Here is who will benefit from the state cashback

Who will get the cashback? The article by Enrico D'Elia for La Voce.info

WHO USES CARDS AND ATMs IN ITALY

Italy is among the most backward countries in Europe in the use of electronic payment instruments. The Bank of Italy reports that in 2018 transactions with cards and the like were still 111 per person per year, compared to 265 in the Eurozone. In the intentions of the government, cashback, bonuses and super bonuses, together with other initiatives such as the receipt lottery, should discourage the use of cash, contributing to the fight against micro-tax evasion and crime, as recently also supported by Leonzio Rizzo and Massimo Taddei on this site. In addition, the use of electronic payment instruments could save on the cost of managing cash (storage, transport and security), which according to the Bank of Italy in 2016 amounted to 7.4 billion a year (0, 4 percent of GDP).

Individual data from the latest Bank of Italy Household Balance Sheet Survey, relative to the end of 2016, show that at least one card or ATM is available in about 80 per cent of households. It is presumed that the share increased by 2-3 points after the introduction of citizenship income, which involves the use of a particular rechargeable card for about 1.2 million families.

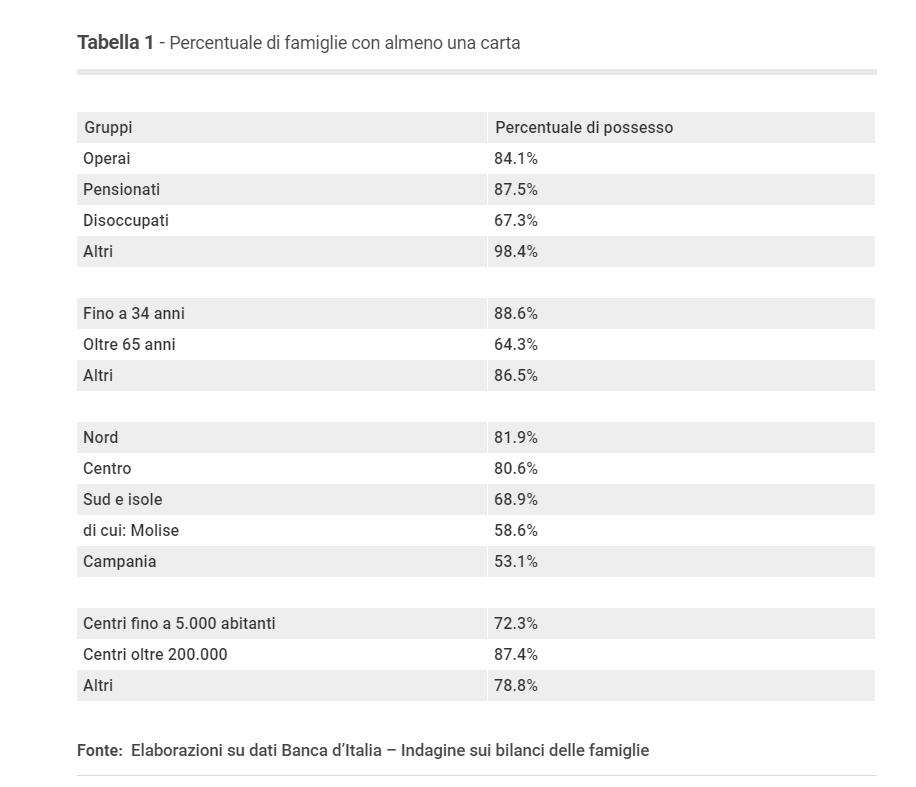

As can be seen from Table 1, there is at least one card in only 64 percent of households when the breadwinner (i.e. who earns the most) is over 65, compared to 90 percent when the breadwinner is under 35. The families of office workers, managers, entrepreneurs, professionals and self-employed people almost certainly have at least one card, while 16 per cent of blue-collar families and 13 per cent of pensioners do not have one. 33 percent of the unemployed (before citizenship income) declared that they did not have electronic means of payment and it is surprising that the share is not even higher.

