Here’s how Alphabet, Amazon, Apple, Meta etc will monopolize the Nasdaq less

The Nasdaq 100 index, which includes the stocks of the most famous tech companies in the world, has announced a "special" rebalancing due to the excessive concentration of the Magnificent Seven (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla). The analysis by Giorgio Broggi, Quantitative Analyst of Moneyfarm

The Magnificent Seven ( Alphabet , Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) have become too "heavy" and the Nasdaq 100 index, which includes the stocks of the most famous tech companies in the world, implements the rebalancing announced on 7 July.

WHAT IS THE NASDAQ 100

The Nasdaq 100 is a market capitalization-weighted index and subject to rebalancing on a quarterly basis even if a "special" rebalancing had already been necessary in the past to protect its integrity: this happened in 1998, in 2011 (when the Apple's weight was cut from 20% to 12%, while Microsoft, Oracle, Intel and Cisco Systems were weighed more) and this is what is happening today, precisely because of the excessive concentration of the Sects.

THE BOOM OF THE MAGNIFICENT SEVEN

As can be seen in the graph below, in the last 10 years the market value of these companies has more than doubled and data collected by Bloomberg in early July show that the top seven companies on the Nasdaq 100 had now reached a weight close to 50 % of index. The objective of this special rebalancing is therefore to maintain a level of diversification such as to ensure that the index represents the entire US tech market and not just the largest companies.

To confirm their outsized weight on the performance of the Nasdaq 100, consider that, since the beginning of 2023, the Seven have contributed approximately 75% to the return of the index, against the 60% achieved between 2016 and the end of 2023. 2022. The rebalancing therefore has the objective of reducing this imbalance, going to underweight the major components and putting a ceiling on the aggregate weight of companies that exceed 4.5% in the index so that, adding the value of the Seven, we reach 48% of the total index at most.

THE IMPACT ON THE MARKETS

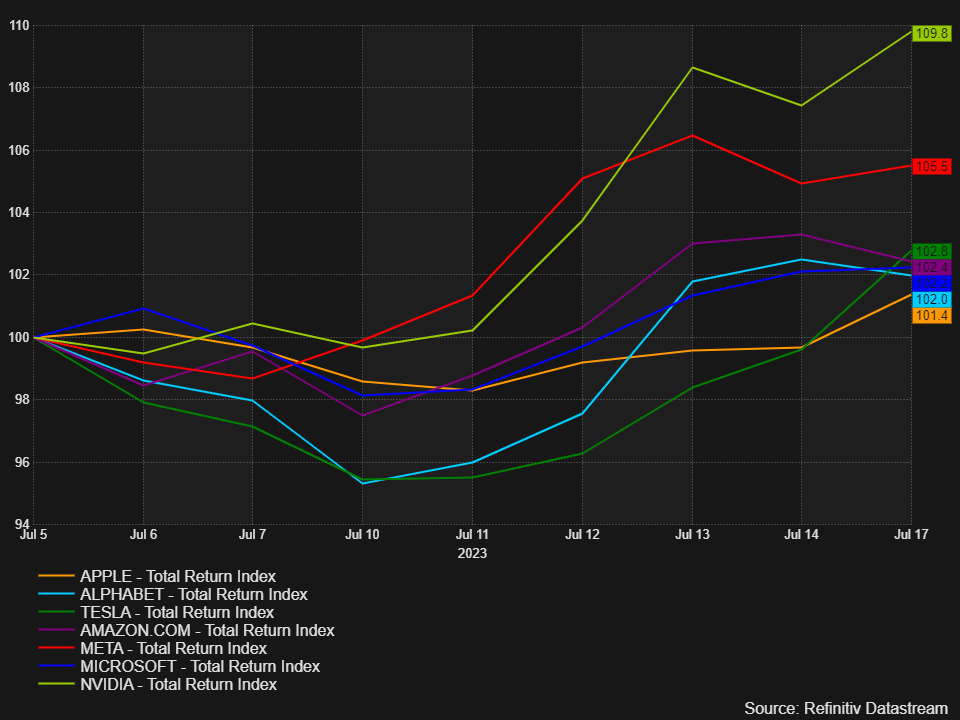

If on the one hand this special rebalancing could have repercussions on Big Tech – we recall that in the days following the announcement Apple lost 1.1%, Alphabet and Amazon more than 2%, Microsoft and Tesla more than 1% – on the other, one cannot help but notice that the Seven recovered within 10 days. The impact on the markets therefore does not seem to have been profound, as can also be seen from the graph below, which shows the total return of those who invested in these companies between 5 and 17 July.

Beyond the short-term impacts, the rebalancing will have positive effects for investors, especially for lovers of passive instruments such as ETFs who, seeing an increase in diversification within the index, are able to protect themselves from the risks associated with investments in individual names.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/nasdaq-magnifiche-sette/ on Sun, 30 Jul 2023 05:50:06 +0000.