Here are 10 macroeconomic forecasts that could turn out to be wrong

What prospects for 2024? The point of Jeffrey Cleveland, Chief Economist of Payden & Rygel

Although most people take for granted that they are essentially right in every area of life, starting from political and religious beliefs, the reality of the facts is that, contrary to what we are unconsciously led to believe, we are not omniscient, on the contrary we get it wrong quite often.

Confirmation comes from the financial markets: if last year at this time we had asked ourselves about the possibility of an economic recession in the United States during 2023, two thirds of financial operators would have declared themselves in favor of this hypothesis. Likewise, the bond market was convinced that the Fed would bring interest rates to a peak of 5% and then make 2 or 3 cuts already by the end of the year and many investors and analysts argued that the cooling of inflation dynamics would necessarily have had to come from a significant increase in the unemployment rate.

The fact that none of these scenarios actually occurred should warn investors against the temptation to predict the fate of the global economy at all costs. For this reason, at Payden we try not to pay too much attention to macroeconomic forecasts, but, through the scientific method, we aim to collect as much evidence as possible to then refute the macro hypotheses that influence market trends. Ours is a critical approach to macroeconomics and what attracts our attention above all are the views unanimously shared by economists, the so-called "absolute truths".

Here, therefore, are 10 widespread predictions on the markets that in 2024, when tested by facts, could prove to be wrong:

- “In 2024 a recession will be inevitable”: despite the great denial of 2023, the hypothesis of a recession has not stopped enjoying success among market operators, who attribute a 50% probability to it for the current year, although with due precautions (the so-called “soft landing”). At Payden we believe that the probability of a recession for 2024 is closer to 12.5%, while we expect GDP growth in line with or even slightly higher than the current trend, in the wake of US consumption which remains resilient.

- “The savings of US consumers are running out!”: we think that the rumors about the financial constraints faced by the average US consumer are exaggerated. It's true that post-pandemic personal savings rates have declined as spending patterns normalized, but overall, the American consumer still has trillions in savings. Furthermore, it is worth highlighting how US economic growth is driven by the increase in income (not by that of savings), which continued to be robust until November 2023.

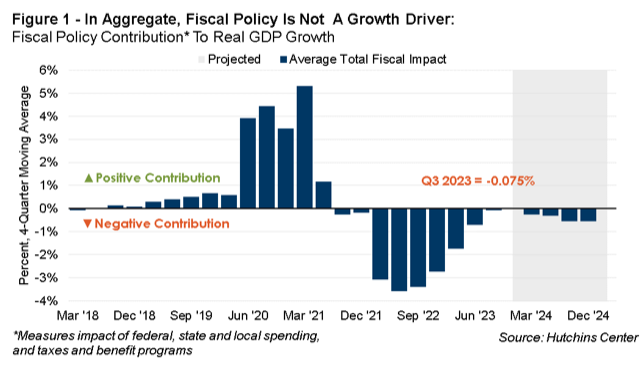

- “US fiscal policy is fueling growth”: skeptics who refuse to recognize the well-being of the average American consumer tend to attribute to fiscal policy the role of driving economic growth that they believe is unsustainable in the medium term. In contrast, fiscal spending was responsible for a modest increase in overall growth over the past four quarters (+0.3%), while consumer spending contributed to more than half of GDP growth in 2023. Net fiscal impact, a measure that aggregates the effect of government spending at the federal, state and local levels, has been negative for the past three quarters (see Figure 1). Furthermore, it is important to consider that, in political election years such as 2024, public spending usually tends to increase, not decrease.

- “The US government will not be able to finance such a massive public debt”: it is true that the US budget deficit widened during 2023, mainly due to the decline in revenues following the stock market crash of 2022 However, demand for government bonds from domestic and global investors remained strong, and the issuance of the Treasury Bill covered much of the 2023 deficit, driven by the enthusiasm of US families and businesses. At the moment, less than 3% of US GDP is allocated to debt financing, a commitment that seems quite manageable in the short term.

