Here’s Biden’s tax plan. Numbers and controversies

Biden has proposed a $7.3 trillion budget for the 2025 fiscal year: more aid to the lower and middle class and more taxes on large fortunes. But Republicans won't pass it in Congress. All the details

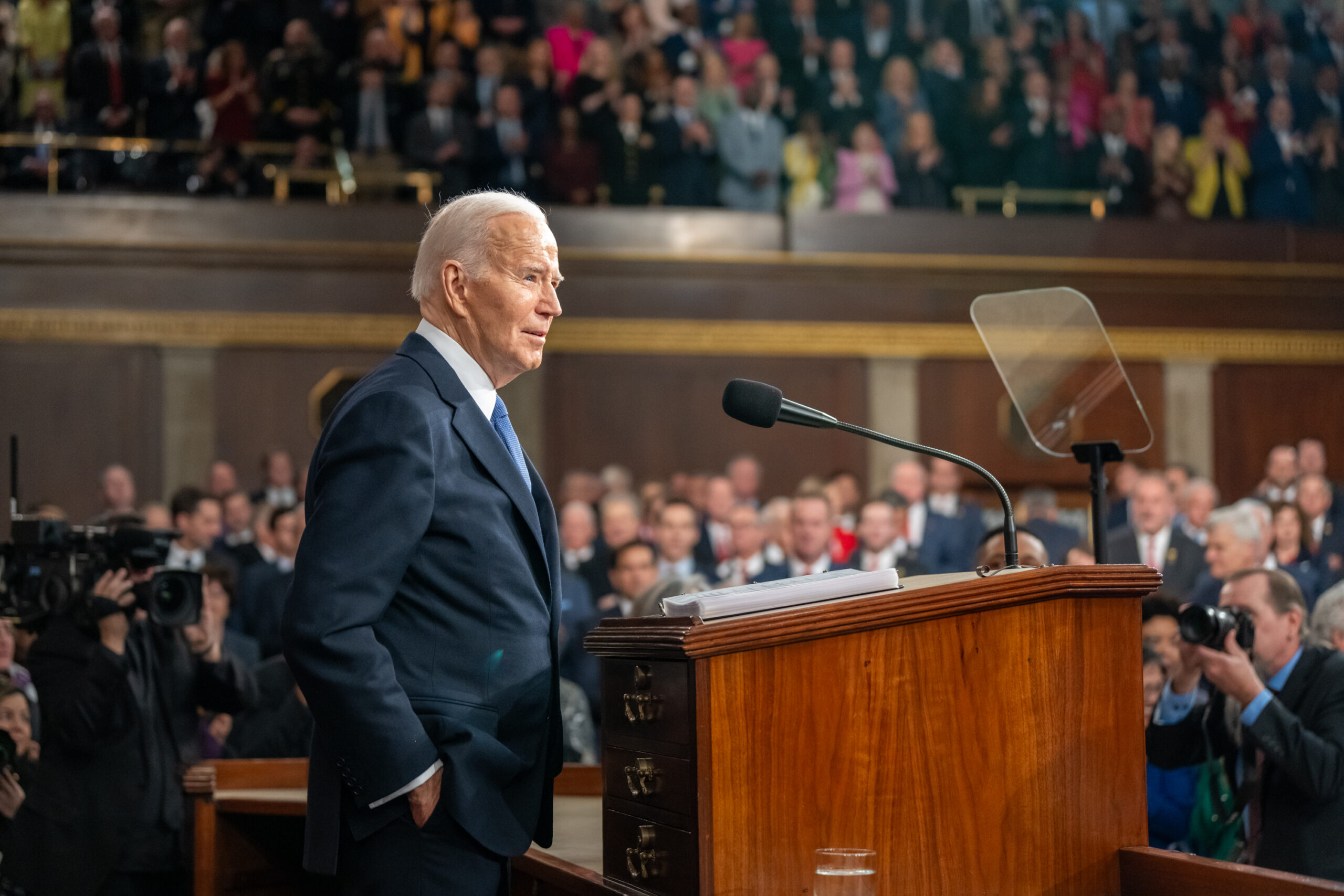

On Monday, US President Joe Biden proposed to Congress a $7.3 trillion budget containing new spending for social programs, a series of measures to combat rising costs for consumers (in particular housing and for university) and higher taxes on large companies and large fortunes.

