Here’s how Leonardo is doing sector by sector, all the numbers

What emerges from Leonardo's 2021 results on the trends of the main business sectors (Helicopters, Electronics, Aeronautics and Space)

The defense sector drove Leonardo's recovery in 2021.

The board of directors of the defense and aerospace group has approved the accounts in 2021 which close with revenues at 14.1 billion (+ 5%), orders for 14.3 billion (+ 4%) and profits at 587 million (+142) %).

The aeronautics sector grew (+ 15%), in which the aircraft component offsets the expected decline in the civil component. The Defense and Security Electronics sector is also growing, benefiting from the positive performance of the European component of the sector. Helicopters recorded a volume of orders substantially in line with the previous year.

“2021 was an important year” comments the CEO of Leonardo Alessandro Profumo. "The defense and government business remains solid, accounting for 88% of revenues, and we see signs of recovery in civil aeronautics", Profumo emphasizes. “2021 operating cash flow“ was above the guidance and double compared to expectations. We have resumed the growth path with results above pre-pandemic levels ".

However, the aerostructures sector continues to suffer (which burned cash for over 300 million), "for which the restructuring and relaunch plan is underway", recalls Profumo.

Finally, the former Finmeccanica group returns to distribute the dividend: the coupon is 14 cents per share.

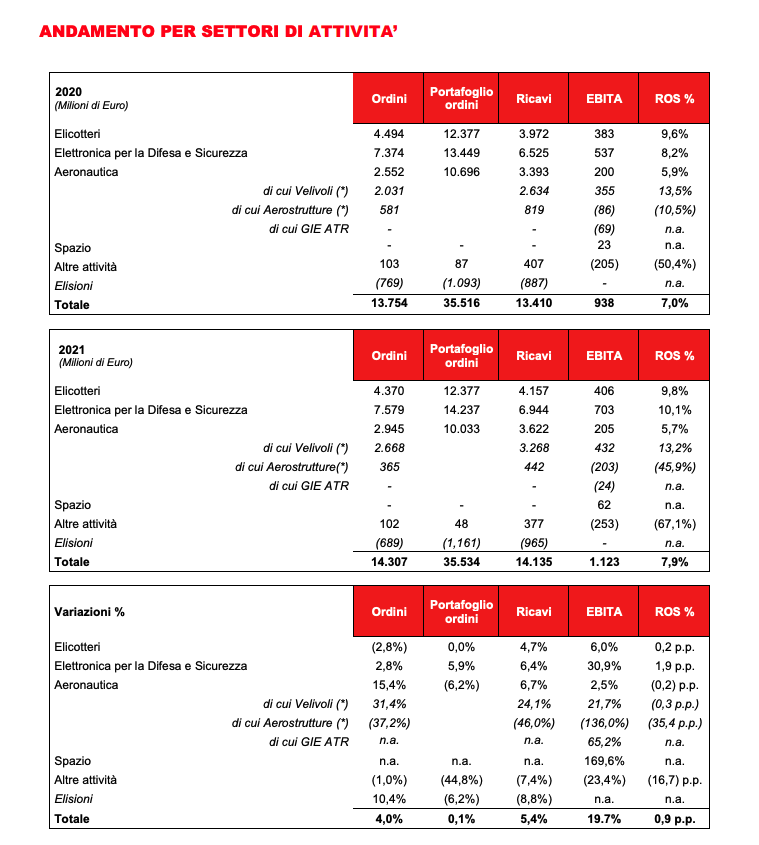

Here are the details on the performance of the individual sectors as can be seen from the press release and the report on the 2021 Leonardo accounts:

HELICOPTERS

The 2021 trend confirms the growth trend of Revenues and EBITA, albeit in a context still characterized by the pandemic in the civil / commercial segment, which shows signs of recovery in terms of acquisitions. In the course of 2021, deliveries were made of n. 128 new helicopters (111 in 2020).

Orders: basically online. The growth in acquisitions in the civil / commercial sector balances a reduction in the contribution of acquisitions in the government sphere, which was particularly significant in the comparative period.