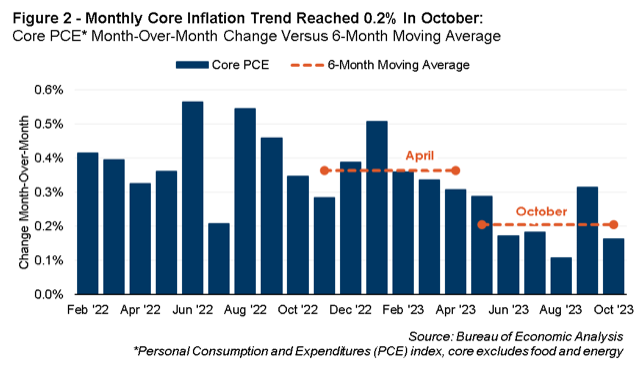

- “Persistent inflation could push the Fed towards an excessively restrictive monetary policy and therefore towards a recession”: this prospect seemed more plausible to us towards mid-2023, with US GDP growing by +5%, while today we see with greater the hypothesis of a “soft landing” is optimistic. In October, the six-month moving average of the PCE Core Index reached the Fed's target of 0.2%, with the unemployment rate near cycle lows. Obviously, we believe the Fed will have to wait a few more months to declare victory over inflation. Regarding the hypothesis that the US central bank's recent change of direction is due to political reasons (specifically this year's presidential elections), we suggest investors take a look at the Core PCE data for the last six months (Figure 2).

- “Global labor markets are already showing the first signs of weakness. ECB, BoE and BoC will not be long in following in the Fed's footsteps, opting for a rate cut": with the exception of the United Kingdom and Canada, most developed countries are facing the challenges of inflation and the labor market better than expected believe it. For example, Canada's core inflation sits just outside the 1-3% target range. As a result, it is likely that most central banks will reduce rates less aggressively than expected and that the Fed, given the strength of the US labor market, is unlikely to take the lead (Figure 3). Furthermore, it is necessary to take into account the waning of the aggressive monetary policy of the main global central banks, which has represented a significant source of stress for financial markets over the last two years.

- “The effects of monetary policy on the economy will soon be felt”: we believe that these effects may already have had their consequences (as in the SVB case). US consumers and businesses, however, seem to have resisted the monetary tightening, while the role of banks in granting credit today is much less critical than in past decades. Mortgage installments have not undergone significant increases and corporate debt financing costs remain at historic lows. All this certainly does not play in favor of the thesis of those who bet against the US economy.

- “The escalation of geopolitical tensions will set the global economy adrift”: in their undoubted tragic nature, geopolitical conflicts usually have a temporally limited impact on the financial markets. Unless there is a sharp oil shock that hits consumers hard, as happened in 2008, a recession triggered by geopolitical events remains a low probability scenario.

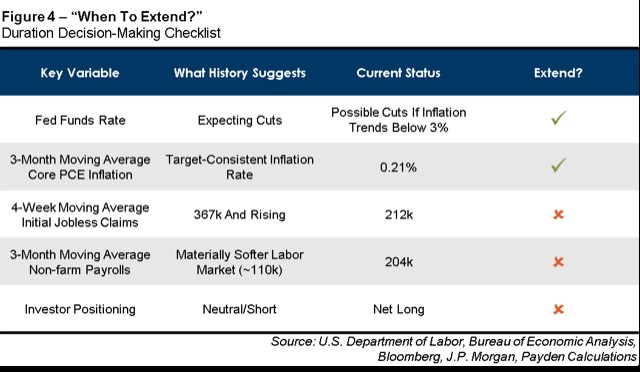

- “We need to extend the duration of the portfolio as soon as possible”: taking a “long duration” position, i.e. preferring government bonds with longer maturities rather than liquidity, proves to be an effective strategy when: a) central banks make cuts that are more significant than expected priced; b) inflation is below the target level; c) the labor market is deteriorating. While rates are likely to have peaked, until the conditions below are met (Figure 4), there may still be scope to add duration to the portfolio.

- “There is no hope that the credit and equity sectors can recover from this situation”: first of all we need to look at the absolute and inflation-adjusted return of bonds compared to recent history. Second, a “soft landing” (i.e. a scenario in which the Fed is able to precisely calibrate rates, volatility decreases, the dollar weakens, inflation comes back under control and the economy continues to grow) represents the perfect recipe for credit and shares. Finally, to understand where monetary policy rates are headed over the next year, we think the Fed will cut rates less than markets expect, which could disappoint investors in the short term.

We know that our critical approach could disappoint those looking for fortune-telling prophecies, but we believe it is the best strategy, because only by refuting the most deeply rooted certainties is it possible to highlight errors and, perhaps, discover some truths. Our goal must not be to achieve absolute precision, but rather to identify all possible alternatives and eliminate the incorrect ones, to better prepare ourselves to face the direction that the future will take.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-le-10-previsioni-macroeconomiche-che-potrebbero-rivelarsi-errate/ on Sat, 13 Jan 2024 06:32:20 +0000.