Here are the sectors that cry (and those that laugh) with the pandemic. Report Ref

The analysis of the economist Fedele De Novellis, head of Congiuntura Ref

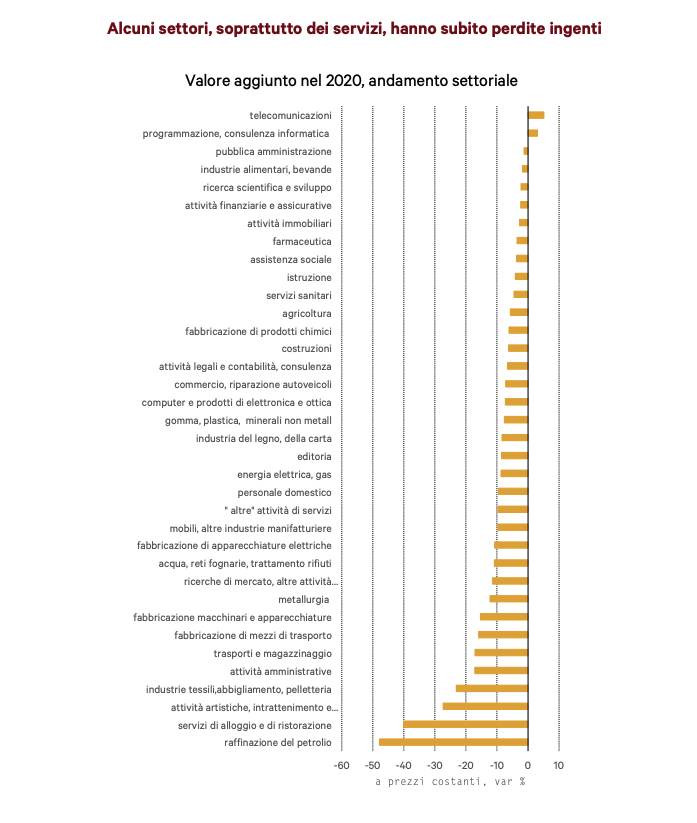

Istat has just released the data relating to the national economic accounts for the fourth quarter of last year. The final figures for the whole of 2020, as well as the profile of the main variables during the year, did not reserve any surprises: after the collapse in the first half of the year, and the strong rebound in the third quarter, the recovery struggled to consolidate at the end of the year. The fluctuations reflected the restriction measures adopted to counter the spread of Covid-19 and therefore present not only a wide variability over time, but also in the trends of the different components of demand and the various production sectors. The extent of product losses in the various sectors during the year shows a wide dispersion. Furthermore, the greatest falls were recorded in some sectors that are not normally particularly cyclical: the main one is that of accommodation and catering services, which recorded a fall of 40 per cent, equal to 24 billion euros; a large contraction characterizes the refining sector, which obviously could not fail to be affected by the limits to mobility (-48 per cent); followed by entertainment, whose activities in many cases were completely interrupted (-27 per cent) and the textile, clothing and leather products sector (-23 per cent) which was confronted with a collapse in demand, given that the increased time spent at home reduced the need for wardrobe renewal. On the contrary, positive changes characterized the telecommunications and information technology activities, in line with the growth of many activities related to distance learning and work from home.

