Here’s how and why America will (maybe) avoid default

Battle over the US debt ceiling: is there anything new? The analysis by Edward Al-Hussainy, Senior Interest Rate Analyst at Columbia Threadneedle Investments

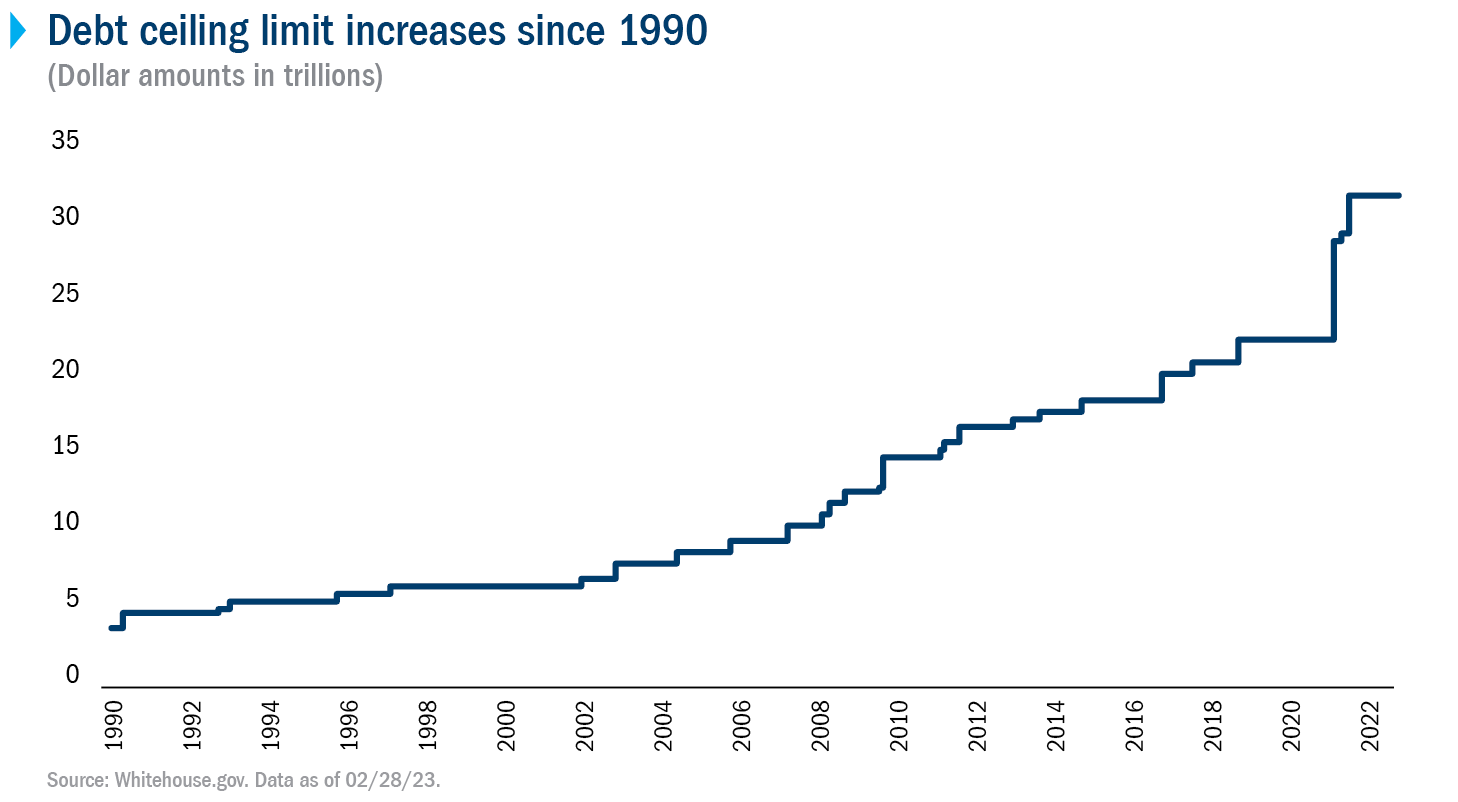

At one time, raising the debt ceiling was considered a "non-event". Since the cap was put in place in 1917, Congress has increased the debt limit dozens of times without incident. But recently, particularly in 2011 and 2013, debt ceiling battles led to the first US credit rating downgrade. This forced us to consider the unthinkable: that the world's largest economy could default on its debt.

Today we find ourselves once again before this precipice. Indeed, since mid-January, the US Treasury Department has taken extraordinary steps to ensure that the government has enough cash to meet its obligations, including payments to debt holders. The US Treasury Department estimates the country could default as early as June unless the cap is raised or suspended. Considering the past history and the current political situation in Congress, we expect this debate to drag on to the last minute and prepare to face extraordinary and unusual market dynamics.