The main acquisitions during the period include: the second and third orders under the TH-73A program (AW119) for the US Navy for a total of n. 72 helicopters; the second additional act for the completion of the development activities and for the supply of n. 4 standard helicopters relating to the NEES program (New Helicopter for Exploration and Escort) for the Italian Army; the contracts relating to the supply in Saudi Arabia of n. 9 AW139 helicopters in the government sector for the Saudi Royal Court and 16 AW139 helicopters for The Helicopter Company, a company established by the Public Investment Fund (PIF) as the first and only operator authorized to commercial flights in the Kingdom; the contracts relating to the supply in Italy of n. 8 AW139 helicopters for the Guardia di Finanza; the contract, signed as part of the Government-to-Government (G2G) Italy-Austria Agreement, for the supply of n. 18 AW169M LUH (Light Utility Helicopter) helicopters for the Austrian Ministry of Defense; further orders relating to the Italian AW169 LUH programs for the Carabinieri and the Army for a total of no. 17 helicopters; the contract relating to the extension for a further five years of the WIST (Wildcat Integrated Support and Training) program for the supply to the UK Ministry of Defense of logistical support and training services for the AW159 Wildcat helicopter fleet.

Revenues: growing due to increasing government activities, in particular on the NH90 programs for Qatar and TH-73A for the US Navy and on the AW189 / AW149 lines, which absorb the expected slight decline in revenues in the civil commercial sector, in particular on the line AW139.

EBITA: increase commensurate with the higher volumes of revenues, with profitability substantially in line with 2020.

The trend of the Divisions in the sector over the last 4 years:

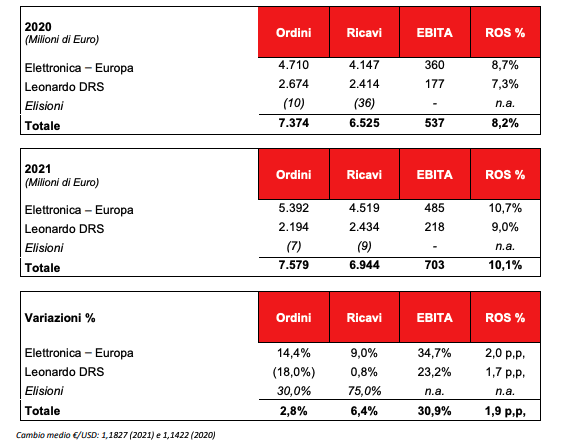

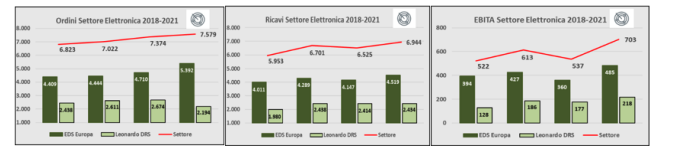

ELECTRONICS FOR DEFENSE AND SECURITY

The 2021 results are characterized by an excellent commercial performance confirming the good positioning of the Sector's products and solutions, with revenue volumes and profitability growing in all business areas both in the European component and in Leonardo DRS.

Orders: up compared to 2020, which in the last quarter benefited from important acquisitions with particular reference to Electronics Europe. The main acquisitions that characterized the excellent commercial performance include the supply of equipment for two U212 Near Future Submarines (NFS) submarines that will become part of the Italian Navy fleet starting from 2027 and, as part of the broad Quadriga program, the order relating to the supply of radar and aerial protection systems that will equip the 38 Typhoon aircraft intended to replace the Tranche 1 aircraft currently supplied to the German Ministry of Defense. As part of the broader VBM plus program, we note the order for the upgrade of the shooting system and the supply of the new digital intercom and a completely updated CIS system and the new Command and Control system, called C2D / N Evo In the Cyber area, the order relating to Phase 4 of the Sicote program (Territory Control System) should be noted, focusing on innovative solutions to support the institutional activities of the Carabinieri and the Defense Staff. In the field of Automation, the order to enhance the logistics management of the baggage handling systems, which will be equipped with the safety technology approved by the European Civil Aviation Conference (ECAC) for n. 10 Spanish airports. Finally, for Leonardo DRS, further orders are highlighted for the production of modular hardware systems called Mounted Family of Computer Systems (MFoCS) to be installed on land combat vehicles to support maneuverability and logistics for the United States army and the M-SHORAD order for the initial supply of a Mission Equipment Package, to be integrated on heavy striker-type vehicles and which will allow the neutralization of low-altitude aerial threats including remote-controlled ones (drones).

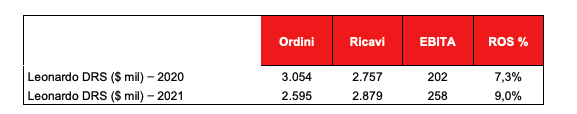

Revenues: growing both in the European component, which last year had been affected by the application of the containment measures of the COVID-19 contagion, and in Leonardo DRS, excluding the unfavorable effect of the USD / € exchange rate.

EBITA: increasing due to higher volumes and better profitability compared to that recorded in 2020 which had been affected, with particular reference to the European component, by the effects deriving from the application of the containment measures of the COVID-19 contagion. Leonardo DRS, whose result recorded a marked growth, confirms the trend of increase in profitability due to the passage into production of some development programs.

