Here is what the effects of cost inflation will be

Taper tantrum, cost inflation, aging population: short and long term impact. The analysis by Antonio Cesarano, Intermonte's chief global strategist

Some considerations on the theme of the taper tantrum which are beginning to be discussed in view of the post Covid reopening, also in the wake of what emerged from the minutes of the last Fed meeting on 28 April.

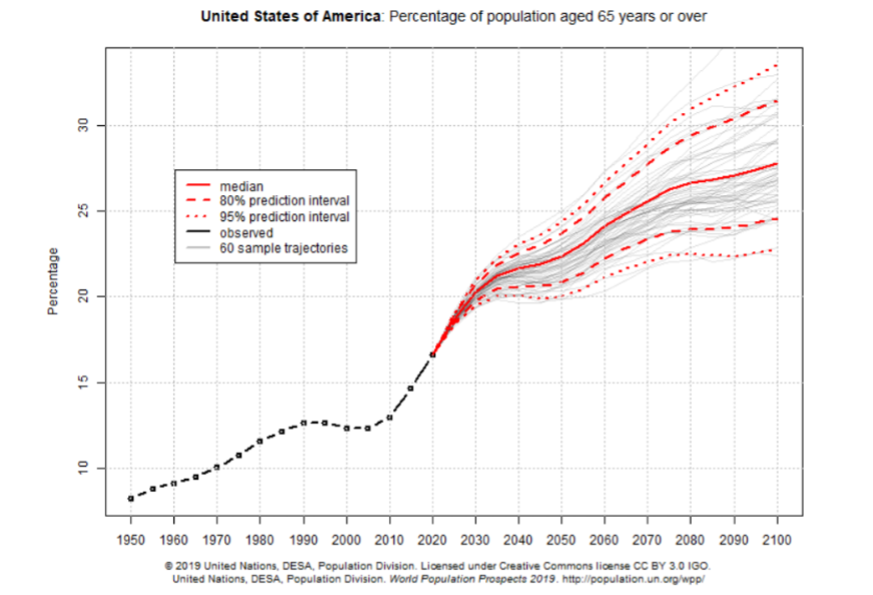

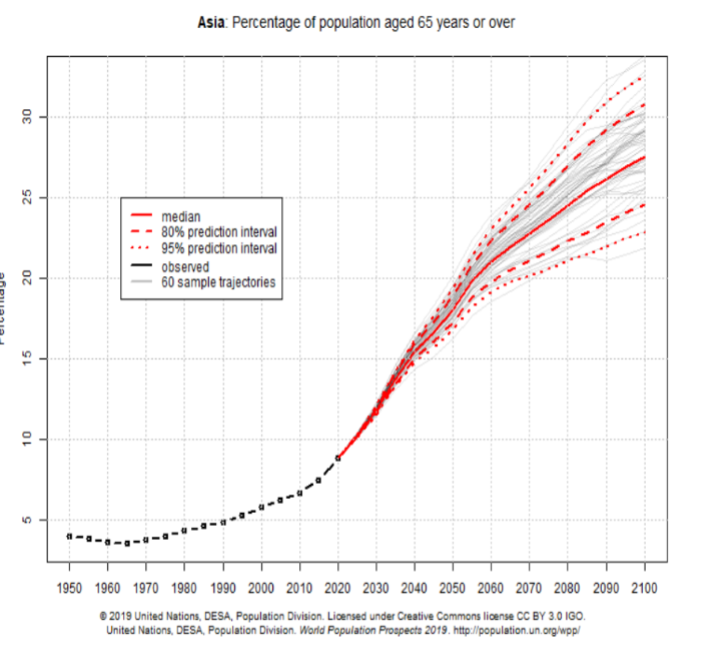

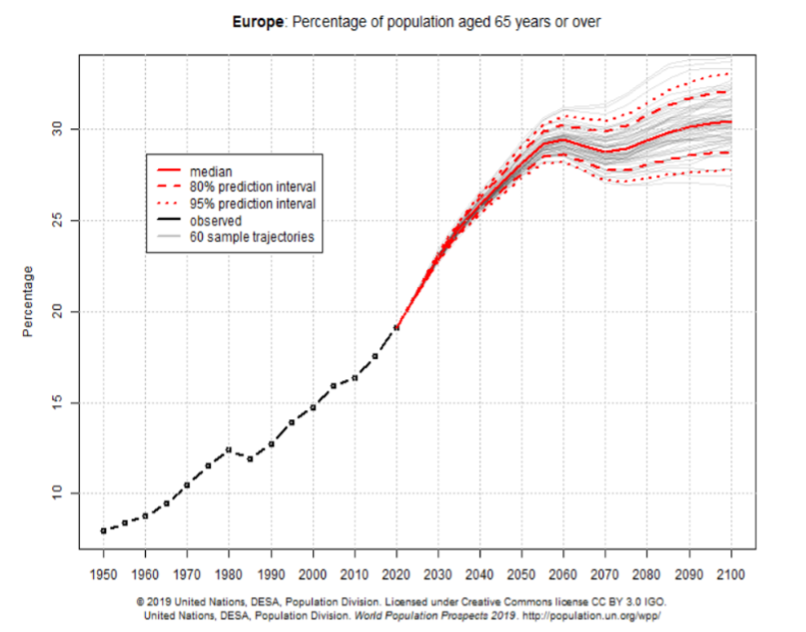

Let's try to distinguish between short-term issues compared with the long-term trend, in my opinion increasingly dictated by demographic considerations, due to the growing effect of population aging on a global scale, albeit at an unequal rate in the world.

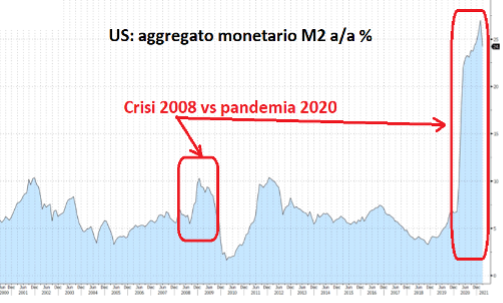

The pandemic has led to a sharp acceleration of global liquidity injections, especially in the US, where the growth of monetary aggregates has been in the order of over 20% y / y.

