moreover, against the aforementioned average annual "triple" growth (4.5% against 1.5%), citizens/users:

- in "absolute poverty" – instead of being numerically reduced in significant terms so as to confirm the correctness of the disbursement of these huge financial resources – more than doubled, going from 2.11 to 5.6 million, with an increase of 3.49 million (+165%)!

- in “relative poverty” have risen from 6.5 to 8.8 million, with an increase of 2.3 million (+35%)!

This phenomenon – which constitutes a striking paradox of paradoxes – entails and makes it no longer deferrable the need to establish (and finally build) in Italy, as also envisaged by the 2015 Jobs Act, a "Central Assistance Records Office" on the model of that of pensions and pensioners, since it is necessary to carefully monitor, also through this fulfilment, to formalize and institutionalize a "general register of assistance", i.e. the database on assistance where to bring together, by code and by family unit, all services provided by the State, Regions and Local Authorities.

CONFEDIR, FEDER.SPeV. and APS-Leonida represent that the substantial increase in social security expenditure in the two-year period 2023 and 2024 is attributable to the explosion of inflation with annual incremental rates which have led to an unexpected/unforeseen and unexpected/unpredictable substantial increase in the index of automatic equalization of retirement benefits. In this regard, it can be noted that:

- in just one year, 2023, pensions up to 4 times the minimum INPS treatment grew/revalued by 7.3%,

- while in the period 2014-2021 (a good seven years) the same pensions grew/revalued by 4.89% overall, i.e. on average 0.7 percentage points/year (equal to one tenth of the annual revaluation in 2023!).

In conclusion, we cannot avoid the need to point out that the substantial increase in the total expenditure on pension benefits in the two-year period 2023-2024, induced by the sustained incremental inflationary trend mentioned above, has not been paid nor will it be paid, for now, a correlated increase in social security contributions due to the fact that the wages and salaries of workers in service activities have not yet recorded a similar consistent and corresponding increase such as to generate an adequate and corresponding increase in social security contributions.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/spesa-per-le-pensioni-previdenziali-pure-i-veri-numeri/ on Sat, 08 Jul 2023 05:40:25 +0000.