Here is the state of health of Italy, the EU and the USA. Confindustria report

Risks are growing along the rise in Italian GDP: the cost of energy weighs on industry, and on services the new infections. Uncertain scenario for the Eurozone, while the US is weakening. Confindustria study center report

A slippery path of ascent.

A slowdown in the Italian economy is confirmed in the 4th quarter: the scarcity of commodities, the high energy prices, the eroded margins, the increase in infections are worrying. But the uptrend should continue: after the rebound in the 3rd quarter (+ 2.7%), Italian GDP is -1.3% from the pre-Covid level (from a minimum of -17.9%) and recovery is expected to be completed in early 2022.

Industry: energy risks.

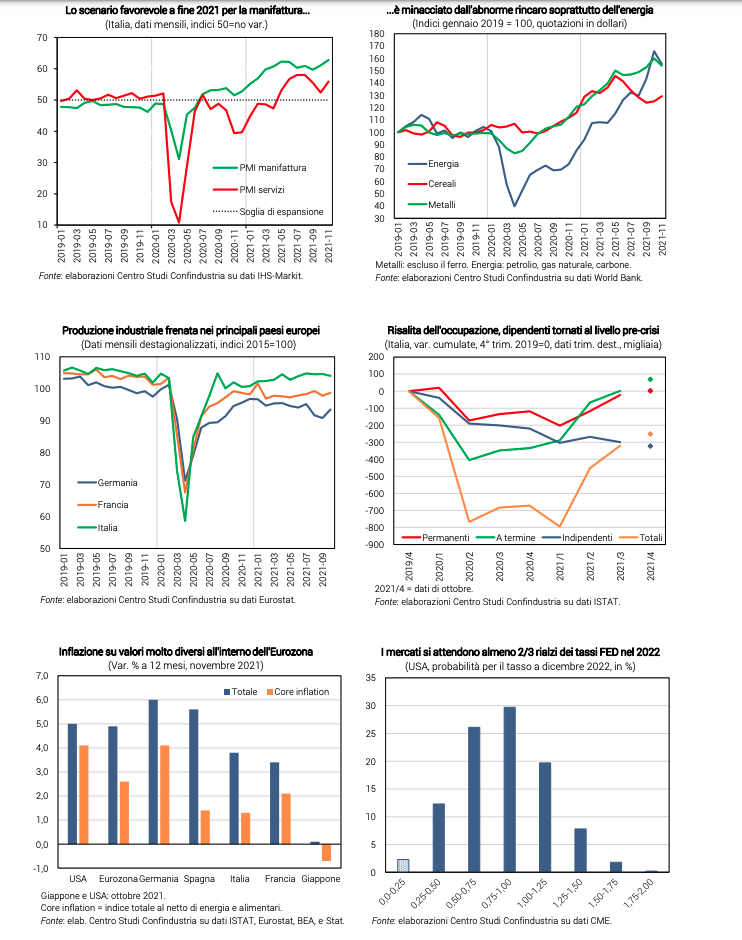

The scenario for manufacturing would be favorable: in November the PMI rose further (62.8 from 61.1), indicating expansion, thanks to increasing orders. However, the abnormal surge in the European price of gas and, therefore, of electricity in Italy (+ 572% in December on the pre-crisis), if persistent, puts activity in the energy-intensive sectors at risk. Also because it adds to the scarcity and price increases of various production inputs. First impacts were recorded on industrial production in Italy (-0.6% in October, after the slowdown in the third quarter), as already happened in Germany and France.

Services: contagion risks.

The services SME recovered in November (55.9 from 52.4), confirming that the recovery is continuing. For tourism, the recovery up to October is very partial (-22.9% foreigners' trips to Italy since 2019). In this sector, the risks come from the new wave of infections, which keeps the uncertainty and prudence of families high, even if so far the limitations remain moderate.

More uncertainty about investments .

Investments are already above pre-crisis values (+ 6.9% in the 3rd quarter), thanks to the contribution of construction. Their expansion is expected to continue in the 4th quarter, thanks to the driving force of the NRR and incentives. However, the rise in those in machinery and equipment could be held back by the low margins of companies and by the once again very uncertain context.

Split export.

Italian exports of goods (+ 2.5% above the pre-crisis in the 3rd quarter) rebounded in October (+ 1.5% in value), after the decline in September. At the beginning of the 4th quarter the level was higher than the 3rd in value (+ 0.8%), but lower in volume (-0.8%); this reflects the jump in the prices of intermediate goods and energy. Intra-EU sales are expanding (+ 2.3% on the 3rd), non-EU sales are down (-0.8%), in particular to the UK, Russia, Switzerland. The indications for the end of 2021 remain positive, but in an uncertain framework: robust expansion of demand, according to foreign manufacturing orders, but persistent bottlenecks in supplies.

Employees at pre-crisis levels.

Employment increased in October (+ 35 thousand units), confirming the positive scenario of the labor market in 2021: the number of employed persons, at a minimum in January 2021, has since recovered much of the fall (+ 625 thousand), but has registered still a gap (-217 thousand since the end of 2019). Employees have recovered to pre-Covid levels, including permanent ones, but self-employed workers continue to decline, widening a contraction that began before the crisis.

Very heterogeneous inflation.

The trend in consumer prices is high and rooted in the US (+ 5.0% annually, + 4.1% the core net of energy and food). In the Eurozone (+ 4.9%) the situation is better, because the core has risen little (+ 2.6%). The picture is diversified between countries: in Italy, with energy skyrocketing (+ 30.7%), inflation rose less (+ 3.8%) and the core almost nothing (+ 1.3%) ; Germany experiences the greatest increase (+ 6.0% and + 4.1%). Japan is out of the box: inflation is stubbornly low.