In April / May, the greatest contribution on the liquidity issue came from companies, especially the US which, according to what was declared in the first 4 months of 2021, fielded about 480 billion $ in buyback in addition to increasing the flow of dividends. Not surprisingly, since the beginning of the year, the S&P buyback index has a double performance compared to the S & P500 index (+ 20% vs + 10% approximately).

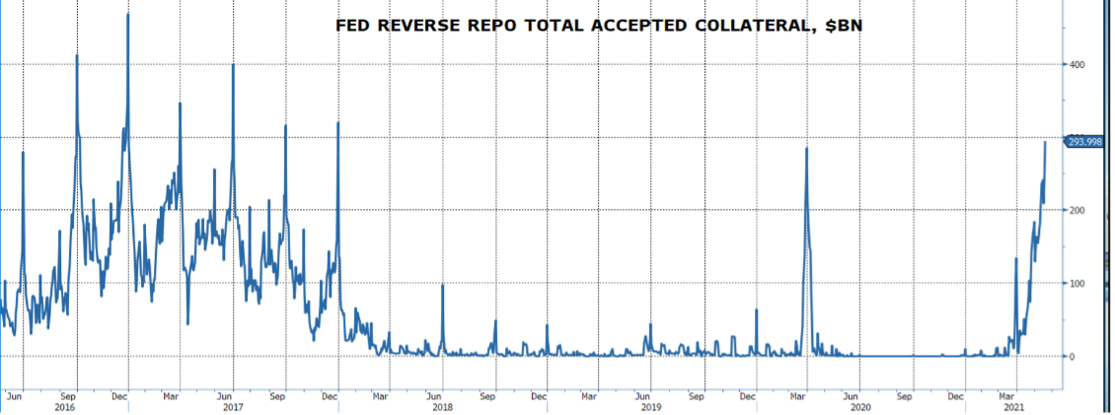

The sea of liquidity has become such that US banks have started to have difficulty managing it, ending up resorting to the more traditional port, that is, to pour it into the Fed through daily reverse repo operations, which, in recent days, have reached the record level since 2017 of almost $ 300 billion.

The growing pressure of the liquidity delivered by the banks to the Fed leads the Fed itself to start considering the hypothesis of reducing the liquidity injected, (ie buying fewer assets, including Treasuries).