Learn from the past and position yourself for the future

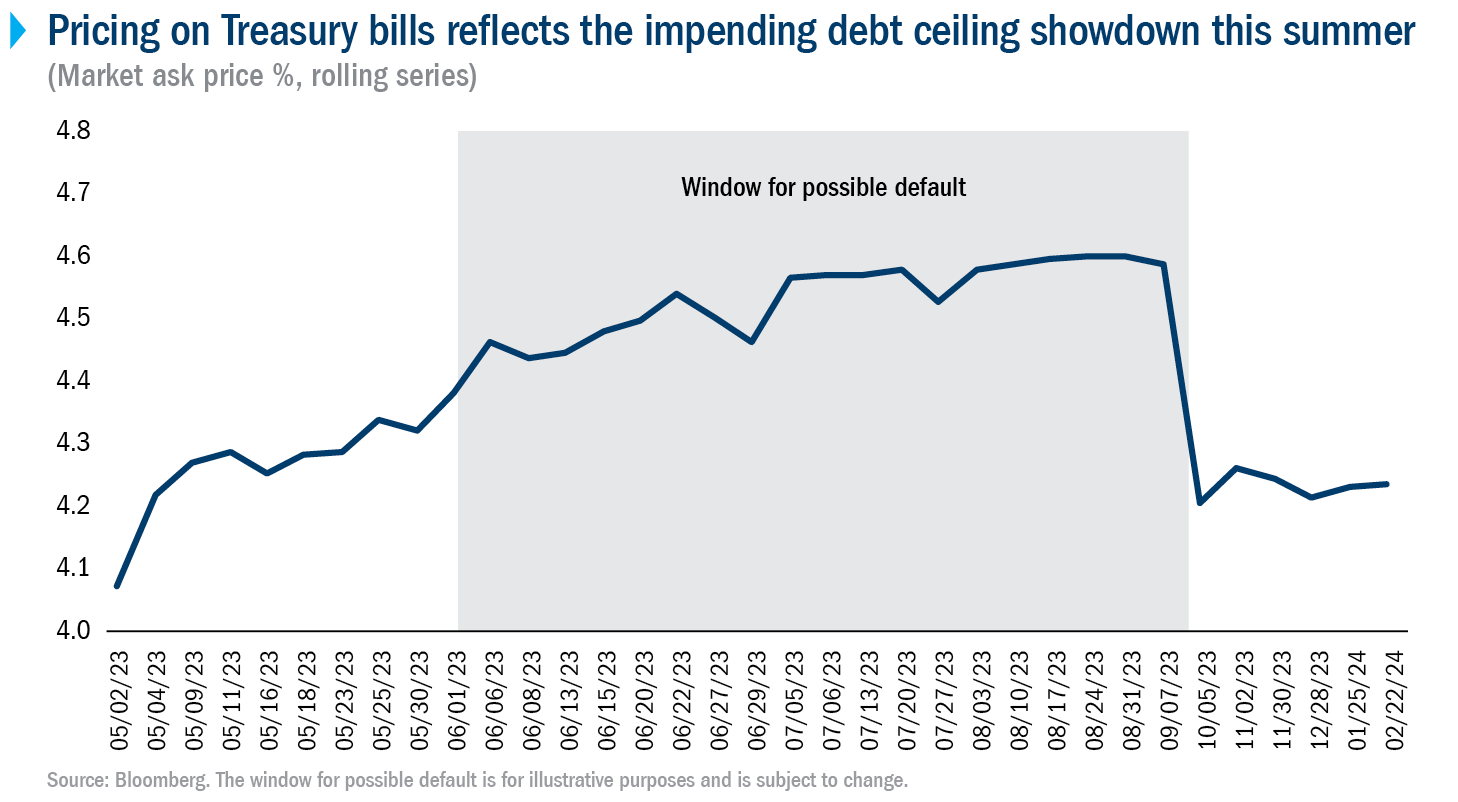

Although Congress still has time to raise the debt limit without bringing the country to the brink of default, we don't expect a resolution anytime soon. We are already seeing distortions in the price of some short-term fixed income government bonds, especially T-bills, which mature at a time when the US could default without an increase in the debt ceiling. As seen in the chart below, investors are demanding a higher risk premium to hold the six-month end of the T-bill curve, while bonds that mature shortly before the government can run out of cash are in high demand.

We saw a similar dynamic back in 2011: in the months before the debt ceiling was breached, markets skewed more and more, until Congress finally reached an agreement to raise the debt ceiling on July 31, just two days before the country's debt capacity was exhausted. We will therefore continue to monitor developments in Washington and on the markets. We believe we could see a deeper inversion of the Treasury curve and a widening of spreads as the standoff on the debt ceiling progresses. If this were to happen, investors may want to reevaluate certain parts of the portfolio positioning.

What's different about this debt crisis

While the experience of investing in different crises has taught us a lot, we are also aware that no two crises – or even two debt ceiling crises – are the same. So while 2011 offers some useful lessons, we see two important differences with the current stalemate. The first difference is the interest rate environment. In 2011 the Fed funds rate was zero, and had been for several years. Today we are in the midst of a sharp hike that saw the Fed funds rate go from 0% to 4.75% in less than a year. Given the difference in base rates, we don't expect percentage point swings in stressed markets to be as large as they were in 2011, but they could still be large on an absolute basis.

Another difference is the fragility of the Republican majority in Congress. Twelve years ago, Republicans held a solid and united majority. Today, they have a razor-thin and somewhat fragmented edge in the House. As part of the marathon to win the presidency of the House, Kevin McCarthy had to make numerous concessions to members of his party, including the provision that any individual member of the House can ask for a motion to leave the speaker's chair at any time. Since some of the same Representatives, who opposed McCarthy's candidacy for Speaker of the House, appear to have taken a hard line on raising the debt ceiling, we cannot overlook the possibility that one of them may fire McCarthy if not satisfied with the way in which the negotiations on the subject will proceed. If this were to happen while the government is running out of reserves, and no agreement can be found on a new speaker (as happened for four days and 14 ballots in January), then the House would be unable to even conduct the more ordinary activities, not to mention raising the debt ceiling. Therefore, in the worst case scenario, the US could "stumble" into default without a functioning House to prevent it.

However, we remain convinced that, after a protracted battle and a last-minute compromise, the government will avoid default. As we believe markets are likely to experience significant volatility and price dislocations before a debt ceiling agreement is reached, it will be imperative that financial advisers help investors develop effective strategies to weather the market turmoil that will result from these tensions in the future. short period.

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/economia/stati-uniti-tetto-debito-default/ on Wed, 24 May 2023 07:59:16 +0000.