Here is the map of non-performing loans. Fabi report

Here is the complete territorial breakdown of the risks of credit institutions: region by region all the numbers on bad debts, unlikely to pay and overdue loans. Fabi report

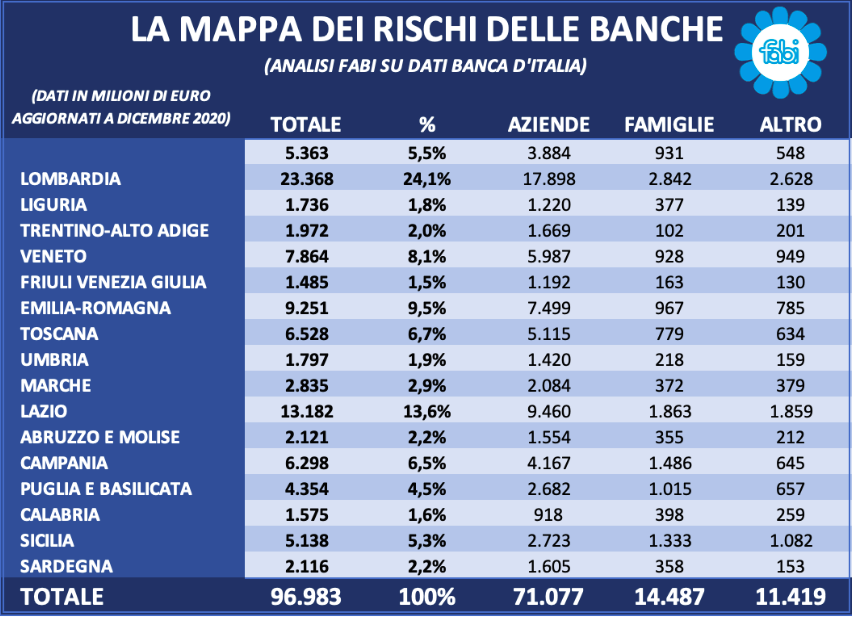

Almost 97 billion euros of impaired loans, of which half concentrated in Northern Italy and only 40% distributed between the Center and the South.

These are the numbers of a phenomenon from which emerges a country still in trouble, with differences between household debt and corporate debt, which is under the magnifying glass of the European supervisory authorities.

Fabi took a photograph on the geography of banks' risks.