The trend of the Divisions in the sector over the last 4 years:

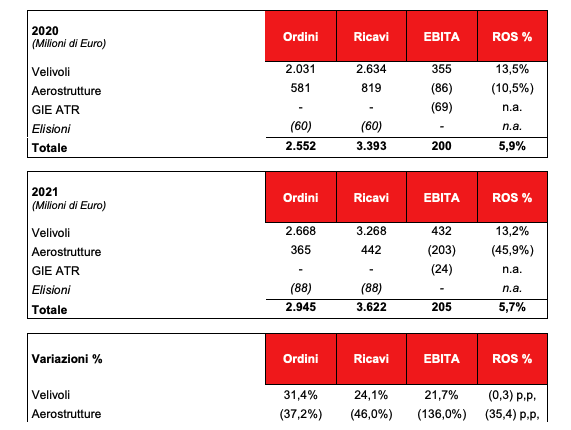

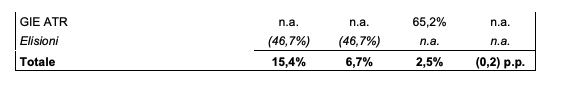

AERONAUTICS

The Sector shows an excellent performance of the military business, also recording the first signs of recovery in the regional transport sector, with the GIE-ATR consortium reporting an increase in terms of deliveries and orders. The situation of unsaturation in the Aerostructures Division remains due to the slow recovery of the civil business of the main customers (Boeing and Airbus).

Aircraft

From a production point of view for the Division's military programs, Lockheed Martin No. 43 wings and 12 final assys for the F-35 program (37 wings and 7 final assys delivered in 2020). The first 2 deliveries of Typhoon aircraft to Kuwait are also highlighted.

Orders: the Division has finalized significant export orders for 16 M-346 aircraft, as well as further orders on JSF and logistics support programs for Typhoon aircraft. Revenues: higher production volumes of the Division, in particular on the line of trainers M-346 and the Kuwait program.

EBITA: the Division benefited from higher volumes, confirming the high level of profitability.

Aerostructures

For the Division, n. 28 fuselage sections and n. 16 stabilizers for the B787 program (105 fuselages and 72 stabilizers delivered in 2020) and n. 15 fuselages for the ATR program (# 26 in 2020).

Orders: the Division was affected by the lack of new orders from Boeing customers (B787 program) and GIE consortium, receiving orders from the Airbus customer only on the A220 and A321 programs, which confirm the growth trend. The demand for B767 remains stable.

Revenues: decrease in the Division, which is affected by the reduction in production rates on the B787 and ATR programs. EBITA: for the Division, the expected reduction in business volumes and the consequent unsaturation of production sites resulted in a net decrease compared to 2020.

GIE-ATR

EBITA: recorded an improvement result thanks to cost containment actions and the increase in deliveries (31 deliveries in 2021 compared to 10 in 2020).

The trend of the Divisions in the sector over the last 4 years:

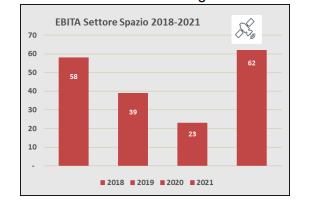

SPACE

In 2021 the sector recorded, on the main indicators, values well above those of 2020, the year in which the effects of the pandemic had heavily affected commercial performance, production volumes and profitability, especially in the manufacturing segment. The economic result is up sharply. In the manufacturing segment, thanks to a return of revenues to pre-pandemic levels, the marked increase in profitability also due to a greater containment of extra costs on telecommunications programs, and the excellent performance of the Observation, Exploration and Navigation domain and in particular of TAS Italy.

The satellite services segment is also progressing, which again this year recorded a solid performance and an extraordinary volume of orders such as to guarantee a significant order backlog to support the volumes of the coming years.

In addition to the aforementioned industrial performance, there is the significant economic benefit recorded on the Italian component of the manufacturing business deriving from the effects of the realignment of the tax value of goodwill, in fulfillment of the concessions provided for by the Decree "Urgent measures to support and relaunch the economy", converted with amendments into Law no. 126 of 13 October 2020 and subsequent 2021 Budget Law.

The trend of the sector over the last 4 years:

This is a machine translation from Italian language of a post published on Start Magazine at the URL https://www.startmag.it/innovazione/ecco-come-va-leonardo-settore-per-settore-tutti-i-numeri/ on Fri, 11 Mar 2022 10:40:06 +0000.