Hamas-Israel war, what will happen in the markets

All macroeconomic scenarios linked to the conflict in the Middle East between Hamas and Israel. Analysis by Peter van der Welle, Robeco Multi Asset Strategist

Hamas' surprise assault on Israel on October 7 came almost exactly 50 years after the start of the Yom Kippur War, when Israel was attacked by Egypt and Syria. The roots of this conflict are deep and date back at least to the creation of the State of Israel in 1948. History clearly demonstrates that there are no easy solutions or quick victories (either military or political) regarding the Israeli conflict. Palestinian. First and foremost, the current events unfolding in the Middle East represent a profound human tragedy.

The latest explosion of violence in the Middle East is part of a trend of increasing geopolitical volatility that we addressed in the macroeconomic section of our September expected returns 2024-2028 publication “Triple Power Play”. One of the three power plays we see unfolding in the future is an increasingly fragmented world due to the erosion of mutual trust between (super)powers. The likelihood of trade wars and, ultimately, hot (proxy) wars is increasing in an era when the long-standing peace dividend resulting from the 1945 Allied victory and subsequent U.S. domination of the world scene.

Scenario analysis

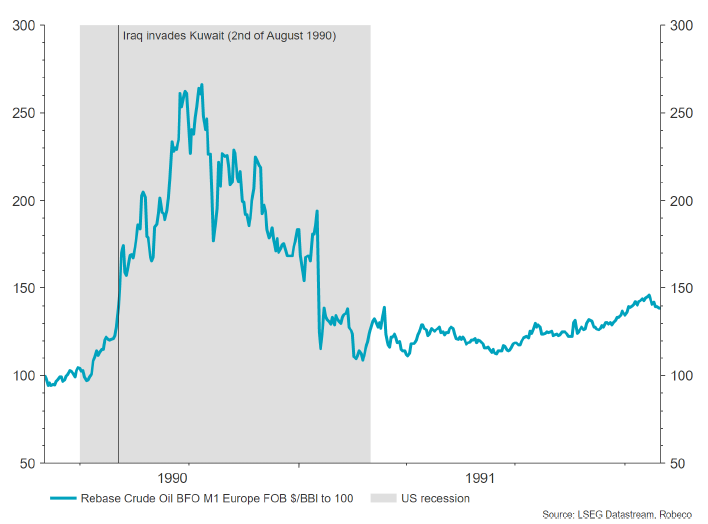

What are the implications of the situation in the Middle East for investors? The three most likely scenarios are a confined war between Hamas and Israel concentrated in Gaza, a proxy war if Hezbollah opens another front and, in the worst case scenario, an all-out conflict between Iran and Israel. It is important to note that a direct conflict between Iran and Israel would usher in an economic scenario of stagflation for the global economy. It could be similar to what happened in 1990 when Iraq invaded Kuwait, oil prices could skyrocket, potentially 50%, with the VIX soaring 16 points, triggering a global recession.

However, oil prices will not remain high for long, as the resulting recession would quickly stifle demand. The benefit to oil prices if conflict escalates is limited today compared to the 1990s, as the energy intensity of global economic growth has declined and advanced economies such as the United States have become net exporters of oil. According to our analysis, a 50% oil price shock to $135 per barrel would result in a contraction in US real GDP by 70 basis points within 3 quarters, all else being equal.

In the event of a regional war, oil prices could see a surge, but probably less noticeable and short-lived than after the invasion of Kuwait in the 1990s.

In a statement prepared for the UN, Iran said on October 15 that it would not involve Israel as long as Israel "does not dare to attack Iran, its interests or its citizens." Many political observers agree that an Israeli ground offensive in Gaza would interfere with Iranian interests. At the same time, the global diplomatic effort to contain this war is vigorous and could prevent a major ground offensive. For example, last week US Secretary of State Blinken traveled to six Middle Eastern countries to gather support for de-escalation. It is above all in the interests of US President Biden to organize a truce in the Middle East, as another surge in oil prices in an election year would ruin his re-election chances. The absence of a large ground offensive could also mitigate the first risk scenario of “confined war” in Gaza, if diplomatic pressure forces the Israeli army to strike exclusively Hamas hot spots in the Gaza Strip. In short, the crisis is still ongoing and the range of outcomes is very wide. Therefore, it is risky to provide scenario probabilities at this time.

