Here is the map of state aid on bank loans. Fabi report

Data, comments and bank loan scenarios guaranteed by Mediocredito Centrale and Sace in the analysis of Fabi, the banking federation led by Secretary General Lando Maria Sileoni

Here is the Fabi map of state aid on bank loans.

In total 311 billion euros, divided as follows: approximately 60 billion of moratoriums still active, against 500,000 suspensions granted, three million requests for loans presented, more than 220 billion of loans guaranteed by Mediocredito Centrale ( Invitalia group) and 31 billion those provided through Sace (Cdp group).

These are the numbers, updated as of last January 6, of the resilience of the Italian production system, induced by the Italian parachute with the measures introduced by the State starting from spring 2020, to resist the most acute economic crisis of the last 20 years, caused by the pandemic from Covid, and governing the uncertainty of the present, emerges from the analysis of Fabi, the major banking union led by Lando Maria Sileoni.

Two years after the start of the pandemic, the balance sheet of guaranteed loans shows significant figures because if the impact of the virus on the Italian economy has been profound and extensive, the measures activated by the government have been equally valid, underlines the Fabi research. And so, if the drop in revenues and the drop in profit margins were the signs of a setback in the Italian production system in the last 18 months, the growth in government support measures – Fabi points out – "has definitely allowed Italian companies to resist the impact of the pandemic and to govern uncertainty ”.

Official statistics show that in the European panorama, Italy – together with Spain – not only stands out for the percentage of recourse to loans backed by public guarantees (about 5% of the outstanding in the banking system), but also boasts the primacy of higher coverage ratio with an average 85% compared to Spain and Germany (80%) and France (55%), according to the Fabi research.

HERE IS THE ANALYSIS OF STATE AID ON BANK LOANS:

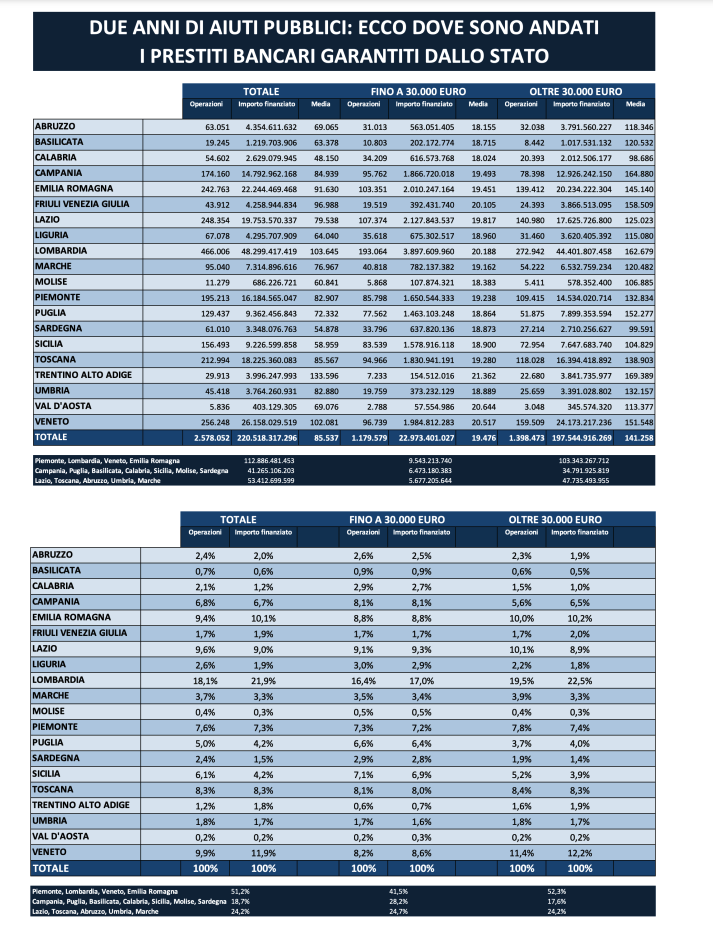

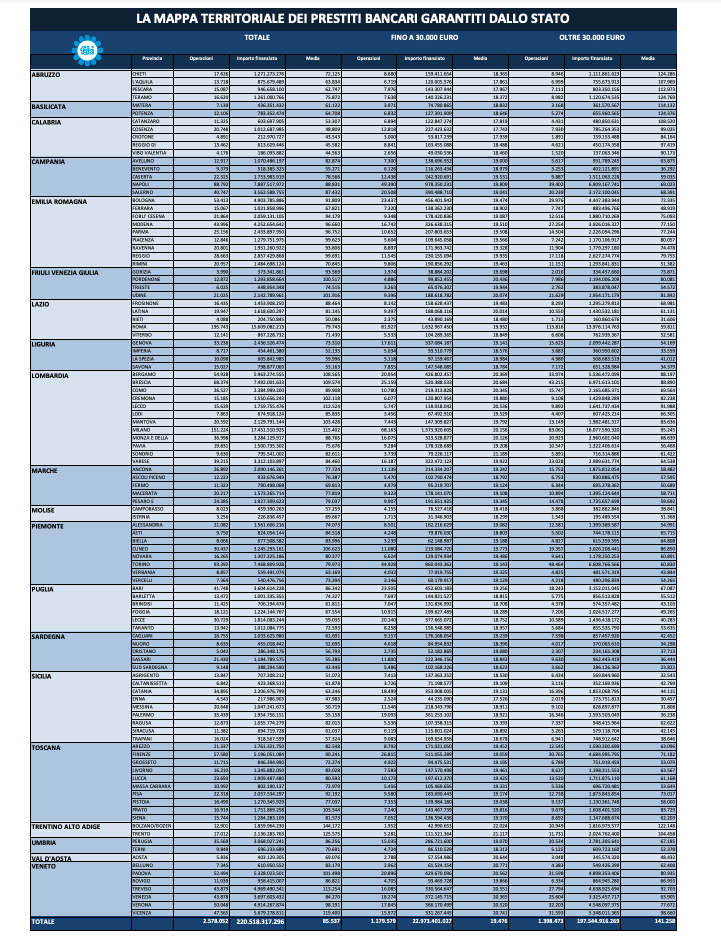

However, the overall geography of the concessions shows us a two-speed picture once again because more than 50% of the overall operations were presented in the regions with the largest number of companies and workers in the national territory and which, probably, were also affected in greater measure from the crisis. The mapping of the 250 billion in aid shows that the largest share went to the Northern regions (Piedmont, Lombardy, Veneto, Emilia-Romagna), followed by those of the Center such as Lazio, Tuscany, Abruzzo, Umbria and Marche. The fabric of Italian small and medium-sized enterprises, which is concentrated in Southern Italy, although it has instead received only 18.7% of total funding, is the one that boasts the record – after the first five in the North – for amounts up to 30,000 EUR. However, it is still penalized in the category of loans over 30 thousand, where the South collects only 17.6% of total aid resources, compared to 52.3% in the northern area of Italy and 24.2% of the North Central District. If the loans were intended for all economic activities on the Italian territory, the most representative size class was that of loans for an amount exceeding 30,000 euros, which attracted almost 90% of the total resources used. The residual 10% share instead went to transactions of less than 30,000 euros. Beyond the macro advantages of all the support measures and their "relief" effect on the health of the local production system, Italian companies have only partially learned to resist an unexpected crisis and manage its uncertainty. The real stress test is in fact still expected in 2022, when Italian companies will have to deal with the end of the moratoriums, the restrictions on loans, and the guarantees of the Central Guarantee Fund on liquidity loans for large-scale transactions to 60% higher than 30,000 and from 90% to 80% on those of an amount within 30,000) and the introduction of a hidden tax in the form of a commission which will certainly not serve to encourage the economic-financial quality of the business system and which will not help to govern the phase, which has just started, of gradual elimination.

THE GEOGRAPHY OF THE GUARANTEES: IN ONLY FOUR REGIONS MORE THAN HALF OF THE LOANS

With 2,578,052 applications presented, for a total amount of approximately 221 billion, the details of the aid in the form of guarantee loans are distributed as follows: 1,179,579 requests for financing up to 30,000 euros for a total of 22.9 billion ( average amount of 19,476 euros) and 1,398,473 requests for loans exceeding 30,000 euros for a total of 197.5 billion (average amount of 141,258 euros). Analyzing in detail the transactions for amounts exceeding 30,000 euros, up to now the largest share of financing has gone to the Northern regions (Piedmont, Lombardy, Veneto, Emilia-Romagna) with 103.3 billion, absorbing approximately 52.3% of the total resources for this amount range. The area of the Center North follows with 47.7 billion, of which 37% destined for Lazio, 34% for Tuscany, 8% for Abruzzo and the remaining 21% distributed between Umbria and Marche. The fabric of the Italian small and medium-sized enterprises, which is concentrated in Southern Italy, instead received only 17.62% of loans exceeding 30,000 euros. In particular, Molise and Basilicata are the regions with the lowest percentages of public aid in this amount category (0.3% and 0.5% respectively), followed by Calabria (1%) and Sardinia (1 , 4%). Also in terms of number of operations, the regions with the lowest number of requests are represented by Molise (5,411) and Basilicata (8,442) – compared to an average national number of 1-398,473 – which together with Sicily, Puglia and Basilicata benefited overall 0.8% of total transactions. Among the southern regions, the peak of funding was disbursed in favor of Campania which, with 6.5% of the total resources disbursed by amount class, benefited from 12.9 billion euros of state aid. In terms of distribution and concession, the percentages and large numbers are also repeated with reference to transactions of less than 30,000 euros, where, out of 1,179,579 transactions, more than a quarter were presented in the regions with the highest number of companies and workers in the national territory and who, probably, have also been affected to a greater extent by the crisis: these are Lombardy (16.4%) and Lazio (9.1%) followed by Emilia Romagna (8.8%) and Veneto (8.2%).

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-la-mappa-degli-aiuti-di-stato-sui-prestiti-bancari-report-fabi/ on Fri, 14 Jan 2022 07:01:15 +0000.