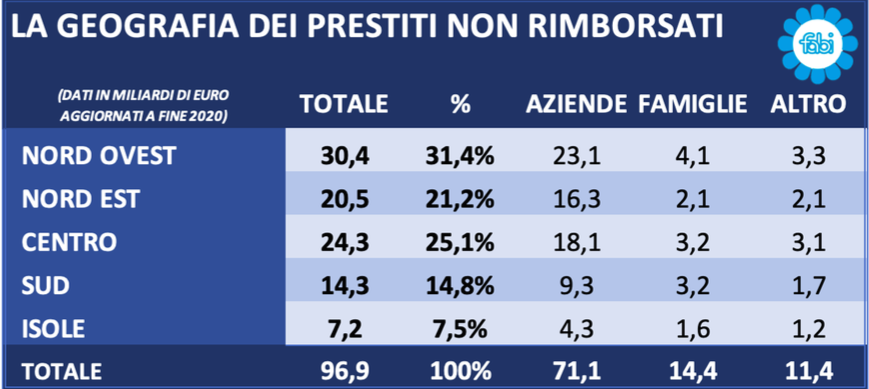

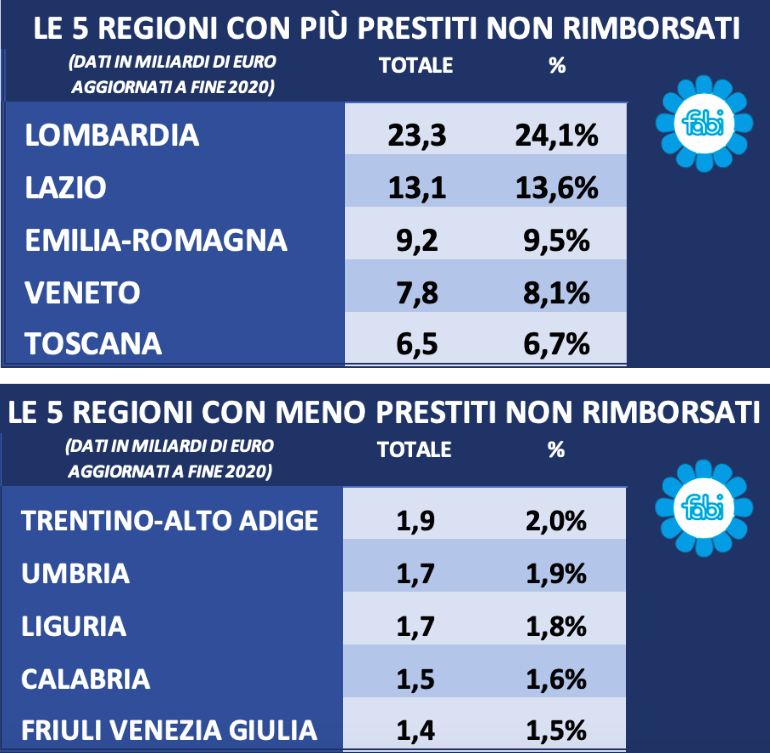

The picture, drawn up at the end of 2020, sees 71.1 billion euros of impaired loans concentrated in Italian companies and only 14.4 billion euros in households. It is a debt that is concentrated mostly in five regions and with a territorial distribution that covers more than half the North West and the Center, 20% the North East and the remainder is divided between the Center (24%). and South (14%). The map of all impaired loans is in fact more dyed red for regions such as Lombardy (24%), Lazio (13%), Emilia-Romagna (9%), Veneto (8%) and Tuscany (6.7%) while it is more yellow for Trentino-Alto Adige (2%), Umbria (1.9%) and Liguria (1.8%). The most comforting data are those found for Calabria (1.6%) and Friuli-Venezia Giulia (1.5%). The picture of impaired loans overlaps with the Italian economic geography: there is a balance between the distribution of bad loans and the areas of the country that produce the most.

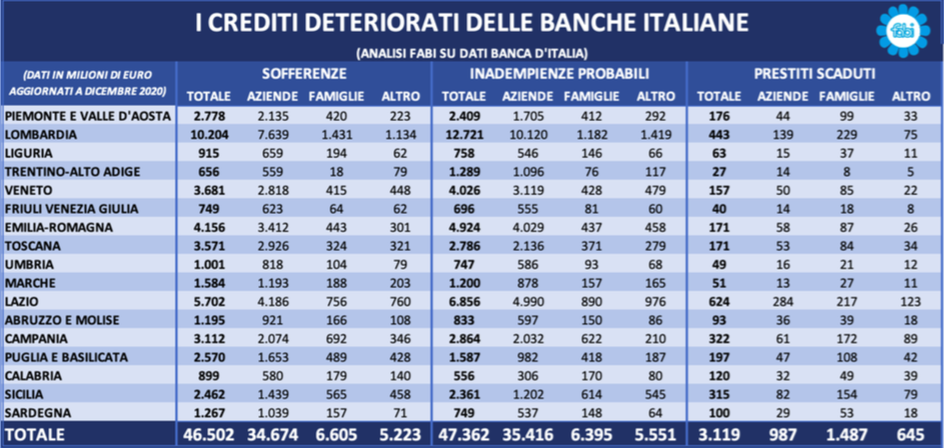

With the exception of overdue loans, in all the other two categories of credit risk (bad loans and unlikely to pay) the Italian production sector has greater risks than households, although more pronounced in some areas than in others. Only 27% of the overall 96.9 billion euro is owned by families (14.4 billion) while over 70% of the volumes belong to companies (71.1 billion), which prove to be the most troubled debtors in towards banks.

Between the approximately 50 billion euros of unpaid loans in the North and the 38 billion euros still pending in the Central South, Emilia-Romagna, Lazio and Lombardy jointly account for almost half of the total debtors and respectively 52% of defaults probable and 43% of bad debts. Even families and businesses in Sicily and Sardinia are not immune from the increase in credit risk, where the percentage of businesses brought to their knees at the end of 2020 for non-repayments together represent 7.5% of the total.

“These numbers show how businesses and households are particularly affected by a severe economic crisis and the government must put these subjects in a position to be able to restart and also show that the situation has worsened in the second phase of the pandemic. Where there are more companies, the economic crisis also caused by Covid has hit the most. A topic that is close to our heart, and we have fought it, is the approval of the rule that allows us to extend the deadlines for repaying loans for the purchase of houses that have ended up at auction. Finally, hundreds of thousands of families will no longer run the risk of losing their homes in this way, ”comments the general secretary of Fabi, Lando Maria Sileoni. «The president of the ECB Supervisory Commission, Andrea Enria, has harshly called on banks to pay greater attention to the risks related to bank loans. The European Central Bank and the EBA (European Banking Authority) have asked the banks to manage bank bad debts, that is, non-repaid loans, strongly increasing the control and management criteria: from this year European banks have to dispose of from 7 to Non-performing loans covered by collateral for 9 years, those without collateral in just 3 years. We keep under control what the Italian banks are doing and therefore we have created a risk map or the territorial distribution of bad loans »adds Sileoni.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-la-mappa-dei-crediti-deteriorati-report-fabi/ on Sat, 22 May 2021 09:29:49 +0000.