Here are the effects of the dividend freeze for banks. Bis report

Blocking dividends for bank shareholders, even if it harms stock prices, is good for the capitalization of institutions. An in-depth study of The Walking Debt , Maurizio Sgroi's blog, based on a report by the Bis of Basel

As we live in extraordinary times, nothing more than the ordinary becomes worthy of attention. So it is very useful to read a bulletin recently published by the Bis of Basel which asserts with the chrism of scientific observation what common sense could already suggest to us. Which, that is to say, blocking dividends for bank shareholders, even if it harms stock market prices, is good for the capitalization of institutions and therefore strengthens them when it is necessary to guarantee ample lending capacity.

A conclusion that has the merit of agreeing with the spirit of the times, which clearly hates any form of financial income and therefore sees nothing wrong with following the shearing of savers – the fall in interest rates is another example – that of the shareholders who, this must be the thought, are rich enough to be able to bear to run out of dividends for a year or two. Thought perhaps right, but exquisitely unspoken, as befits our time that avoids talking about what cannot be said.

You will recall that after the explosion of the financial crisis caused by the pandemic, policymakers found themselves obliged to take actions capable, on the one hand, of guaranteeing financial stability – think of the monetary easing action decided by central banks – on the other of favoring the provision of bank credit, as many companies, deprived of cash flows due to the lockdowns, had run out of steam.

In this climate, in some jurisdictions, the decision was taken to put a stop to bank dividends, also because the fall in prices, caused by the collapse of the stock exchanges, could induce banks to "pump" dividends to compensate for the short-term gains of shareholders. .

However, this has negative effects on the capital base of the institutions, increasing their riskiness to the detriment of bondholders and depositors, as well as reducing "the capital available to support the loan, with negative implications for the economy". This is not to say that this dividend containment policy has only positive effects. For example, it can “discourage future efforts to raise capital”.

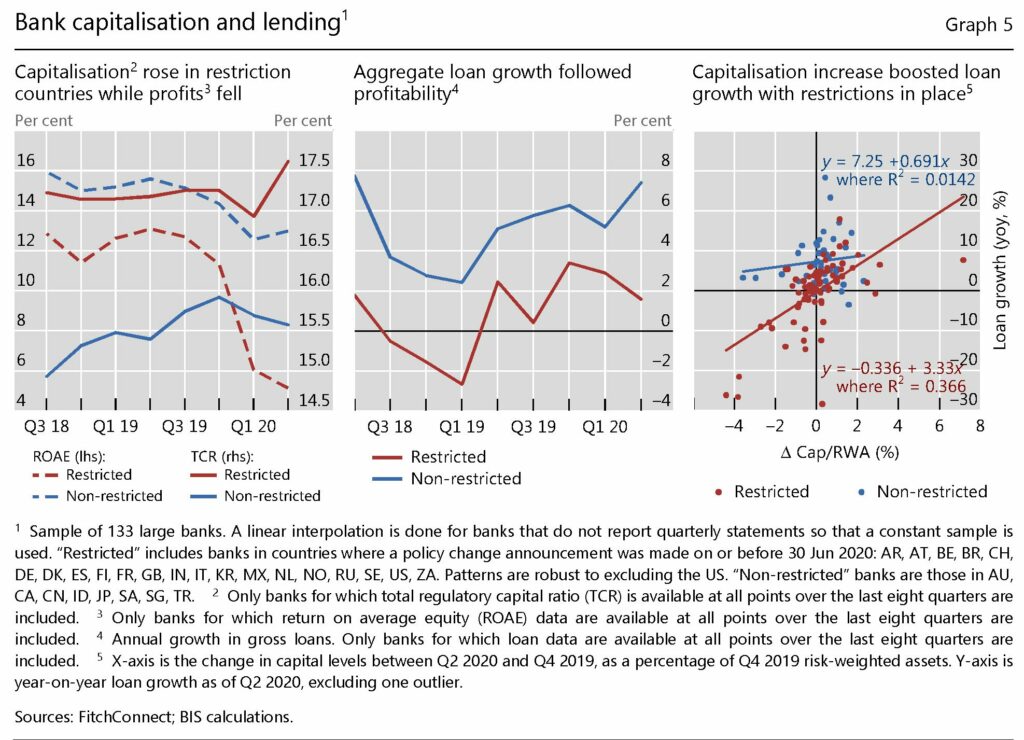

The results observed by Bis are consistent with these theoretical premises. The prices of dividend-restricted bank shares fell, but credit default swaps did not, demonstrating that the market has not priced any risk to the financial stability of these institutions. At the same time, bank capitalization has grown, favoring financial stability and at the same time lending policy.

This effect was obtained by decreasing the amount of dividends paid in 2020 by 57% compared to 2019, with the maximum decline concentrated in Europe. For the big banks, dividends were almost nil. In emerging markets, dividends fell more moderately. In China, for example, they fell by 26%. In the US, on the other hand, banks paid dividends mostly through buybacks, but did not exceed 25% of the 2019 value.

As for the equity falls caused by the announcement of the suspension of dividends, in Europe and the UK, on average, prices fell by 10% after the announcements of the ECB and the BoE. Other jurisdictions, where this announcement had not been made but where it was deemed probable, still saw the shares decrease by 3%.

The effects on capitalization are summarized in the graph below.

Simply put, a 2% capital increase produced a 6.7% increase in lending, corroborating the conjecture that a full dividend freeze would increase lending capacity by between 2 and 16%. The complete block was not there. But that sooner or later will come, when necessary, many are ready to swear.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/banche-azionisti-dividendi-bus/ on Sun, 28 Mar 2021 06:00:18 +0000.