THE POLITICAL OBJECTIVE: THE NOVEMBER PRESIDENTIAL ELECTIONS

As the New York Times wrote, the new budget proposal does not differ much from last year's (and which was not approved by Congress). Biden has asked to spend around 100 billion on strengthening controls at the southern border – in order to combat irregular immigration, one of the most relevant issues for the US electorate – and on providing aid to Ukraine, Taiwan and Israel.

The New York Times adds that it is very unlikely that the new spending and tax increase proposals contained in the budget for the fiscal year 2025 will become law, given that the Republican Party controls the House of Congress and opposes the Biden's economic agenda. Last week, however, the House Republicans presented their budget proposal, containing very different measures from those advanced by the Democratic Party.

Biden's budget proposal will then act as a programmatic platform for the president in view of the November elections, useful for highlighting the policy differences with Donald Trump , the almost obvious candidate of the Republican Party. Biden wants to present himself to public opinion as the one who will increase public aid to workers, families, students and pensioners, while simultaneously committing himself to containing global warming. To finance all these measures and reduce the public deficit, the president has proposed increasing taxes on the wealthiest American citizens and large companies.

TAXES ON LARGE COMPANIES AND LARGE ASSETS

More specifically, Biden is proposing to raise the corporate income tax rate from 21 to 28 percent and to force fortunes of $100 million to pay at least 25 percent of their income in taxes. The federal government would like to use these resources to finance – for example – tax relief for low- and middle-income families with children, but also childcare and new home construction programs, twelve-week parental leaves for workers and plans to strengthen the police forces.

CRITICISM OF THE REPUBLICANS AND TRUMP'S PLAN

According to Republicans, however, Biden's proposal reflects an "insatiable appetite for unbridled spending" and a "disdain for fiscal responsibility". According to a Reuters poll conducted last January, 40 percent of Americans think that Trump will be able to manage the United States economy better, compared to 31 percent who support Biden; 28 percent cannot choose between the two candidates or prefer not to answer.

In 2017, Trump passed a major law – the Tax Cuts and Jobs Act – that lowered the federal corporate income tax rate from 35 percent to 21 percent. If re-elected, the ex-president promises a sharp increase in import duties and fewer constraints on energy companies: already today, however, the United States is the largest oil producer in the world and the largest exporter of liquefied gas .

– Read also: Trump's tax cuts make Netflix, Nike, General Motors and more rejoice

Democrats accuse Trump of widening the public deficit with his tax cuts and favoring wealthier Americans, but they did not eliminate his measures when they were in control of Congress, between 2021 and 2023.

FORECASTS ON THE DEFICIT, THE GDP AND MORE

Biden's budget proposal foresees an increase in tax revenue to 4,951 billion dollars over ten years, of which 2,700 billion in corporate tax increases and almost 2,000 billion in increases on individual large fortunes. White House forecasts say that in fiscal year 2025 the public deficit will amount to 1.8 trillion dollars, 6.1 percent of GDP; but it will fall below 4 percent of GDP within a decade.

The White House also forecasts growth of 1.7 percent of GDP in real terms in 2024, 1.8 percent in 2025 and 2.2 percent by 2030. Estimated consumer price inflation for 2024 it is 2.9 percent and 2.3 percent in 2025; the unemployment rate will instead be 4 percent, falling to 3.8 percent by the end of the decade.

WHAT DOES BIDEN'S BUDGET PREDICT ON DEFENSE AND SPACE

Biden's budget proposal contains $895 million for national security and includes a reduction in new F-35 fighters and Virginia-class submarines.

As for space, the White House has requested 25.3 billion dollars for NASA, or five hundred million more than the agency received in the 2024 fiscal year but significantly less than the funds allocated to it in previous years to finance the Artemis lunar program. Biden has also proposed allocating $33.7 billion to space defense, including $29.4 billion for the Space Force.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/mondo/bilancio-biden-anno-fiscale-2025/ on Tue, 12 Mar 2024 12:27:16 +0000.