Here’s how and when the effects of monetary tightening will be felt

High rates and the macro economy. Analysis by Ben Rodriguez, Multi-asset fund manager, and Matt Rees, Multi-asset portfolio manager at Columbia Threadneedle Investments

In late 2021 and early 2022, the focus of consumer demand shifted from goods to more labour-intensive areas of services. This shift, coupled with a decline in the labor force participation rate, has made labor markets tighter, resulting in an acceleration of wage growth.

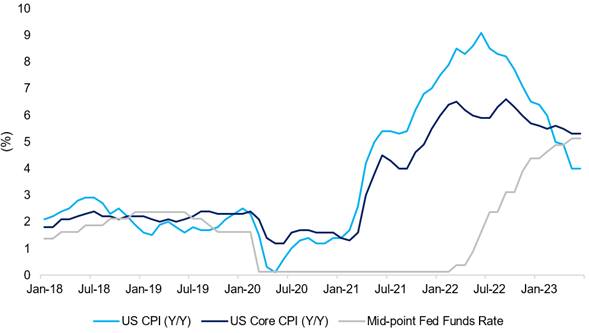

Central banks cannot meaningfully influence – and should scrutinize – short-term inflation fluctuations driven by supply dynamics, as was the case with asset price-driven inflation at the start of the pandemic which, at the time, was described as “transient”. However, increases in prices, core inflation levels and wage growth are the elements that determine inflation above the target, on which central banks are called to intervene through monetary policy instruments. Therefore, starting with the Bank of England (BoE) in December 2021, the main central banks of developed markets launched a rapid monetary policy tightening programme, with the aim of rebalancing supply and demand in the various economies with inflation targets consistent with the equilibrium level (Figure 1)

Currently, the discussion focuses on the adequacy of the monetary tightening implemented so far by central banks aimed at reducing demand. In this debate, the two positions are, on the one hand, “what has already been done is (more than) enough and now we need to wait more time for the full effects to be felt”, and on the other hand, “the effects have already materialized in full, and further tightening is needed to bring core inflation back to the target level”.

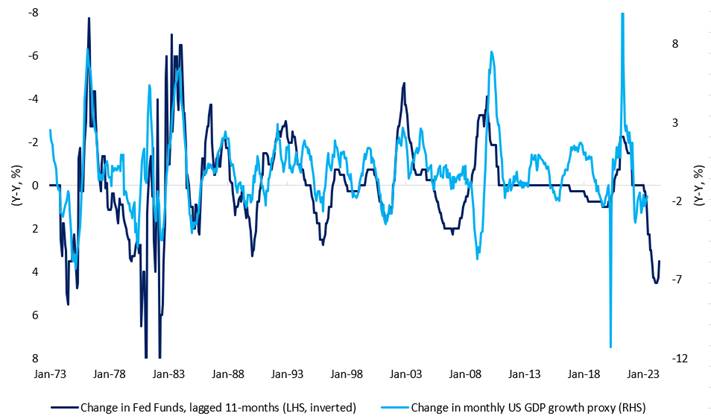

The discussion is centered on the extent of the delay with which any further tightening will lead to the consequent drop in demand. We have analyzed the empirical relationship between changes in central bank policy rates and changes in GDP growth in the US, the UK and the eurozone. We found that the lag between the initiation of the monetary policy shift and the economic impact was 11 months in the US (Display 2), eight months in the UK and nine months in the eurozone. This suggests that the economic impact of interest rate hikes began to be felt in the first quarter of 2023 in the US, and in the third quarter of 2022 and second quarter of 2023 in the UK and the eurozone, respectively. Furthermore, this analysis highlights that the maximum impact of the implemented hikes will not manifest before the fourth quarter of 2023 / first quarter of 2024.

The analysis also examined the historical lags with which the impact of monetary tightening materialized in the labor market. Expectedly, the duration of the delays is slightly longer in this case, as companies tend to react to a deteriorating economic environment by cutting staff. From this perspective, reports indicate that the maximum impact on labor markets is expected to materialize between the first and second quarters of 2024 in the United States and the United Kingdom, and in the fourth quarter of 2024 in the eurozone.

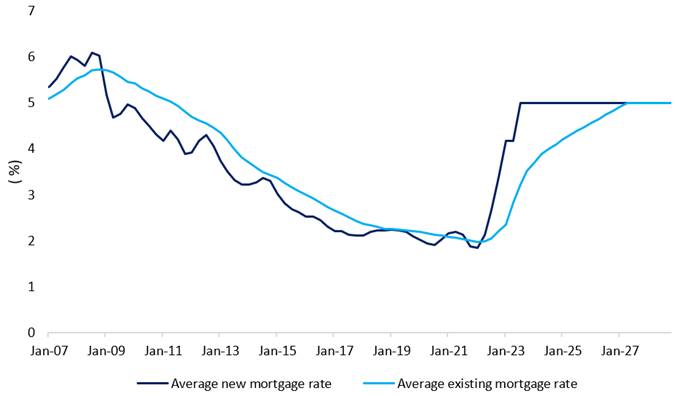

Unsurprisingly, these relationships are not constant over time as, at any point in time, GDP growth and labor markets are impacted by a variety of other factors as well as changes in monetary policy. For example, in the UK mortgages are logically an important transmission mechanism from higher rates to a reduction in economic activity. However, structural trends in this market suggest a change in the transmission rate of monetary tightening. In the UK, the share of mortgages negotiated at variable rates exceeded 70% in 2012; in the first quarter of this year it was 12.5%. Thus any monetary tightening by the BoE that would have immediately reduced the disposable income of a larger proportion of British households in 2012 now has this effect on a much smaller proportion of households. Despite the fact that the final effect of the increase in interest rates will be felt by all households with mortgages, its transmission will still take years – about half of all mortgages taken out in 2021 have a fixed term of five years. Indeed, assuming that interest rates remain at their end-May levels, the average rate on outstanding mortgages is likely to reach 4% in the third quarter of 2024 alone (Figure 3). As a result, based on the model under consideration, the maximum impact of the October 2023 rate hikes on UK GDP is likely to materialize later than historical data suggests.

Although there is uncertainty about the timing of the full impact of the restrictive monetary policy implemented by central banks, we are confident that economic activity will continue to be held back by the monetary tightening implemented so far to an increasing extent. In line with our expectations, we continue to structure our multi-asset portfolios with higher allocations to government bond duration, and slightly reduced equity allocations.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/stretta-monetaria-effetti-quando/ on Sun, 23 Jul 2023 05:57:18 +0000.