Added to this is the expected increase in inflation expectations (US 10y breakevens are at their highest since 2013, the year of Bernanke's famous taper tantrum). All this contributed to push the ten-year rate up to the 1.70% area.

The most striking previous cases of taper tantrum (Bernanke in the second half of 2013 and Powell at the end of 2018) led to marked increases in interest rates in the face of unequal impacts on the equity front.

In particular, the impact on rates was strongly upward in 2013 and the same happened in 2018. On the stock markets the impact of the taper tantrum was localized only in a few months in 2013 and more pronounced, instead, between November and December 2018. Yet, in both cases the level of the US 10-year rate hit the 3% area.

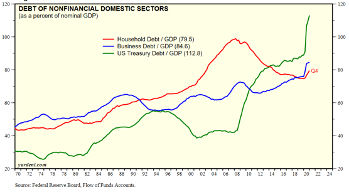

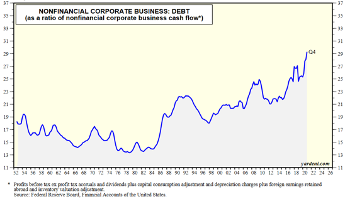

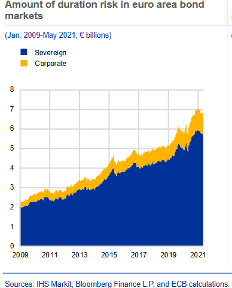

Why this different impact on equity markets? The explanatory variable could be the sharp acceleration of the aging rate of the population which has resulted in a growing level of public debt but also on the corporate side. This trend led to an extension of the average duration of both government and corporate debt.

In summary, as often recalled in the financial stability reports of various institutions, the sensitivity of the system to rising interest rates has increased markedly. Even slightly higher rates can annoy stock exchanges, whose correlation to the liquidity theme increases over time.

The root problem probably lies in the aging of the population which, in fact, has guided the trend and the pace of manifestation of the decades-long trend of falling rates.

On the subject of population aging, it is sufficient to look at the data reported below on the United Nations projections relating to the percentage of the population over 65 in the coming years in the USA, Asia and Europe.

CONCLUSIONS

Short term: the discussion on the taper tantrum mixed with that on post-pandemic cost / consumption inflation will be the central theme between now and the end of the semester.

The two important meetings of the ECB (June 10) and Fed (June 16) are concentrated in June, called to give their addresses for the following months.

OPEC will have to do the same on June 1, also in view of the return of Iran among the producers, once the post-agreement sanctions on nuclear power that appear imminent have been eliminated.

These factors could gradually bring US 10y rates back to the 1.75 / 2% area between June and July, with the ten-year Bund rate returning to positive territory, also in view of the comparison with a competing issuer such as the EU (Sure bond + above all Recovery bonds, of which 1/3 green) that it had never had in the past, at least in the proportions that we will have in the coming quarters.

These factors could lead to progressive profit taking on the stock markets but on average gradually, thanks to the parachute effect exerted mainly by company liquidity – through liquidity resulting from generous pay out ratios (buy back in primis).

The dollar could temporarily appreciate to the 1.18 area.

Second semester: during the second half of the year two themes could emerge more clearly:

- consumption not up to par with the rise in inflation and the related rise in costs (the latter factor could remain in place for at least 1 or 2 quarters).

- the temporary return of the focus on the twin US deficits after the passage to Congress of the additional programs proposed by Biden in the order of about $ 4 trillion, financed largely through tax increases.

The first factor could mitigate the excess rate hike that we will be able to see in the next 1 or 2 months and especially towards the end of the year, when the macro variables will again be guided more by the trend in consumption not yet up to the rise in inflation .

The second point could instead have an impact, leading to a depreciation of the dollar against the euro in the 1.23 / 1.25 area between July and October.

Long term: As early as next year, the demographic variable could begin to exert its impact more clearly and the decreasing trend in interest rates, especially the US, should be more evident.

Therefore, on the interest rate world the thesis of a primary decreasing trend in rates interspersed with temporary upturns often linked to central banks' taper tantrum attempts still prevails. In summary, the 2.50% area of the 10-year treasury (corresponding to 3% in 2018) appears extremely difficult to drill upwards.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-quali-saranno-gli-effetti-inflazione-da-costi/ on Sat, 05 Jun 2021 06:14:23 +0000.