Here is the Def of Meloni and Giorgetti with the cut to the tax wedge

The Council of Ministers approved the Def, the Economic and Financial Document. Here are numbers, tables and comments

The first Def of the Meloni government is ready. Here's what it contains.

THE DEF WITH THE CUT TO THE TAX WEDGE

The government will further cut the contributions paid by employees with medium-low incomes for a total value of "over three billion for the period May-December 2023". This was decided yesterday by the Council of Ministers which approved the Def, the Economic and Financial Document .

THE NUMBERS ON THE TAX WEDGE CUT

The three billion that will be used to "support the purchasing power of families" derive from maintaining the target of a deficit this year equal to 4.5% of gross domestic product against a trend (i.e. with current legislation) by 4.35%. The government will therefore increase the deficit by just over 3 billion, bringing it to 4.5%, to reduce the tax wedge, "with a measure to be implemented soon", in favor of middle-low income workers. Therefore, in the wake of what was done with the latest Budget law, which had confirmed for 2023 the cut of two points of contributions on salaries up to 35 thousand euros gross, adding one point (for a total of three) for those up to 25,000 euros, underlined Corriere della Sera : “An operation costing a total of 4.2 billion. To which three are now being added for 7 months: from May to December”.

THE WORDS OF MELONI

“Today the Government has outlined the economic policy for the next few years, a line made up of stability, credibility and growth. Let's responsibly revise the GDP estimates upwards and continue the process of reducing the public debt. These are the cards with which Italy presents itself in Europe”, said the Prime Minister, Giorgia Meloni, at the end of the CDM which approved the Def.

From the next budget law – Meloni said during the Council of Ministers – the problem of demographic decline and new births must be addressed, with adequate measures ». And the Minister of Economy, Giancarlo Giorgetti, observes: «We face great challenges, from climate change to the demographic decline of the Italian population, but also considerable opportunities to open a new phase of development. The reforms intend to rekindle confidence in the future, protecting the birth rate and families also through the tax reform which will favor large households».

THE EXPLANATION OF GIORGETTI

“In the face of an estimated deficit trend for the current year of 4.35 per cent of GDP, maintaining the existing deficit target (4.5 per cent) will make it possible to introduce, with a measure soon to be implemented , a cut in the social security contributions payable by employees with medium-low incomes of over 3 billion for the current year. This will support the purchasing power of households and contribute to the moderation of wage growth. Together with similar measures contained in the budget law, this decision demonstrates the Government's attention to protecting workers' purchasing power and, at the same time, to wage moderation to prevent a dangerous wage-price spiral”. Economy Minister Giancarlo Giorgetti explained it.

In recent weeks, the technicians of the Ministry of the Economy have worked on the economic and financial document, taking into account the indications of maximum prudence on the estimates given the macroeconomic scenario, characterized by great uncertainty due to the global tensions triggered by the invasion of Ukraine by the Russia, with the subsequent rise in prices, starting with energy prices, which led to high levels of inflation.

Another key figure in the document expected in the CDM is the growth forecast: the 2023 trend GDP (which analyzes the situation net of public finance maneuvers) will settle at 0.9%, a figure revised upwards compared to what is written in the Dpb which estimated a “loss of momentum in activity”, with growth “revised downwards” to 0.6%”. While the trend deficit/GDP ratio for 2023 will be 4.35%.

THE DECLINE IN THE TAX PRESSURE

The Def forecasts "a downward trend in the tax burden which should go from 43.3% in 2023 to 42.7% by 2026". This can be read in the 2023 economic and financial document for the three-year period 2024-2026 approved by the Council of Ministers.

BANKITALIA EVALUATIONS

A growing trend that is confirmed by Bank of Italy, which observes in the latest economic bulletin: "according to our models, economic activity in Italy would have increased slightly in the first quarter of 2023, supported by the manufacturing sector, which benefits from the decline of energy prices and the easing of bottlenecks along supply chains”.

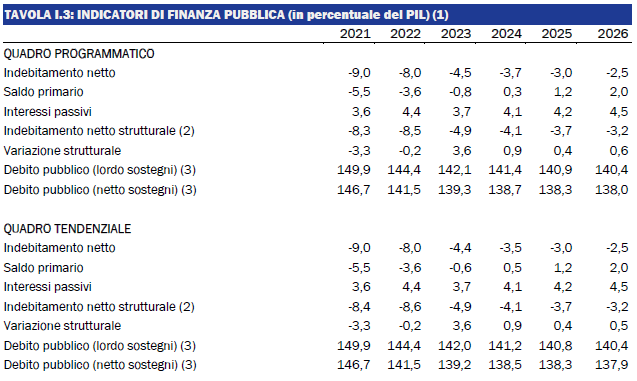

The debt-to-growth ratio falls in the estimates contained in the Def. In 2025, it is reported, the ratio of public gross debt to GDP will be 140.9%, down from 144.4% in 2022. A slightly better estimate than the end-of-year Dpb, which instead noted in 2023 a gross public debt "at 144.6% of GDP, while in the final year of the projection, 2025, at 141.2%".

A "PRUDENT" APPROACH

Ministry sources recall that in drafting the economics and finance document, Minister Giancarlo Giorgetti adopted a "prudent and serious" approach to estimates relating to growth and debt, in line with the dialogue and relationship with the EU and with the country's public debt situation. A type of approach, it is recalled, that had already been adopted in recent months with the Nadef and the budget law.