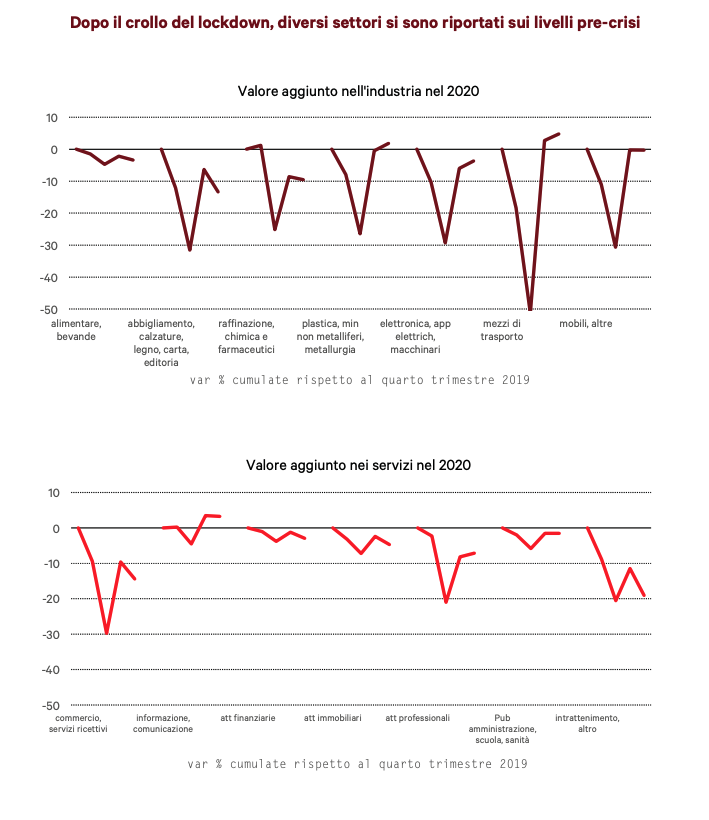

“V” CRISIS AND “L” CRISIS: THE SECTORAL DIFFERENCES

The average annual data are in turn attributable in part to the depth of the fall in the months of the spring lockdown, and in part to the persistence of the contraction, in fact linked to the restrictions on behavior in the second wave. The description of trends at a more aggregate level (the quarterly accounting is less detailed than the annual one) shows that at the low point of the second quarter the most marked falls were in the industrial sectors. However, by the end of the year many sectors of the industry had already largely recovered, describing in fact a “V” cycle; 2021 is expected for these sectors, with a markedly positive change. In services, on the other hand, there are several sectors that had continued to produce even in the lockdown. The sectors that were still in deep crisis at the end of the year, and which will have to wait for the end of the epidemic to recover, are in the hospitality and recreational services chains, together with the clothing and leather sectors.

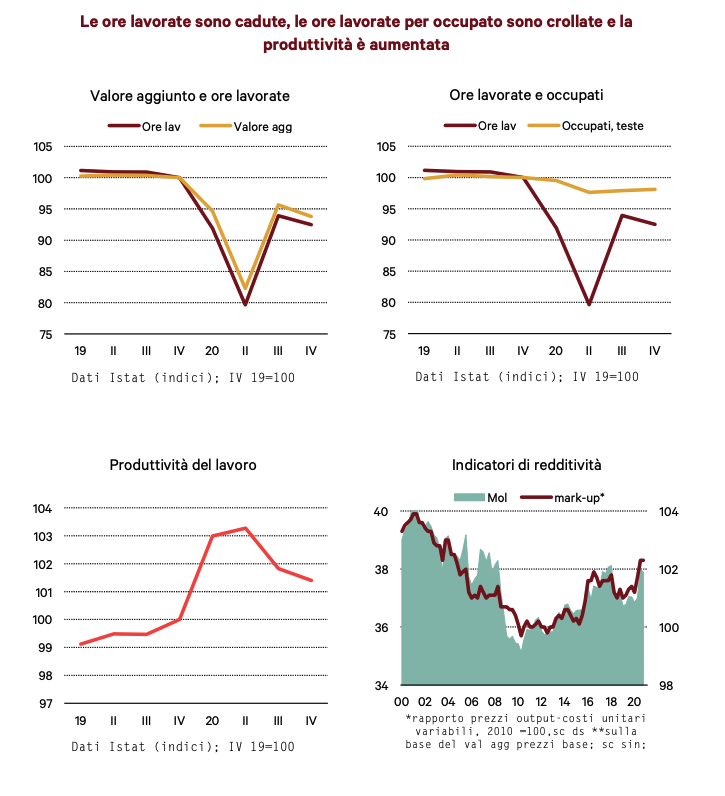

IMMEDIATE REACTION TO THE DEMAND FOR WORK

Another significant aspect of the 2020 picture is that the reaction of labor demand to the fall in value added has been very rapid. In fact, the hours worked contracted in parallel with the added value and there was no cyclical contraction in productivity that normally characterizes the first quarters of the recession phases.

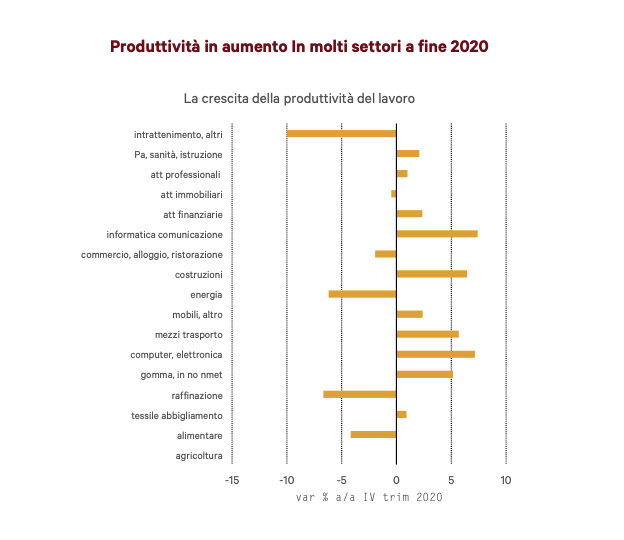

This behavior can be explained in the light of the fact that when the presence of Covid-19 in Italy was known and the first lockdown measures were adopted, the companies immediately perceived the arrival of the crisis and, therefore, reviewed the production plans within a few days. The government's reaction was also rapid, with the first financing measures for social safety nets. In fact, already in the month of April, there is an explosion of recourse to the Cig. This made it possible to immediately reduce the hours worked in response to the contraction in economic activity. Looking at the sectoral data for the fourth quarter of 2020, it is significant that labor productivity, calculated on the basis of standard work units, has increased in most sectors, and in several cases with significant variations.