Even a correct prediction of the medium-term outcome of this conflict could still lead strategists to be wrong about the investment implications (recall for example the mid-2016 bearish consensus on stocks in the event of Trump's victory in the 2016 elections). In his book “Geopolitical Alpha”, Marko Papic (2020) warns against the proverbial “armchair general”.

Focus on the level of uncertainty expected for potential outcomes

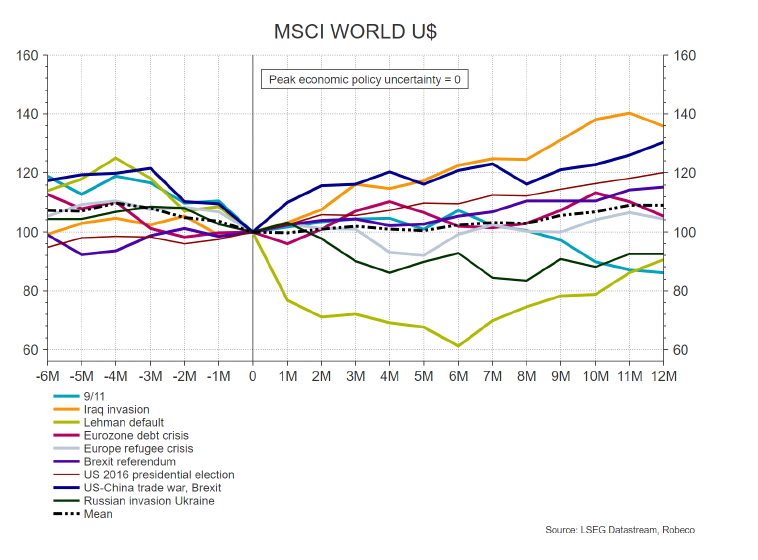

It is important to recognize that markets are agnostic and much less concerned with particular policy outcomes than with the level of uncertainty surrounding them. Markets must put a price on the level of risk. This observation is supported by the fact that developed stock markets tend to sell-off before a peak of political uncertainty and often recover afterwards (see chart).

Stock markets tend to sell-off before the peak of political uncertainty

Financial markets: an insufficient reaction or a justified calm?

We prefer to focus on risk metrics that measure the level of geopolitical risk priced into this conflict, rather than putting a spanner in the works of a baseline scenario.

Are we close to a peak of uncertainty in the financial markets due to the Israeli-Palestinian war? So far, markets have remained remarkably optimistic. The risk indicators on our radar – gold and oil – have performed well, within recent ranges. The US dollar remains well supported, although US stock markets have rallied 1.6% since the attack and still have a VIX below 20. Sovereign bond yields have seen large daily movements, but overall US Treasury bond yields are marginally lower than last week.

Our current assessment: Markets are more likely to have underestimated the risk in the event of an escalation

Markets have a tendency to initially underreact and then overreact. Clearly, the market has not overreacted at this time, seemingly pricing in a scenario where diplomacy prevails. A potential escalation is therefore a greater risk for financial markets, given the lack of reaction so far, even in case of unexpected effects of the second round. We continue to focus on the pillars of our process (valuations, macro and technicals), while evaluating whether events will dent the positive sentiment in equities this year or make central banks more accommodative. Potentially attractive hedges for escalating conflict beyond Gaza are long dollar, long inflation-linked bonds and long US Treasuries at the short end of the curve.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/guerra-hamas-israele-conseguenze-mercati/ on Sun, 22 Oct 2023 05:18:20 +0000.