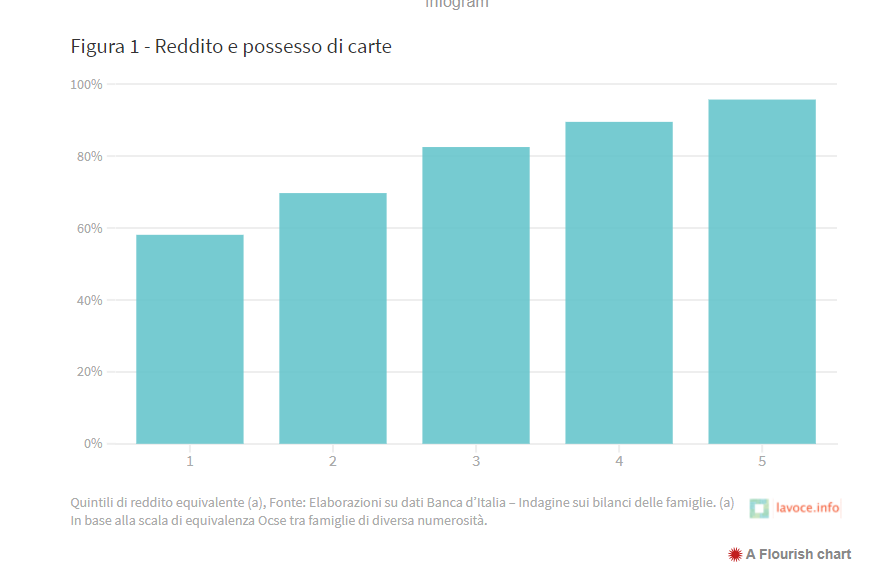

However, the most significant differences in card ownership are recorded in terms of income and geography, as also shown by a study by the Bank of Italy. By re-proportioning the survey data on the corresponding national accounting aggregates, the per capita income of households without cards in 2016 amounted to about 14,000 euros per year, net of taxes, compared to 20,000 (43 per cent in plus) households with at least one ATM. Using the OECD "equivalence scale" (which weighs each component on the basis of the square root of their total number), we obtain the distribution of possession of cards by quintiles of equivalent income represented in Figure 1. The share increases with income, going from 58 per cent for the poorest families to almost 100 per cent for the richest ones.

At a regional level, cards are much more widespread in the North (with the curious exception of the Aosta Valley) than in the Center-South, where for example only 53 percent of Campania families own them, 59 percent of Molise families. and 68 percent of those from Abruzzo. There are also transversal differences between the geographical areas concerning the demographic dimension of the municipalities of residence. In large cities (with over 200,000 inhabitants) over 87 per cent of families have at least one card, while the percentage drops to just over 72 per cent in centers with less than 5,000 inhabitants and ranges between 77 and 81 percent in the other municipalities.

WHO WILL GET CASHBACK

There is therefore a significant concentration of alternative means to cash among the inhabitants of the North and, more generally of the large cities, with a householder under the age of 65, a medium-high income and a condition other than that of a worker or unemployed. . While a mechanical relationship between card possession and actual use cannot be established, it is likely that these categories will benefit most from cashback and related bonuses and super bonuses. It is therefore probable that the measure will accentuate the inequality between incomes , favoring the richest families, with a presumably lower propensity to consume, causing a fairly modest multiplicative effect on GDP. If all families obtained the maximum bonus compatible with their habits and spending capacity, the Gini inequality index calculated on the Bank of Italy sample would rise from 35.21 to 35.43 per cent.

Some cashback operating methods also appear questionable. First of all, almost 73 percent of families already spend more than the ceiling envisaged by the provision through cards (3,000 euros per year for each adult, equal to an average of around 5,900 euros per family). Therefore, most could receive maximum benefit even without stepping up their card use. Under these conditions, the incentive to squeeze the use of cash will depend more on the monthly and annual bonus than on ordinary cashback. On the other hand, it is unlikely that those without cards or currently using them for an amount below the ceiling will actually be able to reach it, because most of them cannot spend those amounts. On average, the families of the poorest fifth should in fact increase their spending on cards by almost 40 percent, while the wealthiest ones by only 1 percent.

Considering the margin between current spending with cards and the ceiling (or total consumption, if lower), it can be calculated that the incentive could act on a maximum of 4.2 per cent of household expenses (excluding "imputed rents", which do not involve transactions). It would have been enough to set the ceiling at 6 thousand euros and the percentage of cashback at 5 percent to make it attractive for 40 percent of families, potentially affecting 10 percent of consumption, without additional burdens for the public budget and also obtaining a very slight reduction of inequality compared to the current solution.

Registration on the PagoPa handyman IO app and the deferred repayment on the bank account are unnecessarily cumbersome, so much so that some managers of electronic payment instruments have already made more agile systems available, which obviously require the subscription of the respective fintech products. Perhaps it would have been easier to provide a discount at the same time as the payment, leaving the card managers to settle accounts with their customers.

Given its regressive effects, costs (almost 5 billion in two years) and application criticalities, it is not certain that cashback will have significant effects on revenue, because the relationship between use of cash and evasion is rather weak and is also uncertain the direction of the causal link between the two phenomena. It is also probable that electronic transactions will grow in sectors already with low evasion, such as large-scale distribution which, according to Istat, absorbs almost half of retail spending, rather than in critical ones.

Article published on Lavoce.info, here the full version.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/ecco-chi-avvantaggera-il-cashback-di-stato/ on Sat, 12 Dec 2020 02:50:18 +0000.