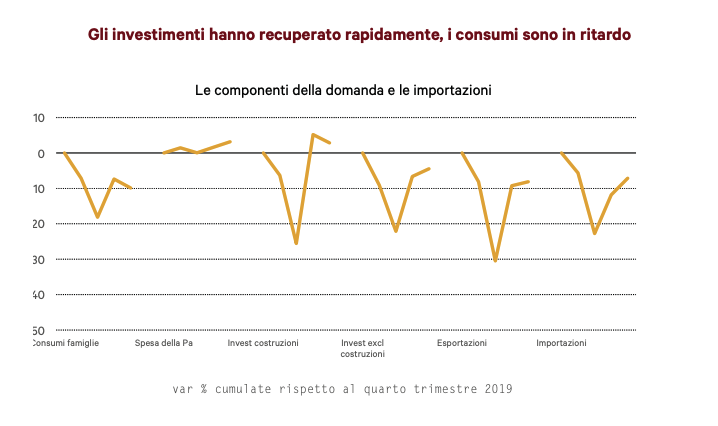

The impact of the reduction in the demand for labor, linked to the increase in the use of social safety nets, has therefore allowed companies to rapidly adjust cost levels to lower revenues; this type of trend was also supported by the fall in the prices of raw materials which took place in the central quarters of the year. The data therefore confirm another rather particular result of 2020, represented by the stability of the profit margins of companies in a period of recession, and in particular in the industrial sectors. This in turn has favored an improvement in the climate of confidence in these sectors and a relative resilience of investments. In fact, investments excluding construction also increased in the fourth quarter, reducing the gap with respect to pre-crisis levels, while those in construction had already risen above pre-crisis levels. This is the first time that in a recession phase, investments do not play a role of amplifier of the economic cycle but, on the contrary, are rather a stabilizer of demand.

The fact that, like all other product purchases, they were less affected by the restrictions on economic activity played in favor of the resilience of investments; the good conditions of access to credit for businesses and the need to invest in IT equipment on the part of businesses that continued their smartworking activities also contributed ; on this aspect a new phase has probably begun, in which the entire economic system has initiated the introduction of various process innovations that had been postponed in previous years, generating an important delay in our country compared to other economies.

The data on trade with foreign countries also show a recovery for both flows; moreover, both imports and exports have returned to close to pre-crisis levels for the component of trade in goods, so the distance to be recovered almost entirely concerns the exchange of services with foreign countries, which continued to be penalized especially in the tourist component. In fact, the weakest component of demand was consumption. Also in the fourth quarter they recorded a contraction of 2.7 per cent on the previous quarter, which corresponds to a 10 per cent drop compared to pre-crisis levels. The restrictions linked to the second wave therefore penalized demand at a decisive moment for many sectors linked to purchases during the Christmas period. It is no coincidence that the dispersion of the results in terms of falling demand is very wide, and reflects the pattern already commented on looking at the trends in the production sectors.

The interpretation of the data at the end of 2020, in addition to reiterating the decisive role of the restriction measures, also highlights how the fall in expenditure is significantly higher than the losses suffered by household incomes. In the third quarter, Istat estimated that the level of household disposable income in real terms had practically returned to pre-crisis values. A decline is likely to have occurred in the quarter, but the year-over-year drop will be less than 2 percent. Nothing to do with the drop in spending in the same period. Therefore, the protective role of the public budget emerges which, like what has been seen for the aggregate of companies, has managed to "isolate" household budgets from the consequences of the crisis, and this could obviously justify the expectation of a certain liveliness of the asks when vaccines will allow you to get out of the restriction period. Of course, precisely this configuration raises two other extremely important questions. The first relates to the budget policy exit strategy, and the second to a social issue.

On the first point, it is essential that the overcoming of the protection measures, especially the social safety nets, take place at the same time as the recovery of demand: not before, to prevent massive job interruptions, with effects on production potential and an increase in uncertainty for workers; not afterwards, to avoid a delay effect of the activation times of the offer when the demand resumes. On the second point, it must not be forgotten that the stability of household incomes, like that of corporate profits, is a result that transpires from the aggregate data, but which naturally hides within itself wide differences according to the categories of workers. These differences may be attributable to the different degree of protection these workers have benefited from, both directly through the provision of social safety nets, and indirectly, via support to demand more generally, which has evidently limited the effects of the crisis on the sectors. not restricted. Since this protection largely derives from the absorption of the consequences of the recession by the public budget (as many as 8 points of GDP, the increase in the deficit in 2020 compared to the previous year), it is clear that there is a problem of equity towards those categories. who have not benefited from these measures, especially workers with flexible contracts and those who even operate in the underground. It is no coincidence that in the recent debate on the reform of social safety nets an important role is played by the definition of a subsidy of a universal nature, which therefore tends to limit the differences between categories of workers in crisis phases.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-i-settori-che-piangono-e-quelli-che-ridono-con-la-pandemia-report-ref/ on Sun, 07 Mar 2021 07:23:31 +0000.