Interest rates: Fed change of course, not ECB.

The Fed's decision, in November-December, to rapidly reduce purchases of securities, suggests an increase in US official rates in 2022. Instead, the ECB remains on a very expansive policy, having decided in December only small adjustments in the path of the shopping. Good news for Italy, a country with high debt: the BTP remains low and stable (0.91% in December).

Eurozone: uncertain scenario.

Industrial production in the area in October rose significantly, albeit less than expected (+ 1.1% from -0.2%), thanks to the rebound (+ 2.8%) of the German one after four drops in five months. Retail sales also rose (+ 0.2% from -0.4%). But in December the manufacturing PMI, albeit above 50 points, decreased (58.0 from 58.4) and worse for the PMI in services (53.3 from 55.9). Furthermore, business confidence worsened in December (13.5 from 18.3, Sentix index).

Use in weakening.

US economic activity in November slowed down compared to October (+ 0.5% from + 1.7%). Dynamics influenced by the manufacturing sector (+ 0.7% from + 1.4%), as confirmed by the SME in December, still expansive but down (57.8 from 58.5), and by the PhillyFed index, which more than halved (15.4 from 39.0). The services PMI also fell (57.5 from 58.0), while business confidence improved (61.1 from 60.8). The jobs created in November were confirmed above the critical threshold, 235 thousand units, but have fallen since October. Retail sales suffered an unexpected slowdown (+ 0.3% from + 1.7%), while consumer confidence remained very high (Michigan index at 70.4 from 67.4).

CONSUMPTION POWERED BY EXTRA-ACCUMULATED SAVINGS

Lights and shadows for shopping.

The expected rise in consumption risks a slowdown due to the jump in energy prices, which reduces purchasing power. Consumption, however, remains supported by a powerful driver: the savings accumulated by families during the crisis. The complete recovery of employees and income prospects is also in favor.

Lower income with the pandemic …

In 2020, the temporary closures of many commercial and industrial activities had led to a sharp reduction in employees and hours worked, with the consequent fall in the gross disposable income of households: -5.6% in the 2nd quarter compared to the 4th in 2019 ( equal to approximately -16 billion euros). Subsequently, this fall was largely recovered: -0.8% the residual gap in the second quarter of 2021, equal to -4 billion compared to the pre-Covid trend (CSC estimates).

… and collapse in consumption …

The fewer resources available together with the new life and work habits due to the pandemic, have forced families to give up many expenses in 2020, especially in services. This is due to government restrictions, the fear of contagion, and the uncertainty triggered by the crisis. In the 1st and 2nd quarter of 2020, the decline in household spending was 19.7% compared to 4th 2019 (-52 billion). The annual loss of consumption in 2020, compared to the pre-Covid trend, was 127 billion (CSC estimates). At the moment, this collapse has only partially recovered: spending on goods and services in the 2nd and 3rd quarters of 2021 has restarted strongly, with + 10.4% (+ 3.4% in goods, +18, 1% in services). This has reduced the gap from the pre-pandemic level to -3.8%, all in services (-7.2%), while in goods the recovery is already full. In 2021, the "annual" loss compared to the trend is therefore lower, but not yet canceled (73 billion in the first 3 quarters).

… With accumulated savings.

The greater fall in consumption compared to income was reflected in a greater accumulation of savings, largely "forced". The propensity to save reached 20% in Q2 2020 and then suffered a partial decline, reaching 12.9% in Q2 2021, still high (the 2010-2019 average was 8.2% ). In the whole of 2020, savings reached maximum values, reaching 170 billion (the 2010-2019 average was 90 billion). The widening of the distance between income and consumption, calculated with a counterfactual exercise at Bilbiie, Eggertsson and Primiceri (Voxeu, 2021), was approximately 80 billion in all of 2020; in the first half of 2021 the distance has narrowed, but remains substantial (37 billion).

Lots of liquidity on current accounts.

The expansion of savings has largely flowed towards liquid financial assets of Italian households. The resources flowed through an increase in bank loans, on the other hand, were modest (+ 1.8% in 2020). The amount of household deposits therefore increased by 66 billion in 2020, from 1,043 at the end of 2019 to 1,109 billion, well beyond its significant growing trend (at current prices). This trend continued in 2021, with a more contained increase, equal to +40 billion until October.

Resources for the ascent.

The greater savings accumulated by Italian households in bank deposits is a buffer of resources readily available for spending in the near future. This "extra-liquid savings" (conservatively estimated by the CSC at 26 billion in 2020 and positive also in the first 3 quarters of 2021, albeit very low) will be used in part to fuel the rise in consumption at the end of 2021 and in 2022. Which are still under the pre-crisis (-10 billion in the 3rd quarter 2021 from the 4th 2019; -40 annualized).

How will the extra savings be spent?

Despite the relaxation of restrictive measures thanks to the vaccination campaign, families continue to maintain a cautious attitude. Furthermore, the intensity of the recovery in consumption, after recessions concentrated in the services sector, may be weaker, because it was largely "lost" purchases (eg cinema tickets) and not "postponed" purchases ( e.g. washing machine). Finally, the pandemic could have long-term effects, such as changes in lifestyle and work habits, which could lead to a structural increase in the propensity to save (lower spending outside the home). All this leads to a gradual release of the liquid extra savings accumulated so far. Therefore, also due to the cost of energy, consumption should still remain below the pre-crisis level well into 2022.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-lo-stato-di-salute-di-italia-ue-e-usa-report-confindustria/ on Wed, 22 Dec 2021 09:24:21 +0000.