Here is the disastrous Houthi effect for world trade

What is happening in international trade due to the Houthis' action in the Red Sea

The consequences of theHouthi threat on shipping and global trade were not long in coming, including an increase in travel times and transport and insurance costs due to the choice to avoid Suez and delays in the delivery times of goods which created difficulties large companies such as Tesla, Volvo and Ikea. But the increases and inconvenience are not remotely comparable to those experienced with Covid issues.

ALTERNATIVE ROUTES TO THE RED SEA

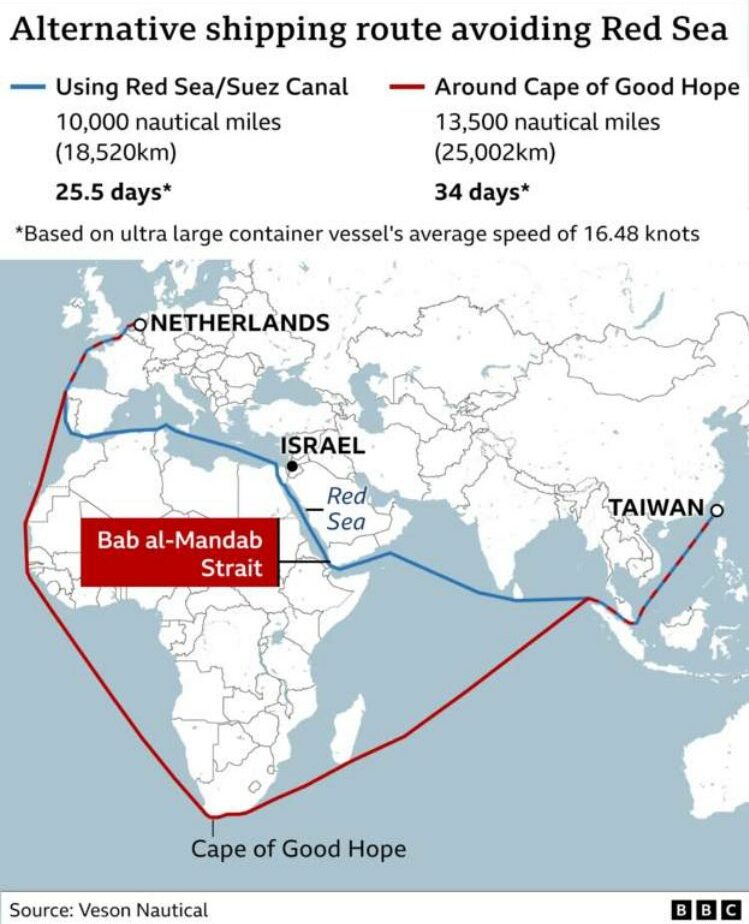

Attacks on merchant ships in the Red Sea have redirected the trade that normally passes through this crucial corridor towards the alternative route of the Cape of Good Hope, resulting in an instant increase in transport times and costs.

STRATEGIC CORRIDOR

Oil and natural gas, grain, electronics and all types of goods travel in the stretch of sea that separates Africa from the Arabian peninsula and ends up at Suez from where 12% of world trade normally enters and exits, 40% of that between Asia and Europe and more than one million barrels of oil per day.

Now, however, the main global shipping companies including Maersk, MSC, CMA CGM, Hapag-Lloyd and the energy giant BP no longer pass their ships through Suez.

RINCARI

The cost of transferring a standard container by sea from China to Northern Europe has jumped, according to data from the Kiel Institute for the World Economy cited by the Associated Press , from the usual 1,500 dollars to 4,000, a very high level but far from the record of 14,000 achieved during the pandemic.

According to Sky News , however, the increase in shipping costs would be 310%, equivalent to that recorded by the cost of the Shanghai Containerized Freight Index (SCF1) which last Friday was equal to 3,101 dollars for each container transferred from Shanghai to Europe. However, Sky News also recalls that the costs were much higher in March 2021 when the Suez Canal was blocked by the Ever Given ship.

The increase in costs also reflects that of insurance, personnel and the fuel needed to travel the longest route.

DELAYS

They are also delaying delivery times, which have just forced Tesla and Volvo to slow production at their European factories due to parts not arriving from Asia, while Ikea has also admitted that some of its products may be temporarily unavailable.

In December, the accumulated delays contributed to a 1.3% decline in world trade, according to the Associated Press .

Exacerbating this situation is a factor, reported by Sky News , such as the temporary increase in demand for goods caused by the upcoming Chinese New Year holidays.

THE NEXT PLC CASE

A significant example of the hardship is that of the British retailer Next Plc, whose home and clothing products are all manufactured in Asia.

As Bloomberg reports, the company expects a two or even two and a half week delay in deliveries. But its CEO Simon Wolfson recalls that at the time of Covid, companies like his had to deal with delays of up to eight weeks.

In any case, Next expects to increase its prices, as a consequence of the current situation, by less than 1%.

MEANWHILE OIL

Immediately after the US and London attack on Houthi targets on Thursday, the price of oil rose by around 4%, while Brent reached 78 dollars per barrel, still 6 dollars less than its price on the eve of the attack. Hamas on 7 October.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-il-disastroso-effetto-houthi-per-il-commercio-mondiale/ on Sun, 14 Jan 2024 08:26:06 +0000.