THE COMMENT OF CORRIERE DELLA SERA

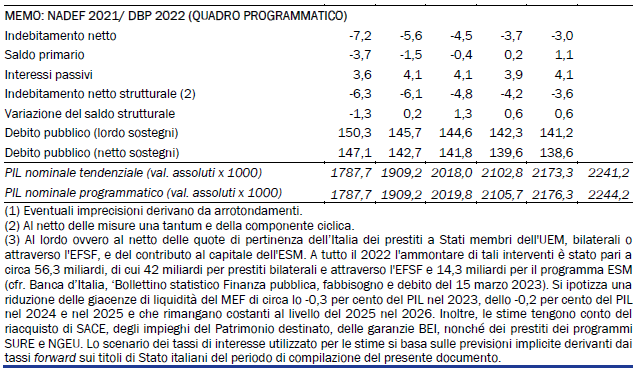

“Prudence on budgetary policy is dictated by the need to keep deficits and debt under strict control. It is no coincidence that the Def 2023 confirms the net debt objectives present in the NaDef (the update note to the Def 2022 of last November): 4.5% of GDP in 2023; 3.7% in 2024; 3% in 2025; 2.5% in 2026. For 2024, 3.7% of the planning framework should be compared with 3.5% of the trend deficit. This means that the government is counting on just 0.2% of GDP, or about 4 billion, to finance the next maneuver in deficit. They will be allocated, says the executive, to the "Fund for the reduction of the tax burden". Few, however, compared to the ambitious plans for tax cuts and flexible retirement ages. Reforms that will therefore have to be covered with spending cuts and revenue increases”.

THE ANALYSIS OF THE SOLE 24 HOURS

"The three billion that are "freed up" this year thanks to the small gap between the tendential deficit of 4.35% and the planned deficit of 4.5% in the Economic and Financial Document approved yesterday by the Council of Ministers will be directed towards a new cut in the tax wedge for low- and middle-income employees. The figure, which will be used to finance "a measure to be implemented soon" as filtered by the government meeting, is not light if we consider two aspects: the latest budget law earmarked just under 5 billion euros for the same purpose, reinforcing the measures already taken last year by the Draghi government with 3 billion, but the new funds will probably be concentrated on a six-monthly basis. The effect on the single paycheck, therefore, in addition to adding up to those produced by the 2023 maneuver, could also prove to be more intense.

The measure announced yesterday is the most concrete result that the government can draw from the new public finance program, and aims to support the purchasing power of workers in times still complicated by the price race without triggering that spiral between prices and wages which would still the sunset of inflation. Because over the next few years, starting with the maneuver, the horizons are becoming more difficult.

Indeed, the cost of living that is struggling to fall complicates the path towards the budget law, which is still weighed down by the effects of the Superbonus as they are keen to underline by the Ministry of the Economy. But the Def also offers the opportunity to translate into figures the repercussions on the Italian accounts of the surge in interest on debt fueled by the ECB's anti-inflation monetary policy. And these are impressive figures: interest spending, which in the years of zero interest rates traveled quietly at just over 60 billion a year, will rise from 74.7 billion in 2023 to 91.3 billion in 2025 to break through the 100 billion a year wall in 2026. Compared to the hypotheses of twelve months ago, this is 66.9 billion more in the three-year period 2023-25 alone”.

+++

THE PALAZZO CHIGI RELEASE

The Council of Ministers, on the proposal of the Minister of Economy and Finance Giancarlo Giorgetti, approved the Economic and Financial Document (DEF) 2023, envisaged by the public accounting and finance law (Law No. 196 of 31 December 2009).

The Document outlines the three main programmatic objectives of the Government's economic and budgetary policy for the medium term:

- the gradual abandonment of some of the extraordinary fiscal policy measures implemented in the past three years and the identification of new interventions to support the most vulnerable subjects and to relaunch the economy;

- the gradual but sustained reduction over time of the deficit and debt of the public administration in relation to the gross domestic product (GDP). The Government confirms the net debt-to-GDP targets already declared in November in the Draft Budgetary Plan (DPB), i.e. 4.5 per cent this year, 3.7 per cent in 2024 and 3.0 per cent in 2025 The target for 2026 is set at 2.5 per cent;

- support for the recovery of the Italian economy, aimed at achieving higher growth rates in GDP and the economic well-being of citizens than those recorded in the past two decades.

In the short term, efforts will be made to support the restart of growth signaled by the latest data, as well as to contain inflation. Maintaining the existing deficit target (4.5 per cent) will make it possible to introduce, with a measure soon to be adopted, a cut in social security contributions paid by employees with medium-low incomes of over 3 billion for the May period -December of this year. This will support the purchasing power of households and contribute to the moderation of wage growth. Together with similar measures contained in the budget law, this decision demonstrates the Government's attention to protecting workers' purchasing power and, at the same time, to wage moderation to prevent a dangerous wage-price spiral. Also for 2024, public finance projections show that, given a deficit trend of 3.5 per cent, maintaining the target of 3.7 per cent of GDP will create a "budget space" of about 0.2 points of GDP, which will be allocated to the Tax Reduction Fund, the financing of the so-called 'policy change' starting in 2024 and the continuation of the tax cut in 2025-2026, and will contribute to a significant revision of public spending and to greater understanding between the tax authorities and the taxpayer.

In this context, the GDP growth forecasts of the DEF are the most cautious, intent on drawing up budgetary projections inspired by caution and reliability. In the trend scenario with legislation in force, real GDP is expected to grow by 0.9 per cent in 2023 – a figure revised upwards compared to the November Draft Budgetary Plan (DBP), in which 2023 growth was figured in a 0.6 percent – and therefore to 1.4 percent in 2024, 1.3 percent in 2025 and 1.1 percent in 2026.

Thanks to the new fiscal measures for 2023 and 2024 outlined, GDP growth in the policy scenario is expected to be 1.0 percent this year and 1.5 percent in 2024.

The following table shows the main public finance indicators.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/def-governo-meloni/ on Wed, 12 Apr 2023 05:56:05 +0000.